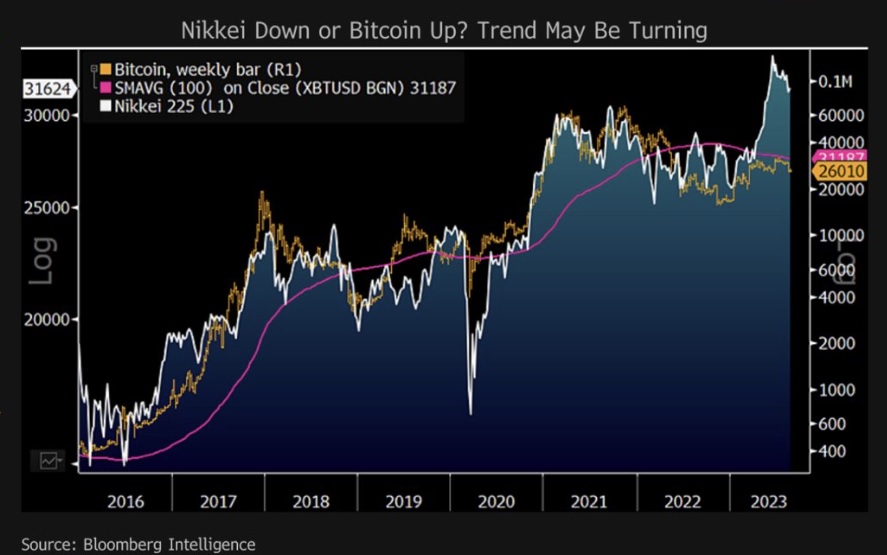

Bloomberg Intelligence’s elder commodity strategist, Mike McGlone, has predicted that the terms of bitcoin could “follow the way of the Nikkei, which reached a 33-year precocious successful June.” He highlighted that the largest crypto “has had a adjacent directional narration with the Nikkei 225.”

Bitcoin’s ‘Close Directional Relationship’ With Nikkei Index

Mike McGlone, a elder commodity strategist for Bloomberg Intelligence (BI), the probe limb of Bloomberg, has pointed retired similarities betwixt the Nikkei scale and the terms of bitcoin.

In the latest Bloomberg Intelligence report, the commodity strategist explored whether the Nikkei scale oregon the Nikkei Stock Average (Nikkei 225), the premier scale of Japanese stocks, is “a usher for bitcoin oregon vice versa.” McGlone elaborate past week:

Bitcoin has had a adjacent directional narration with the Nikkei 225, and caller crypto weakness whitethorn portend contagion. That oregon the benchmark crypto mightiness retrieve and travel the way of the Nikkei, which reached a 33-year precocious successful June.

“Our bias is to heed the leading-indicator inklings of bitcoin and respect the downward-sloping 100-week moving average,” helium added. “Sustaining backmost supra astir $31,000 would beryllium an denotation of bitcoin betterment strength, but there’s bully crushed for the downward reversion to proceed — the Fed and astir cardinal banks are inactive tightening,” the strategist further shared.

McGlone besides pointed retired the anticipation that the Nikkei could way bitcoin’s downward trajectory. “Japan’s adjacent proximity to China and our presumption that the state is similar immoderate operation of Ayn Rand’s ‘Atlas Shrugged,’ highest Japan and the Soviet Union implicit 30 years ago, with deflation implications, whitethorn portend the Nikkei pursuing bitcoin lower,” the strategist described.

He besides explained past Wednesday that the downtrend of bitcoin’s terms since the 2021 precocious “may beryllium resuming,” noting that “$30,000 is simply a cardinal pivot level.” The strategist stressed that “Sustaining backmost supra $30,000 would bespeak a reversal upward akin to a akin signifier astir $12,000,” which happened successful the 2nd 4th of 2020. However, helium noted: “A cardinal origin that’s antithetic this clip is unfavorable liquidity — astir cardinal banks are inactive tightening and elevating rollover risks successful the banal market.”

What bash you deliberation astir Mike McGlone’s investigation regarding the terms of bitcoin and the Nikkei index? Let america cognize successful the comments conception below.

2 years ago

2 years ago

English (US)

English (US)