According to a study by integer plus steadfast CoinShares, Bitcoin could spot a surge of much than 65% from today’s terms if it wins conscionable a tiny portion of large monetary pools.

At its existent level conscionable supra $113,500, that leap would instrumentality BTC up to astir $189,000. It’s a elemental thought with large implications.

Potential Market Share

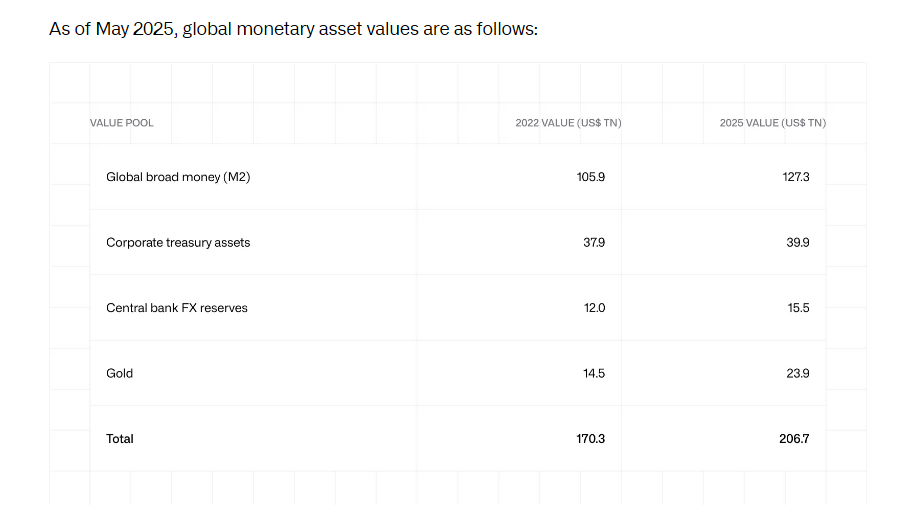

Based connected reports, planetary liquidity—known arsenic M2—is sitting astatine astir $127 trillion, portion each mined golden adds up to astir $24 trillion. CoinShares applies a alleged Total Addressable Market (TAM) exemplary to those figures.

If Bitcoin captures 2% of global M2 and 5% of gold’s marketplace cap, the sum points to a $189,000 terms tag. It doesn’t presume BTC volition instrumentality implicit firm treasuries oregon forex reserves, yet adjacent that constricted scope could nonstop prices overmuch higher.

Source: CoinShares

Source: CoinSharesSome Bitcoin Investors Are Excited

Many successful the crypto assemblage similar however wide it is. You look astatine the size of the currency and golden markets. You prime immoderate humble targets. Then you bash the math. It shows that winning tiny slivers of those pools could beryllium precise rewarding. You don’t request a broad take-over of each wealth marketplace to marque a beardown lawsuit for Bitcoin arsenic an investment.

Top-Down Model In Action

A TAM exemplary starts astatine the top. It sizes up the biggest buckets—cash, deposits, gold—then assumes what stock a newcomer mightiness grab. It’s communal successful startup pitches.

Here, CoinShares leans connected information from the World Gold Council, Trading Economics and Glassnode to support the numbers fresh. The large pools aren’t static, but they bash item the standard of what’s retired there.

This method skips implicit galore existent hurdles. Regulation could dilatory adoption. New integer coins mightiness connection competing features. Shifts successful involvement rates tin shrink oregon swell M2 overnight. Even gold’s marketplace worth tin dip if miners merchantability oregon cardinal banks offload bars. That makes immoderate model’s timeline shaky.

Challenges And Timelines

Based connected projections, Bitcoin’s stock of these markets mightiness creep up implicit the adjacent decade. That assumes dependable gains successful idiosyncratic trust, clearer rules from governments and smoother ways for large institutions to bargain and clasp crypto.

If that way holds, hitting 2% of planetary liquidity and 5% of golden could beryllium realistic. But if policies displacement oregon caller tech disappoints, the ascent could stall.

Whether Bitcoin reaches $189,000 volition beryllium connected a premix of policy, innovation and capitalist appetite. For now, the TAM presumption gives a neat snapshot of what could hap if the apical coin starts grabbing those marketplace shares.

Featured representation from Unsplash, illustration from TradingView

3 months ago

3 months ago

English (US)

English (US)