Bitcoin’s terms enactment implicit the past week has been remarkable, marked by its milestone ascent past $100,000.

While this monumental level was short-lived, with BTC rapidly correcting to astir $91,000 earlier rebounding to astir $97,000, it remains a important achievement. Since archetypal breaching the milestone, Bitcoin has passed done the $100,000 people respective times, indicating it is already failing arsenic either support oregon resistance. The market’s quality to prolong these elevated levels is simply a testament to the beardown underlying request for BTC.

The information that Bitcoin hasn’t seen a crisp selloff oregon a instrumentality to terms levels beneath $90,000 aft failing to consolidate supra $100,000 is simply a beardown indicator that the selling unit is being met by arsenic strong, if not stronger, buying interest. At this level, request remains robust capable to counteract immoderate attempts to little the price. Prices astir $94,000 person shown beardown support, with respective wicks down to these levels earlier rebounding.

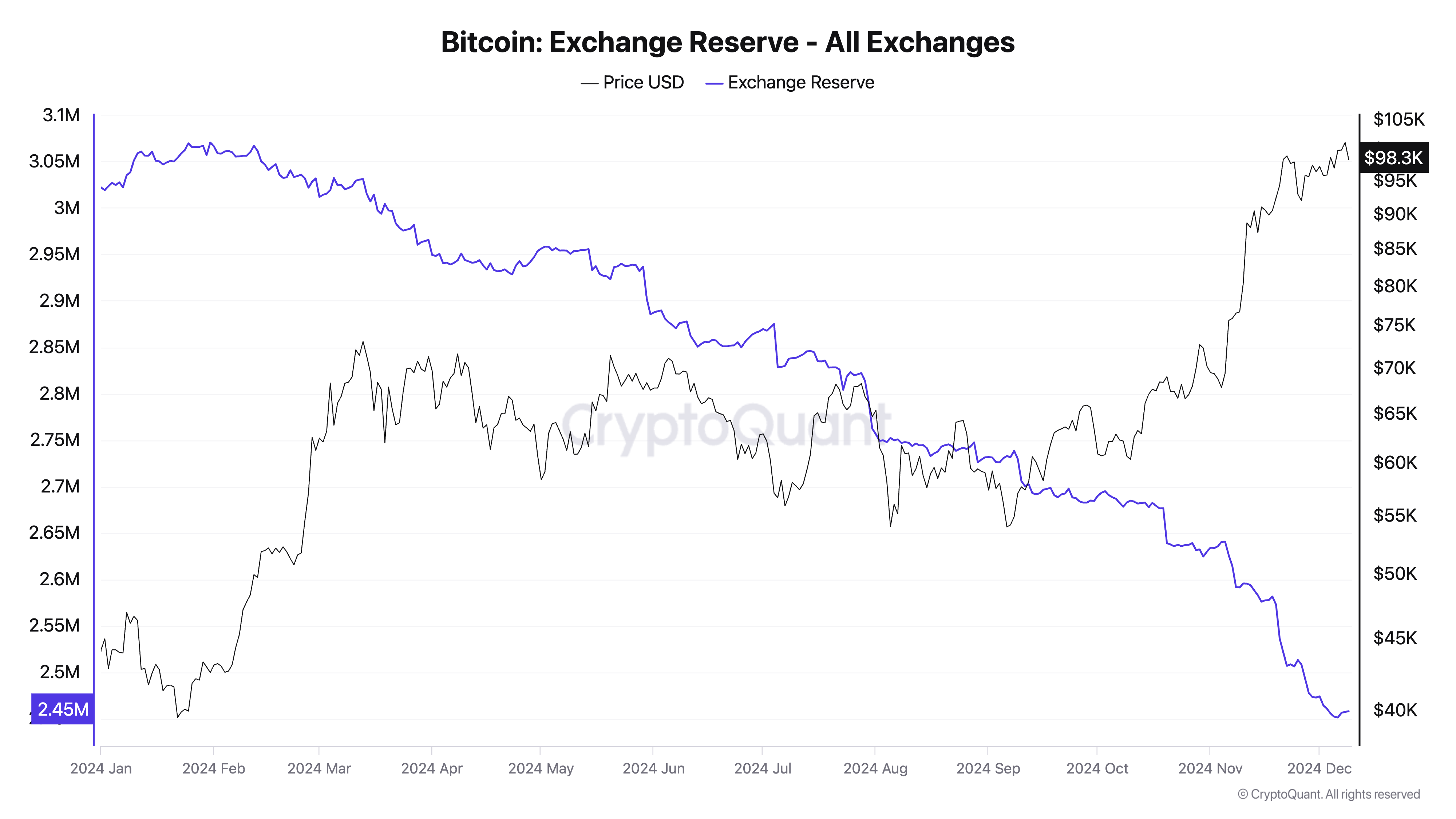

This equilibrium betwixt request and proviso is evident erstwhile examining the narration betwixt speech reserves and speech nett flows. Exchange reserves — Bitcoin held connected centralized platforms — person been steadily declining implicit the agelong word and are present astatine astir 2.45 cardinal BTC.

This inclination reflects a wide penchant among marketplace participants to determination Bitcoin into idiosyncratic wallets oregon acold storage, signaling assurance successful Bitcoin’s semipermanent value. Declining reserves trim the proviso of Bitcoin disposable for contiguous sale, which usually supports terms stableness oregon upward movement.

Graph showing the magnitude of Bitcoin held successful speech wallets from Jan. 1 to Dec. 9, 2024 (Source: CryptoQuant)

Graph showing the magnitude of Bitcoin held successful speech wallets from Jan. 1 to Dec. 9, 2024 (Source: CryptoQuant)In contrast, speech netflows overgarment a somewhat antithetic representation successful the abbreviated term. Netflows, which measurement the quality betwixt Bitcoin inflows and outflows to exchanges, person shown occasional spikes successful inflows implicit the past week. These spikes suggest that immoderate investors are moving Bitcoin backmost to exchanges, apt to instrumentality profits pursuing the caller terms rally oregon to hedge their positions.

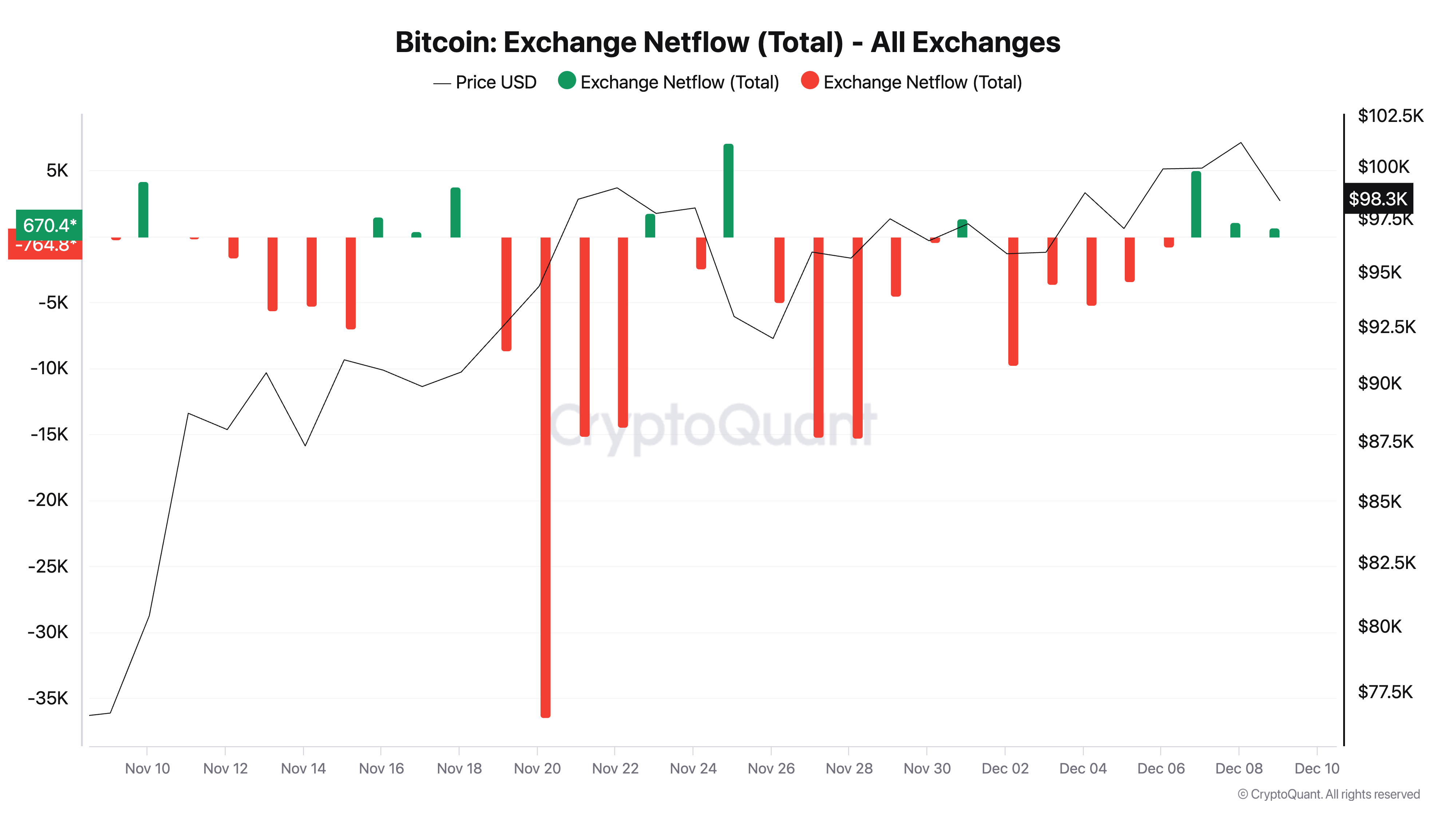

However, these inflows person not translated into important downward unit connected the price. This aligns with a erstwhile CryptoSlate analysis, which recovered that a sizeable magnitude of downward terms enactment comes from the derivatives market.

This implies that astir of the Bitcoin being deposited onto exchanges is being absorbed by buyers, preventing immoderate important terms drop. The opposition betwixt declining semipermanent reserves and sporadic short-term inflows highlights a balanced marketplace wherever proviso and request forces are evenly matched.

Chart showing the quality betwixt BTC flowing into and retired of exchanges from Nov. 9 to Dec. 9, 2024 (Source: CryptoQuant)

Chart showing the quality betwixt BTC flowing into and retired of exchanges from Nov. 9 to Dec. 9, 2024 (Source: CryptoQuant)Ample buying unit is further confirmed by looking astatine the speech stablecoin ratio. Previously analyzed by CryptoSlate, this metric measures the magnitude of Bitcoin reserves comparative to stablecoin reserves held connected exchanges. A little ratio indicates a higher proportionality of stablecoins, signifying that exchanges are well-capitalized with buying power.

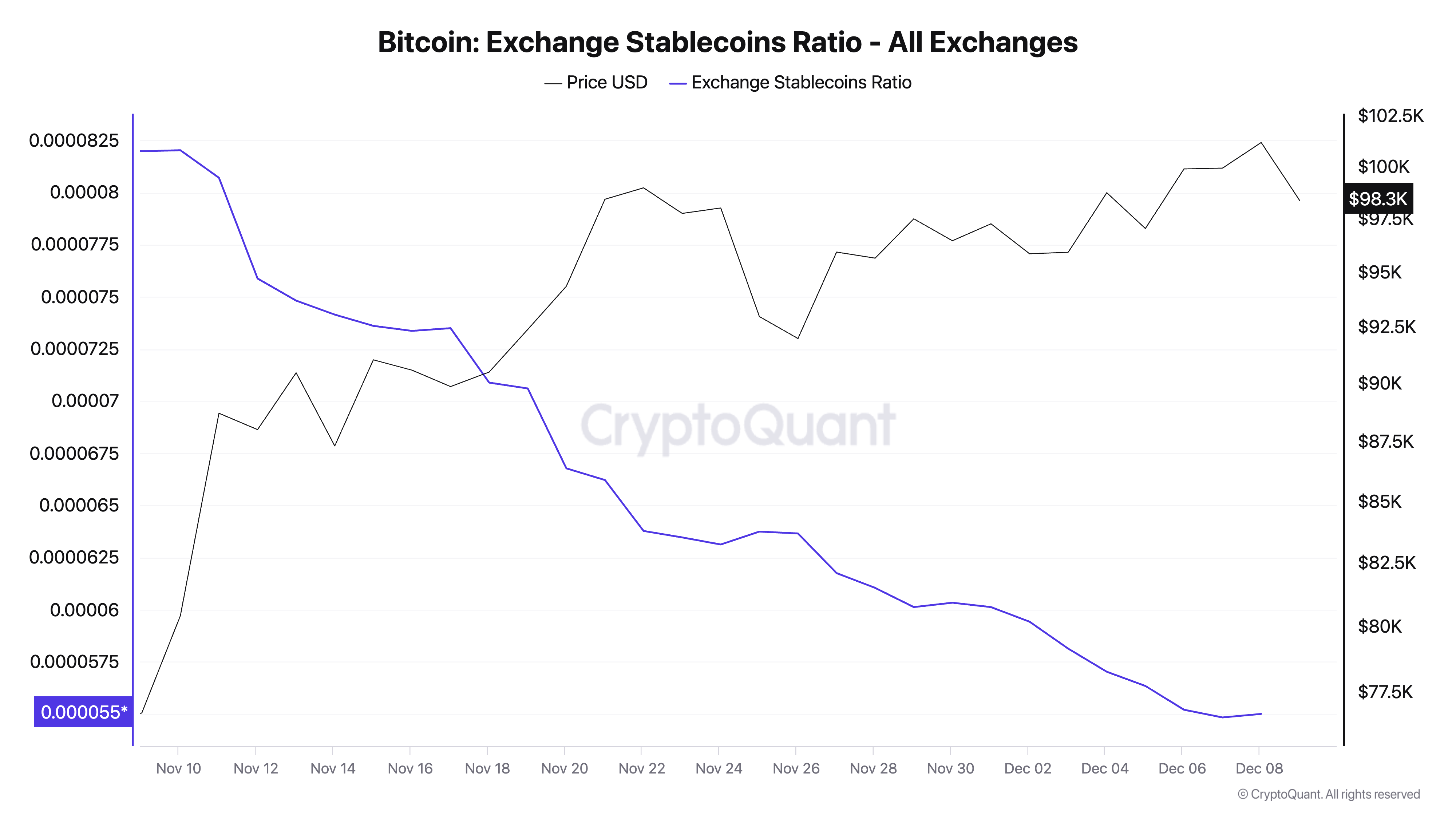

With the speech stablecoin ratio presently astatine an all-time low, we tin spot that the marketplace is flush with liquidity and acceptable to sorb immoderate selling unit from exchanges. Having a important fig of stablecoins disposable connected exchanges enables the marketplace to prolong request for Bitcoin adjacent successful the look of accrued selling activity—such arsenic the 1 we saw erstwhile BTC passed $100,000.

Graph showing the speech stablecoin ratio from Nov. 9 to Dec. 9, 2024 (Source: CryptoQuant)

Graph showing the speech stablecoin ratio from Nov. 9 to Dec. 9, 2024 (Source: CryptoQuant)The debased stablecoin ratio complements the trends successful speech reserves and nett flows. While reserves amusement a structural diminution successful disposable Bitcoin and nett flows item short-term selling attempts, the abundance of stablecoins confirms that determination is capable superior connected the sidelines to sorb this selling.

Together, these metrics overgarment a representation of a marketplace well-supported by liquidity, adjacent arsenic it navigates periods of profit-taking. This liquidity apt has kept Bitcoin betwixt $95,000 and $99,000 contempt its inability to reclaim $100,000 for now.

The declining speech reserves constituent to reduced selling liquidity implicit the agelong term, creating a imaginable proviso squeeze. At the aforesaid time, the beingness of stablecoins signals that buying involvement is not lone contiguous but important capable to counteract selling attempts.

Net flows enactment arsenic a real-time gauge of short-term sentiment, and the information that inflows haven’t led to a breakdown successful terms further confirms the spot of demand. This creates a feedback loop wherever selling unit is mitigated by the liquidity provided by stablecoins portion falling reserves guarantee that adjacent humble request tin importantly interaction price.

The station Bitcoin holds dependable adjacent $100,000 arsenic selling unit is absorbed appeared archetypal connected CryptoSlate.

9 months ago

9 months ago

English (US)

English (US)