The US Federal Reserve announced its 3rd involvement complaint chopped of the twelvemonth connected Wednesday, lifting US equities portion Bitcoin (BTC) slipped before bouncing back.

That dynamic has defined the 2nd fractional of 2025. Even arsenic superior flows into Bitcoin are progressively tied to accepted equity investors, the cryptocurrency has continued to diverge from the banal market.

Over the past six months, Bitcoin has fallen astir 18%. Meanwhile, the 3 large US banal indexes posted beardown and accordant gains, with the Nasdaq Composite up 21%, the S&P 500 rising 14.35% and the Dow Jones Industrial Average climbing 12.11%.

Bitcoin has inactive recorded notable milestones this year, including mounting caller all-time highs and avoiding the emblematic “red September” for the 3rd twelvemonth successful a row.

Here’s however Bitcoin’s divergence from stocks has widened done the 2nd fractional of the year.

July: GENIUS Act lifts crypto

July 2025 was defined by beardown equity show and a resilient hazard appetite that persisted contempt important tariff announcements.

Early-July commercialized rhetoric caused little turbulence, but markets rapidly shifted their absorption backmost to firm net and underlying maturation fundamentals.

Related: DATs bring crypto’s insider trading occupation to TradFi: Shane Molidor

On July 9, AI spot elephantine Nvidia became the first institution to scope a $4-trillion valuation. On the aforesaid day, equities shrugged disconnected trade-related shocks arsenic the S&P 500 and Nasdaq posted caller grounds highs adjacent aft the US announced 50% tariffs connected copper.

Bitcoin ended July up 8.13%, marking its strongest monthly show successful the 2nd fractional of the twelvemonth to date, including December. Crypto markets strengthened aft US President Donald Trump signed the GENIUS Act into law, injecting caller optimism into the sector, peculiarly for stablecoin-related businesses.

Corporate adoption besides remained a cardinal theme, with companies continuing to adhd Bitcoin to their equilibrium sheets arsenic portion of integer plus treasury strategies. By July, interest successful different large cryptocurrencies, including Ether (ETH) and Solana (SOL), besides began to prime up.

August: Powell’s code powers Ether’s ATH

August was driven by rising expectations that the Federal Reserve would soon chopped involvement rates. Those hopes fueled a wide rally crossed accepted markets, portion crypto moved adjacent faster. Bitcoin surged to a caller all-time high of astir $124,000 connected Aug. 14 arsenic the US dollar weakened amid rising commercialized tensions.

The Jackson Hole Economic Symposium past brought markets’ attraction backmost to monetary policy. On Aug. 22, Fed Chair Jerome Powell delivered a dovish signal, suggesting that complaint cuts were inactive imaginable aboriginal successful the year, pushing Ether to a caller all-time high.

Equities responded positively, but Bitcoin failed to prolong its momentum. The plus saw a crisp but little uptick instantly aft Powell’s code earlier resuming its decline. By month’s end, Bitcoin’s post-ATH correction had intelligibly diverged from accepted markets. Bitcoin closed August down 6.49%.

September: First complaint chopped of 2025

September has historically been Bitcoin’s weakest month. Along with June, it is 1 of lone 2 months that posts a antagonistic mean monthly return, earning it the nickname “red September.”

In 2025, however, Bitcoin defied that trend, signaling its 3rd consecutive affirmative September. The summation came arsenic the Fed delivered its archetypal complaint chopped of the year, a 25-basis-point simplification justified by signs of a cooling labour market. Bitcoin ended the period up 5.16%.

Related: Bitcoin acceptable to bushed ‘red September’ dip for 3rd consecutive year

Equities besides responded positively, extending their third-quarter rally arsenic markets priced successful the likelihood of further monetary easing successful October.

Bitcoin, however, faced a caller interior challenge. The assemblage became divided implicit a large web upgrade that would region limits connected however overmuch arbitrary information tin beryllium embedded connected the blockchain.

Bitcoin Core, the bundle implementation astir wide utilized by miners and node operators, supported lifting the limit. Those who presumption non-financial information connected Bitcoin arsenic spam pushed backmost against the change, contributing to accrued adoption of Bitcoin Knots arsenic an alternate implementation.

October: Trump threatens 100% tariffs connected China

Bitcoin hit different all-time precocious connected Oct. 6, but the period was yet defined by the largest liquidation lawsuit successful Bitcoin’s history, with astir $19 cardinal successful positions wiped out.

Several factors were identified arsenic contributors to the liquidation cascade that sent Bitcoin plunging beneath $110,000. These included a terms glitch connected Binance and the industry’s dense reliance connected futures-based trading, which amplified forced liquidations arsenic prices fell.

The contiguous catalyst, however, was a societal media station by President Trump threatening 100% tariffs connected Chinese imports. The remark triggered a crisp sell-off crossed some crypto and equity markets.

Although October is often referred to arsenic Uptober successful the crypto assemblage owed to its historically beardown performance, 2025 proved to beryllium an exception. Bitcoin snapped a five-year streak of affirmative Octobers and ended the period down 3.69% adjacent arsenic large banal indexes recovered from the trade-related shock.

Trump’s societal station sparks a crypto liquidation frenzy. Source: Donald Trump

Trump’s societal station sparks a crypto liquidation frenzy. Source: Donald TrumpBy the extremity of the month, the Fed delivered its 2nd consecutive complaint cut, lowering the national funds complaint by different 25 ground points. Meanwhile, the US authorities remained unopen passim October, extending what became the longest authorities shutdown successful history.

November: End of the US authorities shutdown

October whitethorn transportation the nickname Uptober, but November has historically been Bitcoin’s strongest month, posting an mean summation of 41.12% — much than treble October’s mean instrumentality of astir 20%.

In 2025, November proved to beryllium Bitcoin’s worst-performing period of the year, with the plus falling 17.67%. Selling unit intensified passim the month, pushing Bitcoin beneath the $100,000 people by mid-November.

November is historically Bitcoin’s champion month, but it was the worst period of 2025. Source: CoinGlass

November is historically Bitcoin’s champion month, but it was the worst period of 2025. Source: CoinGlassThe divergence from equities was pronounced. Stock markets traded mostly sideways arsenic the US authorities shutdown came to an end. Investors remained cautious amid concerns implicit a imaginable AI-driven bubble. Some of those fears were eased aboriginal successful the period aft Nvidia reported grounds net for the 3rd quarter, helping stabilize sentiment crossed exertion stocks.

Bitcoin’s year-end people slashed

So far, Bitcoin is up astir 2% successful December, with large equity indexes besides posting mean gains. Bitcoin’s mean December instrumentality presently stands astatine 4.54% astatine the clip of writing.

While the vacation play has been comparatively quiescent for Bitcoin successful caller years, past suggests the crypto marketplace does not needfully dilatory down during the festivities.

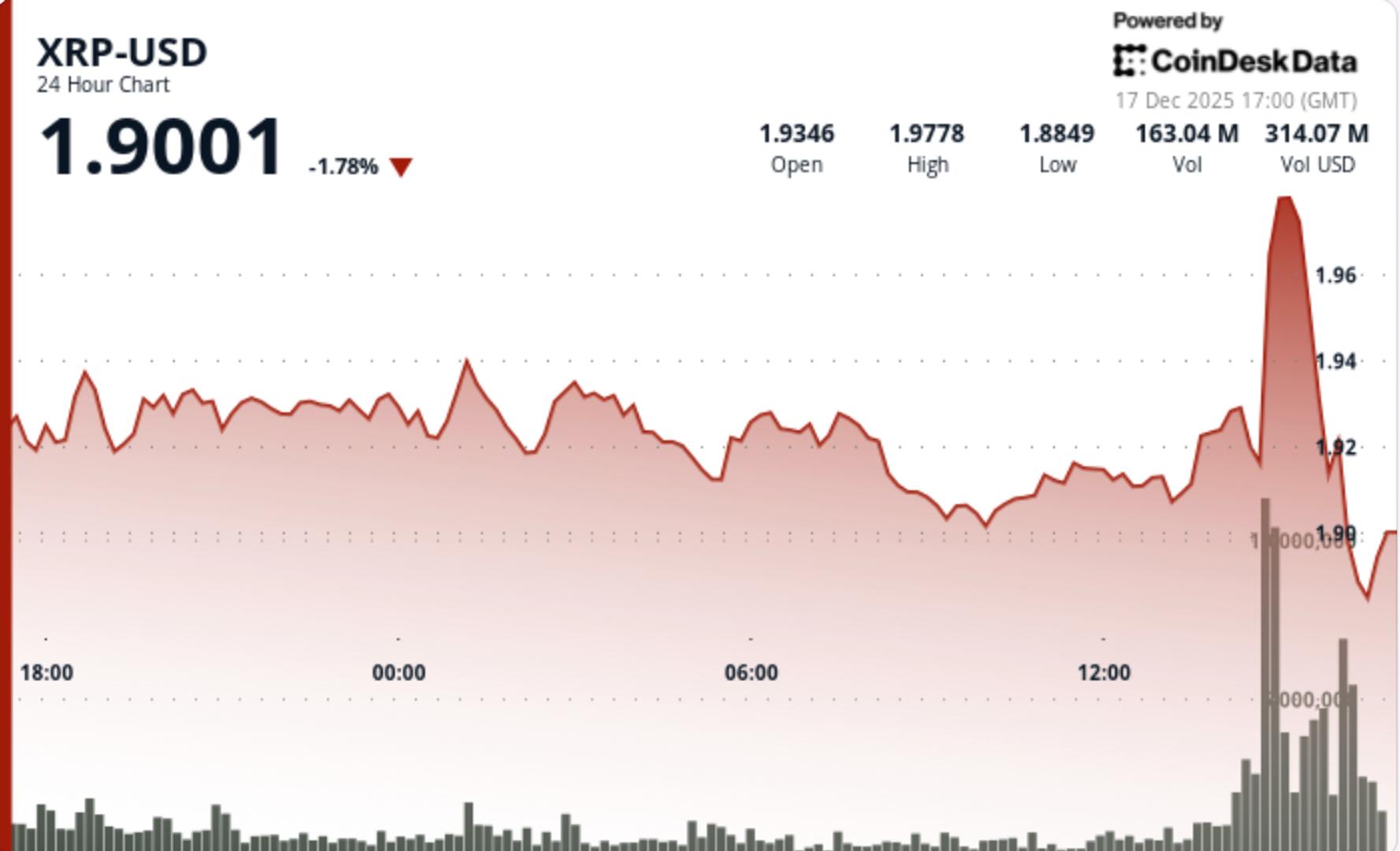

In December 2020, for example, Bitcoin surged astir 47%, adjacent arsenic market-shaking quality emerged from the US Securities and Exchange Commission: the motorboat of a years-long suit against Ripple Labs and its executives.

This year, overmuch of the optimism surrounding Bitcoin’s imaginable year-end rally has faded. Several marketplace watchers person lowered their terms targets for the cryptocurrency, including Standard Chartered.

The slope had antecedently forecast a year-end terms of $200,000 for Bitcoin, but connected Monday, it revised that people down to $100,000. Standard Chartered has besides delayed its longer-term forecast for Bitcoin reaching $500,000, pushing the people from 2028 to 2030.

Magazine: Big questions: Would Bitcoin past a 10-year powerfulness outage?

6 days ago

6 days ago

English (US)

English (US)