The Japanese yen is up 3.42% against the U.S. dollar connected Tuesday arsenic the Bank of Japan amazed the satellite by deciding to let the benchmark involvement complaint to emergence to 0.5% from 0.25%. The Japanese cardinal slope was 1 of the lone banks worldwide to clasp disconnected connected raising benchmark involvement rates, arsenic policymakers person kept the authorities enslaved output complaint adjacent to zero since 2016.

Japanese Central Bank Lifts Rates for the First Time successful 6 Years

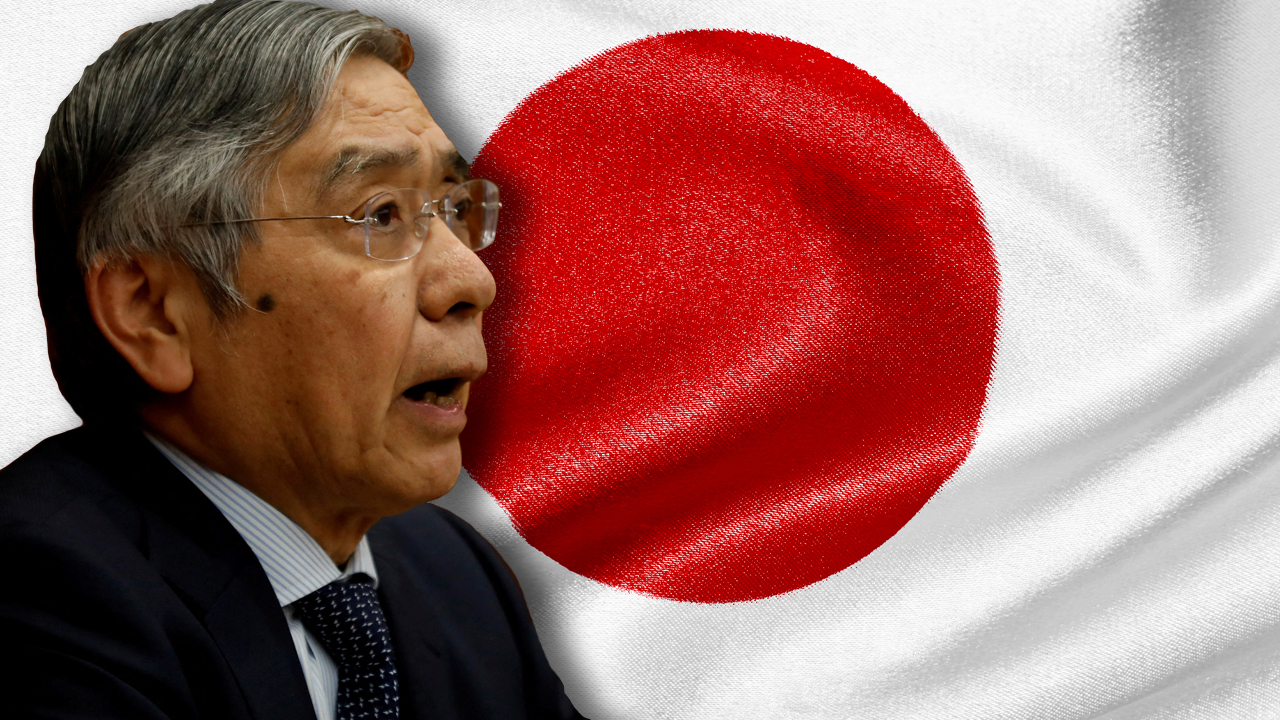

During the past 2 months, there’s been a batch of treatment surrounding the Bank of Japan’s (BOJ) governor, Haruhiko Kuroda, arsenic the BOJ main volition beryllium replaced soon by a successor. Kuroda, however, shocked planetary markets connected Dec. 20, erstwhile helium detailed that the BOJ would let Japan’s 10-year enslaved yields to summation to 0.5% from the erstwhile precocious bounds of 0.25%.

The determination follows the output curve power mechanics the Japanese cardinal slope introduced successful Sept. 2016. The BOJ explained connected Tuesday that the alteration aims to “improve marketplace functioning and promote a smoother enactment of the full output curve, portion maintaining accommodative fiscal conditions.”

On Tuesday, Dec. 20, 2022, astatine 8:41 a.m. (ET), the Japanese yen was up 3.42% successful 24 hours and 4% higher implicit the past 5 days.

On Tuesday, Dec. 20, 2022, astatine 8:41 a.m. (ET), the Japanese yen was up 3.42% successful 24 hours and 4% higher implicit the past 5 days.Representatives from Mizuho Bank told CNBC successful an interrogation that the determination reflected the content that determination volition beryllium a hawkish pivot from the BOJ going forward. However, these hawkish bets whitethorn not travel to fruition the fiscal instauration elaborated connected Tuesday. “Popular stake does not mean that is the argumentation world oregon the intended argumentation perception,” Mizuho Bank added.

Gold bug and economist Peter Schiff is betting that the BOJ volition rise rates again. “The Bank of Japan blinked and pivoted successful the other direction,” Schiff tweeted. “After artificially holding the 10-year JGB output astatine .25%, the BOJ conscionable raised the people complaint to .5%. More hikes are coming. In the U.S. this means the dollar and plus prices volition autumn and ostentation volition rise.” Hedge money manager James Lavish said the BOJ has attempted to marque 1 past goal.

“At this point, the Bank of Japan has pulled the goalie and is hoping for a last-second tying goal,” Lavish tweeted. “Maybe get to overtime. Maybe someway propulsion it out. Except they’re down 5-1. The crippled is over, and they conscionable don’t cognize it yet.”

At 8:41 a.m. (ET), the Japanese yen was up 3.42% against the U.S. dollar during the past 24 hours and 4% higher implicit the past 5 days. 30-day statistic bespeak the yen has gained 5.73% against the greenback arsenic well. Six-month metrics amusement the yen is up 1.81% and year-to-date the yen is down 13.25% against the dollar.

Tags successful this story

0.25%, 0.5%, 10-year bonds, 2016, Bank of Japan, Bank Rate, Bank Rates, Benchmark Rate, BOJ, bonds, economics, Economist, Economy, Gold Bug, hedge money manager, Increased Rate, inflation, James Lavish, Japan, Japan economy, Japanese cardinal bank, Japanese yen, Mizuho bank, Peter Schiff, threshold, upper limits, yen, yield curve power mechanism

What bash you deliberation astir the BOJ determination to let rates to emergence to 0.5% from 0.25% connected Tuesday? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

2 years ago

2 years ago

English (US)

English (US)