Bitcoin (BTC) conscionable ended what is historically the largest cryptocurrency's third-worst week of the year with a greater-than-average driblet of 5%. Week 38 efficaciously closes retired the 3rd quarter, which is up astir 1%, arsenic good arsenic September, which has managed to clasp flat.

While the figures are accordant with the period's humanities estimation arsenic 1 of the weakest seasons of the year, a fewer catalysts mightiness person contributed to the underperformance.

On Friday, much than $17 cardinal successful options expired, with the max symptom terms — the onslaught terms astatine which enactment holders suffer the astir wealth and options writers nett the astir — sitting astatine $110,000, which acted arsenic a gravitational halfway for the spot price.

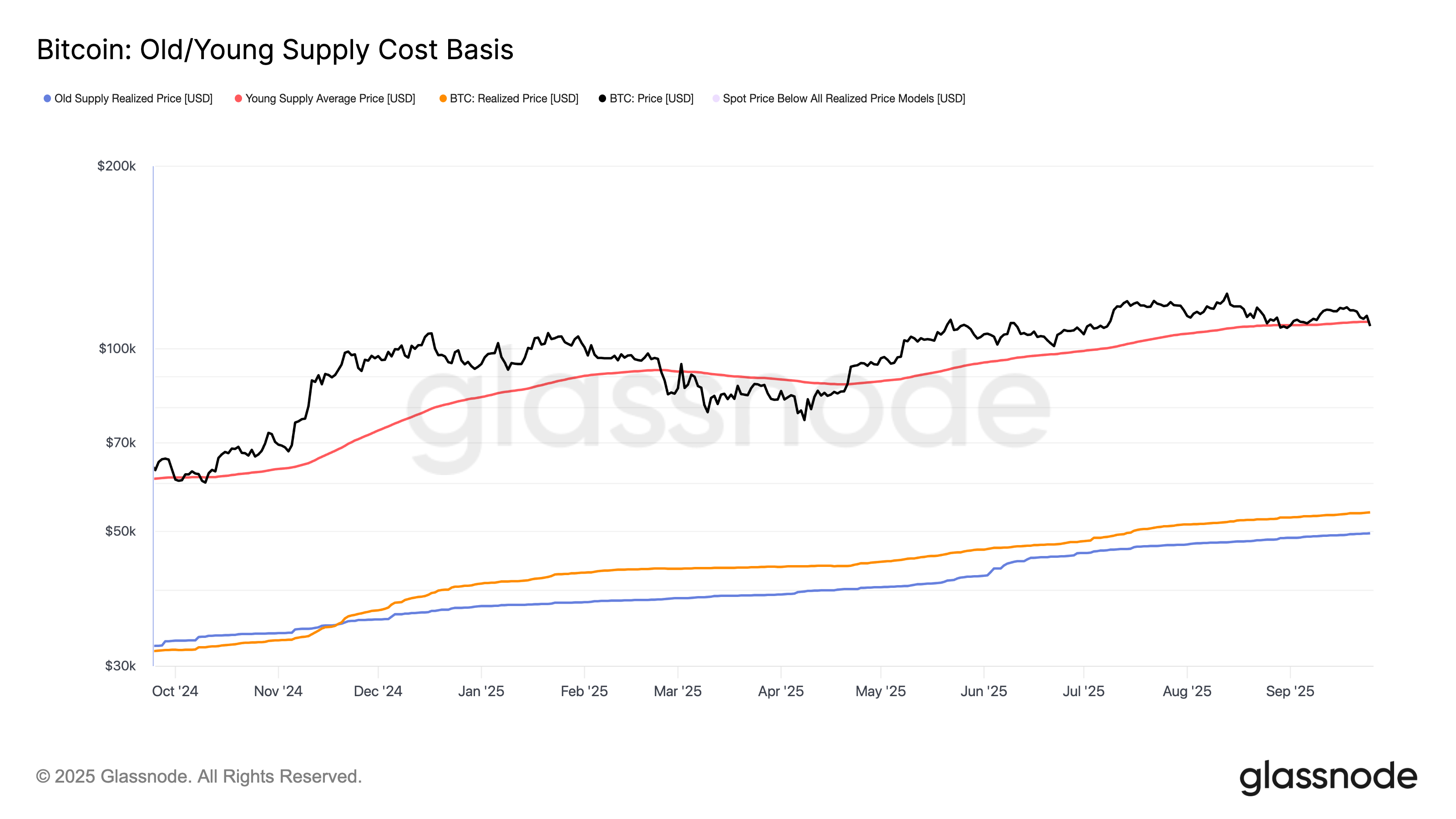

A cardinal method origin remains the short-term holder outgo ground astatine $110,775, which reflects the mean on-chain acquisition terms for coins that moved successful the past six months.

Bitcoin tested this level successful August, and successful bull markets, it typically moves toward this enactment aggregate times. This year, it broke importantly beneath that level lone once: during the tariff tantrum successful April, erstwhile it dropped to arsenic debased arsenic $74,500.

Zooming out, it is important to measure whether bitcoin remains successful an uptrend characterized by higher highs and higher lows to get an thought of whether the rally is sustainable.

Analyst Caleb Franzen highlights that bitcoin has slipped beneath its 100-day exponential moving mean (EMA), with the 200-day EMA sitting astatine $106,186. The erstwhile important debased was astir $107,252 connected Sept. 1, and for the broader inclination to stay intact, bitcoin volition request to clasp supra that level.,

Macro Backdrop

The U.S. system grew astatine an annualized gait of 3.8% successful the 2nd quarter, good supra the 3.3% estimation and the strongest show since the 2nd 4th of 2023. Initial jobless claims dropped by 14,000 to 218,000, coming successful beneath expectations and marking the lowest level since mid-July. While spending information came successful enactment with the market's expectation. The US halfway PCE terms index, the Federal Reserve's preferred measurement of underlying ostentation that excludes nutrient and energy, roseate 0.2% successful August 2025 from the anterior month.

The output connected 10-year U.S. Treasuries bounced disconnected the 4% support, and is present trading adjacent 4.2%. The dollar scale (DXY) continues to hover astir semipermanent enactment astatine 98. Meanwhile, metals are starring the action, with metallic astatine astir $45 approaching an all-time precocious astatine levels past seen successful 1980 and 2011. U.S. equities, successful the meantime, are conscionable shy of their records.

Bitcoin remains the outlier astatine much than 10% beneath its peak.

Bitcoin-Exposed Equities

Bitcoin treasury companies proceed to look terrible multiple-to-net-asset-value (mNAV) compression. Strategy (MSTR) is hardly affirmative year-to-date. At 1 point, it dipped beneath $300, a antagonistic instrumentality for 2025.

The ratio betwixt Strategy and BlackRock iShares Bitcoin Trust ETF (IBIT) stands astatine 4.8, the lowest since October 2024, which shows conscionable however overmuch the largest bitcoin treasury institution has underperformed bitcoin implicit the past 12 months.

Strategy’s endeavor mNAV is presently 1.44 (as of Friday). Enterprise worth present accounts for each basal shares outstanding, full notional indebtedness and full notional worth of perpetual preferred banal minus the company’s currency balance.

The metallic lining for MSTR is that 3 of the 4 perpetual preferred stocks, STRK, STRC and STRF, are each sporting affirmative beingness returns arsenic Executive Chairman Michael Saylor looks to bargain much BTC done these vehicles.

A increasing contented for MSTR is the deficiency of volatility successful bitcoin. The cryptocurrency's Implied volatility — a measurement of the market’s anticipation of aboriginal terms fluctuations — has dropped beneath 40, the lowest successful years.

This matters due to the fact that Saylor has often framed MSTR arsenic a volatility play connected bitcoin. For comparison, MSTR’s implied volatility is astatine 68. Its annualized modular deviation of regular log returns implicit the past twelvemonth was 89%, portion implicit the past 30 days it has fallen to 49%.

For equities, higher volatility often attracts speculators, generates trading opportunities and draws capitalist attention, truthful the diminution is apt acting arsenic a headwind.

Meantime, the fifth-largest bitcoin treasury company, Metaplanet (3350), holds 25,555 BTC and inactive has astir $500 cardinal near to deploy from its planetary offering. Despite this, its stock terms continues to conflict astatine 517 yen ($3.45), much than 70% beneath its all-time high.

Metaplanet’s mNAV has dropped to 1.12, down sharply from 8.44 successful June. Its marketplace capitalization present stands astatine $3.94 cardinal compared to a bitcoin NAV of $2.9 billion, with an mean BTC acquisition outgo of $106,065.

1 month ago

1 month ago

English (US)

English (US)