The vacation tone failed to bring immoderate stableness to the crypto market, with Bitcoin seeing its terms driblet from $97,300 connected Dec. 22 to $94,800 connected Dec. 24. Christmas Day saw a flimsy recovery, but Bitcoin consolidated backmost to $98,000 arsenic it met important absorption supra $99,000.

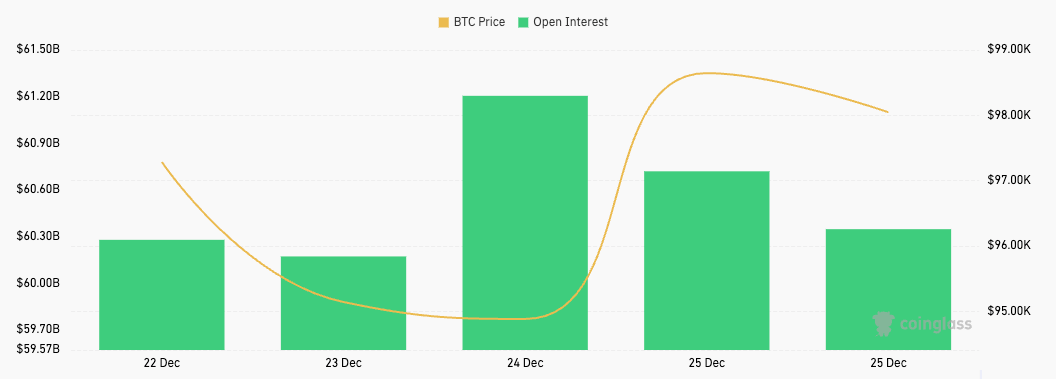

This terms volatility was accompanied by adjacent volatility successful the derivatives market. The futures marketplace maintained comparatively unchangeable unfastened interest, ranging from $60 cardinal to $61 cardinal during the aforesaid period, with a diminution from $61.21 cardinal to $60.35 cardinal connected Dec. 25.

Chart showing the full unfastened involvement for Bitcoin futures from Dec. 22 to Dec. 25, 2024 (Source: CoinGlass)

Chart showing the full unfastened involvement for Bitcoin futures from Dec. 22 to Dec. 25, 2024 (Source: CoinGlass)This alteration successful futures OI alongside rising prices suggests that traders are closing retired leveraged agelong positions to instrumentality profits and trim their appetite for leverage arsenic the terms increases. The timing of this driblet successful OI, occurring supra the intelligence $98,000 level, shows profit-taking and de-risking by leveraged traders.

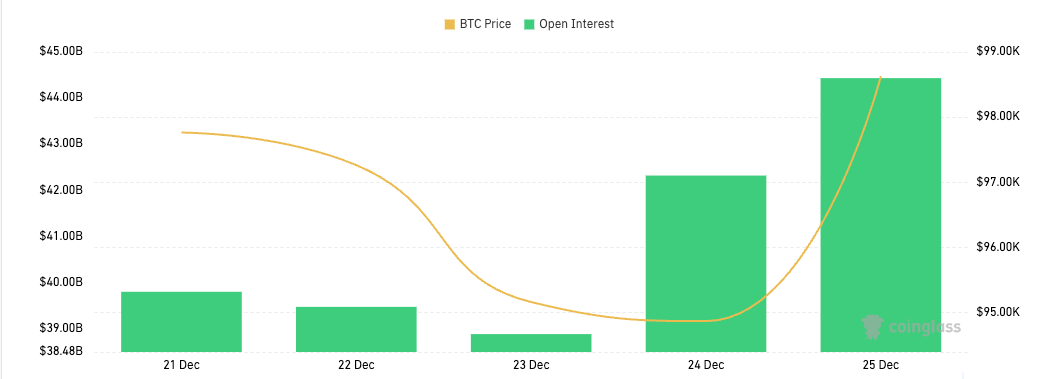

In contrast, the options marketplace has shown rather a spot of spot successful the past respective days, with OI expanding from $39.47 cardinal to $44.43 billion, representing a 12.6% rise. CoinGlass information shows options sentiment leans decidedly bullish, with calls dominating some unfastened involvement (63.58% versus 36.42% puts) and measurement (57.22% versus 42.78% puts). This organisation of options positioning powerfully suggests traders are anticipating further upside potential.

Chart showing the full unfastened involvement for Bitcoin options from Dec. 21 to Dec. 25, 2024 (Source: CoinGlass)

Chart showing the full unfastened involvement for Bitcoin options from Dec. 21 to Dec. 25, 2024 (Source: CoinGlass)The divergence betwixt futures and options OI indicates a alteration successful marketplace hazard appetite. Rather than representing axenic deleveraging, this displacement suggests traders are becoming much nuanced successful their attack to marketplace exposure. Data shows traders are dilatory moving distant from high-leverage, unlimited-risk futures positions successful favour of defined-risk options strategies that connection akin vulnerability imaginable with superior hazard management. This behaviour is particularly notable astatine higher terms levels, wherever downside hazard becomes much pronounced.

Professional traders are the ones driving these marketplace shifts arsenic they typically similar options for precise hazard absorption and presumption sizing with nonstop maximum nonaccomplishment parameters. The maturation successful options activity, peculiarly with analyzable strategies similar spreads and straddles, indicates expanding organization information and wide marketplace maturation. And portion the futures marketplace is inactive importantly larger than options, the maturation we’ve seen successful options shows traders are processing much precocious hazard absorption strategies arsenic the marketplace infrastructure improves.

This has important implications for terms and liquidity. With little nonstop liquidation hazard from futures and much gamma-driven terms enactment from options, we whitethorn spot slower, much controlled upward moves, though crisp terms movements stay imaginable if cardinal onslaught prices are breached. The displacement besides affects marketplace depth, with futures markets perchance showing reduced liquidity portion options marketplace makers instrumentality connected larger roles, starring to much analyzable hedging flows successful the spot market.

Despite the mostly steadfast marketplace indicators, determination are ever risks. The precocious implicit levels of some futures ($60+ billion) and options ($44+ billion) unfastened involvement bespeak important marketplace participation, which means imaginable for volatility. The call-heavy positioning could accelerate upside moves and make the hazard of crisp unwinding if the terms drops.

The station Bitcoin options OI hits $44B arsenic futures trading cools appeared archetypal connected CryptoSlate.

9 months ago

9 months ago

English (US)

English (US)