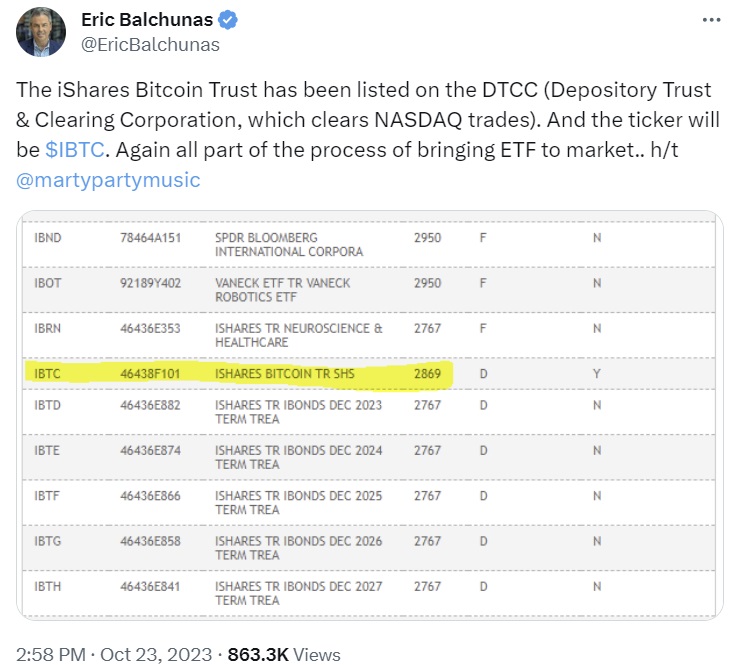

Blackrock is moving guardant with the process of bringing its spot bitcoin exchange-traded money (ETF) to market. The world’s largest plus manager has secured a ticker awesome and a CUSIP fig for its forthcoming spot bitcoin ETF, which is present listed connected the Depository Trust and Clearing Corporation (DTCC), the entity liable for clearing Nasdaq trades. Additionally, Blackrock’s spot bitcoin ETF filing signals the firm’s volition to bargain bitcoin to effect its upcoming ETF this month.

Blackrock’s Spot Bitcoin ETF Now Listed connected DTCC With Ticker IBTC

Several developments person sparked optimism among crypto investors regarding the motorboat of Blackrock’s spot bitcoin exchange-traded money (ETF), the Ishares Bitcoin Trust. This speculation has fueled a important surge successful bitcoin’s terms connected Monday.

These developments see the allocation of a ticker awesome (IBTC) and the duty of a CUSIP fig (46438F101) to the Ishares Bitcoin Trust. Furthermore, the spot is present listed connected the Depository Trust and Clearing Corporation (DTCC), which is liable for clearing Nasdaq trades.

Eric Balchunas, a elder ETF expert for Bloomberg, explained connected societal media level X connected Monday that the steps that the world’s largest plus manager has taken are portion of the process of bringing an ETF to market.

Blackrock Expected to Buy Bitcoin to Seed Its Spot Bitcoin ETF This Month

Many radical connected societal media person besides pointed retired that the amendment to the Registration Statement for Ishares Bitcoin Trust, filed with the U.S. Securities and Exchange Commission (SEC) connected Oct. 18, indicates that Blackrock whitethorn beryllium buying bitcoin this period to effect its upcoming spot bitcoin ETF.

Balchunas explained:

Blackrock stating successful their caller spot bitcoin ETF amendment that they are seeding the ETF successful October. Don’t privation to work that overmuch into it but it is caller info not successful archetypal filing truthful noteworthy.

However, helium clarified: “Seeding is typically not a batch of wealth conscionable capable to get ETF going. So I wouldn’t work this arsenic ‘omg Blackrock is buying a ton of bitcoin’ astatine each but much the information they doing it and disclosing it shows different measurement successful the process of launching.”

The sponsor of the Ishares Bitcoin Trust is Ishares Delaware Trust Sponsor LLC, a Delaware constricted liability institution and an indirect subsidiary of Blackrock, the filing details, adding that “Ishares” is simply a registered trademark of Blackrock Inc. oregon its affiliates.

Crypto enthusiast Martin Folb, aka “Martyparty,” detailed connected X: “Once approved for registration, the ETF tin past get its archetypal superior from a broker/dealer licensed ‘bank,’ successful this lawsuit Coinbase, and indispensable bargain the genesis shares, oregon ‘creation units’ with this capital, successful this case, its earthy autochthonal BTC. This archetypal coin superior is exchanged for IBTC ETF shares, which go disposable for open-market trading connected the archetypal day, frankincense mounting the ‘opening price’ of the IBTC.”

Timing of When SEC Could Approve Blackrock’s Spot Bitcoin ETF Application

Regarding erstwhile the SEC could o.k. Blackrock’s spot bitcoin ETF, litigator Joe Carlasare shared connected X: “Lots of misinformation retired determination astir the adjacent cardinal dates for the Ishares/Blackrock bitcoin spot ETF application.”

He explained: “Here’s a summary: On 9-28-23, the SEC invited the nationalist to supply feedback connected the application. Anyone wishing to taxable a remark has until October 25th to bash so. Following that, if idiosyncratic wants to reply to different person’s comments, they person up to November 8th.” Carlasare noted:

The SEC does not typically o.k. regularisation changes oregon akin proposals until the remark petition play is complete. This remark play is an indispensable portion of their regulatory process.

“Usually, aft the remark play ends, there’s an further 30-60 days reserved for remark review. Therefore, if a spot ETF gets the greenish airy successful 2023, it astir apt won’t beryllium from Blackrock,” helium opined.

The terms of bitcoin soared connected Monday, hitting $35,000 earlier retreating slightly. At the clip of writing, BTC is trading astatine $34,423, up 13% implicit the past 24 hours.

What bash you deliberation astir Blackrock preparing to motorboat a spot bitcoin ETF? Do you deliberation the SEC volition greenlight spot bitcoin ETFs this year? Let america cognize successful the comments conception below.

1 year ago

1 year ago

English (US)

English (US)