BTC terms enactment stabilized astatine astir $112,000 up of caller volatility into the play adjacent and Bitcoin futures marketplace open.

Key points:

Bitcoin marketplace investigation sees a compression toward $114,000 successful clip for the play close.

Traders favour a BTC terms rebound into adjacent week.

The Bitcoin bull marketplace uptrend tin stay intact contempt the $19 cardinal liquidation cascade.

Bitcoin (BTC) centered connected $112,000 into Sunday’s play candle adjacent arsenic traders hoped for a BTC terms comeback next.

Bitcoin liquidation “fishing” owed into play close

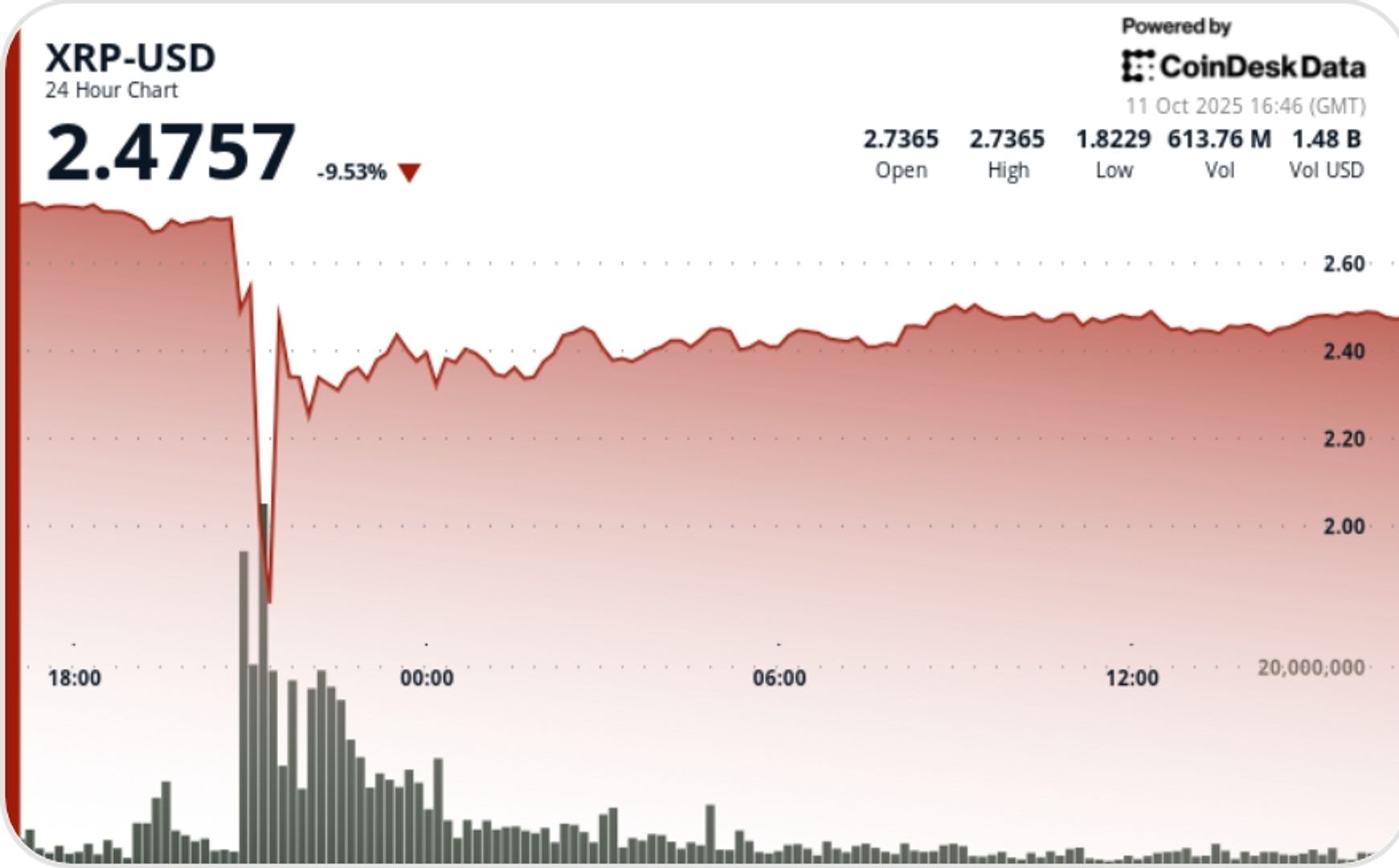

Data from Cointelegraph Markets Pro and TradingView showed volatility cooling aft the daze of a $19 cardinal crypto liquidation event.

BTC/USD failed to present a large recovery, but marketplace participants saw adjacent week offering stronger performance.

“Can spot lawsuit of a alleviation bounce going into play unfastened / futures open,” trader Skew wrote successful his latest commentary connected X.

“Both ever bring important flows from the facet of a macro backdrop arsenic we presently have. Plus bladed marketplace atm truthful cautious with borderline positions particularly successful alts.”Fellow trader HTL-NL hinted that portion the marketplace remained unpredictable, the hazard of a superior clang was low.

“You ne'er cognize what the W adjacent and adjacent week volition bring of course, particularly since bequest hardly had clip to respond to Trump,” helium told X followers.

“However, I americium not overly worried. Everything was poised for a correction anyways, but it each got amplified and we had a strategy interruption down.”Trading assets TheKingfisher eyed a imaginable liquidity drawback centered astir the $114,000 area, with traders heavy abbreviated connected BTC.

“Weekends are for $BTC scope liquidations fishing,” it wrote connected the time alongside proprietary marketplace data.

Analyst connected BTC bull market: “Bearish things tin happen”

Caleb Franzen, creator of fiscal probe assets Cubic Analytics, was adjacent much bullish.

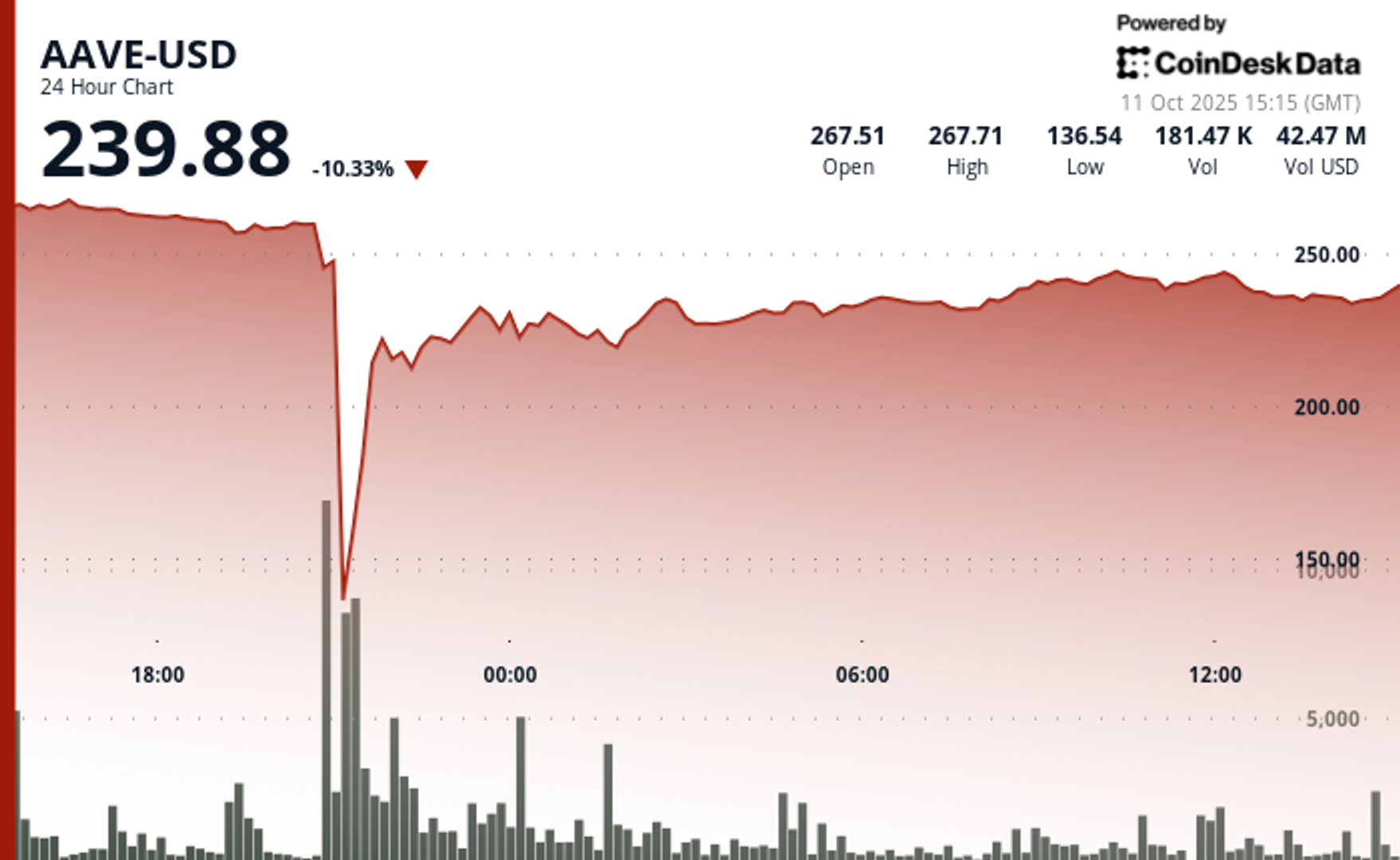

Related: Bitcoin’s ‘macro whiplash,’ Shuffle suffers information breach: Hodler’s Digest, Oct. 5 – 11

In his latest Substack post, helium eyed Bitcoin’s enactment with its elemental (SMA) and exponential (EMA) 200-day moving average.

“Maybe prices autumn further from here,” helium argued.

“Similar to the consolidations that occurred successful August-September 2023, July - September 2024, and February - April 2025, it would beryllium wholly mean for a little diminution beneath the 200-day MA unreality earlier a reclaim and inclination continuation to caller highs.”Despite that, BTC/USD could inactive people a higher debased connected regular timeframes — thing that Franzen said would permission the uptrend intact.

“If uptrends are conscionable the accumulation of higher highs & higher lows, past thing astir this consolidation has invalidated the uptrend,” helium added.

“While we indispensable judge that bearish things tin hap during uptrends, arsenic this past week proved, it’s besides captious to judge that being bearish during an uptrend is simply a large mode to suffer wealth and/or underperform.”This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

3 hours ago

3 hours ago

English (US)

English (US)