As the last 4th of 2025 gets underway, investors are entering a historically favorable play for crypto markets — peculiarly for bitcoin (BTC), which has delivered an mean Q4 instrumentality of 79% since 2013.

According to a caller study from CoinDesk Indices, respective factors whitethorn assistance that inclination repeat, including monetary easing, surging organization adoption and caller regulatory momentum successful the U.S.

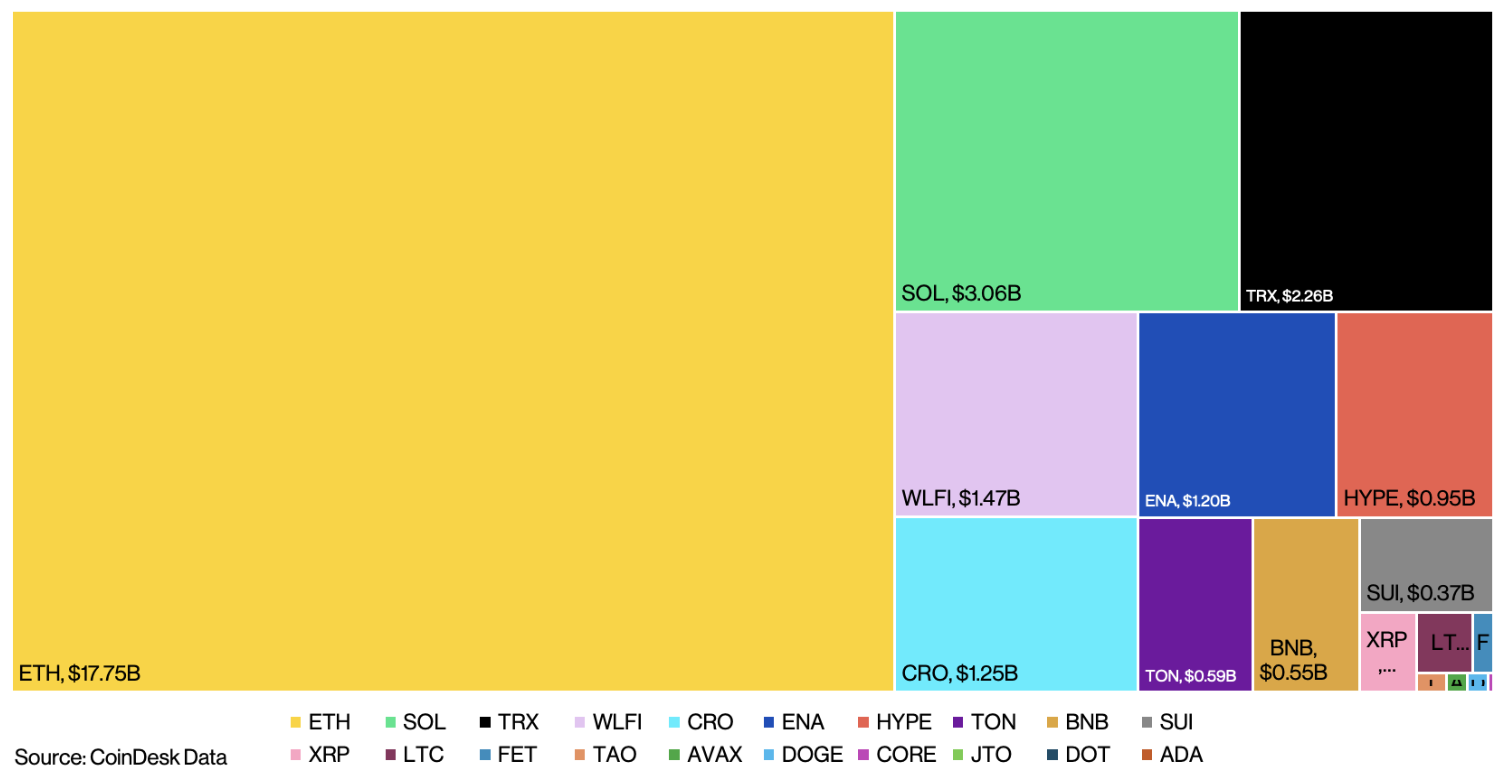

The backdrop is shifting fast. The Federal Reserve’s latest complaint chopped brought involvement rates to their lowest level successful astir 3 years, mounting the signifier for broader risk-on sentiment. Institutions responded aggressively successful Q3: U.S. spot bitcoin and ether (ETH) ETFs saw combined inflows of implicit $18 billion, portion nationalist companies present clasp much than 5% of bitcoin’s full supply.

Altcoins, too, person made inroads, with implicit 50 listed firms present holding non-BTC tokens connected their equilibrium sheets, 40 of which joined conscionable past quarter.

Bitcoin ended Q3 up 8%, closing astatine $114,000, driven mostly by treasury adoption among nationalist companies. With expectations for further complaint cuts and increasing involvement successful bitcoin arsenic a hedge against currency debasement, CoinDesk Indices expects the asset’s momentum to proceed into year-end.

But this clip around, bitcoin is sharing the spotlight. Ethereum surged 66.7% successful Q3, hitting a caller all-time precocious adjacent $5,000. That determination was led by treasury accumulation and ETF flows, but aboriginal gains whitethorn hinge connected November’s Fusaka upgrade which is aimed astatine improving scalability and web efficiency. If successful, it could reenforce Ethereum's relation arsenic the instauration for on-chain fiscal activity, particularly successful “low-risk” DeFi.

Solana (SOL) saw a 35% quarterly gain, backed by large-scale firm purchases and grounds ecosystem revenue. With caller exchange-traded products launching and the Alpenglow upgrade successful the pipeline, Solana is positioning itself arsenic the high-performance furniture for decentralized applications, a communicative that resonates with institutions seeking throughput and outgo efficiency.

XRP, meanwhile, delivered a year-to-date summation of astir 37%, fueled by ineligible clarity aft the Securities and Exchange Commission (SEC) and Ripple withdrew appeals successful their long-running case. Investors are watching intimately arsenic Ripple's stablecoin RLUSD expands globally. The stablecoin’s accelerated maturation could gully much DeFi protocols to the XRP Ledger, deepening XRP’s utility.

Cardano (ADA) roseate 41.1% successful Q3, outperforming respective of its peers. While enactment connected the concatenation remains comparatively modest, accordant maturation successful stablecoin use, derivatives measurement and DEX enactment has created a much unchangeable basal for imaginable expansion. A pending determination connected a spot ADA ETF could people a turning constituent for organization adoption.

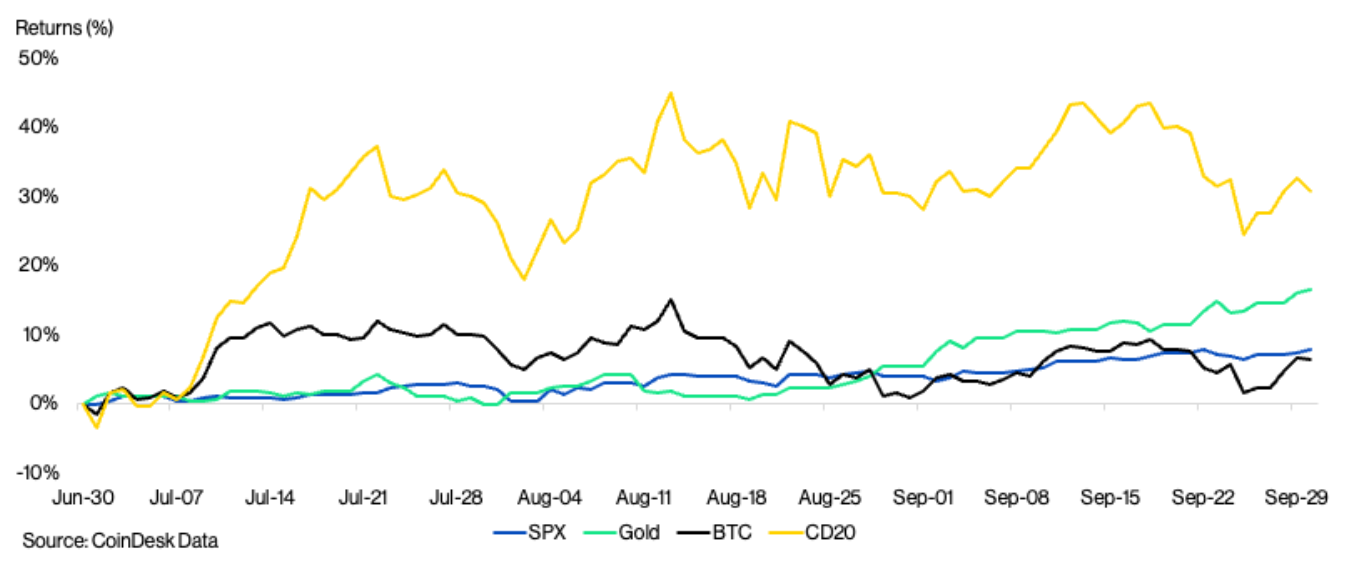

The broader inclination is besides evident successful scale performance. The CoinDesk 20 Index, which tracks the 20 astir liquid and tradable integer assets, gained implicit 30% successful Q3, outpacing bitcoin. The CoinDesk 80 and CoinDesk 100, which seizure mid- and small-cap assets, besides posted beardown returns, reflecting increasing involvement crossed the marketplace headdress spectrum.

Looking ahead, the support of generic listing standards for crypto ETFs and the emergence of multi-asset and staking-based ETPs could further accelerate inflows. For traders, Q4 presents a unsocial mix: a favorable macro environment, deepening organization engagement and renewed involvement successful altcoins.

2 months ago

2 months ago

English (US)

English (US)