In a station shared connected TradingView, crypto expert Xanrox argues that the existent bullish rhythm is astir over, pointing to a imaginable downtrend that would spot the Bitcoin terms clang to $60,000. This investigation comes arsenic Bitcoin is trading wrong a precise quiescent phase, prompting galore crypto traders and crypto analysts to start reassessing its adjacent direction.

Xanrox Predicts Bitcoin Top At $122,000 And Crash To $60,000

The world’s largest cryptocurrency has been hovering conscionable supra the $118,000 terms level for respective days now, struggling to interruption decisively above this portion but besides showing nary large signs of a breakdown. Despite this consolidation, marketplace sentiment remains upbeat.

The crypto fearfulness and greed scale continues to flash “greed,” and astir analysts inactive reason that Bitcoin is mounting up for different limb upward. However, an absorbing method outlook challenges this bullish statement and issues a clang warning.

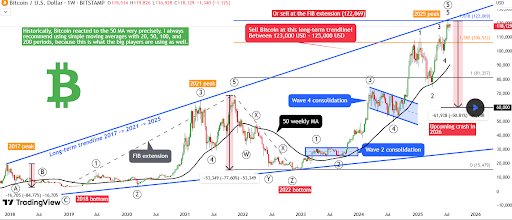

Notably, crypto expert Xanrox identified a merchantability awesome on the play candlestick timeframe illustration aft Bitcoin reached the 1.618 Fibonacci hold and touched the semipermanent 2017–2021–2025 trendline, with the latest interaction of the trendline aligning to Bitcoin’s caller all-time precocious astatine $122,800.

According to him, the astir caller interaction of this trendline mightiness beryllium the apical of the existent cycle. Furthermore, helium noted that the Elliott Wave operation has present completed Wave 5 of a rising wedge and a larger Wave 5 impulse move. As such, a corrective signifier is astir to start.

What’s Next For Bitcoin?

As shown successful the illustration below, the adjacent large determination could beryllium astatine slightest a 50% decline, with Bitcoin dropping to astir $60,000 by 2026. This projection is based connected erstwhile terms action, wherever Bitcoin embarked connected 84% and 77% terms crashes aft touching the trendline successful 2017 and 2021, respectively.

Source: Xanrox connected Tradingview

Source: Xanrox connected TradingviewThe method setup besides aligns with statistical information that shows August and September historically bring accrued selling pressure. Xanrox noted that portion traders tin hold for further confirmation, specified arsenic a interruption beneath the 50-week moving average, helium personally believes the apical is already in. Large institutions and nonrecreational investors wage adjacent attraction to the 20, 50, 100, and 200-period moving averages.

Related Reading: Bitcoin Short Squeeze Incoming As Market Makers Set Trap To Go Above $123,000

Xanrox’s outlook is simply a crisp opposition to the prevailing sentiment among crypto investors. Bitcoin’s existent operation is inactive showing spot connected higher timeframes, and respective different analysts spot the caller consolidation betwixt $117,000 and $119,000 arsenic a basal for continuation toward $130,000 and beyond.

The deficiency of large sell-side volume, the steadfast clasp supra the $118,000 terms level and the 50-week moving average, and bullish indicators crossed altcoins similar Ethereum are on-chain signals that the Bitcoin terms still has much country to run earlier it reaches a highest terms this cycle.

Featured representation from Pixabay, illustration from Tradingview.com

3 months ago

3 months ago

English (US)

English (US)