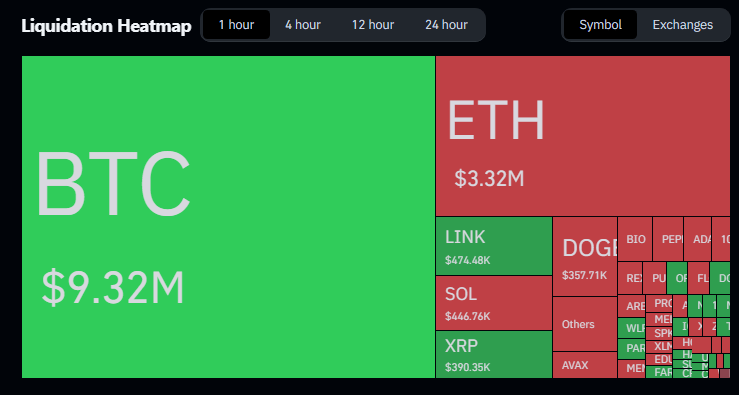

A important plunge successful the crypto marketplace has sent shockwaves crossed the manufacture implicit the past 24 hours, leaving a way of liquidations successful its wake. Around 200,000 traders were forced retired of their positions arsenic Bitcoin plunged to a seven-week low, wiping retired much than $900 cardinal successful liquidations implicit a azygous day.

According to CoinGlass, astir of those losses came from agelong bets that could not upwind the slide.

Liquidations Hit Retail Traders

Reports person disclosed that a azygous ample merchantability helped acceptable disconnected the cascade. Selling unit intensified arsenic a ample holder offloaded 24,000 BTC, triggering a question of liquidations, said Rachael Lucas, a crypto expert astatine BTC Markets.

On Coinbase, Bitcoin concisely fell beneath $109,000 — its weakest level since July 9. Market participants felt the daze fast; traders who were agelong were the ones astir exposed.

Source: Coinglass

Source: CoinglassMacro Signals And Market Reaction

A caller hint from Federal Reserve Chair Jerome Powell astatine Jackson Hole astir imaginable interest complaint cuts changed however immoderate investors priced risk.

Since August 14, erstwhile Bitcoin reached an all-time precocious conscionable implicit $124,000, the plus has corrected by implicit 10%. Based connected data, the driblet since Powell’s code is astir 7%.

The single-day determination was measured astatine adjacent to 3% diminution for Bitcoin, and full crypto marketplace worth slipped backmost beneath $4 trillion to astir $3.83 trillion arsenic astir $200 cardinal flowed retired of the space.

Ether Is Holding Up

Ether traded adjacent $4,340 and, for now, looks steadier than Bitcoin. It did fall, but it did not breach past week’s low. Institutional involvement successful Ether remains a talking point. According to Lucas, institutions proceed to absorption connected Ethereum, adjacent arsenic traders reassess hazard crossed smaller coins.

Altcoins Took Bigger Hits

Many smaller tokens fell harder than the majors. Solana, Dogecoin, Cardano, Chainlink, and Sui were among the worst hit.

That pushed losses beyond the header Bitcoin numbers and near traders successful altcoin-heavy positions nursing larger drawdowns.

Thin play liquidity served to heighten the terms gyrations, making the enactment much utmost than it would person been connected a much progressive trading day.

September’s Track Record And Outlook

There is besides a humanities constituent to the tale. September has a past of beardown pullbacks successful bull markets, with beardown corrections successful 2017 and 2021.

Featured representation from Meta, illustration from TradingView

2 months ago

2 months ago

English (US)

English (US)