By Omkar Godbole (All times ET unless indicated otherwise)

As some accepted and crypto markets await the U.S. nonfarm payrolls data, immoderate unrelated quality deed the wires, underscoring gold's entreaty arsenic a cosmopolitan haven.

The Financial Times reported that Tether, the issuer of world’s largest dollar-pegged stablecoin, is considering a superior play successful the golden industry. CEO Paolo Ardoino has said the metallic is safer than immoderate authorities currency, calling it a cleanable complement to bitcoin.

If the report, which cited radical acquainted with the talks, comes to fruition, it could mean crypto is astir to go a bigger portion of gold’s reflexive bullish cycle. The precious metallic is already soaking up beardown bids globally arsenic sticky inflation, fiscal headaches and concerns implicit cardinal slope independency measurement connected investor. Countries are trimming their U.S. Treasury holdings and scooping up golden arsenic a safer, sanctions-proof haven.

Tether's involvement could besides boost the entreaty of Tether Gold (XAUT), which is issued by its affiliate institution TG Commodities. Each XAUT represents ownership of 1 good troy ounce of carnal golden and was precocious terms astir $3,560.

Meanwhile, the prospects for bitcoin (BTC), ether (ETH) and the wider crypto marketplace are apt to beryllium determined by the jobs report.

"A anemic people volition cement expectations for a 25bps complaint cut, apt softening the dollar and easing Treasury yields, which volition beryllium affirmative for hazard assets, including crypto," Timothy Misir, caput of probe astatine BRN, said successful an email. "But the existent hazard is simply a beardown report: adjacent a humble upside astonishment could unwind dovish positioning, nonstop yields higher, and unit BTC and ETH backmost toward their enactment levels."

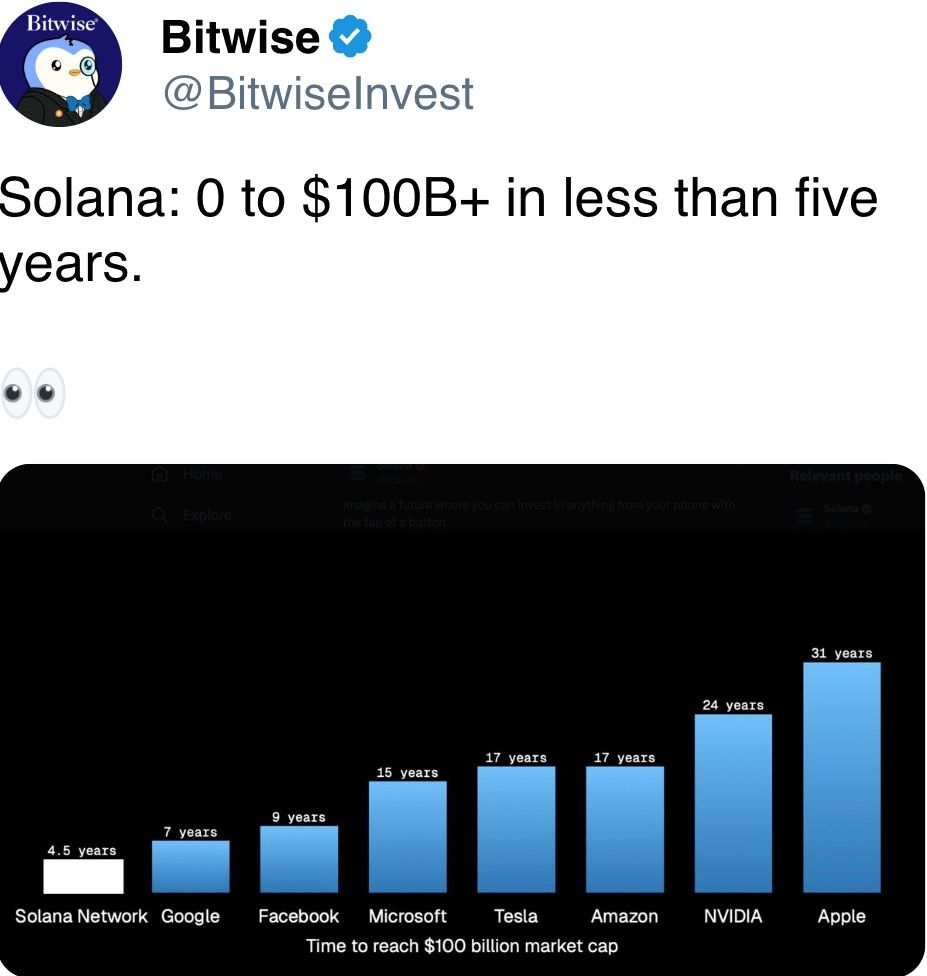

In different cardinal news, organization enactment points to involvement broadening beyond BTC and ETH. DeFi Development Corp. precocious bought implicit 196,000 Solana (SOL) tokens, establishing a treasury worthy immoderate $427 million. And Thumzup Media, backed by Donald Trump Jr., said it acquired $1 cardinal of BTC, on with caller purchases of DOGE, LTC, SOL and XRP.

In accepted markets, the MOVE scale spiked, signaling accrued volatility successful U.S. Treasury yields, which could pb to fiscal tightening and measurement connected hazard assets. Stay alert!

What to Watch

- Crypto

- Sept. 10, 9:15 a.m.: Comptroller of the Currency Jonathan V. Gould volition talk about integer assets astatine the CoinDesk: Policy & Regulation Conference successful Washington.

- Macro

- Sept. 5, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases July shaper terms ostentation data.

- PPI MoM Prev. -1.25%

- PPI YoY Prev. 3.24%

- Sept. 5, 8:30 a.m.: The U.S. Bureau of Labor Statistics releases August employment data.

- Nonfarm Payrolls Est. 75K vs. Prev. 73K

- Unemployment Rate Est. 4.3% vs. Prev. 4.2%

- Government Payrolls Prev. -10K

- Manufacturing Payrolls Est. -5K vs. Prev. -11K

- Sept. 5, 8:30 a.m.: Statistics Canada releases August employment data.

- Unemployment Rate Est. 7% vs. Prev. 6.9%

- Employment Change Est. 7.5K vs. Prev. -40.8K

- Sept. 5: S&P 500 Rebalance update released aft marketplace close. Strategy (MSTR) is 1 of the companies being considered for inclusion successful the index.

- Sept. 5, 7 p.m.: Colombia’s National Administrative Department of Statistics releases August user terms ostentation data.

- Inflation Rate MoM Est. 0.2% vs. Prev. 0.28%

- Inflation Rate YoY Est. 5.11% vs. Prev. 4.9%

- Sept. 5, 7 p.m.: El Salvador's Statistics and Census Office releases August user terms ostentation data.

- Inflation Rate MoM Prev. 0.33%

- Inflation Rate YoY Prev. -0.14%

- Sept. 5, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases July shaper terms ostentation data.

- Earnings (Estimates based connected FactSet data)

- Sept. 9: GameStop (GME), post-market, $0.19

Token Events

- Governance votes & calls

- Uniswap DAO is voting on deploying Uniswap v3 connected Ronin with $1M successful RON and $500K successful UNI incentives to marque it the chain’s superior decentralized exchange. Voting ends Sept. 6.

- Lido DAO is voting connected a proposal to migrate Nethermind’s ~7,000 Ethereum validators to infrastructure operated by Twinstake, a staking supplier co-founded by Nethermind. Voting ends Sept. 8.

- Uniswap DAO is voting to found “DUNI,” a Wyoming DUNA arsenic its ineligible entity, preserving decentralized governance portion enabling off-chain operations and liability protections, with $16.5M successful UNI for legal/tax budgets and $75K UNI for compliance. Voting ends Sept. 8.

- Uniswap DAO is voting connected an updated Unichain-USDS Growth Plan to accelerate adoption done performance-based incentives and DAO-guided distribution. The connection introduces minimum KPIs, a “no result, nary reward” model. Voting ends Sept. 9.

- Unlocks

- Sept. 9: Sonic (S) to unlock 5.02% of its circulating proviso worthy $46.02 million.

- Sept. 11: Aptos (APT) to unlock 2.2% of its circulating proviso worthy $48.86 million.

- Sept. 15: Starknet (STRK) to unlock 5.98% of its circulating proviso worthy $15.66 million.

- Sept. 15: Sei (SEI) to unlock 1.18% of its circulating proviso worthy $16.01 million.

- Sept. 16: Arbitrum (ARB) to unlock 2.03% of its circulating proviso worthy $46.05 million.

- Token Launches

- Sept. 5: WORLDSHARDS (SHARDS) to beryllium listed connected Binance Alpha, MEXC, Gate.io and others.

- Sept. 5: Boost (BOOST) to beryllium listed connected Binance Alpha, Bitget, MEXC, BitMart, and others.

- Sept. 8: Openledger (OPEN) to beryllium listed connected Binance Alpha, MEXC and others.

- Sept. 8: OlaXBT (AIO) to beryllium listed connected Binance Alpha and others.

Conferences

The CoinDesk Policy & Regulation Conference (formerly known arsenic State of Crypto) is simply a one-day boutique lawsuit held successful Washington connected Sept. 10 that allows wide counsels, compliance officers and regulatory executives to conscionable with nationalist officials liable for crypto authorities and regulatory oversight. Space is limited. Use codification CDB15 for 15% disconnected your registration.

- Day 3 of 3: bitcoin++ (Istanbul)

- Day 2 of 2: ETHWarsaw 2025 (Warsaw)

- Day 2 of 3: Taipei Blockchain Week (Taiwan)

- Sept. 5: Bitcoin Indonesia Conference 2025 (Bali)

- Sept. 9-10: Fintech Week London 2025

- Sept. 9-10: WOW Summit Hong Kong 2025

- Sept. 9-13: Boston Blockchain Week (Quincy, Massachusetts)

- Sept. 10: CoinDesk Policy & Regulation Conference (New York)

- Sept. 12: Independent Investor Summit (New York)

Token Talk

By Oliver Knight

- The memecoin assemblage had shown signs of fading earlier this year, peculiarly aft the short-lived hype cycles astir tokens similar TRUMP and MELANIA successful January. Those launches concisely captured attention, but failed to prolong momentum, reinforcing the cognition that the memecoin commercialized was exhausted aft 2023’s frenzy.

- Both subsequently slumped. TRUMP is present 88% little and and MELANIA is down 95% contempt being touted by the U.S. president and archetypal woman successful January.

- However, there's a caller kid connected the block: MemeCore, a layer-1 blockchain solely focused connected transitioning memecoins from speculative assets to thing that has inferior successful decentralized concern (DeFi).

- The platform's autochthonal token, M, has risen by 261% successful the past week contempt a wider marketplace pullback.

- The flurry of enactment tin besides beryllium tied to the MemeX liquidity festival, which offers $5.7 cardinal successful rewards to traders. It's worthy noting that 85% of the trading measurement has taken spot connected decentralized speech PancakeSwap, indicating important retail flows arsenic opposed to on-chain utility.

- While immoderate whitethorn reason this is conscionable different flash successful the pan, the surge demonstrates conscionable however rapidly memecoin sentiment tin shift.

- The affirmative sentiment astir MemeCore could find a mode of moving backmost to Solana-based memecoin level Pump.fun, whose $15.8 cardinal successful regular gross successful January has tumbled to betwixt $1.5 cardinal and $2.5 cardinal this week.

Derivatives Positioning

- Ether's unfastened involvement successful USDT and dollar-denominated perpetual contracts connected large exchanges declined to 1.93 cardinal ETH, a four-week low. This superior outflow raises questions astir the sustainability of ETH's astir 18% summation implicit the period.

- Except for LINK and BTC, unfastened involvement declined crossed the apical 10 tokens. OI successful large Solana perpetuals slipped beneath 11 cardinal SOL, threatening to invalidate the four-week uptrend.

- BTC futures enactment connected the CME remains subdued, but options are heating up, with unfastened involvement rising to 47.23K BTC, the highest since April. The notional OI has risen to $5.21 billion, the astir since November. Some traders person been buying inexpensive out-of-the-money puts, prepping for a imaginable hotter-than-expected U.S. nonfarm payrolls (NFP) report.

- Consistent with trends connected offshore exchanges, Ether’s futures unfastened involvement connected the CME slipped beneath 2 cardinal ETH, portion the three-month annualized premium roseate from 5% to 7%.

- On Deribit, BTC puts proceed to commercialized astatine a premium to calls crossed each tenors, pointing to downside concerns.

- The seven-day volatility hazard premium has retraced astir to zero, suggesting that the implied volatility for 7 days is present astir adjacent to the realized volatility. In different words, investors aren't expecting a premium to hedge against aboriginal volatility spikes, contempt the U.S. jobs information owed aboriginal today.

- In ETH's case, puts are trading astatine a premium to calls retired to the end-November expiry.

- Block flows connected the OTC table astatine Paradigm person been mixed, with a BTC $116K telephone lifted alongside an ether $4K put.

Market Movements

- BTC is up 1.71% from 4 p.m. ET Thursday astatine $112,306.62 (24hrs: +1.4%)

- ETH is up 2.14 astatine $4,398.33 (24hrs: -0.19%)

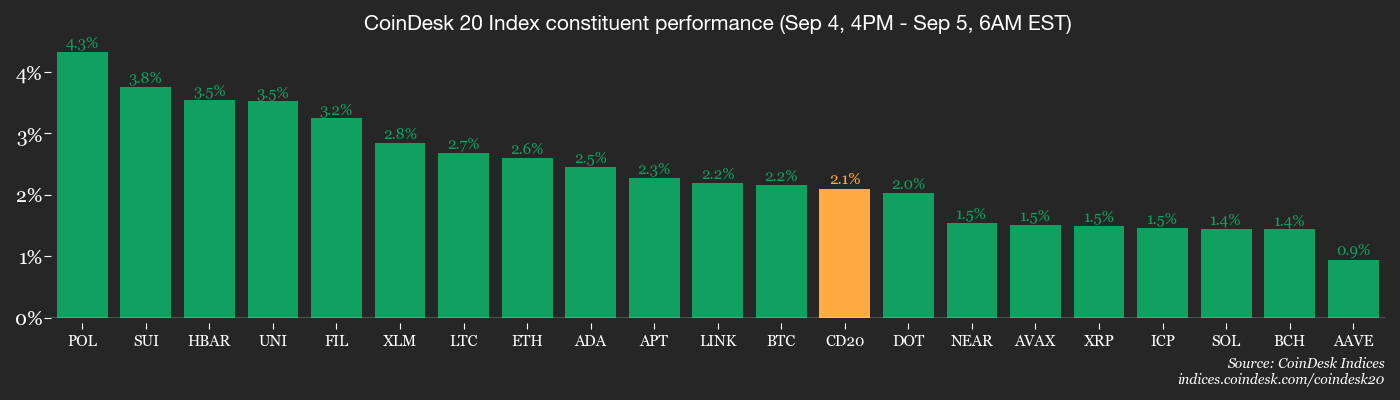

- CoinDesk 20 is up 1.85% astatine 4,050.32 (24hrs: +0.28%)

- Ether CESR Composite Staking Rate is up 1 bps astatine 2.88%

- BTC backing complaint is astatine 0.0015% (1.6425% annualized) connected KuCoin

- DXY is down 0.35% astatine 98.00

- Gold futures are unchanged astatine $3,609.80

- Silver futures are unchanged astatine $41.42

- Nikkei 225 closed up 1.03% astatine 43,018.75

- Hang Seng closed up 1.43% astatine 25,417.98

- FTSE is up 0.26% astatine 9,241.13

- Euro Stoxx 50 is up 0.18% astatine 5,356.16

- DJIA closed connected Thursday up 0.77% astatine 45,621.29

- S&P 500 closed up 0.83% astatine 6,502.08

- Nasdaq Composite closed up 0.98% astatine 21,707.69

- S&P/TSX Composite closed up 0.57% astatine 28,915.89

- S&P 40 Latin America closed up 0.49% astatine 2,770.29

- U.S. 10-Year Treasury complaint is down 1.5 bps astatine 4.161%

- E-mini S&P 500 futures are up 0.21% astatine 6,524.25

- E-mini Nasdaq-100 futures are up 0.5% astatine 23,787.25

- E-mini Dow Jones Industrial Average Index are unchanged astatine 45,664.00

Bitcoin Stats

- BTC Dominance: 58.73% (unchanged)

- Ether to bitcoin ratio: 0.03914 (0.82%)

- Hashrate (seven-day moving average): 973 EH/s

- Hashprice (spot): $52.48

- Total Fees: 4.86 BTC / $537,022

- CME Futures Open Interest: 133,775 BTC

- BTC priced successful gold: 31.6 oz

- BTC vs golden marketplace cap: 8.92%

Technical Analysis

- The ether-bitcoin (ETH) ratio is looking to apical the Ichimoku unreality connected the play chart. Crossovers supra the unreality are said to corroborate a bullish displacement successful momentum.

- The brace has already topped the descending trendline, characterizing the three-year-long downward trend.

Crypto Equities

- Coinbase Global (COIN): closed connected Thursday astatine $306.80 (+1.49%), +1.53% astatine $311.49 successful pre-market

- Circle (CRCL): closed astatine $117.49 (-0.82%), +0.54%% astatine $118.12

- Galaxy Digital (GLXY): closed astatine $22.91 (-6.07%), +1.27% astatine $23.20

- Bullish (BLSH): closed astatine $49.01 (-9.68%), +1.27%% astatine $49.63

- MARA Holdings (MARA): closed astatine $15.11 (-4.91%), +1.52% astatine $15.34

- Riot Platforms (RIOT): closed astatine $13.16 (-2.16%), +1.98% astatine $13.42

- Core Scientific (CORZ): closed astatine $113.62 (+0.29%)

- CleanSpark (CLSK): closed astatine $9.08 (-3.81%), +1.1% astatine $9.18

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $29.17 (-4.98%)

- Exodus Movement (EXOD): closed astatine $29.17 (-0.08%), +2.84% astatine $25.00

Crypto Treasury Companies

- Strategy (MSTR): closed astatine $327.59 (-0.81%), +2.2% astatine $334.86

- Semler Scientific (SMLR): closed astatine $13.62 (+0.29%)

- SharpLink Gaming (SBET): closed astatine $15.43 (-8.26%), +2.53% astatine $15.82

- Upexi (UPXI): closed astatine $6.33 (-4.52%), +2.69% astatine $6.50

- Mei Pharma (MEIP): closed astatine $4.27 (-5.74%), +1.87% astatine $4.35

ETF Flows

Spot BTC ETFs

- Daily nett flows: -$222.9 million

- Cumulative nett flows: $54.63 billion

- Total BTC holdings ~1.29 million

Spot ETH ETFs

- Daily nett flows: -$167.3 million

- Cumulative nett flows: $13.19 billion

- Total ETH holdings ~6.52 million

Source: Farside Investors

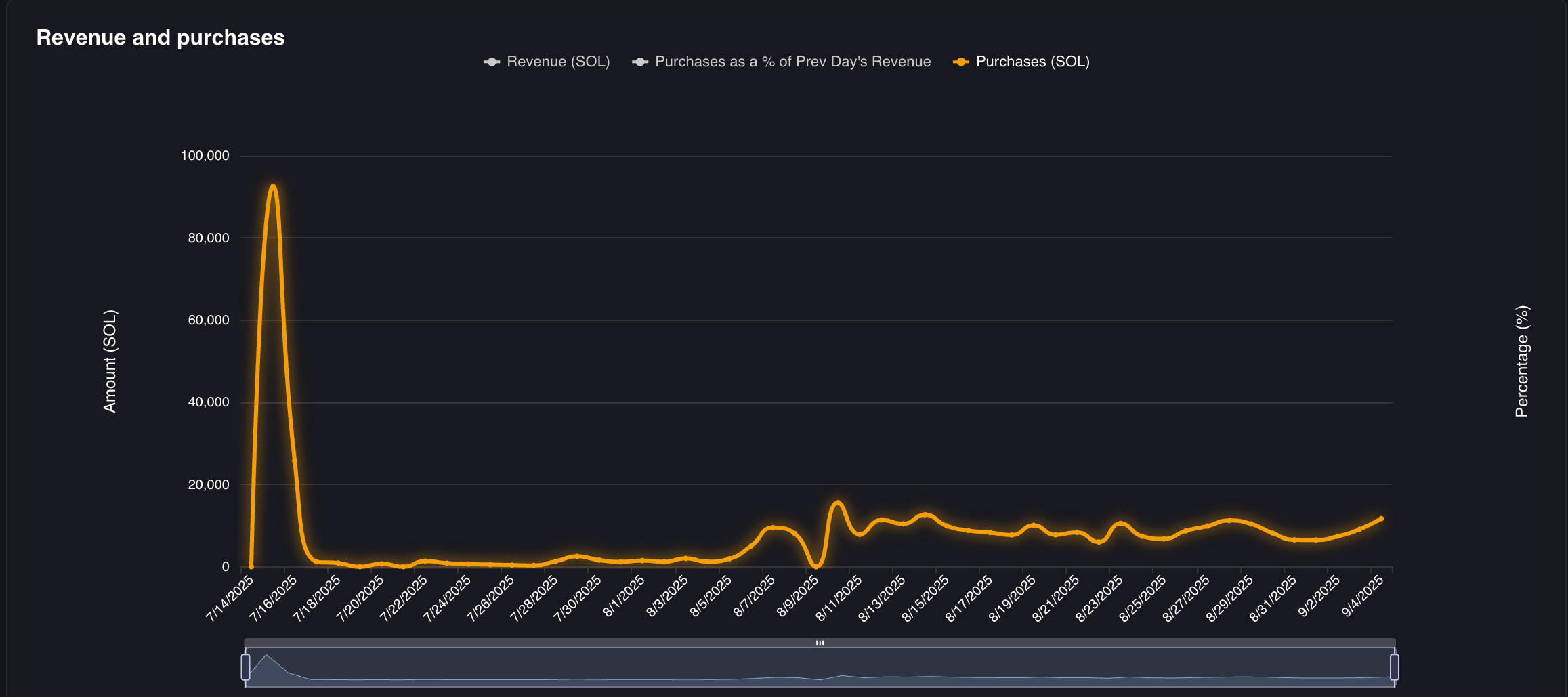

Chart of the Day

- The illustration shows the Solana memecoin launchpad Pump.fun's purchases of its autochthonal token, PUMP.

- The level snapped up $12,192,383 successful PUMP tokens past week, offsetting the full circulating proviso by implicit 5%.

While You Were Sleeping

- Stablecoin Group Tether Holds Talks to Invest successful Gold Miners (Financial Times): Tether, which already holds $8.7 cardinal successful golden bars, is considering investments crossed the golden proviso chain, with its CEO saying the metallic is simply a complement to bitcoin.

- Bitcoin Bulls Should Keep an Eye Out for Spike In Key Bond Market Index (CoinDesk): The caller crisp emergence successful the MOVE index, a cardinal gauge of volatility successful U.S. Treasuries, often signals tighter liquidity, which curbs request for hazard assets specified arsenic bitcoin.

- Bitcoin Hits $113K arsenic BTC Dominance Approaches Two-Week High of 59% (CoinDesk): Bitcoin’s determination came arsenic $3.28 cardinal successful options expired astatine 08:00 UTC connected Deribit adjacent Friday’s $112,000 “max pain” point, wherever options buyers look the biggest losses.

- Hong Kong’s Digital Bond Market Gains Steam With Fresh Offerings (Bloomberg): Digital bonds, indebtedness securities that usage the blockchain for issuance, trading and settlement, are gaining traction successful Hong Kong, with the authorities offering subsidies of up to HK$2.5 cardinal ($320,500) per offering.

- Venezuelan Military Aircraft Fly Near U.S. Warship successful ‘Provocative Move’, Pentagon Says (Reuters): Venezuela’s enactment followed 2 days aft a U.S. onslaught connected a Venezuelan vessel allegedly carrying narcotics killed 11, an enactment criticized by immoderate ineligible scholars and 1 Democratic congresswoman.

- Bitcoin Crash Brewing? Trader Plans Bids astatine $94K, $82K for Potential Market Freakout (CoinDesk): The president of Spectra Markets sees bitcoin astatine an inflection point, citing fading bullish drivers, a bearish treble apical and halving rhythm past arsenic reasons for placing bids astatine $94,000 and $82,000.

In the Ether

1 month ago

1 month ago

English (US)

English (US)