Bitcoin’s terms rally has deed turbulence implicit the past 48 hours, and this has opened the doorway for bearish voices to resurface. After reaching a caller precocious of $124,128 conscionable 3 days ago, the starring cryptocurrency has since declined by astir 4.8%, sliding backmost to the $117,000 to $118,000 terms portion astatine the clip of writing. This pullback has opened up a anticipation that the much-anticipated macro apical whitethorn already beryllium in, and further downside whitethorn beryllium possible if determination is simply a deficiency of bullish momentum.

Analyst Maps Out Bearish Bitcoin Wave Structure

Bitcoin showed signs of gathering connected successful aboriginal August aft bouncing disconnected a debased astir $112,000. However, aft its latest precocious astatine $124,128, sellers rapidly stepped in, pulling the terms down. The diminution has been accompanied by fading short-term momentum. Although it mightiness beryllium excessively aboriginal to conclude, comparative spot scale (RSI) readings are starting to constituent to a bearish divergence connected the 4-hour candlestick timeframe chart.

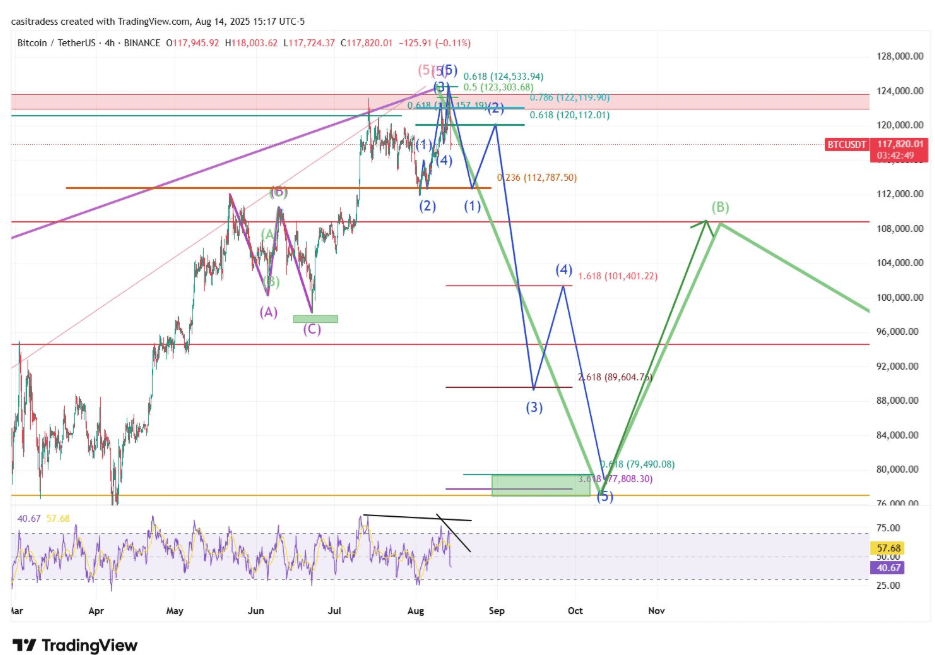

Taking to the societal media level X, crypto expert CasiTrades outlined what they judge could beryllium the commencement of a larger ABC corrective operation for Bitcoin. According to the projection, Bitcoin whitethorn beryllium entering Wave A, which consists of a five-wave corrective operation that could nonstop the terms to arsenic debased arsenic $77,000 astatine the macro 0.382 Fibonacci retracement.

The roadmap of this terms clang envisions an archetypal Wave 1 driblet to $112,000, a little Wave 2 betterment backmost to $120,000, and past different Wave 3 diminution into the $89,000 range. After this, the adjacent measurement is simply a Wave 4 retest interruption of $100,000 earlier reversing into Wave 5, which brings the eventual Wave A bottommost astatine $77,000.

Chart Image From X: CasiTrades

The accompanying illustration posted by the expert shows the question counts with subwave precision. Interestingly, the expert besides pointed retired that the eventual macro people for the extremity of this correction is astatine $60,000, close astatine the aureate 0.618 Fibonacci retracement. This is astatine the macro level and tin lone travel to fruition if the ABC corrective waves play retired to completion.

A Bearish Tone Amidst Bullish Predictions

This investigation introduces a sobering counterpoint astatine a clip erstwhile galore forecasts proceed to overgarment Bitcoin arsenic being connected way for $150,000 and beyond. Even though beardown organization inflows and method milestones, specified arsenic the realized terms flipping supra the 200-day moving average are bullish indicators, the bearish script from CasiTrades could inactive beryllium valid.

If Bitcoin fails to reclaim bullish momentum, the existent correction could alteration into thing deeper, making the $124,000 precocious not conscionable a intermission but the macro apical of this cycle.

Although galore cryptocurrencies person mostly followed Bitcoin’s movements this cycle, CasiTrade’s investigation isn’t a bearish lawsuit for the full crypto market. According to the analyst, if this bearish lawsuit plays out, it could origin the long-discussed superior rotation out of Bitcoin and into large-cap altcoins, immoderate of which whitethorn surge to caller all-time terms highs adjacent arsenic Bitcoin retraces. At the clip of writing, Bitcoin was trading astatine $118,203.

Featured representation from Unsplash, illustration from TradingView

2 months ago

2 months ago

English (US)

English (US)