Despite the broader marketplace situation induced by the U.S. indebtedness ceiling issue, Bitcoin and commodities, peculiarly golden and silver, person demonstrated notable show since the commencement of 2023.

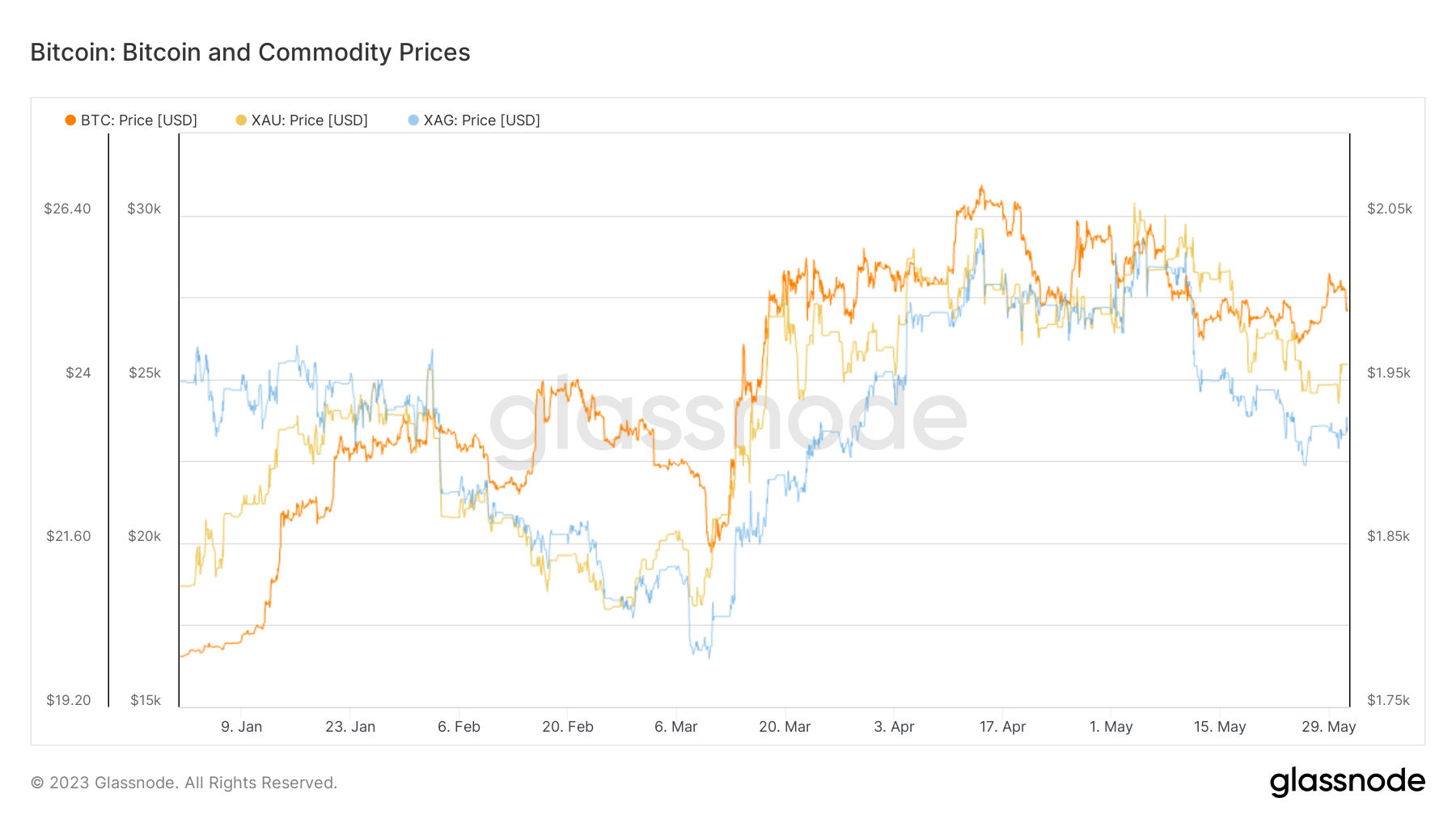

Graph showing the YTD terms of BTC, XAU, and XAG connected May 31 (Source: Glassnode)

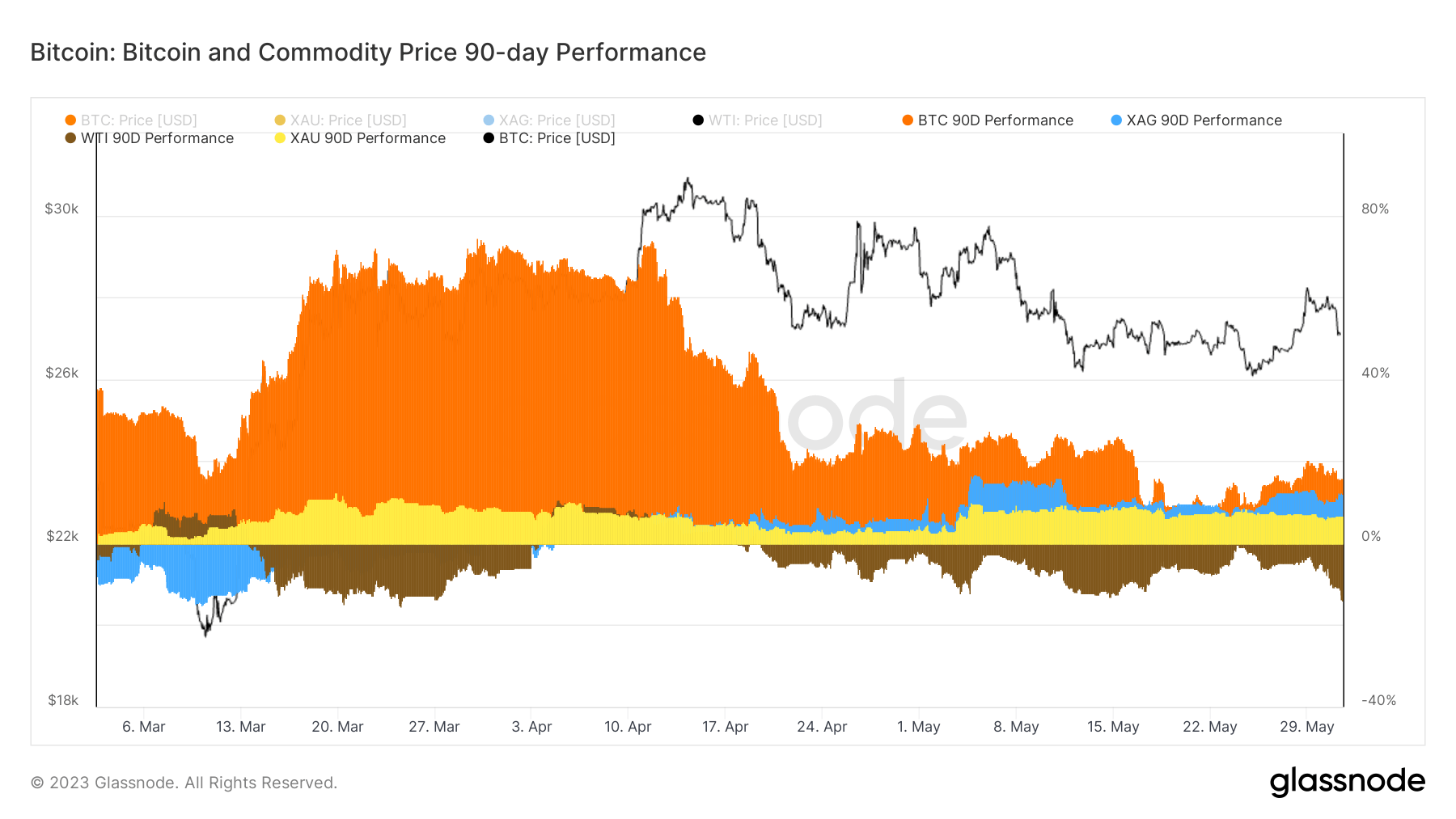

Graph showing the YTD terms of BTC, XAU, and XAG connected May 31 (Source: Glassnode)Over the past 90 days, Bitcoin has recorded a 15.85% increase, outperforming silver’s 12.41% emergence and gold’s 6.82% gain.

Graph showing the 90-day show for BTC, XAU, XAG, and WTI connected May 31 (Source: Glassnode)

Graph showing the 90-day show for BTC, XAU, XAG, and WTI connected May 31 (Source: Glassnode)However, the observed dilatory and dependable returns of Bitcoin should not beryllium misconstrued arsenic an indicator of an impending unchangeable market.

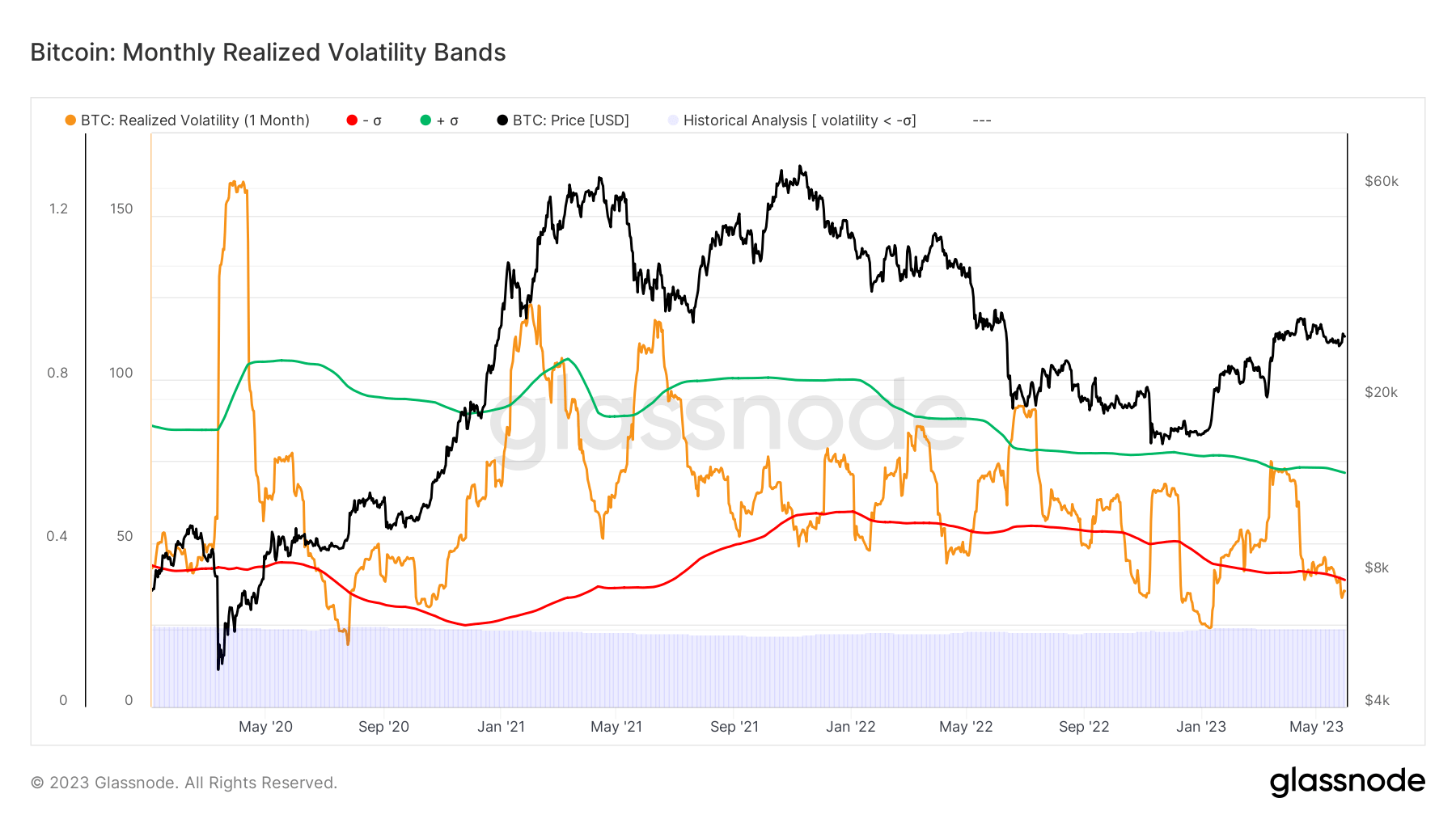

Bitcoin’s monthly realized volatility, a metric reflecting the grade of saltation oregon dispersion of an asset’s returns implicit a month, has dropped to 34.1%, slipping beneath the little bounds of the 1-standard deviation Bollinger Band.

Bollinger Bands are a method investigation instrumentality that plots a acceptable scope astir an asset’s price, with wider bands indicating higher volatility and vice versa. A driblet beneath the little set whitethorn awesome an upcoming correction oregon reversal.

Graph Bitcoin’s Monthly Realized Volatility bands from 2020 to 2023 (Source: Glassnode)

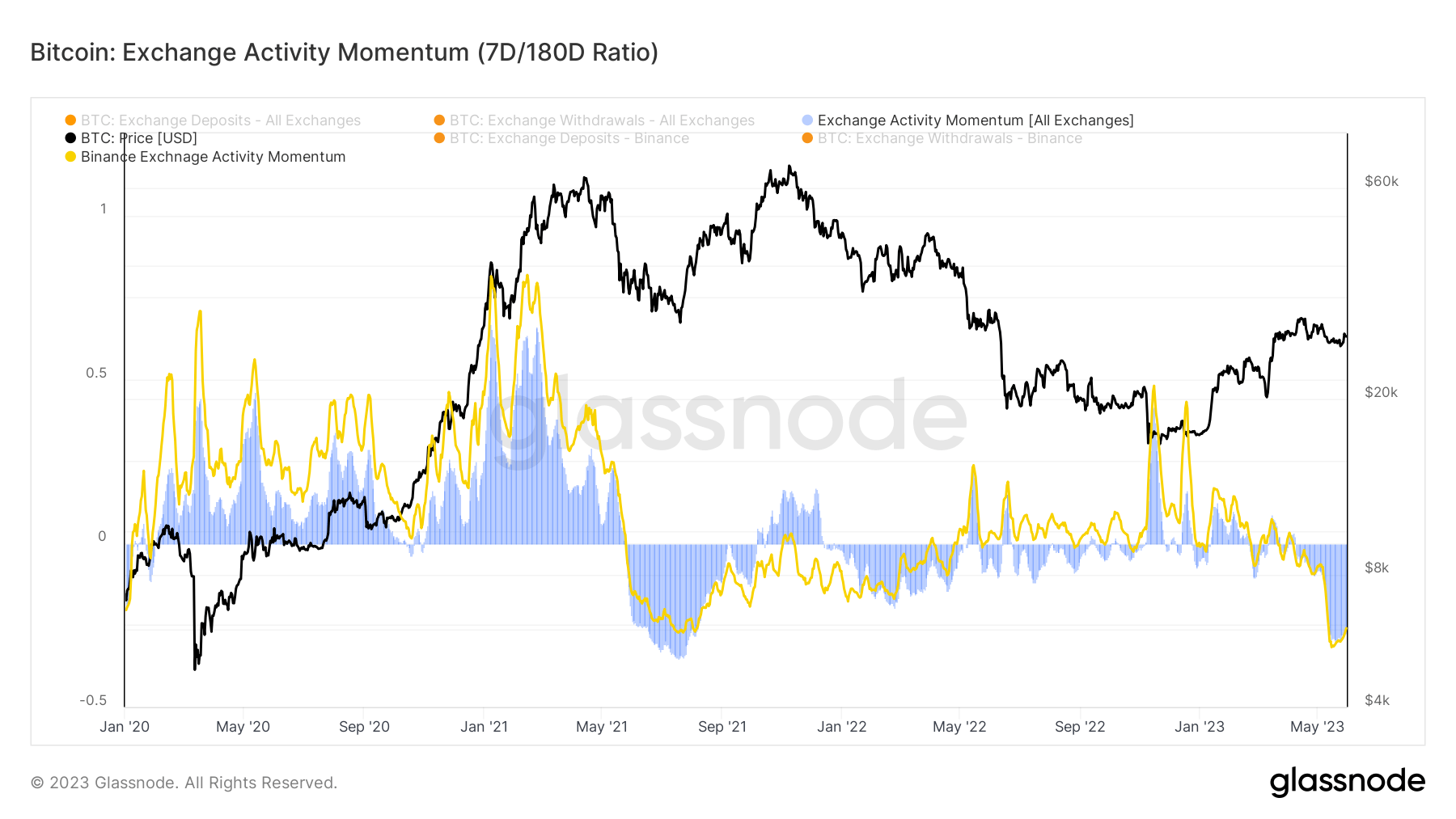

Graph Bitcoin’s Monthly Realized Volatility bands from 2020 to 2023 (Source: Glassnode)The slowing down of Bitcoin’s marketplace enactment is further substantiated by the momentum seen successful speech activity. Glassnode calculates this metric by comparing the existent week’s mean fig of speech deposit/withdrawal transactions to the median of specified transactions implicit the preceding six months, creating an enactment ratio.

A caller 27.3% simplification successful this ratio, compared to the past six months, verifies the inclination of diminishing marketplace participation.

Graph showing Bitcoin’s speech enactment momentum from 2020 to 2023 (Source: Glassnode)

Graph showing Bitcoin’s speech enactment momentum from 2020 to 2023 (Source: Glassnode)These 2 factors – debased capitalist enactment and decreased monthly realized volatility – overgarment a representation of a dormant, level market. However, according to Glassnode, specified low-volatility periods represent lone 19.3% of Bitcoin’s marketplace history, suggesting a beardown probability of an incoming volatility surge.

The station Bitcoin outperforms commodities arsenic marketplace gears up for precocious volatility appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)