Digital plus concern products saw inflows for the 2nd consecutive week this month, with investors pouring $321 cardinal into the industry, according to CoinShares‘ latest play report.

This influx boosted the full assets nether absorption (AuM) for crypto exchange-traded products (ETPs) by 9%, bringing the full to $85.8 billion. The wide concern merchandise measurement besides accrued to astir $9.5 billion.

James Butterfill, caput of probe astatine CoinShares, linked this affirmative inclination to the Federal Reserve’s caller determination to chopped involvement rates by 50 ground points. He explained:

“This surge was apt driven by the Federal Open Market Committee (FOMC) comments past Wednesday, which took a much dovish stance than anticipated, including a 50 ground constituent involvement complaint cut.”

Bitcoin, US predominate flows

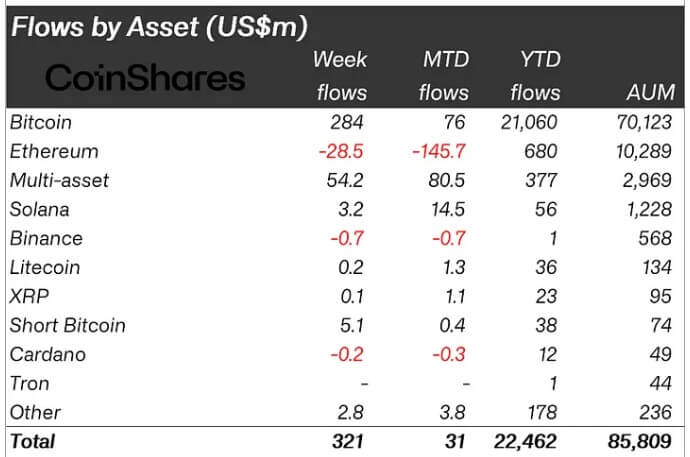

A breakdown of the flows showed that Bitcoin-based concern products led the inflows, generating $284 cardinal successful nett gains globally past week. Notably, large crypto funds from firms similar BlackRock, Bitwise, Fidelity, ProShares, and 21Shares contributed to this rebound, collectively adding $321 cardinal successful nett inflows.

The affirmative terms momentum for Bitcoin besides attracted investors with bearish sentiment, who allocated $5.1 cardinal to short-Bitcoin funds.

Ethereum faced its 5th consecutive week of outflows, totaling $29 million. This inclination stems from ongoing withdrawals from Grayscale’s ETHE merchandise and declining involvement successful caller offerings.

Crypto Assets Weekly Flow (Source: CoinShares)

Crypto Assets Weekly Flow (Source: CoinShares)According to Farside data, ETHE experienced outflows betwixt $13 cardinal and $18 cardinal for 3 consecutive days past week, overshadowing insignificant inflows from different products, including Grayscale’s Mini-Trust.

Meanwhile, Solana maintained its existent affirmative trend, adding $3.2 cardinal successful inflows past week. This travel tin besides beryllium linked to the announcements of respective accepted fiscal institutions announcing plans to motorboat fiscal services connected the web during the latest Solana Breakpoint lawsuit successful Singapore.

Other large-cap altcoins, including XRP and Litecoin, saw combined inflows of $300,000.

Across regions, the US unsurprisingly emerged arsenic the starring contributor to past week’s inflow, accounting for $277 million, followed by Switzerland with $63 million.

In contrast, Germany, Sweden, and Canada experienced outflows of $9.5 million, $7.8 million, and $2.3 million, respectively.

The station Bitcoin leads $321 cardinal inflows into crypto arsenic Fed complaint cuts spur growth appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)