By James Van Straten (All times ET unless indicated otherwise)

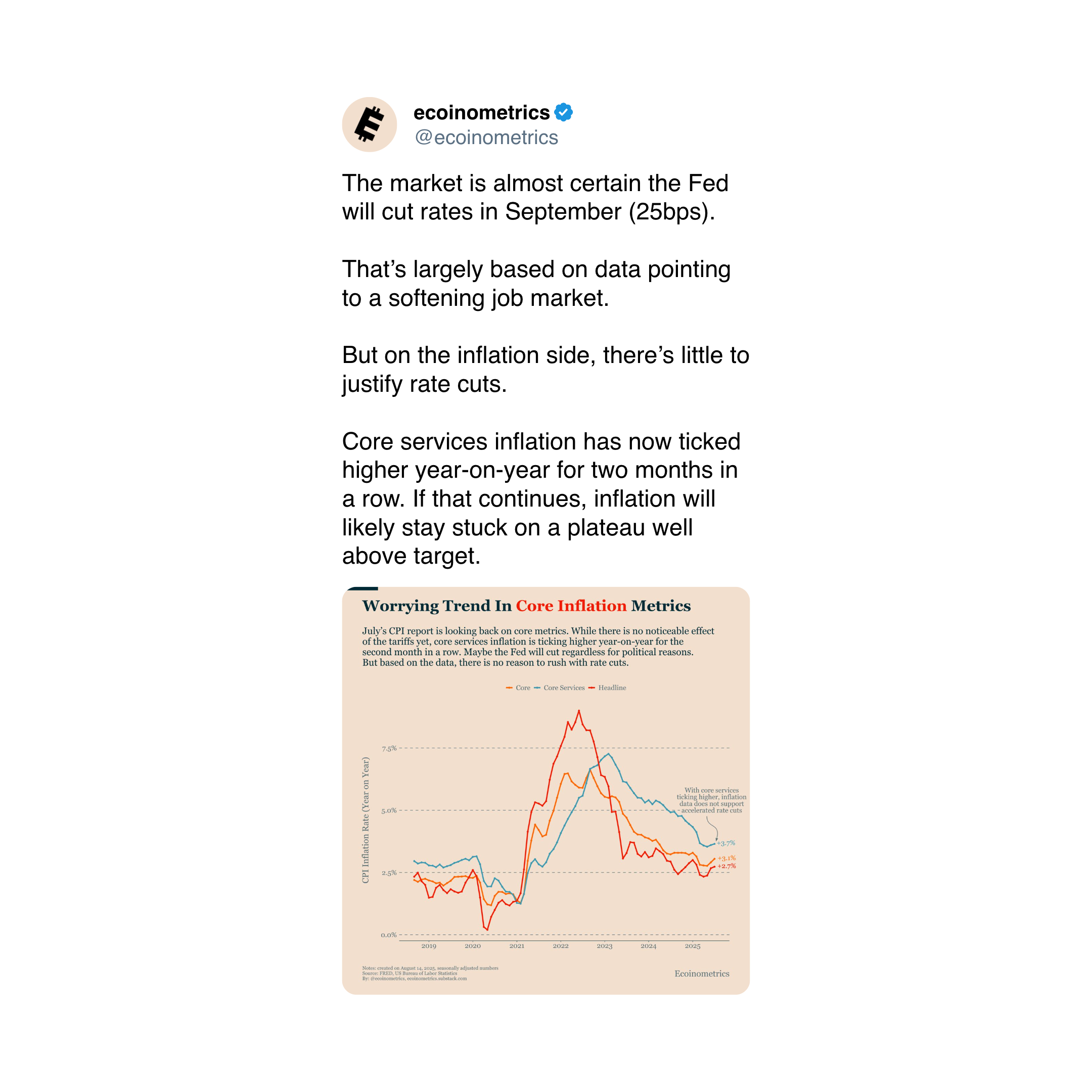

Bitcoin's (BTC) flirt with a grounds precocious $124,000 connected Thursday was followed by a driblet that led to it closing past weekend's CME gap astatine $117,600 aft hotter-than-expected PPI inflation information and Treasury Secretary Scott Bessent’s evident flip-flop connected bitcoin purchases for a strategical reserve.

The spread occurs due to the fact that CME hours for BTC futures don't lucifer bitcoin's 24/7 trading. When the futures marketplace is closed implicit the weekend, bitcoin's movements tin make a discontinuity successful prices connected the CME chart. While filling the spread is simply a recurring signifier successful marketplace behavior, there's not warrant it volition instrumentality place.

Bitcoin has present acceptable 4 all-time highs successful 2025. Importantly, the magnitude of pullbacks pursuing these peaks has been shrinking. After it deed $109,000 successful January, BTC fell 30% to $76,000 by April. In May, the $112,000 precocious was followed by a 12% driblet successful June. July’s $123,000 highest led to a 9% decline. Most recently, August’s $124,000 precocious has truthful acold seen lone a 7% percent pullback, though we're lone 1 time in.

Looking ahead, Friday’s U.S. retail income study is forecast astatine 0.7% month-over-month, which would people the strongest speechmaking since March. A stronger-than-expected fig could further undermine expectations for a September complaint cut.

Further out, attraction turns to the extremity of August erstwhile $12 cardinal successful bitcoin options are acceptable to expire connected Deribit. The bulk of unfastened telephone options are concentrated betwixt the $120,000 and $124,000 onslaught prices, suggesting that if bitcoin trades adjacent these levels, it would align with the positioning of galore derivatives traders. Stay alert!

What to Watch

- Crypto

- Aug. 15: Record day for the next FTX distribution to holders of allowed Class 5 Customer Entitlement, Class 6 General Unsecured and Convenience Claims who conscionable pre-distribution requirements.

- Aug. 18: Coinbase Derivatives volition launch nano SOL and nano XRP U.S. perpetual-style futures.

- Aug. 20: Qubic (QUBIC), the fastest blockchain ever recorded, volition acquisition its archetypal yearly halving event arsenic portion of a controlled emanation model. Although gross emissions stay fixed astatine 1 trillion QUBIC tokens per week, the adaptive pain complaint volition summation substantially — burning immoderate 28.75 trillion tokens and reducing nett effectual emissions to astir 21.25 trillion tokens.

- Macro

- Aug. 15, 3 p.m.: U.S. President Donald Trump and Russian President Vladimir Putin volition meet successful Alaska to sermon imaginable bid presumption for the warfare successful Ukraine.

- Aug. 15, 12 p.m.: Colombia's National Administrative Department of Statistics (DANE) releases Q2 GDP maturation data.

- GDP Growth Rate QoQ Prev. 0.8%

- GDP Growth Rate YoY Est. 2.6% vs. Prev. 2.7%

- Aug. 15, 4 p.m.: Peru’s National Institute of Statistics and Informatics releases June GDP YoY maturation data.

- GDP Growth Rate YoY Est. 4.7 vs. Prev. 2.67%

- Aug. 18, 6 p.m.: The Central Reserve Bank of El Salvador releases July shaper terms ostentation data.

- PPI YoY Prev. 1.29%

- Earnings (Estimates based connected FactSet data)

Token Events

- Governance votes & calls

- SoSoValue DAO is voting to allocate 5 cardinal SOSO tokens for a Researcher Ecosystem Fund aimed astatine boosting top-tier crypto probe done competitions and incentives, improving contented quality, transparency and SOSO’s utility. Voting ends Aug. 18.

- Uniswap DAO is voting to allocate $540,000 successful UNI over six months to arsenic galore arsenic 15 apical delegates, with up to $6,000 a period based connected voting activity, assemblage engagement, connection authorship and holding 1,000+ UNI. Voting ends Aug. 18

- Aavegotchi DAO is voting connected a Bitcoin Ben’s Crypto Club Las Vegas sponsorship: a $1,000/month firm rank (logo connected sponsor wall, squad access, newsletter feature, 1 branded meetup/month) oregon a $5,000, 90-day Graffiti Wall mural with promo. Voting ends Aug. 23.

- Unlocks

- Aug. 15: Avalanche (AVAX) to unlock 0.33% of its circulating proviso worthy $41.84 million.

- Aug. 15: Starknet (STRK) to unlock 3.53% of its circulating proviso worthy $18.12 million.

- Aug. 15: Sei (SEI) to unlock 0.96% of its circulating proviso worthy $18.94 million.

- Aug. 16: Arbitrum (ARB) to unlock 1.8% of its circulating proviso worthy $49.95 million.

- Aug. 18: Fasttoken (FTN) to unlock 4.64% of its circulating proviso worthy $91.6 million.

- Aug. 20: LayerZero (ZRO) to unlock 8.53% of its circulating proviso worthy $57.59 million.

- Aug. 20: Kaito (KAITO) to unlock 8.82% of its circulating proviso worthy $27.55 million.

- Token Launches

- Aug. 15: PublicAI (PUBLIC) launches connected Bitget, Binance Alpha, KuCoin and LBank.

- Aug. 15: Pepecoin (PEP) launches connected AscendEX.

Conferences

The CoinDesk Policy & Regulation conference (formerly known arsenic State of Crypto) is simply a one-day boutique lawsuit held successful Washington connected Sept. 10 that allows wide counsels, compliance officers and regulatory executives to conscionable with nationalist officials liable for crypto authorities and regulatory oversight. Space is limited. Use codification CDB10 for 10% disconnected your registration done Aug. 31.

- Day 4 of 7: Ethereum NYC (New York)

- Day 2 of 2: CryptoWinter ‘25 (Queenstown, New Zealand)

- Aug. 15: Bitcoin Educators Unconference (Vancouver)

- Aug. 17-21: Crypto 2025 (Santa Barbara, California)

- Aug. 18-21: Wyoming Blockchain Symposium 2025 (Jackson Hole)

- Aug. 21-22: Coinfest Asia 2025 (Bali, Indonesia)

Token Talk

By Oliver Knight

- The crypto marketplace driblet successful the past 24 hours sparked astir $1 cardinal worthy of liquidations, with the bulk occurring connected ETH trading pairs, according to Coinglass data.

- Ether is trading backmost astatine $4,630 portion a fig of altcoins similar TIA, CRV and OP each mislaid much than 7%.

- One asset, however, stood out: AERO roseate 4.5% contempt relentless waves of selling unit and liquidations.

- AERO is the autochthonal token of decentralized speech Aerodrome, which precocious benefited from integration with Coinbase, allowing the exchange's lawsuit basal to commercialized straight connected the DEX via the Coinbase app.

- Trading measurement connected Aerodrome jumped arsenic a result, with $1.1 cardinal worthy of crypto changing hands to people the DEX's largest time since February, according to DefiLlama.

- Aerodrome is the largest autochthonal portion of the Base ecosystem, with $612 cardinal successful full worth locked (TVL).

- The lone different protocols with a higher totals are Morpho and Aave, some of which are distributed crossed aggregate blockchains portion Aerodrome is connected Base alone.

Derivatives Positioning

- Open involvement (OI) crossed apical derivatives venues remains elevated, with bitcoin (BTC) sitting astatine $32.5 billion, conscionable shy of its all-time high. Bitcoin OI is led by Binance ($13.8 billion) and Bybit ($9.3 billion).

- The elevated unfastened involvement is supported by dependable gains successful BTC three-month annualized basis, presently 8%-9% crossed each exchanges, according to Velo data. Compared with fourth-quarter 2024 levels of 15%, determination is inactive country to grow.

- In options, implied volatility (IV) crossed antithetic enactment maturities is upward sloping (contango), with near-term IV debased astatine astir 20% , Velo information show. The enactment rises toward 50% for maturities successful mid 2026, a motion of expanding uncertainty further out.

- Looking astatine the past day's flows for puts vs calls, the ratio is 50:50, implying nary utmost directional bias astatine the moment.

- Funding complaint APRs crossed large perpetual swap venues are muted astatine astir an annualized 5%-7%, pulling backmost from the elevated levels seen successful the tally up to bitcoin's grounds precocious connected Thursday.

- This signifier suggests that the rally was mostly spot driven, with an influx of shorts helping offset agelong demand. With backing present comparatively low, determination is country for caller leveraged longs to participate the market, perchance adding momentum to the adjacent move.

- Coinglass information shows $960 cardinal successful 24 hr liquidations, skewed 85% towards longs. ETH ($342 million), BTC ($162 million) and others ($116 million) were the leaders successful presumption of notional liquidations. Binance liquidation heatmap indicates $117,091 arsenic a halfway liquidation level to monitor, successful lawsuit of further terms drops.

Market Movements

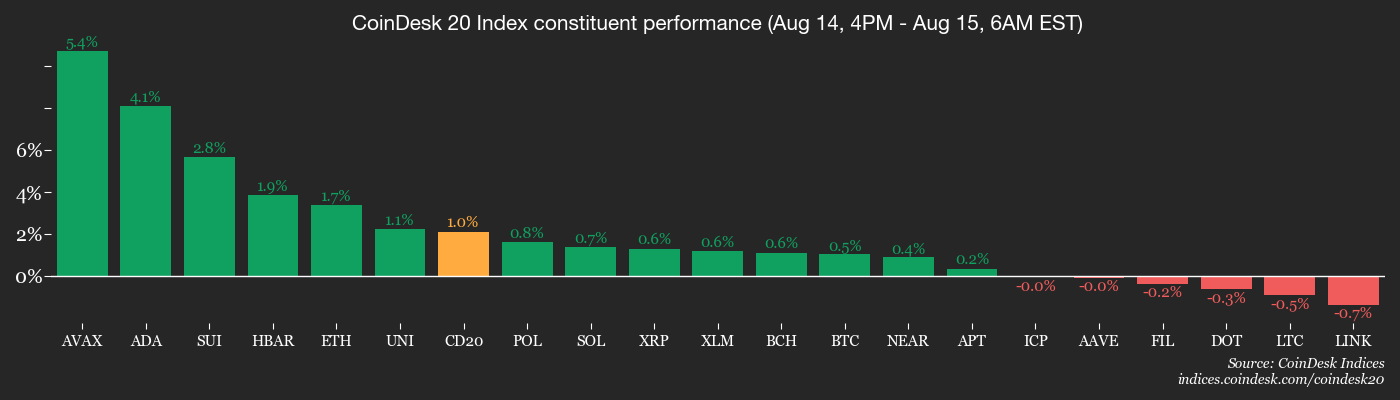

- BTC is up 0.68% from 4 p.m. ET Thursday astatine $118,739.67 (24hrs: -1.67%)

- ETH is up 1.9% astatine $4,622.44 (24hrs: -1.58%)

- CoinDesk 20 is up 1.33% astatine 4,257.98 (24hrs: -2.78%)

- Ether CESR Composite Staking Rate is up 1 bp astatine 3.05%

- BTC backing complaint is astatine 0.0082% (8.9976% annualized) connected Binance

- DXY is down 0.37% astatine 97.89

- Gold futures are up 0.16% astatine $3,388.50

- Silver futures are down 0.52% astatine $37.87

- Nikkei 225 closed up 1.71% astatine 43,378.31

- Hang Seng closed down 0.98% astatine 25,270.07

- FTSE is unchanged astatine 9,181.53

- Euro Stoxx 50 is up 0.42% astatine 5,457.44

- DJIA closed connected Thursday unchanged astatine 44,911.26

- S&P 500 closed unchanged astatine 6,468.54

- Nasdaq Composite closed unchanged astatine 21,710.67

- S&P/TSX Composite closed down 0.28% astatine 27,915.99

- S&P 40 Latin America closed down 1.16% astatine 2,653.40

- U.S. 10-Year Treasury complaint is down 0.2 bps astatine 4.291%

- E-mini S&P 500 futures are unchanged astatine 6,493.75

- E-mini Nasdaq-100 futures are down 0.2% astatine 23,883.00

- E-mini Dow Jones Industrial Average Index are up 0.64% astatine 45,283.00

Bitcoin Stats

- BTC Dominance: 59.4% (-0.42%)

- Ether-bitcoin ratio: 0.03901 (1.5%)

- Hashrate (seven-day moving average): 908 EH/s

- Hashprice (spot): $58.40

- Total fees: 4.33 BTC / $519,718

- CME Futures Open Interest: 140,870 BTC

- BTC priced successful gold: 35.7 oz.

- BTC vs golden marketplace cap: 10.08%

Technical Analysis

- Bitcoin dominance precocious fell beneath the cardinal humanities level of 60%.

- In the past, specified drops person often preceded important altcoin rallies. However, fixed the existent deficiency of a beardown catalyst for a full-fledged altcoin season, the cardinal question is the imaginable severity of the drop.

- The existent level suggests that a selective oregon insignificant 'alt season' is underway. It does not yet connote a major, market-wide displacement successful the mode erstwhile cycles have.

Crypto Equities

- Strategy (MSTR): closed connected Thursday astatine $372.94 (-4.35%), unchanged successful pre-market

- Coinbase Global (COIN): closed astatine $324.89 (-0.65%), +0.11% astatine $325.25

- Circle (CRCL): closed astatine $139.23 (-9.1%), -1.61% astatine $136.99

- Galaxy Digital (GLXY): closed astatine $28.57 (+0.81%), -0.25% astatine $28.50

- Bullish (BLSH): closed astatine $74.63 (+9.75%), +1.73% astatine $75.99

- MARA Holdings (MARA): closed astatine $15.75 (-0.69%), -0.13% astatine $15.73

- Riot Platforms (RIOT): closed astatine $12.25 (+5.69%), -1.14% astatine $12.11

- Core Scientific (CORZ): closed astatine $13.84 (-0.11%), -0.61% astatine $13.75

- CleanSpark (CLSK): closed astatine $9.95 (-0.2%), +0.3% astatine $9.98

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $26.97 (+5.76%)

- Semler Scientific (SMLR): closed astatine $35.13 (-1.24%), unchanged successful pre-market

- Exodus Movement (EXOD): closed astatine $26.85 (-1.79%), +8.01% astatine $29

- SharpLink Gaming (SBET): closed astatine $23.49 (-0.13%), -0.17% astatine $23.45

ETF Flows

Spot BTC ETFs

- Daily nett flows: $230.8 million

- Cumulative nett flows: $54.97 billion

- Total BTC holdings ~1.29 million

Spot ETH ETFs

- Daily nett flows: $639.6 million

- Cumulative nett flows: $12.75 billion

- Total ETH holdings ~6.27 million

Source: Farside Investors

Chart of the Day

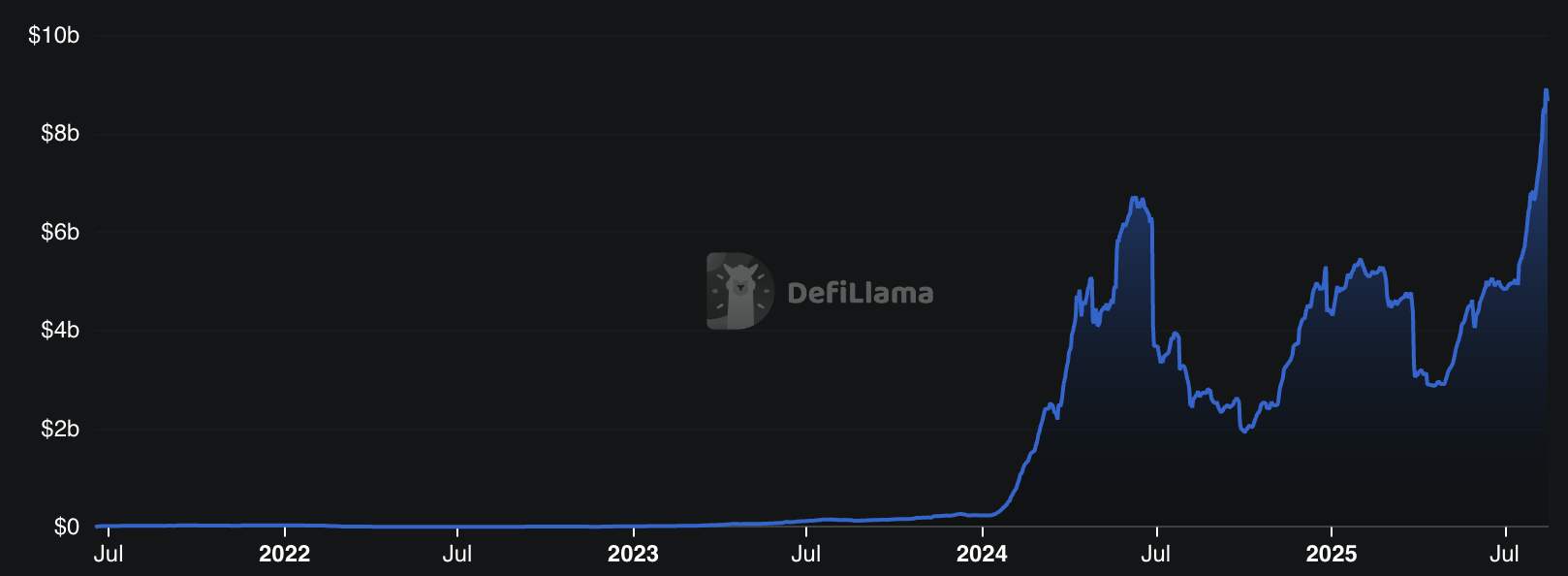

- The full worth locked (TVL) connected yield-trading level Pendle has surged past the $8 cardinal mark, representing a astir 30% summation this period and positioning it arsenic the ninth largest protocol by TVL.

- The bulk of the maturation has taken spot connected the Ethereum blockchain.

- A cardinal origin driving maturation is its adjacent narration with Ethena's stablecoin. Some 68% of Pendle's TVL is tied to USDe and sUSDe, making the protocol a nonstop proxy for the maturation of Ethena's ecosystem and a stake connected the continued enlargement of high-yield, stablecoin-based strategies successful the market.

While You Were Sleeping

- Altcoin Season Could Begin successful September arsenic Bitcoin’s Grip connected Crypto Market Weakens: Coinbase Institutional (CoinDesk): Investor rotation into altcoins could accelerate successful September, fueled by declining bitcoin dominance, amended liquidity for alternate tokens and improving hazard appetite, Coinbase Institutional’s David Duong said.

- Circle to Offer 10 Million Class A Shares astatine $130 Each (CoinDesk): The stablecoin issuer is selling 2 cardinal shares successful a secondary offering, portion insiders are offloading the different 8 cardinal astatine implicit 4 times the terms of the June IPO.

- Hong Kong Regulator Tightens Custody Standards for Licensed Crypto Exchanges (CoinDesk): The SFC acceptable minimum standards for elder absorption responsibility, acold wallet operations, third-party wallet solutions and real-time menace monitoring aft uncovering cyber and asset-protection weaknesses astatine immoderate licensed platforms.

- Crypto Group Backed by Trump Sons Hunts for Bitcoin Companies successful Asia (Financial Times): U.S.-based miner American Bitcoin, co-founded by Eric Trump, is reportedly pursuing listed firms successful Japan and Hong Kong to person into bitcoin-treasury vehicles, seeking to spark request done stock-market exposure.

- China’s Economy Slows Broadly Even arsenic Exports Keep Rising (The New York Times): China’s statistic bureau linked July’s slowdown successful retail sales, mill output and fixed-asset concern chiefly to escalating commercialized frictions, which its main economist characterized arsenic protectionism and unilateralism.

- Japan’s Economy Records Modest Growth Despite Trade Uncertainty (The Wall Street Journal): Second-quarter GDP roseate 0.3%, but economists pass automakers’ prolonged absorption of U.S. tariff costs could compression profits, curb wage maturation and dent household spending.

In the Ether

2 months ago

2 months ago

English (US)

English (US)