Bitcoin's (<a href="https://www.coindesk.com/price/bitcoin" target="_blank">BTC</a>) pullback from the $100,000 level aft continuously hitting caller fresh highs is lone a impermanent setback earlier yet shooting past the obstruction to adjacent higher prices, crypto analytics steadfast CryptoQuant said.

According to a Wednesday study shared with CoinDesk, aggregate blockchain information metrics suggest that the largest crypto has much country to tally earlier topping.

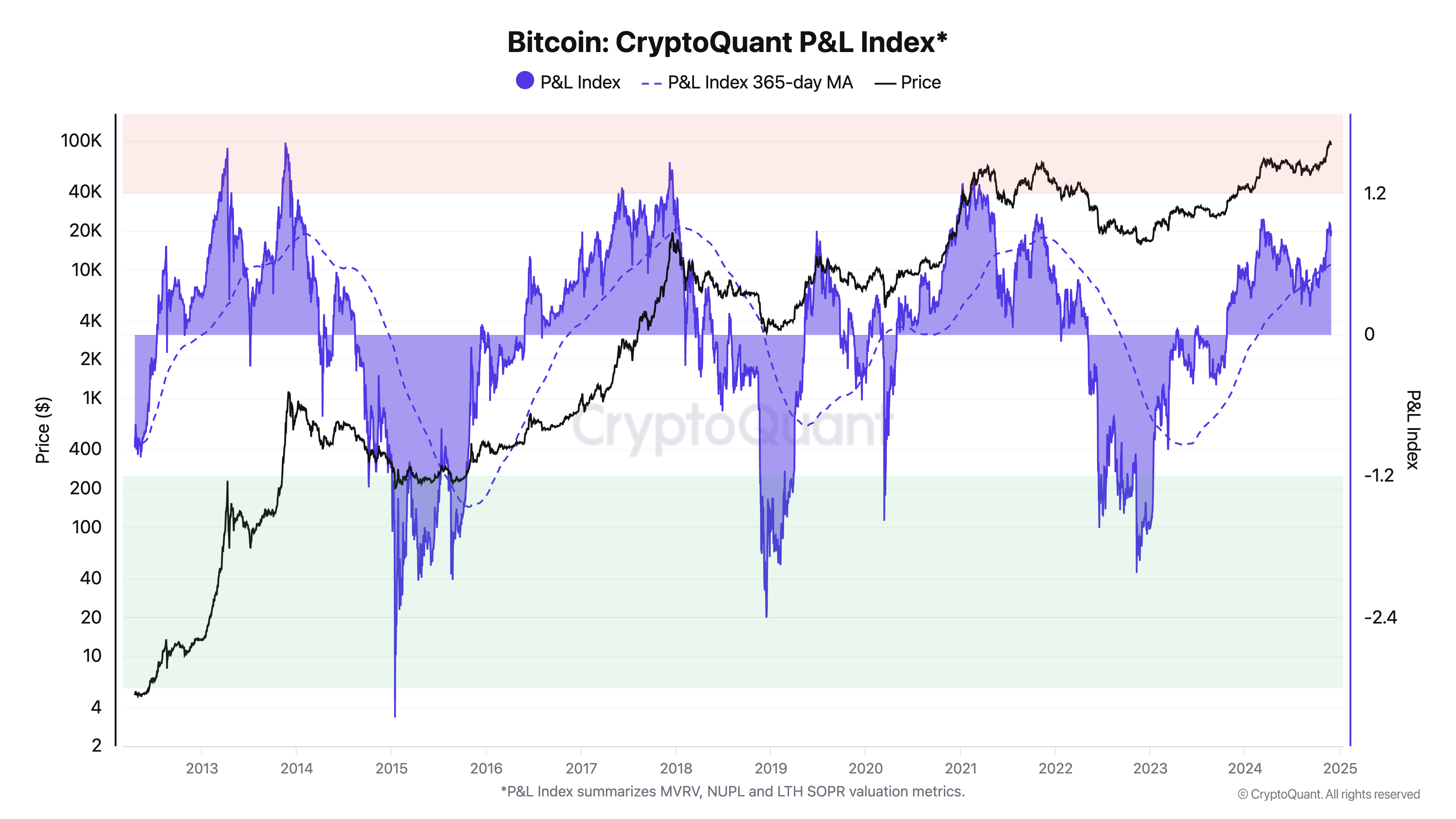

CryptoQuant's customized P&L index, which combines respective on-chain valuation metrics to awesome whether BTC is overvalued oregon undervalued, shows that the plus is firmly successful a bull marketplace but acold from the overvalued levels it reached astatine the erstwhile marketplace peaks successful 2021, 2017 and 2013.

The firm's Bull-Bear Market Cycle Indicator has lone started to vigor up aft dipping somewhat into carnivore marketplace territory earlier this twelvemonth arsenic BTC corrected from March's grounds $73,000 to $50,000. The metric is obscurity adjacent the overheated levels seen astatine section tops astatine this March oregon different section tops.

Meanwhile, information of retail investors is inactive muted, contrary to the emblematic buying frenzy observed astir erstwhile rhythm tops. Per CryptoQuant data, retail sold 41,000 bitcoin since October lowering their holdings apt to instrumentality profits. Large investors, meanwhile, accrued holdings by 130,000 BTC during the aforesaid period.

New investors aren't rushing to participate the marketplace either. The worth of BTC held by caller investors, oregon addresses holding the plus since little than six months ago, stands astatine 50% of the full worth invested successful bitcoin (Realized Cap). That's acold beneath the 80%-90% levels successful 2017 and 2021.

"Price tops typically hap erstwhile caller investors participate the marketplace to bargain astatine highly precocious prices, which causes them to clasp a ample proportionality of the full worth invested," the authors said. "Previous bull cycles person ended erstwhile retail investors bargain aggressively, which is not the lawsuit today."

Bitcoin's highest target

Over the past week, BTC's convulsive run-up aft Donald Trump's U.S. predetermination triumph was halted astatine the $100,000 barrier, sliding backmost arsenic overmuch arsenic 9% from its latest record. On Thursday, CoinDesk information shows, it changed hands astatine astir $95,000.

Despite the setback, surpassing the $100,000 obstruction is lone a substance of time, CryptoQuant analysts said.

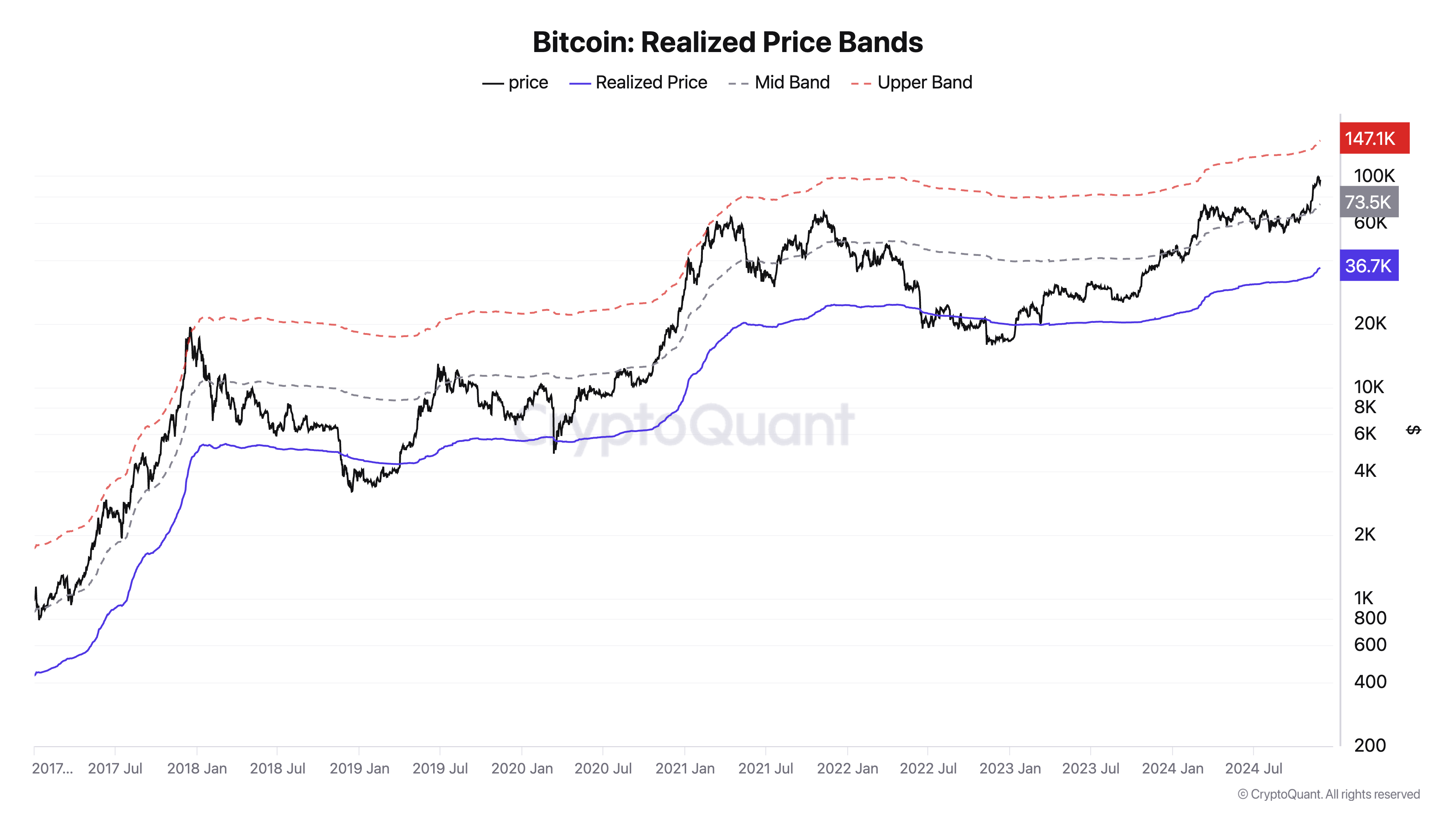

Previous bitcoin bull markets topped astir the precocious set of bitcoin's realized terms metric, acceptable astatine 4 times the mean terms astatine which each BTC successful circulation has been transferred for the past time. Data shows that the realized terms is presently astatine $36,000-$37,000 and rapidly rising, marking the precocious set astatine $147,000.

If the signifier repeats, BTC could rally to astatine slightest $147,000 earlier reaching a marketplace rhythm top, per CryptoQuant.

CryptoQuant isn't the lone steadfast that is bullish connected bitcoin's rally. Recently, Galaxy Research said the terms is expected to scope $100,000 successful the adjacent word and whitethorn tally up higher, citing expanding organization adoption and the imaginable for the instauration of bitcoin nation-state reserves.

Read more: <a href="https://www.coindesk.com/markets/2024/11/27/bitcoin-bull-market-is-far-from-over-galaxy-research-says" target="_blank">Bitcoin Bull Market Is Far From Over, Galaxy Research Says</a>

11 months ago

11 months ago

English (US)

English (US)