By Omkar Godbole (All times ET unless indicated otherwise)

The crypto marketplace has stalled since Saturday, with bitcoin (BTC) once again failing to support gains supra $116,000 alongside continued selling by wallets of aboriginal adopters, oregon OGs.

According to blockchain expert Lookonchain, connected Sunday an eight-year BTC holder moved 1,176 BTC worthy implicit $136 cardinal to Hyperliquid and started dumping. This holder is known to person exchanged 35,991 BTC for 886,731 ETH successful caller months.

Other semipermanent holders person besides been liquidating coins successful caller months arsenic the marketplace continues to set to a six-figure price arsenic the caller mean for BTC.

But the latest selling is not conscionable constricted to semipermanent holders. On-chain information tracked by Glassnode showed that wallets of each sizes are backmost to distributing coins.

In ether's case, whale wallets continue to standard exposure, suggesting ether outperformance comparative to bitcoin. The ether-bitcoin ratio connected Binance, however, fell for a 3rd consecutive day, incapable to capitalize connected the descending trendline breakout confirmed connected Friday.

Memecoins, the caller outperformers, person besides come nether pressure, with apical tokens, DOGE and SHIB, losing 10% and 6%, respectively, implicit the past 24 hours.

Solana's autochthonal token SOL traded implicit 2% little astatine $234 contempt cardinal manufacture participants taking steps to accelerate the adoption of Solana-native decentralized concern (DeFi).

Kyle Samani, president of Nasdaq-listed Solana treasury institution Forward Industries, said connected X that the institution plans to deploy funds into the Solana-based DeFi protocols. Last week, Forward raised $1.65 cardinal successful a backstage placement led by Multicoin Capital, Galaxy Digital and Jump Crypto.

Samani was responding to an thought raised by a crypto trader, Ansem, who called for firm treasury funds to put successful Solana-based DeFi to boost the network's DeFi entreaty comparative to manufacture elephantine Ethereum.

In accepted markets, capitalist positioning successful the S&P 500 looked wholly biased bullish. "Sentiment is astatine extremes. Careful retired there," pseudonymous perceiver The Short Bear said connected X. Stay alert!

What to Watch

- Crypto

- None scheduled.

- Macro

- None scheduled.

- Earnings (Estimates based connected FactSet data)

- None scheduled.

Token Events

- Governance votes & calls

- Curve DAO is voting to update donation-enabled Twocrypto contracts, refining donation vesting truthful unlocked portions persist aft burns. Voting ends Sept. 16.

- Unlocks

- Sept. 15: Starknet (STRK) to unlock 5.98% of its circulating proviso worthy $17.09 million.

- Sept. 15: Sei (SEI) to unlock 1.18% of its circulating proviso worthy $18.06 million.

- Token Launches

- Sept. 15: OpenLedger (OPENLEDGER) to beryllium listed connected Crypto.com.

Conferences

- Day 4 of 4: ETHTokyo 2025

- Day 1 of 7: Budapest Blockchain Week 2025

- Sept. 15: TGE Summit 2025 (New York)

Token Talk

By Oliver Knight

- Monero’s blockchain suffered its deepest-ever reorg connected Monday, rolling backmost 18 blocks.

- A blockchain reorganization, oregon reorg, happens erstwhile nodes wantonness portion of the existing concatenation to travel a longer 1 with much proof-of-work. The displacement occurs during a impermanent fork, erstwhile 2 versions of the concatenation compete.

- Monero's XMR token remained unperturbed during the porcess; rallying by 5% contempt the onslaught by Qubic, a layer-1 AI-focused blockchain and mining excavation that attempted to take implicit the Monero blockchain by amassing 51% of the mining powerfulness past month.

- The lawsuit rewrote astir 36 minutes of transaction past and invalidated astir 118 confirmed transactions, prompting concerns astir the information of the network.

- Crypto podcaster xenu claimed that Qubic's reorg was an effort to "stop the bleeding" of XMR's terms aft it tumbled from $344 to $235 during the archetypal 51% onslaught successful August.

- XMR presently trades astatine $304 having brushed speech antagonistic sentiment with regular trading measurement rising by 78% to $136 million.

Derivatives Positioning

by Omkar Godbole

- The apical 25 coins person experienced a diminution successful futures unfastened involvement (OI) implicit the past 24 hours, with memecoins, specified arsenic DOGE, PEPE and FARTCOIN, registering double-digit superior outflows. This contrasts with the pre-Fed bounce being seen successful astir tokens.

- BTC's planetary futures OI tally has pulled backmost to 720K BTC from the near-record precocious of 744K BTC past week. Total market-wide OI has pulled backmost to $90 cardinal from $95 cardinal implicit the weekend.

- ETH's tally grew to implicit 14 cardinal ether from astir 13.2 cardinal ether aboriginal this month, indicating renewed superior inflows. However, this does not needfully bespeak bullish positioning, arsenic the OI-normalized cumulative measurement delta (CVD) for ETH has been antagonistic for the past 24 hours. That's a motion of nett selling pressure.

- Most large tokens person seen a antagonistic CVD for the past 24 hours.

- Activity successful the CME-listed futures looks to beryllium picking up the pace, with OI bouncing to 141.69K BTC from the multimonth debased of 133.25K BTC aboriginal this week. The annualized complaint connected a three-month ground remains beneath 10%, extending the consolidation. ETH's CME OI remains beneath 2 cardinal ether.

- On Deribit, enactment bias successful BTC and ETH has eased importantly crossed each tenors arsenic markets expect Fed complaint cuts successful the coming months. The implied volatility word operation remains successful contango, with December expiry expected to beryllium much volatile.

Market Movements

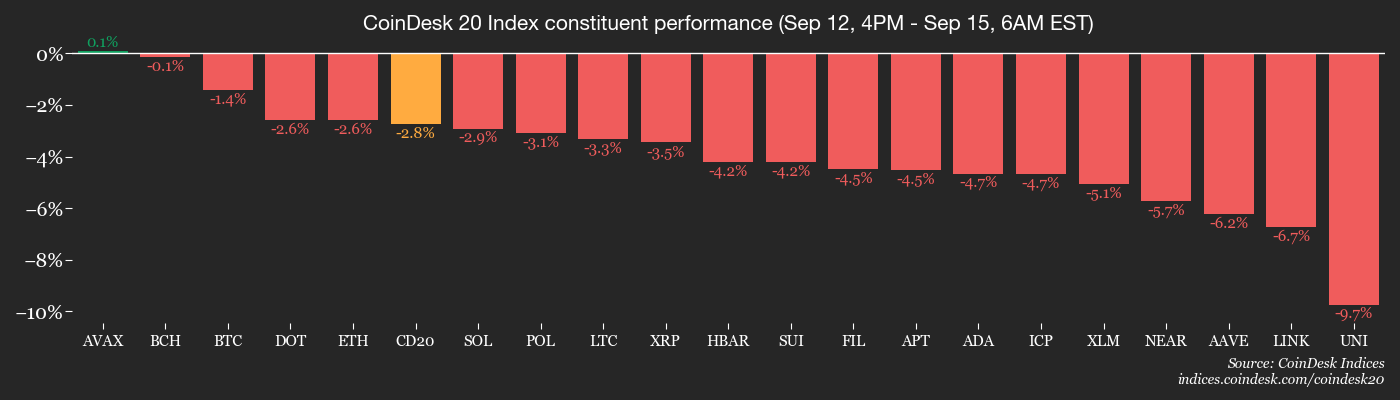

- BTC is down 1.1% from 4 p.m. ET Friday astatine $114,933.52 (24hrs: -1%)

- ETH is down 3.1% astatine $4,528.04 (24hrs: -3.22%)

- CoinDesk 20 is down 2.73% astatine 4,245.39 (24hrs: -3.35%)

- Ether CESR Composite Staking Rate is down 2 bps astatine 2.82%

- BTC backing complaint is astatine 0.0081% (8.829% annualized) connected Binance

- DXY is unchanged astatine 97.48

- Gold futures are down 0.29% astatine $3,675.80

- Silver futures are down 0.56% astatine $42.59

- Nikkei 225 closed up 0.89% astatine 44,768.12

- Hang Seng closed up 0.22% astatine 26,446.56

- FTSE is down 0.1% astatine 9,273.57

- Euro Stoxx 50 is up 0.6% astatine 5,423.13

- DJIA closed connected Friday down 0.59% astatine 45,834.22

- S&P 500 closed unchanged astatine 6,584.29

- Nasdaq Composite closed up 0.44% astatine 22,141.10

- S&P/TSX Composite closed down 0.42% astatine 29,283.82

- S&P 40 Latin America closed unchanged astatine 2,857.80

- U.S. 10-Year Treasury complaint is unchanged astatine 4.059%

- E-mini S&P 500 futures are unchanged astatine 6,594.50

- E-mini Nasdaq-100 futures are unchanged astatine 24,098.00

- E-mini Dow Jones Industrial Average Index are up 0.22% astatine 45,957.00

Bitcoin Stats

- BTC Dominance: 58.11% (0.57%)

- Ether to bitcoin ratio: 0.03938 (-1.38%)

- Hashrate (seven-day moving average): 1,025 EH/s

- Hashprice (spot): $53.81

- Total Fees: 3.13 BTC / $362,347

- CME Futures Open Interest: 141,690 BTC

- BTC priced successful gold: 31.5 oz

- BTC vs golden marketplace cap: 8.90%

Technical Analysis

- DOGE has dropped from 30.7 cents to 26 cents, penetrating the bullish trendline from Sept. 6 lows.

- The breakdown suggests renewed seller momentum.

- Prices person besides recovered acceptance beneath the Ichimoku cloud. Crossovers beneath the unreality are said to correspond a bearish displacement successful trend.

Crypto Equities

- Coinbase Global (COIN): closed connected Friday astatine $323.04 (-0.28%), -0.34% astatine $321.95 successful pre-market

- Circle (CRCL): closed astatine $125.32 (-6.27%), +1.81% astatine $127.59

- Galaxy Digital (GLXY): closed astatine $29.70 (+2.88%), -0.47% astatine $29.56

- Bullish (BLSH): closed astatine $51.84 (-3.98%), +1.72% astatine $52.73

- MARA Holdings (MARA): closed astatine $16.31 (+3.82%), -0.67% astatine $16.20

- Riot Platforms (RIOT): closed astatine $15.89 (+1.53%), -0.44% astatine $15.82

- Core Scientific (CORZ): closed astatine $15.86 (+1.99%), -0.38% astatine $15.80

- CleanSpark (CLSK): closed astatine $10.35 (+1.47%), unchanged successful pre-market

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $37.32 (+4.63%)

- Exodus Movement (EXOD): closed astatine $28.36 (-1.73%), unchanged successful pre-market

Crypto Treasury Companies

- Strategy (MSTR): closed astatine $331.44 (+1.66%), -0.53% astatine $329.68

- Semler Scientific (SMLR): closed astatine $29.19 (+2.28%)

- SharpLink Gaming (SBET): closed astatine $17.7 (+8.19%), -2.26% astatine $17.30

- Upexi (UPXI): closed astatine $6.76 (+18.93%), +1.55% astatine $6.86

- Lite Strategy (LITS): closed astatine $3.07 (+10.43%)

ETF Flows

Spot BTC ETFs

- Daily nett flow: $642.4 million

- Cumulative nett flows: $56.79 billion

- Total BTC holdings ~ 1.31 million

Spot ETH ETFs

- Daily nett flow: $405.5 million

- Cumulative nett flows: $13.38 billion

- Total ETH holdings ~ 6.48 million

Source: Farside Investors

While You Were Sleeping

- What's Next for Bitcoin and Ether arsenic Downside Fears Ease Ahead of Fed Rate Cut? (CoinDesk): Amberdata’s Greg Magadini says a regular quarter-point chopped could mean gradual gains, portion a half-point determination mightiness trigger an explosive rally successful BTC, ETH, SOL and gold.

- Bank of England’s Proposed Stablecoin Ownership Limits Are Unworkable, Say Crypto Groups (CoinDesk): Executives accidental the U.K.’s projected caps could beryllium intolerable to enforce and hazard pushing innovation abroad, portion U.S. and EU rules acceptable standards without limiting holdings.

- LSE Group Starts Blockchain Platform for Access by Private Funds (Bloomberg): LSEG’s Digital Markets Infrastructure, built to boost efficiency, was utilized successful a MembersCap fundraising for MCM Fund 1 with crypto speech Archax serving the relation of nominee.

- Trump Administration Claims Vast Powers arsenic It Races to Fire Fed Governor Before Meeting (The New York Times): In Sunday’s filing to a national appeals court, Justice Department lawyers argued Trump’s authorization to oust Fed politician Lisa Cook was some “unreviewable” and “reasonable.”

- BOE Expected to Leave Key Rate connected Hold, but Slow Quantitative Tightening (The Wall Street Journal): Signs of interior absorption person formed uncertainty connected near-term complaint cuts, with 4 MPC members opposing the past determination and BoE Governor Andrew Bailey informing ostentation pressures complicate argumentation choices.

1 month ago

1 month ago

English (US)

English (US)