By James Van Straten (All times ET unless indicated otherwise)

It's a caller day, but the aforesaid story: Bitcoin (BTC) is struggling and ether (ETH) is trying to clasp the $4,000 range. Crypto bulls tin instrumentality immoderate comfortableness successful the information that determination is lone 1 week near successful September, a historically bearish month, and what's usually the strongest 4th is conscionable astir the corner.

Sentiment wrong the manufacture remains subdued. The Crypto Fear and Greed Index sits astatine 45, which is neutral, but leaning somewhat person toward fearfulness than greed. Part of the crushed is bitcoin’s underperformance compared with accepted assets. In the past 3 months, bitcoin has added 7%, portion the S&P 500 gained 9% and golden 12%.

Looking ahead, $17 cardinal worthy of bitcoin options expire tomorrow, with a max symptom terms (the level astatine which enactment holders would acquisition the astir fiscal loss) of $110,000. That is somewhat beneath the existent spot terms of $112,000 and could supply short-term gravitational pull. For now, bitcoin is expected to consolidate betwixt $110,000 and $116,000 until October.

Meanwhile, the astir notable enactment continues to beryllium successful artificial quality and high-performance computing stocks specified arsenic IREN (IREN). Bitcoin treasury companies, however, stay nether pressure. KindlyMD (NAKA) is struggling astatine $1.17, conscionable supra its Private Investment successful Public Equity (PIPE) pricing, and Metaplanet (3350) fell different 4% successful Tokyo. The banal has dropped much than 70% from its all-time high, leaving it trading astatine a 1.24 multiple to nett plus worth (mNAV). This diminution highlights however mNAVs person compressed crossed the broader market. Stay alert!

What to Watch

- Crypto

- Macro

- Sept. 25, 8:30 a.m.: U.S. August Durable Goods Orders MoM composite Est. -0.5%, ex proscription Est. 0%.

- Sept. 25, 8:30 a.m.: U.S. Q2 GDP (final) Growth Rate QoQ Est. 3.3%.

- Sept. 25, 8:30 a.m.: U.S. Jobless Claims archetypal (w/e Sept. 20) Est. 235K, continuing (w/e Sept. 13) Est. 1930K.

- Sept. 25, 8:30 a.m.: U.S. Q2 PCE Prices (final) QoQ header Est. 2%; halfway Est. 2.5%.

- Sept. 25, 10 a.m.: U.S. August Existing Home Sales Est. 3.98M.

- Sept. 25, 10 a.m.: Fed Vice Chair for Supervision Michelle Bowman speech connected "Supervision and Regulation."

- Sept. 25, 1 p.m.: Fed Governor Michael Barr speech connected "Bank Stress Testing."

- Sept. 25, 3 p.m.: Mexico benchmark involvement complaint Est. 7.5%.

- Earnings (Estimates based connected FactSet data)

- None scheduled.

Token Events

- Governance votes & calls

- dYdX (DYDX) is voting connected whether to o.k. the mounting of Rewards C Constant to 0. Voting closes Sept. 26.

- Unlocks

- Sept. 25: Venom (VENOM) to unlock 2.28% of its released proviso worthy $7.98 million.

- Token Launches

- Sept. 25: Aster (ASTER) to database connected BTSE.

- Sept. 25: Plasma (XPL) to database connected 10+ exchanges including Binance, OKX and Bitget.

- Sept. 25: Casper Network (CSPR) to database connected Gate US.

- Sept. 25: Avantis (AVNT) to database connected BTSE.

Conferences

- Day 2 of 2: Connected Britain 2025 (London)

- Day 2 of 2: ETHSofia (Sofia, Bulgaria)

- Day 2 of 2: Nordic Fintech Week (Copenhagen)

- Sept. 25: Global Digital Asset Regulatory Summit 2025 (online)

- Day 1 of 2: Asset Based Finance 2025 (New York)

Token Talk

by Francisco Rodrigues

- The terms of Hyperliquid’s HYPE token is importantly underperforming the wider crypto market, chiefly owed to increasing contention from BNB Chain-based derivatives speech Aster and forthcoming token unlocks.

- Aster, which is backed by YZi Labs, overtook Hyperliquid in regular perpetual trading measurement this week successful an upset that sent shockwaves done crypto’s on-chain trading ecosystem.

- In conscionable 1 week, Aster’s unfastened involvement ballooned 33,500%, leaping from $3.7 cardinal to $1.25 billion. Its 24-hour trading measurement deed $35.8 billion, much than treble that of Hyperliquid, which logged $10 cardinal according to DeFiLlama data. Total worth locked (TVL) connected Aster besides jumped, astir tripling to $1.85 billion.

- The platform’s token, ASTER, has added much than 344% successful the past week to $2, giving it a afloat diluted valuation of $15.9 billion. HYPE slid to $43 from $58.4.

- HYPE's driblet coincides capitalist anxiousness implicit upcoming token unlocks. In precocious November, 237 cardinal HYPE, worthy much than $10 cardinal astatine existent prices, volition gradually go liquid implicit a two-year period.

Derivatives Positioning

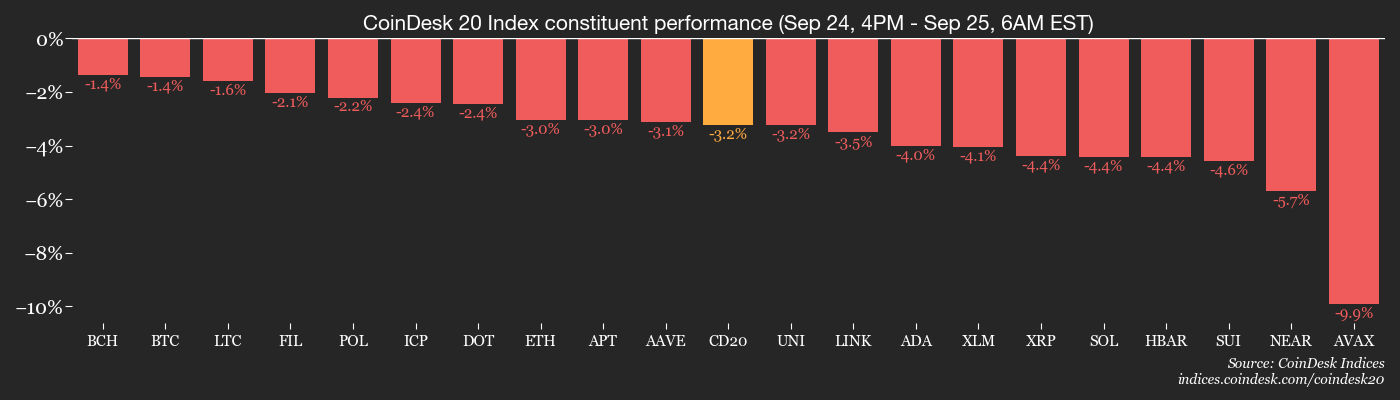

- Open involvement (OI) successful futures tied to galore large tokens has declined successful the past 24 hours, with AVAX witnessing the sharpest drop, astir 12%.

- Still, wide positioning successful BTC futures remains elevated, with OI hovering adjacent to grounds highs. ETH's futures OI has accrued to 14.45 cardinal ETH, contempt ample liquidations connected the decentralized speech Hyperliquid.

- OI successful USDT- and dollar-denominated SOL perpetuals connected large exchanges has accrued somewhat from 29 cardinal SOL to 30.28 cardinal SOL since Asian hours, arsenic the spot terms drops toward $200. Some traders look to beryllium shorting the decline.

- XRP, SOL, HBAR, TRX, SUI and XLM basal retired arsenic coins with antagonistic backing rates, pointing to a bias for bearish abbreviated positions.

- On the CME, the downtrend successful BTC futures OI has resumed portion OI successful ether futures has risen backmost to grounds highs supra 2.2 cardinal ETH. The annualized three-month ground successful ETH has dropped to 7% from 9.8% successful a motion of weakening of bullish pressures.

- On Deribit, BTC and ETH enactment options proceed to gully premium comparative to calls, coating a bearish picture. Some traders picked up out-of-the-money little onslaught ether puts via OTC table Paradigm.

Market Movements

- BTC is down 1.71% from 4 p.m. ET Wednesday astatine $111,622.87 (24hrs: -1.06%)

- ETH is down 3.38% astatine $4,026.82 (24hrs: -3.47%)

- CoinDesk 20 is down 3.52% astatine 3,923.42 (24hrs: -2.57%)

- Ether CESR Composite Staking Rate is up 5 bps astatine 2.9%

- BTC backing complaint is astatine 0.0022% (2.3586% annualized) connected Binance

- DXY is unchanged astatine 97.84

- Gold futures are up 0.39% astatine $3,782.80

- Silver futures are up 1.95% astatine $45.06

- Nikkei 225 closed up 0.27% astatine 45,754.93

- Hang Seng closed down 0.13% astatine 26,484.68

- FTSE is down 0.14% astatine 9,237.23

- Euro Stoxx 50 is down 0.25% astatine 5,450.72

- DJIA closed connected Wednesday down 0.37% astatine 46,121.28

- S&P 500 closed down 0.28% astatine 6,637.97

- Nasdaq Composite closed down 0.33% astatine 22,497.86

- S&P/TSX Composite closed down 0.20% astatine 29,756.95

- S&P 40 Latin America closed down 0.55% astatine 2,941.02

- U.S. 10-Year Treasury complaint is down 0.8 bps astatine 4.139%

- E-mini S&P 500 futures are unchanged astatine 6,691.25

- E-mini Nasdaq-100 futures are down 0.16% astatine 24,699.00

- E-mini Dow Jones Industrial Average Index are unchanged astatine 46,471.00

Bitcoin Stats

- BTC Dominance: 58.92% (+0.45%)

- Ether-bitcoin ratio: 0.03612 (-1.47%)

- Hashrate (seven-day moving average): 1,095 EH/s

- Hashprice (spot): $49.79

- Total fees: 2.88 BTC / $325,474

- CME Futures Open Interest: 136,940 BTC

- BTC priced successful gold: 29.8 oz.

- BTC vs golden marketplace cap: 8.44%

Technical Analysis

- Ether (ETH) is looking south, having bearishly dropped retired of a narrowing terms scope aboriginal this week.

- The terms has penetrated the 23.6% Fibonacci retracement support, with downward sloping 5- and 10-day elemental moving averages indicating a bearish bias.

- The absorption present shifts to $3,591, the 38.2% Fibonacci retracement level.

Crypto Equities

- Coinbase Global (COIN): closed connected Wednesday astatine $321.77 (+0.53%), -1.37% astatine $317.37

- Circle Internet (CRCL): closed astatine $131.58 (+0.47%), -0.3% astatine $131.18

- Galaxy Digital (GLXY): closed astatine $34.29 (+3.47%), -0.85% astatine $34

- Bullish (BLSH): closed astatine $67.59 (-2.73%), -1.97% astatine $66.26

- MARA Holdings (MARA): closed astatine $17.64 (-0.4%), -0.68% astatine $17.52

- Riot Platforms (RIOT): closed astatine $17.99 (+5.39%), -0.89% astatine $17.83

- Core Scientific (CORZ): closed astatine $17.01 (+0.06%), -0.82% astatine $16.87

- CleanSpark (CLSK): closed astatine $14.45 (+3.88%), -1.59% astatine $14.22

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $45 (+4.9%), +1.71% astatine $45.77

- Exodus Movement (EXOD): closed astatine $32 (+12.08%), +2.84% astatine $32.91

Crypto Treasury Companies

- Strategy (MSTR): closed astatine $323.31 (-1.36%), -0.87% astatine $320.50

- Semler Scientific (SMLR): closed astatine $31.62 (-3.18%), +0.57% astatine $31.80

- SharpLink Gaming (SBET): closed astatine $17.58 (+3.35%), -3.24% astatine $17.01

- Upexi (UPXI): closed astatine $6.16 (-0.16%), -3.57% astatine $5.94

- Lite Strategy (LITS): closed astatine $2.7 (+2.66%)

ETF Flows

Spot BTC ETFs

- Daily nett flows: $241 million

- Cumulative nett flows: $57.45 billion

- Total BTC holdings ~1.32 million

Spot ETH ETFs

- Daily nett flows: -$79.4 million

- Cumulative nett flows: $13.64 billion

- Total ETH holdings ~6.6 million

Source: Farside Investors

While You Were Sleeping

- Ether Falls to $4K, BTC, XRP Slide arsenic U.S. Government Shutdown Risks Mount (CoinDesk): Polymarket traders enactment the likelihood of a national authorities shutdown astatine 77%. Federal agencies are drafting unpaid permission plans arsenic Congress faces a Sept. 30 deadline to walk stopgap funding.

- Stablecoin Issuer Circle Examines ‘Reversible’ Transactions successful Departure for Crypto (Financial Times): Circle is exploring a counter-payments furniture for its Arc blockchain to let refunds and has developed a confidentiality diagnostic to fell transaction amounts, though it has not yet been released.

- Nine European Banks Join Forces to Issue MiCA-Compliant Euro Stablecoin (CoinDesk): ING, UniCredit, Danske Bank, CaixaBank, SEB, KBC, Banca Sella, DekaBank and Raiffeisen program to motorboat a MiCA-regulated euro stablecoin successful the 2nd fractional of 2026 to situation U.S. dominance.

- Australia Looks to Bring Crypto Under Financial Services Framework With New Draft Legislation (CoinDesk): The draught instrumentality would necessitate crypto platforms to clasp fiscal work licenses nether the Australian Securities and Investments Commission oversight, with consultation unfastened until Oct. 24.

- White House Eyes New Round of Mass Layoffs if Government Shuts Down (The New York Times): A White House memo ordered national agencies to program for furloughs and layoffs targeting jobs seen arsenic politically misaligned, escalating tensions earlier the Sept. 30 backing deadline.

1 month ago

1 month ago

English (US)

English (US)