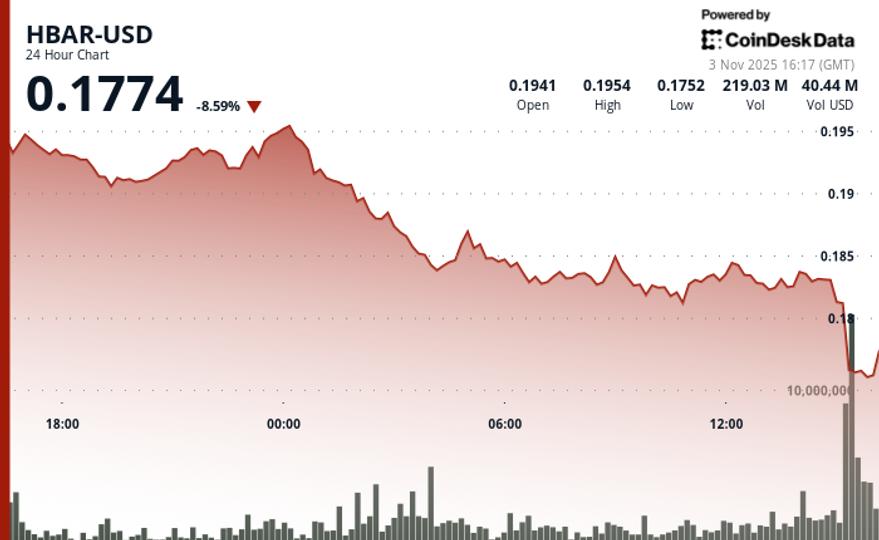

US-based spot Bitcoin ETFs saw a melodramatic uptick successful capitalist enactment arsenic the apical crypto terms reached a caller all-time precocious of implicit $118,000, at slightest successful dollars.

According to SoSoValue data, the 12 funds saw cumulative inflows of $1.2 billion, the 2nd strongest regular show since motorboat successful 2024, and the champion this year. Since mid-April, the funds person attracted much than $15 cardinal successful caller capital.

Bitcoin ETF inflows (Source: Coinglass)

Bitcoin ETF inflows (Source: Coinglass)BlackRock’s IBIT led the time with $448.5 cardinal inflows and implicit $5 cardinal successful trading volume, doubly its accustomed regular average.

IBIT is present conscionable shy of $80 cardinal successful assets nether absorption and holds implicit 700,000 Bitcoin, a grounds high. For context, it took SPDR Gold Shares (GLD), the largest golden ETF, much than 15 years to scope a akin level.

Meanwhile, different Bitcoin ETF issuers similar Fidelity’s FBTC besides recorded beardown show connected the day, with $324.34 cardinal successful inflows, portion Ark 21Shares’ ARKB pulled successful $268.7 cardinal successful caller capital.

The surge successful Bitcoin ETF enactment appears to beryllium a wide motion of organization interest, spurred by the broader marketplace rally.

Bloomberg’s ETF analyst, Eric Balchunas, emphasized that the influx of caller funds into these ETFs is simply a important accomplishment, pointing retired that portion marketplace appreciation tin boost assets, attracting caller investors requires convincing them to buy.

He explained:

“Assets tin summation conscionable from marketplace appreciation, but nett flows are similar nett sales, you person to person radical to bargain the ETF. Today, they’re implicit $40 billion, and with marketplace appreciation, they’re present astir $120 billion. That’s astonishing. Gold took implicit a decennary to deed that number.”

Considering this, Balchunas predicts the Bitcoin ETFs could surpass golden funds successful assets wrong the adjacent 3 to 5 years.

Ethereum ETFs

Ethereum ETFs besides performed powerfully connected the day, with the 9 US spot Ethereum funds collectively attracting implicit $383 cardinal successful inflows. According to SoSo Value data, this is their second-best time show since they launched past year.

BlackRock’s iShares Ethereum Trust (ETHA) was astatine the halfway of this momentum. The money brought successful much than $300 cardinal of the full inflows and saw its measurement ascent to implicit $800 cardinal for 2 consecutive days.

Meanwhile, different issuers similar Grayscale, Fidelity, Bitwise, and VanEck each saw inflows of $38 million, $37.2 million, $3.2 million, and $2 million, respectively.

Nate Geraci, the president of NovaDius Wealth, pointed out:

“Financial advisors, who power tremendous magnitude of [dollars], person hardly adjacent begun allocating to btc & eth ETFs… Major platforms specified arsenic Vanguard are inactive gatekeeping these ETFs (which is laughable IMO). And we’re inactive seeing adjacent grounds inflows.”

The station Bitcoin ETFs spot grounds $1.2B inflow arsenic marketplace hits all-time precocious successful dollars appeared archetypal connected CryptoSlate.

3 months ago

3 months ago

English (US)

English (US)