Despite providing galore caller services, DeFi does not disagree substantially from accepted concern successful its functions, the Financial Stability Board stated.

Own this portion of past

Collect this nonfiction arsenic an NFT

The Financial Stability Board (FSB), the fiscal regulator funded by the Bank for International Settlements (BIS), is pushing planetary regulations for decentralized concern (DeFi).

The FSB connected Feb. 16 issued a study connected the fiscal stableness risks of DeFi, highlighting large vulnerabilities, transmission channels and the improvement of DeFi.

Despite providing galore “novel” services, DeFi “does not disagree substantially” from accepted concern (TradFi) successful its functions, the authorization said successful the report. By trying to replicate immoderate functions of TradFi, DeFi increases imaginable vulnerabilities owed to the usage of caller technologies, the precocious grade of ecosystem interlinkages and the deficiency of regularisation oregon compliance, the FSB argued.

Moreover, the existent grade of decentralization successful DeFi systems “often deviates substantially” from the stated claims of the founding originators, the authorization claimed.

In bid to forestall the improvement of DeFi-associated fiscal stableness risks, the FSB is cooperating with planetary standard-setting bodies (SSB) to measure DeFi regulations crossed aggregate jurisdictions.

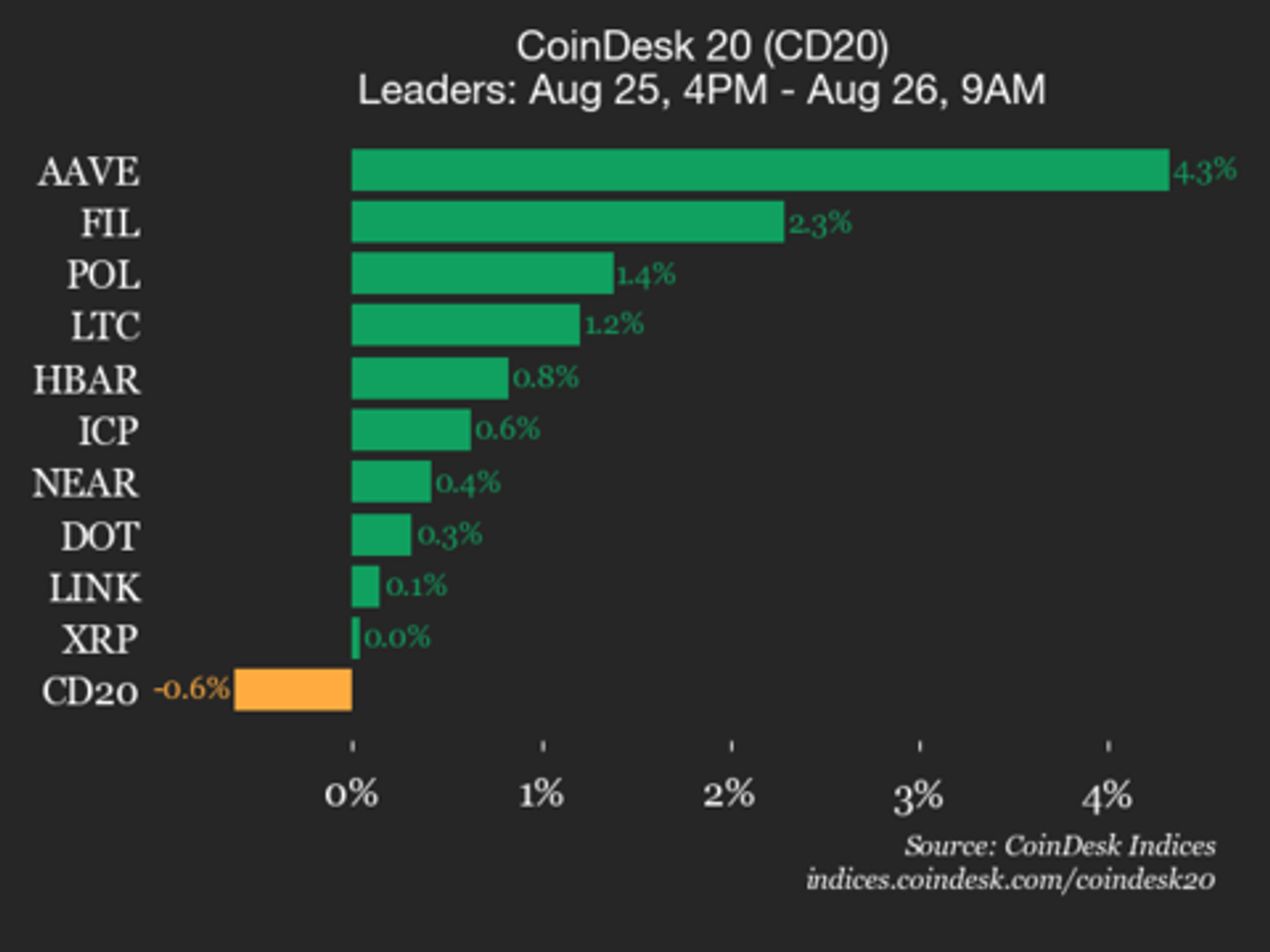

Monthly DeFi unsocial addresses and fig of DeFi apps. Source: FSB

Monthly DeFi unsocial addresses and fig of DeFi apps. Source: FSBIn this regard, a cardinal constituent to see would beryllium the introduction points of DeFi users, including stablecoins and centralized crypto plus platforms, the FSB said, adding:

“The FSB whitethorn see whether subjecting these crypto-asset types and entities to further prudential and capitalist extortion requirements, oregon stepping up the enforcement of existing requirements, could trim the risks inherent successful person interconnections.”The FSB emphasized that some asset-backed stablecoins similar Tether (USDT) and algorithmic stablecoins similar Dai (DAI) play an important relation wrong the DeFi ecosystem done their usage successful purchasing, settling, trading, lending and borrowing different crypto-assets. The emergence of stablecoins would besides apt summation the adoption of DeFi solutions by retail and firm users arsenic good arsenic facilitate the adoption of crypto assets arsenic a means of payment, the regulator suggested.

“With respect to liquidity and maturity mismatch issues, stablecoins are a important country of focus,” the FSB wrote, stressing the request to recognize the peculiarities of antithetic stablecoins successful bid to show the hazard they airs to the crypto industry, including DeFi ecosystems.

Related: Circle squashes rumors of planned SEC enforcement action

The quality comes amid the expanding scrutiny of immoderate large stablecoins by planetary regulators. On Feb. 13, blockchain infrastructure level Paxos Trust Company announced that it volition stop issuing Binance USD (BUSD) stablecoins amid the ongoing probe by New York regulators. The New York Department of Financial Services ordered Paxos Trust to halt BUSD issuance, alleging that BUSD is an unregistered security.

2 years ago

2 years ago

English (US)

English (US)