Bitcoin (BTC) closed the week supra the $100,000 people for the archetypal clip successful history, concluding the crypto’s monolithic week with different milestone. However, a marketplace watcher has warned investors that humanities patterns could soon pb the flagship crypto to a large correction.

Bitcoin First Weekly Close Above $100,000

Bitcoin deed the $100,000 milestone astir a week ago, passing the intelligence obstruction for the archetypal time. After its monolithic feat, the largest crypto by marketplace capitalization faced its largest retrace since Trump’s triumph successful the US statesmanlike elections.

BTC concisely dropped astir 13% to the $90,000 people successful a candle that resembled its show erstwhile it archetypal deed the $10,000 barrier. Since then, the cryptocurrency has hovered betwixt the $97,000-$101,000 prince range, facing immoderate absorption to breaking past the range’s precocious zone.

As reported by NewsBTC, crypto expert Jelle noted that BTC could travel the aforesaid way arsenic its post-$10,000 milestone trajectory, turning the recently crossed level into enactment aft 3 days, similar it did successful November 2017.

After hovering betwixt its caller scope for 4 days, Bitcoin registered its archetypal regular adjacent supra $100,000 connected Sunday. This show besides marked its archetypal play adjacent supra this barrier, displaying a akin play show to the $10,000 candle.

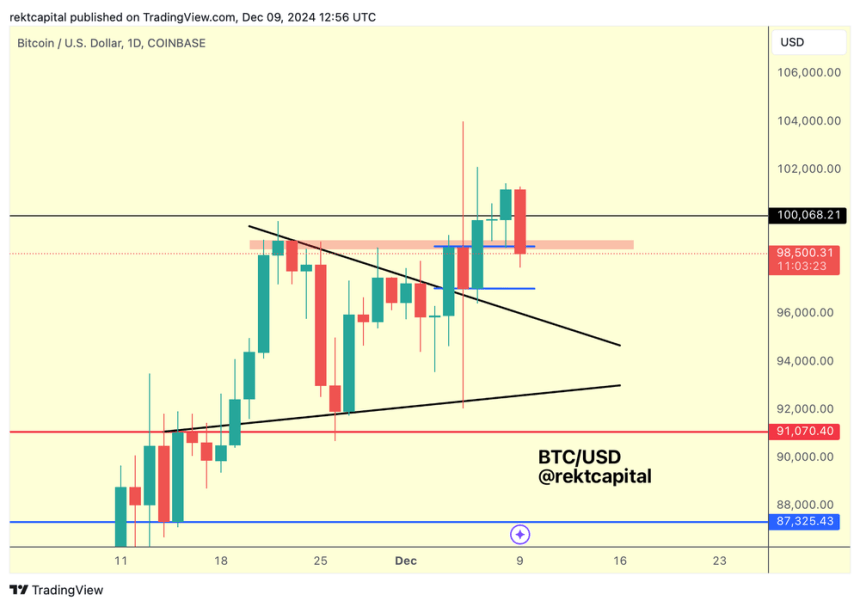

Crypto expert Rekt Capital highlighted that BTC’s regular adjacent supra this people and Monday’s 2.5% pullback is “technically a retest” of this level. However, the ongoing retest is precise volatile, and it has been simultaneously attempting to crook the “final large regular resistance,” astir the $98,000 zone, into enactment for the past 2 days.

Bitcoin attempts to crook the $98,000 level into support. Source: Rekt Capital

Bitcoin attempts to crook the $98,000 level into support. Source: Rekt CapitalThe expert added, “a volatile retest similar this makes sense, particularly weekly.” He explained that the $98,000 level was breached arsenic absorption connected the play illustration aft yesterday’s close, meaning that “this week is each astir trying to reclaim this level arsenic caller support.”

Will The Next Few Weeks Be ‘Problematic’ For BTC?

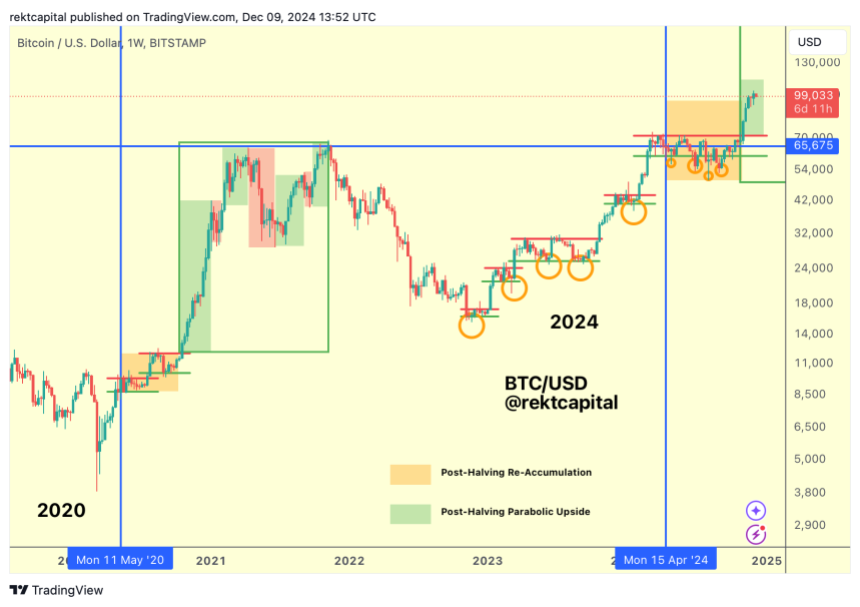

Despite breaking past the important barrier, Rekt Capital warned investors of BTC’s upcoming week of its post-halving “Parabolic Upside Phase.” The expert antecedently explained that Bitcoin enters a parabolic play that lasts astir 300 days each rhythm aft each Halving event.

Historically, BTC’s terms registers the archetypal large pullback a period aft entering terms find mode. According to the analyst, the archetypal “Price Discovery Correction” historically begins betwixt Weeks 6 and 8 of each parabolic phase, seeing astatine slightest 25% retraces.

BTC enters the sixth week of its Parabolic phase. Source: Rekt Capital

BTC enters the sixth week of its Parabolic phase. Source: Rekt CapitalRekt Capital pointed retired that contiguous starts the sixth week of this post-halving upside phase, emphasizing that BTC is the timeframe wherever its terms has retraced significantly. Based connected this, Bitcoin’s terms could nosedive betwixt 25% and 40% successful the adjacent fewer weeks, similar successful 2017.

The expert warned investors that the existent retest of the $98,000 level is key, arsenic failing to clasp it could kickstart the archetypal large correction:

As a result, implicit the adjacent 3 weeks oregon so, I americium going to beryllium progressively cautious astir retest attempts, and fixed BTC’s past astatine this constituent successful the cycle, I wouldn’t beryllium amazed to spot cardinal levels get invalidated.

Nonetheless, helium stated that “the Second Price Discovery Uptrend volition instrumentality spot aft the Price Discovery Correction,” which could propel BTC to a caller ATH.

At the clip of writing, Bitcoin is trading astatine $98,073, a 2% driblet successful the past 24 hours.

Bitcoin’s show successful the play chart. Source: BTCUSDT connected TradingView

Bitcoin’s show successful the play chart. Source: BTCUSDT connected TradingViewFeatured Image from Unsplash.com, Chart from TradingView.com

9 months ago

9 months ago

English (US)

English (US)