As U.S. regulatory pressures proceed to carnivore down connected the cryptocurrency industry, a caller inclination is opening to instrumentality shape, altering the dynamics of Bitcoin’s planetary demand.

The U.S. governmental situation seeks to tighten the regulatory noose astir the cervix of the crypto and mining sectors, causing traders wrong its borders whitethorn beryllium losing religion successful Bitcoin’s resilience.

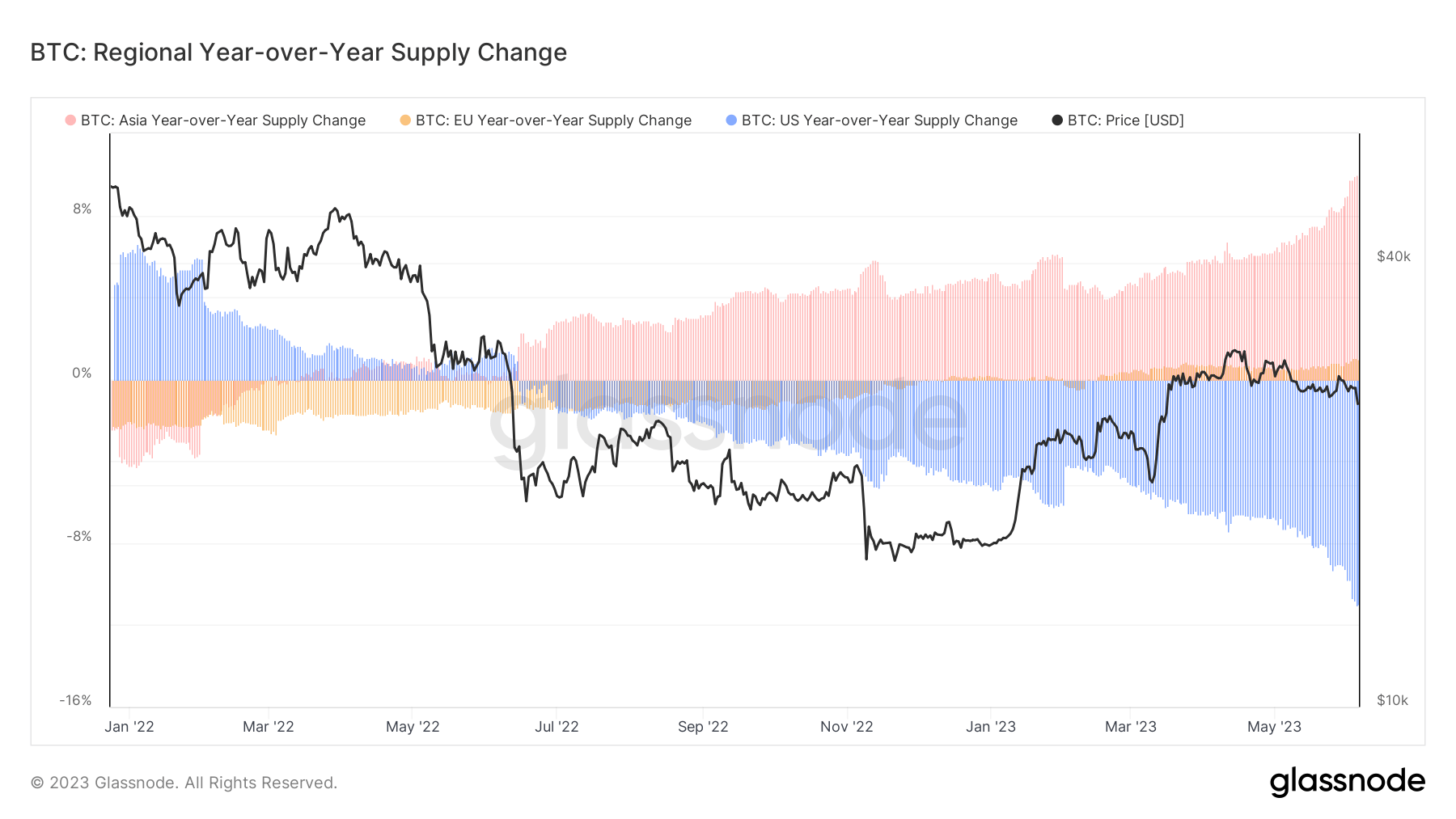

This displacement is evident done Glassnode’s Bitcoin year-over-year (YoY) proviso change, which tracks the magnitude of Bitcoin held by determination entities.

CryptoSlate investigation recovered that the Bitcoin proviso successful the U.S. experienced an 11% YoY dip since June 2022.

Contrarily, the Asian crypto marketplace showed a surge successful Bitcoin supply. According to information from Glassnode, entities operating during Asian trading hours person accrued their Bitcoin holdings by 9.9% since June past year, marking an all-time high.

Graph showing the determination Bitcoin YoY proviso alteration from January 2022 to June 2023 (Source: Glassnode)

Graph showing the determination Bitcoin YoY proviso alteration from January 2022 to June 2023 (Source: Glassnode)Asia’s attraction to Bitcoin sparked questions astir the imaginable driving factors down this shift.

As antecedently reported connected CryptoSlate, mounting regulatory vigor successful the U.S. led traders to pivot distant from Bitcoin and Ethereum, turning alternatively to the perceived information of stablecoins. This antiaircraft determination by traders demonstrates the tangible interaction that regulation, oregon the menace of it, tin exert connected the behaviour and decisions of cryptocurrency marketplace participants. The hazard of imaginable compliance-related penalties and clampdowns tin incentivize a safer play, sometimes astatine the outgo of high-yield investments.

While U.S. regulations formed a shadiness connected the crypto market, Asia has been experiencing a much affirmative question of regulatory changes.

As reported by CryptoSlate, Hong Kong’s Securities and Futures Commission (SFC) has paved the mode for a much crypto-friendly environment, signaling the licensing of implicit 8 crypto companies by year-end and easing regulatory requirements for crypto exchanges.

In effect to these accommodating changes, immoderate crypto entities, specified arsenic CoinEx, person strategically leveraged Hong Kong’s crypto-friendly rules.

Meanwhile, Bitget has committed to investing $100 cardinal to bolster Asia’s Web3 ecosystem. Furthermore, mounting speculation astir a Central Asian country’s imaginable Bitcoin treasury holding reflects a shifting determination sentiment towards Bitcoin.

The station Asia’s Bitcoin proviso soars amid shifting regulatory landscapes appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)