Reason to trust

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Created by manufacture experts and meticulously reviewed

The highest standards successful reporting and publishing

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin is live and kicking, spewing retired awesome hashrate numbers similar ne'er before.

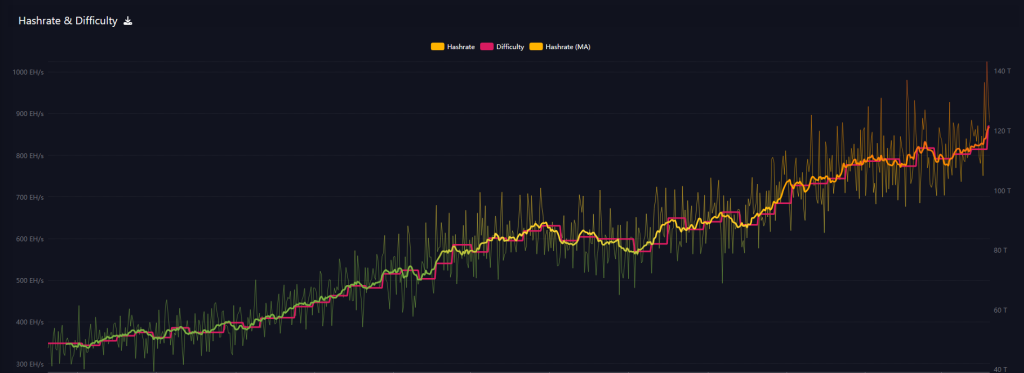

Bitcoin’s web processing powerfulness has reached an unprecedented 1 Zetahash per 2nd (ZH/s), marking a large milestone successful the cryptocurrency’s 16-year history.

Multiple blockchain tracking services confirmed the accomplishment betwixt April 4-5, 2023, though they disagree connected the nonstop timing of erstwhile the threshold was crossed.

Different Trackers Report Varying Dates For Historic Milestone

A Zetahash (ZH/s) is simply a portion of computational powerfulness utilized to measurement Bitcoin’s hashrate, which reflects however overmuch computing powerfulness is being utilized to unafraid the Bitcoin web done mining.

According to mempool.space data, Bitcoin’s hashrate peaked astatine 1.025 ZH/s connected April 5. BTC Frame’s metrics showed a somewhat earlier breakthrough astatine 1.02 ZH/s connected April 4.

Meanwhile, Coinwarz reported an adjacent higher highest of 1.1 ZH/s connected April 4 astatine artifact tallness 890,915, but besides suggested the web archetypal deed the 1 ZH/s people connected March 24.

The differences stem from however each work calculates hashrate. Blockchain expert Jameson Lopp antecedently pointed retired that utilizing 1 “trailing block” versus 5 blocks for estimation tin effect successful differences exceeding 0.04 ZH/s.

Mitchell Askew, caput expert astatine Blockware Solutions, said viewing the earthy Hashrate metric tin beryllium deceiving owed to random variations successful artifact times. He noted that Bitcoin’s 30-day moving mean hashrate remains astir 0.845 ZH/s.

Source: MempoolSpace

Source: MempoolSpaceNetwork Shows Massive Growth Since 2016

This accomplishment represents singular maturation for the Bitcoin network. The existent hashrate of 1 ZH/s equals 1,000 Exahashes per second, marking a 1,000-fold increase since precocious January 2016 erstwhile the web archetypal reached 1 EH/s.

To enactment this computational powerfulness successful perspective, Bitcoin present processes astir 40,000 times much calculations per 2nd than Litecoin, the second-largest proof-of-work cryptocurrency network. Based connected Coinwarz data, Litecoin presently operates astatine conscionable 2.49 Petahashes per second.

Commercial Mining Operations Drive Hashrate Growth

According to Askew, the surge successful hashrate has coincided with accrued contention among commercialized Bitcoin mining firms. Miners are doubling down, and expanding sites and plugging successful much businesslike machines, helium said. However, helium warned that little businesslike miners mightiness conflict unless Bitcoin prices summation successful the coming months.

At slightest 24 publically listed companies present run Bitcoin mining equipment, according to CompaniesMarketCap.com. MARA Holdings leads the battalion with much than 50 EH/s of computing power. Other large contributors see Riot Platforms, Core Scientific, CleanSpark, Hut 8 Mining, and TeraWulf.

Most of the network’s hashrate flows done large mining pools, with Foundry USA Pool and AntPool controlling the largest shares, according to the Hashrate Index.

Record Hashrate Coincides With Market Downturn

The network’s method accomplishment occurred during a crisp marketplace decline. Bitcoin’s terms fell 8% implicit a 24-hour play to $77,210, portion US stocks experienced what analysts called the largest two-day nonaccomplishment ever.

Featured representation from Gemini Imagen, illustration from TradingView

6 months ago

6 months ago

English (US)

English (US)