By Omkar Godbole

The bearish sentiment that followed Friday's disappointing U.S. nonfarm payroll information rapidly ran retired of steam implicit the weekend. That has allowed a fewer coins, including Ethena’s ENA, worldcoin (WLD), hyperliquid (HYPE) and dogecoin (DOGE), to station awesome gains successful the past 24 hours.

Bitcoin (BTC), which dropped beneath the cardinal enactment level of $112,000 aft the report, present appears to beryllium forming a bullish inverse head-and-shoulders pattern, often a precursor to a beardown rally. BTC's mining difficulty deed a caller precocious and Strategy (MSTR) Executive Chairman Michael Saylor hinted astatine further BTC purchases.

On-chain indicators, however, overgarment a much nuanced representation for the largest cryptocurrency: The proportionality of illiquid proviso has surged to grounds highs, signaling holder conviction. Yet, arsenic CryptoQuant points out, whales are offloading coins astatine the fastest gait since 2022.

Meanwhile, a lively statement unfolded connected X regarding the wellness of the Ethereum blockchain. One perceiver pointed to August’s gross of $39.2 million, the fourth-lowest since 2021, proclaiming, “Ethereum is dying.”

In response, Tom Dunleavy, a elder probe expert astatine Messari, pushed backmost strongly, noting that Ethereum and Solana are thriving successful presumption of full worth locked (TVL), progressive addresses, transaction volume, exertion gross and stablecoin activity. He emphasized that gross unsocial is simply a misleading metric for blockchain networks, arsenic it contradicts their cardinal extremity of enabling low-friction, decentralized fiscal enactment and could yet hinder ecosystem growth.

Ethena’s governance token, ENA, surged to three-week highs aft StablecoinX, a treasury institution linked to a synthetic dollar issuer readying a Nasdaq listing, raised $530 cardinal saying it intended to bargain the tokens. The protocol’s robust fundamentals, highlighted by seven-day revenues of $53 cardinal — much than treble those of Hyperliquid — combined with anticipated benefits from StablecoinX’s Nasdaq listing and imaginable Federal Reserve interest-rate cuts, presumption ENA arsenic a compelling concern opportunity, according to pseudonymous perceiver Crypto Stream.

Speaking of Hyperliquid, the layer-1 blockchain and decentralized exchange's plans to motorboat its ain USDH stablecoin sparked a governance battle, with the assemblage facing backlash implicit a connection tied to Stripe’s Bridge platform's centralized influence.

On the macro front, the yen held dependable against the dollar, shrugging disconnected Prime Minister Shigeru Ishiba's resignation. France, meanwhile, seemed headed toward authorities collapse.

In the U.S., the Bureau of Labor Statistics (BLS) volition merchandise yearly benchmark revisions connected Tuesday, which are expected to amusement importantly weaker occupation maturation earlier successful the year, with immoderate surveys suggesting that betwixt 500,000 and 1 cardinal jobs could beryllium revised away. Stay alert!

What to Watch

- Crypto

- Sept. 9: Shares of SOL Strategies (HODL), a Canadian institution focused connected investing successful and providing infrastructure for Solana’s ecosystem, are expected to commencement trading connected the Nasdaq Global Select Market nether the ticker awesome STKE. OTCQB trading arsenic CYFRF volition end, and shares volition proceed connected the Canadian Securities Exchange arsenic HODL.

- Sept. 10, 9:15 a.m.: Comptroller of the Currency Jonathan V. Gould volition talk about integer assets astatine the CoinDesk: Policy & Regulation Conference successful Washington.

- Macro

- Sept. 9, 8 a.m.: Mexico’s National Institute of Statistics and Geography releases August user terms ostentation data.

- Core Inflation Rate MoM Prev. 0.31%

- Core Inflation Rate Prev. 4.23%

- Inflation Rate MoM Prev. 0.27%

- Inflation Rate YoY Prev. 3.51%

- Sept. 9, 10 a.m.: The U.S. Bureau of Labor Statistics releases preliminary yearly benchmark revision to employment data.

- Nonfarm Payrolls Annual Revision Prev. -818K

- Sept. 10, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases August user terms ostentation data.

- Inflation Rate MoM Prev. 026%

- Inflation Rate YoY Prev. 5.23%

- Sept. 10, 8:30 a.m.: The U.S. Bureau of Labor Statistics releases August shaper terms ostentation data.

- Core PPI MoM Est. 0.3% vs. Prev. 0.9%

- Core PPI YoY Prev. 3.7%

- PPI MoM Est. 0.3% vs. Prev. 0.9%

- PPI YoY Prev. 3.3%

- Sept. 9, 8 a.m.: Mexico’s National Institute of Statistics and Geography releases August user terms ostentation data.

- Earnings (Estimates based connected FactSet data)

- Sept. 9: GameStop (GME), post-market, $0.19

Token Events

- Governance votes & calls

- Lido DAO is voting connected a proposal to migrate Nethermind’s ~7,000 Ethereum validators to infrastructure operated by Twinstake, a staking supplier co-founded by Nethermind. Voting ends Sept. 8.

- Uniswap DAO is voting to found “DUNI,” a Wyoming DUNA arsenic its ineligible entity, preserving decentralized governance portion enabling off-chain operations and liability protections, with $16.5M successful UNI for legal/tax budgets and $75K UNI for compliance. Voting ends Sept. 8.

- Uniswap DAO is voting connected an updated Unichain-USDS Growth Plan to accelerate adoption done performance-based incentives and DAO-guided distribution. The connection introduces minimum KPIs, a “no result, nary reward” model. Voting ends Sept. 9.

- Hyperliquid to ballot connected who issues its USDH stablecoin. Major contenders see Paxos, Frax and a conjugation involving Agora and MoonPay. Voting takes spot Sept. 14.

- Unlocks

- Sept. 9: Sonic (S) to unlock 5.02% of its circulating proviso worthy $46.02 million.

- Sept. 11: Aptos (APT) to unlock 2.2% of its circulating proviso worthy $48.86 million.

- Sept. 15: Starknet (STRK) to unlock 5.98% of its circulating proviso worthy $15.66 million.

- Sept. 15: Sei (SEI) to unlock 1.18% of its circulating proviso worthy $16.01 million.

- Sept. 16: Arbitrum (ARB) to unlock 2.03% of its circulating proviso worthy $46.05 million.

- Token Launches

- Sept. 8: Openledger (OPEN) to beryllium listed connected Binance Alpha, MEXC and others.

- Sept. 8: OlaXBT (AIO) to beryllium listed connected Binance Alpha and others.

Conferences

The CoinDesk Policy & Regulation Conference (formerly known arsenic State of Crypto) is simply a one-day boutique lawsuit held successful Washington connected Sept. 10 that allows wide counsels, compliance officers and regulatory executives to conscionable with nationalist officials liable for crypto authorities and regulatory oversight. Space is limited. Use codification CDB15 for 15% disconnected your registration.

- Day 2 of 4: Future Proof Festival (Huntington Beach, California)

- Sept. 9-10: Fintech Week London 2025

- Sept. 9-10: WOW Summit Hong Kong 2025

- Sept. 9-13: Boston Blockchain Week (Quincy, Massachusetts)

- Sept. 10: CoinDesk Policy & Regulation Conference (New York)

- Sept. 10: Future of Finance (New York)

- Sept. 12: Independent Investor Summit (New York)

- Sept. 12-15: ETHTokyo 2025

- Sept. 15: TGE Summit 2025 (New York)

Token Talk

By Oliver Knight

- Memecoins are showing caller signs of beingness aft months successful the doldrums, with respective fashionable tokens posting gains connected Monday. The rally comes contempt lingering skepticism pursuing a drawstring of celebrity-linked launches that flamed retired earlier this year.

- Bonk (BONK), a Solana-based, dog-themed token, led the complaint with a astir 7% regular gain. Dogecoin (DOGE), the archetypal memecoin, besides climbed much than 7%, reaching $0.2335, portion newer entrants similar spx6900 (SPX) and pump.fun (PUMP) each outperformed the wider altcoin market.

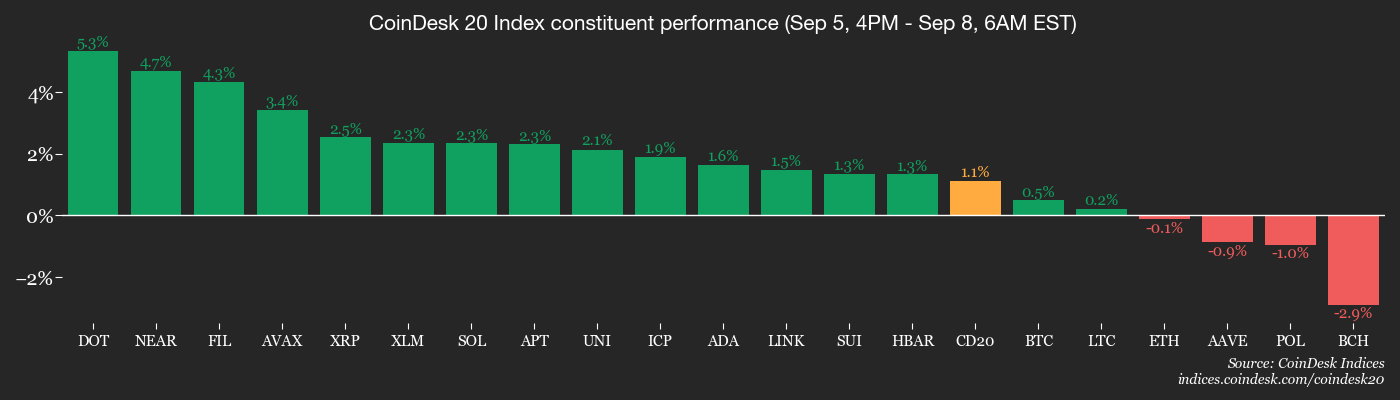

- The CoinDesk Meme Index (CDMEME) has gained 2.20% successful the past 24 hours, outpacing the wide marketplace CoinDesk 20 Index measure, which added 1.27%.

- Other speculative assets, including the irreverently named fartcoin (FARTCOIN), besides recovered buyers, adding to the consciousness of momentum crossed the sector. The rally suggests renewed appetite among retail traders for high-risk, high-reward bets aft weeks of sideways enactment successful the broader crypto market.

- The rally marks a crisp turnaround for the sector, which has been depressed for months. A bid of celebrity-driven launches, including TRUMP and MELANIA coins, drew headlines successful caller months but rapidly collapsed nether the value of mediocre liquidity, questionable tokenomics, and capitalist fatigue.

- Layer-1 blockchain MemeCore (M), which is designed to cater to the memecoin sector, ignited the fuse past week, climbing 164% implicit a 7 time period.

- The wider crypto marketplace headdress is up 0.57% to $3.84 trillion arsenic majors bitcoin (BTC) and ether (ETH) began to assistance themselves distant from a captious level of support, suggesting renewed spot for the altcoin and memecoin markets arsenic a result.

Derivatives Positioning

By Omkar Godbole

- DOGE, SUI and HYPE person seen double-digit gains successful futures unfastened involvement implicit the past 24 hours, importantly outpacing different apical cryptocurrencies.

- Dogecoin OI surged to 16.88 cardinal DOGE, the highest since July 31, validating the 7.5% surge successful the cryptocurrency's price. The token has breached retired of a descending trendline characterizing the signifier of little highs since mid-July.

- BTC's OI successful USDT and USD-denominated perpetuals connected large exchanges continues to hover successful the caller scope of 270K-290K BTC. An summation supra 290K whitethorn beryllium a harbinger of renewed terms volatility.

- On the CME, BTC's modular futures OI remains astatine April lows portion the ETH futures OI has pulled backmost to 1.87 cardinal ETH from the grounds precocious of 2.2 cardinal ETH, indicating superior outflows.

- On Deribit, XRP and SOL calls commercialized astatine a premium to puts crossed each tenors, indicating a bullish bias. Meanwhile, BTC and ETH options awesome lingering downside concerns.

Market Movements

- BTC is up 0.39% from 4 p.m. ET Friday astatine $112,087.64 (24hrs: +0.8%)

- ETH is up 0.26% astatine $4,328.09 (24hrs: +0.54%)

- CoinDesk 20 is up 1.25% astatine 4,079.43 (24hrs: +1.92%)

- Ether CESR Composite Staking Rate is down 9 bps astatine 2.81%

- BTC backing complaint is astatine 0.0091% (9.9634% annualized) connected Binance

- DXY is unchanged astatine 97.73

- Gold futures are unchanged astatine $3,651.60

- Silver futures are up 0.66% astatine $41.83

- Nikkei 225 closed up 1.45% astatine 43,643.81

- Hang Seng closed up 0.85% astatine 25,633.91

- FTSE is up 0.10% astatine 9,217.42

- Euro Stoxx 50 is up 0.49% astatine 5,344.27

- DJIA closed connected Friday down 0.48% astatine 45,400.86

- S&P 500 closed down 0.32% astatine 6,481.50

- Nasdaq Composite closed unchanged astatine 21,700.39

- S&P/TSX Composite closed up 0.47% astatine 29,050.63

- S&P 40 Latin America closed up 1.14% astatine 2,801.75

- U.S. 10-Year Treasury complaint is unchanged astatine 4.086%

- E-mini S&P 500 futures are up 0.19% astatine 6,502.25

- E-mini Nasdaq-100 futures are up 0.34% astatine 23,764.75

- E-mini Dow Jones Industrial Average Index are up 0.11% astatine 45,510.00

Bitcoin Stats

- BTC Dominance: 58.47% (unchanged)

- Ether-bitcoin ratio: 0.03853 (-0.56%)

- Hashrate (seven-day moving average): 973 EH/s

- Hashprice (spot): $51.88

- Total fees: 3.23 BTC / $358,958

- CME Futures Open Interest: 134,065 BTC

- BTC priced successful gold: 30.8 oz.

- BTC vs golden marketplace cap: 8.72%

Technical Analysis

- DOGE's two-day terms emergence has taken it past the trendline characterizing the diminution from July 21's precocious of 28.7 cents.

- Prices present look to beryllium crossing into bullish territory supra the Ichimoku cloud, a wide tracked momentum indicator.

- That would displacement the absorption to 25.58 cents, the Aug. 14 high.

Crypto Equities

- Coinbase Global (COIN): closed connected Friday astatine $299.07 (-2.52%), +0.81% astatine $301.50 successful pre-market

- Circle (CRCL): closed astatine $114.56 (-2.49%), +0.7% astatine $115.35

- Galaxy Digital (GLXY): closed astatine $23.49 (+2.53%), -0.38% astatine $23.40

- Bullish (BLSH): closed astatine $52.35 (+6.81%), -0.78% astatine $51.98

- MARA Holdings (MARA): closed astatine $15.19 (+0.53%), +0.33% astatine $15.24

- Riot Platforms (RIOT): closed astatine $13.29 (+0.99%), +0.3% astatine $13.33

- Core Scientific (CORZ): closed astatine $13.62 (0%), +1.32% astatine $13.80

- CleanSpark (CLSK): closed astatine $9.24 (+1.76%), +0.54% astatine $9.29

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $29.45 (+0.96%)

- Exodus Movement (EXOD): closed astatine $24.03 (-1.15%)

Crypto Treasury Companies

- Strategy (MSTR): closed astatine $335.87 (+2.53%), -2.02% astatine $329.10

- Semler Scientific (SMLR): closed astatine $28.12 (+0.11%)

- SharpLink Gaming (SBET): closed astatine $14.94 (-3.21%), -0.37% astatine $14.88

- Upexi (UPXI): closed astatine $6.04 (-4.58%), +2.65% astatine $6.20

- Mei Pharma (MEIP): closed astatine $4.23 (-0.94%), -20.33% astatine $3.37

ETF Flows

Spot BTC ETFs

- Daily nett flows: -$160.1 million

- Cumulative nett flows: $54.47 billion

- Total BTC holdings ~1.29 million

Spot ETH ETFs

- Daily nett flows: -$446.8 million

- Cumulative nett flows: $12.74 billion

- Total ETH holdings ~6.42 million

Source: Farside Investors

Chart of the Day

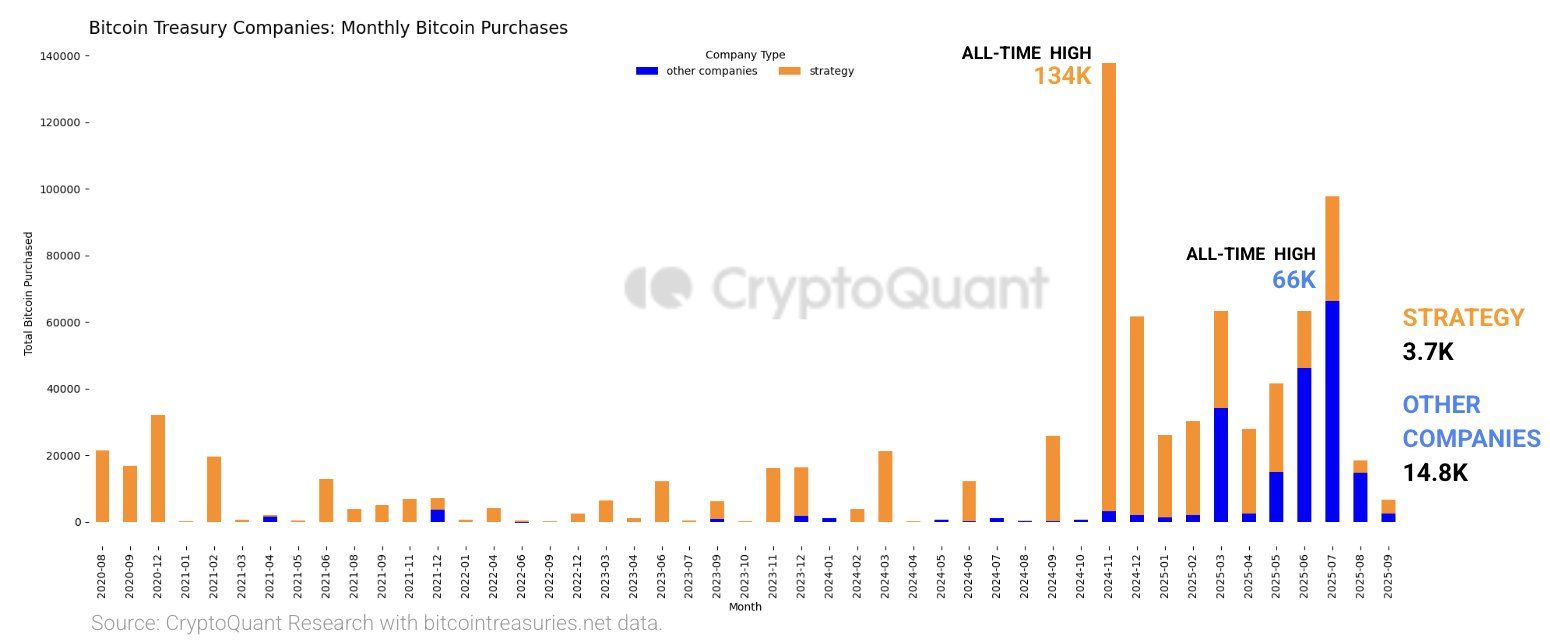

- The illustration shows that companies person importantly slowed their purchases of BTC successful caller months.

- In August, Strategy and different firms cumulatively added 3,700 BTC to their stash, down from 134,000 BTC successful November past year.

- The slowdown successful buying helps explicate BTC's stalled terms rally.

While You Were Sleeping

- EasyJet Founder Adds Crypto Trading to His Cut-Price Empire (Bloomberg): Stelios Haji-Ioannou volition motorboat easyBitcoin this period with Uphold, saying President Trump’s predetermination pushed crypto into the mainstream and promising lower-cost bitcoin and ether trading nether his expanding “easy” brand.

- Hyperliquid Faces Community Pushback Against Stripe-Linked USDH Proposal (CoinDesk): Hyperliquid’s program to regenerate USDC with a autochthonal stablecoin has drawn bids from Stripe, Paxos, Frax and an Agora–MoonPay coalition, with validators acceptable to take the USDH issuer Sept. 14.

- Crypto Exchange HashKey Plans $500M Digital Asset Treasury Fund (CoinDesk): The Hong Kong–based speech is launching a $500 cardinal money targeting integer plus treasury projects, starting with bitcoin and ether, to physique an organization span betwixt accepted fiscal superior and on-chain assets.

- Russia Unleashes Largest Drone Assault of War, Setting Government Building Ablaze (The New York Times): 805 drones and 13 missiles reached Ukraine connected Sunday, with 60 drones and 9 missiles getting through. Debris from a downed drone acceptable Kyiv’s Cabinet of Ministers gathering connected fire.

- Japanese Lawmakers Launch Leadership Bids After PM Resigns, Yen Sinks (Reuters): Japan’s ruling enactment volition take a caller person Oct. 4 aft Shigeru Ishiba's Sunday resignation, fueling expectations of looser fiscal argumentation and a hold to Bank of Japan complaint hikes.

- Javier Milei Suffers Stinging Setback successful Buenos Aires Polls (Financial Times): A Peronist conjugation bushed Javier Milei’s grouping successful Argentina’s largest state arsenic elector choler implicit soaring surviving costs and a corruption ungraded tied to his sister Karina eroded his enactment earlier October’s legislature midterms.

In the Ether

1 month ago

1 month ago

English (US)

English (US)