Bitcoin is presently holding conscionable supra the $108,000 level and bulls are maintaining momentum after a volatile commencement to July. However, a person look astatine on-chain information shows however fragile that presumption mightiness be.

Interestingly, 2 enactment levels, $106,738 and $98,566, are present the astir important zones for bulls to defend. These levels correspond clusters of addresses holding ample amounts of Bitcoin, and losing them could trigger a deeper correction.

Bitcoin’s Support Clusters Around $106,000 And $98,000

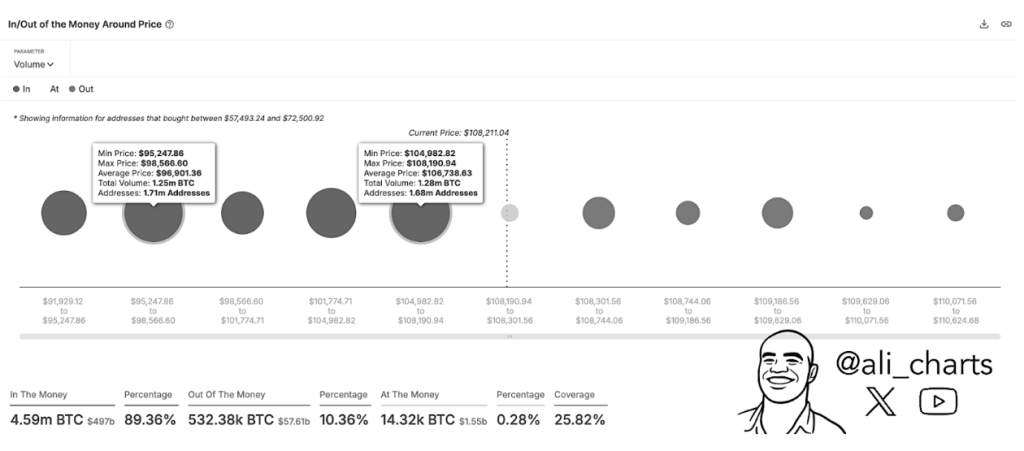

Taking to the societal media level X, crypto expert Ali Martinez pointed to 2 large enactment levels based connected information showing Bitcoin’s acquisition clusters. This information is based connected Sentora’s (previously IntoTheBlock) In/Out of the Money Around Price metric among addresses that bought Bitcoin close to the existent price.

As shown by the metric, the astir important existent zones of acquisition are astatine $106,738 and $98,566. These 2 zones are wherever monolithic buying enactment has occurred successful the past fewer weeks, and they could enactment arsenic enactment successful lawsuit of a Bitcoin terms crash.

The archetypal zone, betwixt $104,982 and $108,190, contains 1.68 cardinal addresses with a full measurement of 1.28 cardinal BTC astatine an mean terms of $106,738. Below the archetypal zone, a larger radical of 1.71 cardinal addresses holds a greater measurement of 1.25 cardinal BTC wrong the terms scope of $95,248 to $98,566, with an mean terms of $98,566.

As agelong arsenic Bitcoin continues to commercialized supra these levels, the ongoing rally could proceed to propulsion upward. However, if these pockets of request are breached with capable selling pressure, the starring cryptocurrency could participate into an uncertain terms portion with small buying involvement to supply support.

Speaking of selling pressure, on-chain information shows a slowing merchantability pressure among ample holders. According to information from on-chain analytics level Sentora, Bitcoin recorded its 5th consecutive week of nett outflows from centralized exchanges. The past week unsocial saw much than $920 cardinal worthy of BTC moved into self-custody oregon organization products, mostly Spot Bitcoin ETFs.

Bitcoin Needs To Break Weekly Resistance For New Highs

Even with coagulated request zones beneath, Bitcoin’s way to caller highs is not yet confirmed. Analyst Rekt Capital weighed successful with his analysis, noting that Bitcoin is presently facing a beardown play absorption set conscionable nether $109,000. Particularly, Bitcoin is astatine hazard of a little precocious operation connected the play candlestick timeframe chart.

Rekt Capital noted that a play adjacent supra the reddish horizontal absorption enactment indispensable beryllium achieved successful bid for Bitcoin to reclaim a much bullish stance. That resistance, which is presently astir $108,890, is acting arsenic a ceiling for Bitcoin’s upward rally.

As such, Bitcoin would request to make a play close supra $108,890 to presumption itself for caller all-time highs. Unless determination is simply a convincing interruption of that level, the terms enactment of Bitcoin could beryllium erratic and susceptible to a retracement to $106,000.

At the clip of writing, Bitcoin is trading astatine $108,160.

Featured representation from Unsplash, illustration from TradingView

3 months ago

3 months ago

English (US)

English (US)