The post Bitcoin Is Absorbing Selling Pressure—What This Says About the Next BTC Price Move appeared first on Coinpedia Fintech News

Bitcoin remained under pressure after falling below $85,000, and the recent rebound above $87,700 suggests that the price has entered a cooling period. However, volatility has been elevated, and sharp intraday swings have shaken both long and short positions. Despite this, the BTC price continues to hold above key higher-timeframe demand zones. This combination suggests the market is transitioning, not collapsing.

Will the current price action, which indicates absorption, where selling is met by steady demand with no emotional buying, help the BTC price reach $100K?

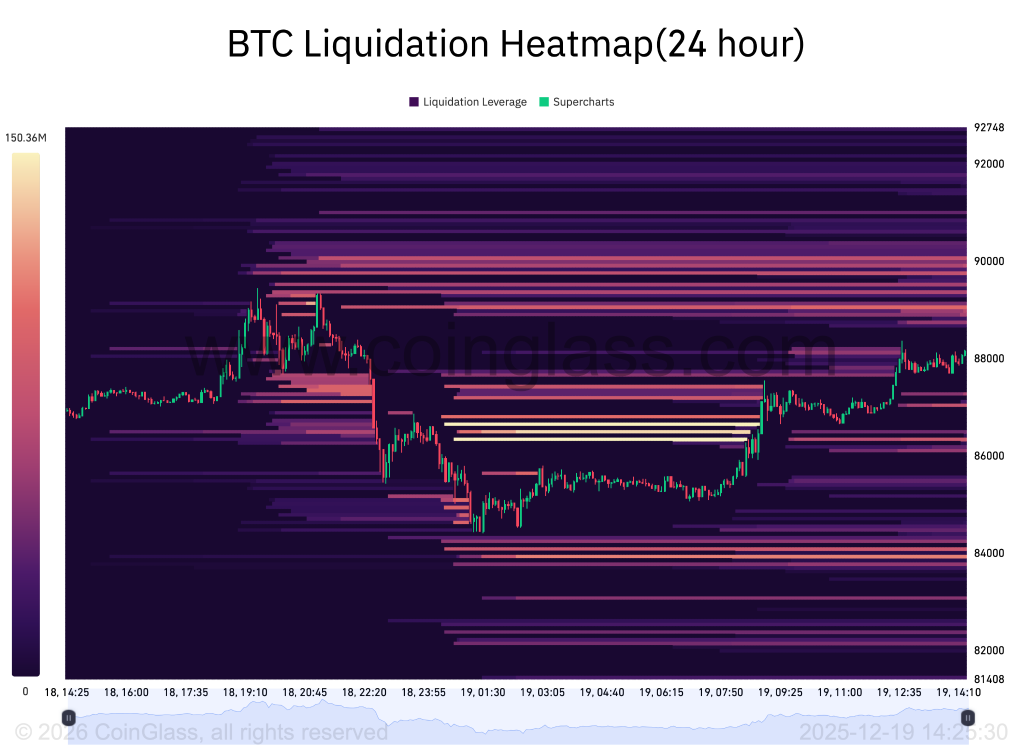

Liquidations Are Cooling—And That Matters

Recent liquidation data shows a sharp decline in forced selling compared to the initial breakdown. Earlier moves saw clusters of long liquidations as the price swept liquidity below local structure. Since then, liquidation intensity has faded, even as Bitcoin continues to trade heavily.

This shift is critical. Forced selling creates disorder and momentum. When it slows, it signals that weak hands have largely exited, leaving price to be governed by spot demand and patient positioning rather than leverage stress. In simple terms, sellers are still present, but they are no longer in control.

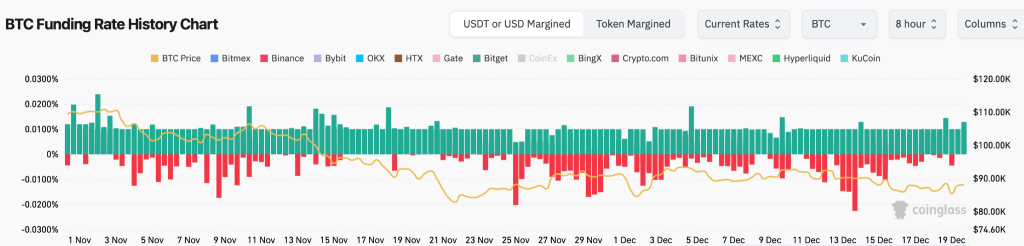

Funding Rates Point to a Reset, Not Panic

Funding across major exchanges has normalised after briefly flipping negative. This indicates leverage has been reduced and the late longs have been flushed out. Importantly, funding is not aggressively positive either—a sign the market is no longer chasing upside prematurely.

Historically, sustainable moves emerge after funding resets, not while it is overheated. The current environment reflects hesitation and balance, which often precedes expansion once the price accepts a direction.

BTC Price Analysis: Structure Holds the Final Clue

On the 4H chart, Bitcoin continues to defend a well-defined demand zone and the ascending trend line, despite multiple tests. Each dip below intraday support has been met with responsive buying, suggesting real interest rather than short covering.

For traders, the message is clear:

- Acceptance above this demand zone keeps recovery scenarios alive

- Failure to hold would open the door to another liquidity sweep lower

Until either occurs, Bitcoin remains in a range-bound compression phase, not a confirmed downtrend.

Wrapping it Up- How Can Bitcoin Price Reach $100K?

Bitcoin (BTC) price is likely to trade in a tight range this weekend, with the price stabilizing above key support as the market digests the recent volatility rather than making a decisive move. As far as the $100K is concerned, that level remains out of reach for now, as the current price action reflects consolidation and absorption, not the kind of momentum or volume expansion required for a breakout of that magnitude

1 hour ago

1 hour ago

English (US)

English (US)