Bitcoin (BTC) fell beneath $111,000 during the overnight trade, reversing Friday's spike caused by Fed Chair Powell's dovish speech, arsenic a whale sold into illiquid marketplace conditions.

The cryptocurrency's terms fell by implicit 2% from $114,666 to $112,546 successful nether 10 minutes to 07:40 UTC. The alleged flash clang occurred erstwhile a azygous whale sold 24,000 BTC, worthy implicit $300 million, according to blockchain information steadfast Timechainindex.com.

"This entity liquidated their full 24,000 balance, sending each of it to Hyperunite. They transferred 12,000 conscionable contiguous and are inactive actively selling, which is apt contributing to the ongoing terms drop," the firm's researcher Sani said connected X, adding that the whale inactive holds a full of 152,874 BTC crossed each associated addresses, including 5,266 BTC.

"The funds primitively came from HTX astir six years agone and had remained inactive until caller transactions involving 1 of their addresses containing astir 24,000 BTC," Sani noted.

Prices yet deed lows nether $111,000 earlier recovering to commercialized adjacent $112,800 arsenic of writing, according to CoinDesk data.

Powel spike reversed

The terms driblet has erased gains seen aft Friday, aft the Fed Chair Jerome Powell appeared to enactment the thought of complaint cuts, portion playing down the semipermanent inflationary interaction of President Trump's tariffs during his yearly code astatine Jackson Hole.

The alleged dovish code saw BTC rally astir 4% from $112,500 to $116,900 alongside a risk-on rally successful U.S. stocks and the diminution successful the dollar index.

Over the weekend, the expert community expressed confidence that a complaint chopped would hap successful September, perchance starring to caller all-time highs successful bitcoin and ether.

Options disagree

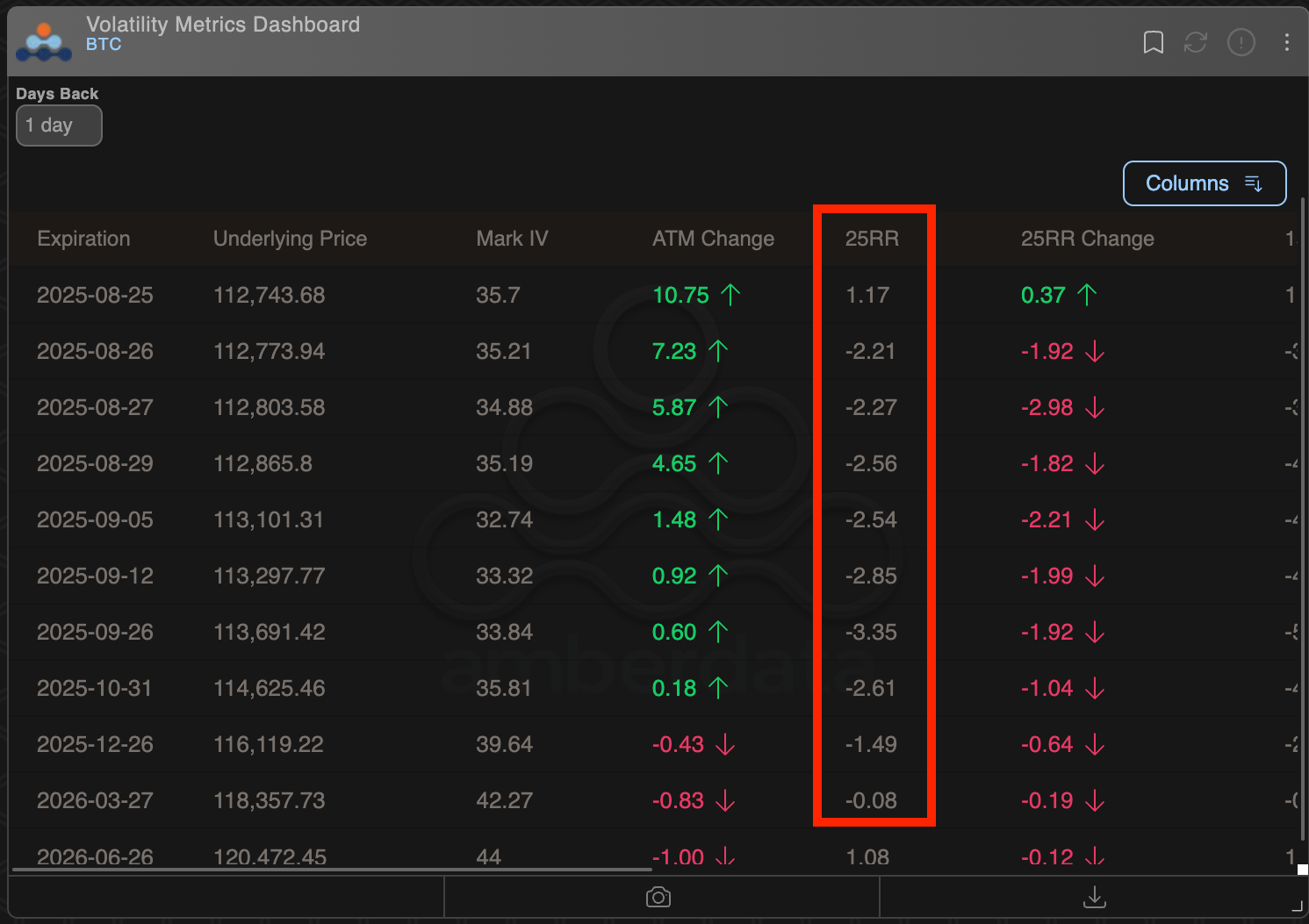

The Deribit-listed bitcoin options uncover a lingering hazard aversion, according to information tracked by Amberdata.

Specifically, the 25-delta hazard reversals, a measurement of capitalist sentiment comparing calls to puts, proceed to commercialized successful the antagonistic territory done the December expiry, reflecting hedging enactment and a bearish title.

A antagonistic hazard reversal means that enactment options, which connection security against terms declines, are much costly than telephone options.

In different words, contempt the alleged dovish pivot by Powell, BTC options traders proceed to terms successful uncertainty, bracing for a imaginable downside volatility.

Read more: Asia Morning Briefing: Bitcoin’s ETFs Kill the Transaction Fees, Punishing the Miners More

2 months ago

2 months ago

English (US)

English (US)