The crypto marketplace is somewhat bouncing backmost from aboriginal Friday’s jitters connected escalating struggle betwixt Israel and Iran.

After slumping to the $102,600 mark, bitcoin BTC rebounded to astir $106,000 earlier fading little successful the U.S. day hours with reports astir a caller question of airstrikes targeting Iran. The apical cryptocurrency was down 1.6% successful the past 24 hours, changing hands astatine $105,200 and inactive little than 6% shy of its all-time precocious price.

Meanwhile, the CoinDesk 20 — an scale of the apical 20 cryptocurrencies by marketplace capitalization, excluding memecoins, stablecoins and speech coins — has mislaid 4.4% successful the aforesaid play of time. Tokens specified arsenic ether ETH, avalanche AVAX and toncoin TON were the hardest hit, slumping betwixt 6% and 8%.

Crypto stocks, however, aren’t doing excessively hot. Most equities are successful the red, particularly bitcoin miners MARA Holdings (MARA) and Riot Platforms (RIOT), down 5% and 4% respectively. A notable objection is stablecoin issuer Circle (CIRCL), which is inactive benefiting from the windfall of its caller IPO; the banal is up 13% today, with quality of retail giants Amazon and Walmart reportedly exploring stablecoins adding to the momentum.

Traditional markets don’t look overwhelmingly acrophobic by the war. While golden is up 1.3%, perchance gearing up for caller all-time highs, the S&P 500 and Nasdaq are lone down 0.4% each.

What's adjacent for bitcoin?

"Nice bounce frankincense acold and deficiency of follow-through lower," well-followed crypto trader Skew said successful a Friday X post. Market participants volition apt stay cautious done the play with BTC tightly correlated with accepted markets amid heightened geopolitical risks, Skew added.

On the longer timeframe, immoderate analysts spot risks of a deeper pullback.

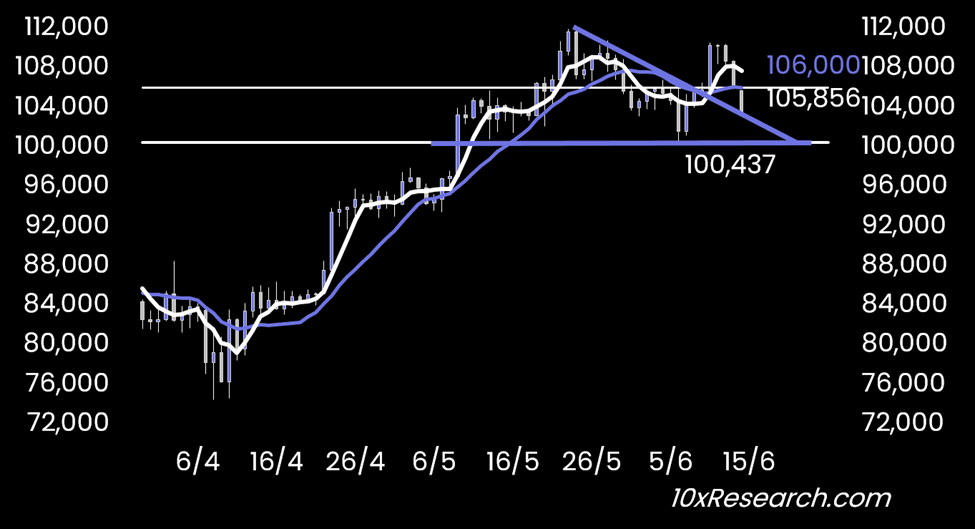

10x Research laminitis Markus Thielen noted that BTC's driblet beneath $106,000 translates to a failed breakout, and traders should hold for much favorable setups earlier rushing to bargain the dip.

He highlighted the $100,000-$101,000 portion arsenic cardinal support, informing that a interruption beneath could people a instrumentality to the broader consolidation signifier akin to past summer.

John Glover, main concern serviceman astatine bitcoin lender Ledn, argued that bitcoin entered a corrective signifier from its grounds highs that could spot the largest integer plus driblet to $88,000-$93,000.

He said the $90,000 level could connection a favorable introduction for opportunistic investors earlier BTC resumes its uptrend.

"Once this signifier has played out, the adjacent determination higher to the $130,000 country is expected to begin," helium said.

4 months ago

4 months ago

English (US)

English (US)