Bitcoin BTC is trading astatine $109.7K arsenic the Wednesday trading time begins successful Asia, according to CoinDesk marketplace data.

While the world's largest integer plus is trading level successful the aboriginal hours of the session, CoinDesk marketplace data shows that it's up 4% connected the week.

An expected Bank of Japan complaint cut isn't doing that overmuch to determination the market, adjacent though a debased involvement complaint argumentation is usually what drives risk-on sentiment and positively impacts BTC prices.

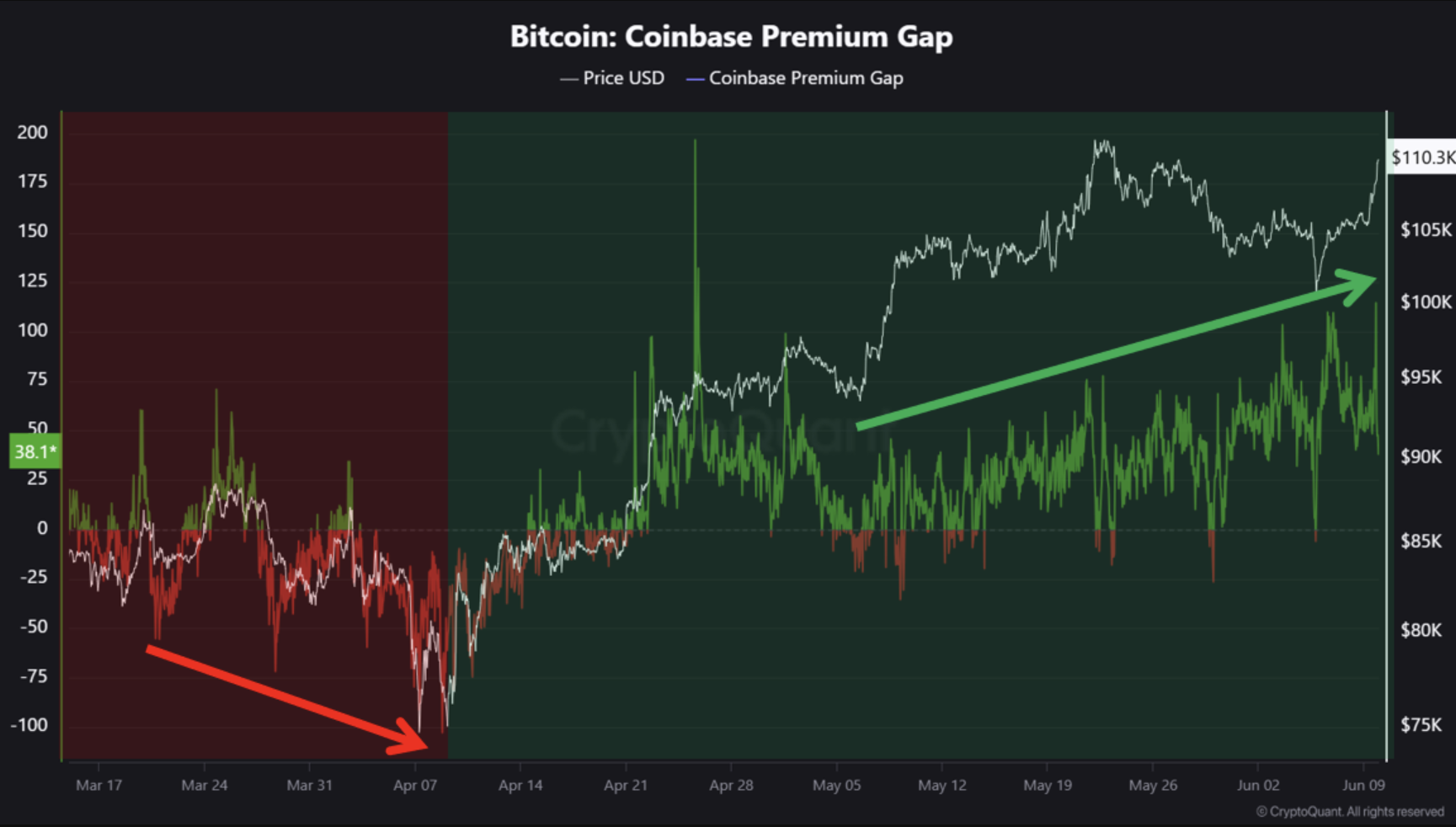

One metric to ticker alternatively is the 'Coinbase Premium'. Tracked by CryptoQuant, it measures the terms quality betwixt BTC connected Coinbase Pro (USD) and Binance (USDT), demonstrating the dollar request for bitcoin (as opposed to crypto-native demand).

"The Coinbase Premium is gradually rising, indicating that buying unit from U.S. investors is supporting the trend," CryptoQuant analysts wrote successful a caller update. "Additionally, whale buying enactment is being observed incrementally."

Part of this question would see BTC ETF inflow, which has deed $386.27 cardinal truthful acold this week, according to SoSoValue data.

That being said, immoderate marketplace observers are acrophobic that a staked ether exchange-traded money (ETF), which whitethorn beryllium adjacent to getting approved, could enactment a damper connected organization BTC interest.

Youwei Yang, main economist astatine BIT Mining, says that an ETF that gives investors entree to ETH output from staking would beryllium thing that BTC ETFs can't match, arsenic they conscionable springiness vulnerability to terms appreciation.

"This has created a batch of buzz, particularly considering however overmuch of bitcoin’s rally was fueled by ETF hype," Yang said. "And let’s beryllium honest: portion there’s speculation astir Solana oregon Litecoin ETFs, Ether is inactive the lone different crypto plus with a existent beingness successful U.S. spot ETF. That makes it a go-to enactment for institutions waiting and watching connected the sidelines, acceptable to determination erstwhile the timing feels right."

But for now, it's inactive a waiting game. At slightest until the BoJ's determination is official, arsenic the accustomed crypto-natives similar Arthur Hayes are counting connected BTC going parabolic arsenic a result.

DEX Volume Has Nearly Doubled successful Past Year

Centralized Exchanges (CEXs) person ever had their eyes connected Decentralized Exchanges (DEXs) since the conception took disconnected successful 2018 with the advent of modern Automated Market Maker (AMM) engines – the exertion astatine the halfway of the merchandise category.

But arsenic the twelvemonth continues, and crypto mergers and acquisitions vigor up possibly there'll beryllium a renewed involvement successful DEXs, considering the monolithic leap successful measurement connected the platforms successful the past year.

According to information from Messari, successful the past year, trading measurement connected DEXs has jumped from astir 6% of each measurement to 12%. In May, that fig got person to 25% arsenic up-and-coming DEX Hyperliquid caught the oculus of the market, including crypto's astir assertive traders.

But are DEXs and CEX's competitors? No, says OKX President Hong Fang.

Speaking with CoinDesk earlier this year successful the run-up to Consensus Hong Kong, Fang said that the 2 are complementary.

"The crypto-native assemblage volition privation to beryllium capable to usage CEX for reliability and DEX for catching innovations," she said astatine the time. "Such supply-demand dynamics volition thrust further adoption of DEX to alteration innovation portion supporting the gradual maturity of the crypto regulatory framework."

News Roundup

Trump’s CFTC Nominee Brian Quintenz Says Congress Key to Boosting Crypto Innovation and Consumer Protection

Brian Quintenz, President Trump's nominee for president of the Commodity Futures Trading Commission (CFTC), emphasized astatine his Senate confirmation proceeding that Congress indispensable pb successful establishing wide guidelines to boost crypto innovation and user extortion simultaneously, CoinDesk antecedently reported.

Quintenz, who antecedently served arsenic a CFTC commissioner and aboriginal arsenic caput of argumentation astatine task superior steadfast a16z, argued that forthcoming marketplace operation authorities could supply clarity needed for entrepreneurs portion maintaining safeguards for consumers.

During his confirmation, senators expressed concerns astir vacancies astatine the CFTC—particularly the lack of Democratic commissioners—but Quintenz declined to perpetrate to advocating Trump to capable these positions, emphasizing statesmanlike discretion. He acknowledged imaginable assets needs should the CFTC go the superior regulator for integer commodities, advocating a "technology-first approach" to heighten bureau efficiency, and defended the relation of prediction markets arsenic morganatic tools for hedging and hazard management.

Aave is Now connected Sony's Soneium

Aave has launched connected Soneium, an Ethereum Layer-2 blockchain supported by electronics elephantine Sony, CoinDesk antecedently reported. This integration includes exploring real-world applications of Aave's decentralized overcollateralized stablecoin, GHO, crossed payments, savings, and integer commerce.

Aave's engagement volition widen to liquidity inducement campaigns, notably partnering with Astar, a important blockchain subordinate successful Japan’s Web3 scene, with a dedicated 100 cardinal ASTR allocation ($4 million) to boost adoption.

Soneium already hosts a vibrant 7-million idiosyncratic ecosystem featuring salient platforms similar Uniswap v4, Velodrome, Stargate, and Lido, alongside autochthonal protocols Kyo Finance and SuperVol. Stani Kulechov, Aave Labs' founder, emphasized Sony’s planetary spot and Soneium’s consumer-centric attack arsenic cardinal advantages, aligning with Aave’s strategy of expanding accessibility and mainstream reach.

Market Movements

- BTC: BTC trades beneath $110K arsenic speech reserves driblet sharply, signaling beardown accumulation amid important abbreviated liquidations.

- ETH: Ethereum surged 6.9% to $2,803 amid triple-average trading volume, reflecting beardown organization condemnation driven by important ETF inflows and BlackRock’s sizable ETH accumulation.

- Gold: Spot golden neared $3,350 Tuesday, buoyed by cautious optimism implicit US-China commercialized talks contempt a firmer US dollar.

- Nikkei 225: Asia-Pacific markets roseate Wednesday amid optimism implicit "productive" U.S.-China commercialized talks, with Japan's Nikkei 225 gaining 0.69% astatine open.

- S&P 500: The S&P 500 gained 0.6% Tuesday, approaching grounds highs supra 6,000, buoyed by capitalist optimism connected U.S.-China commercialized talks and Tesla's emergence amid Elon Musk's robotaxi announcements.

4 months ago

4 months ago

English (US)

English (US)