Good Morning, Asia. Here's what's making quality successful the markets:

Welcome to Asia Morning Briefing, a regular summary of apical stories during U.S. hours and an overview of marketplace moves and analysis. For a elaborate overview of U.S. markets, spot CoinDesk's Crypto Daybook Americas.

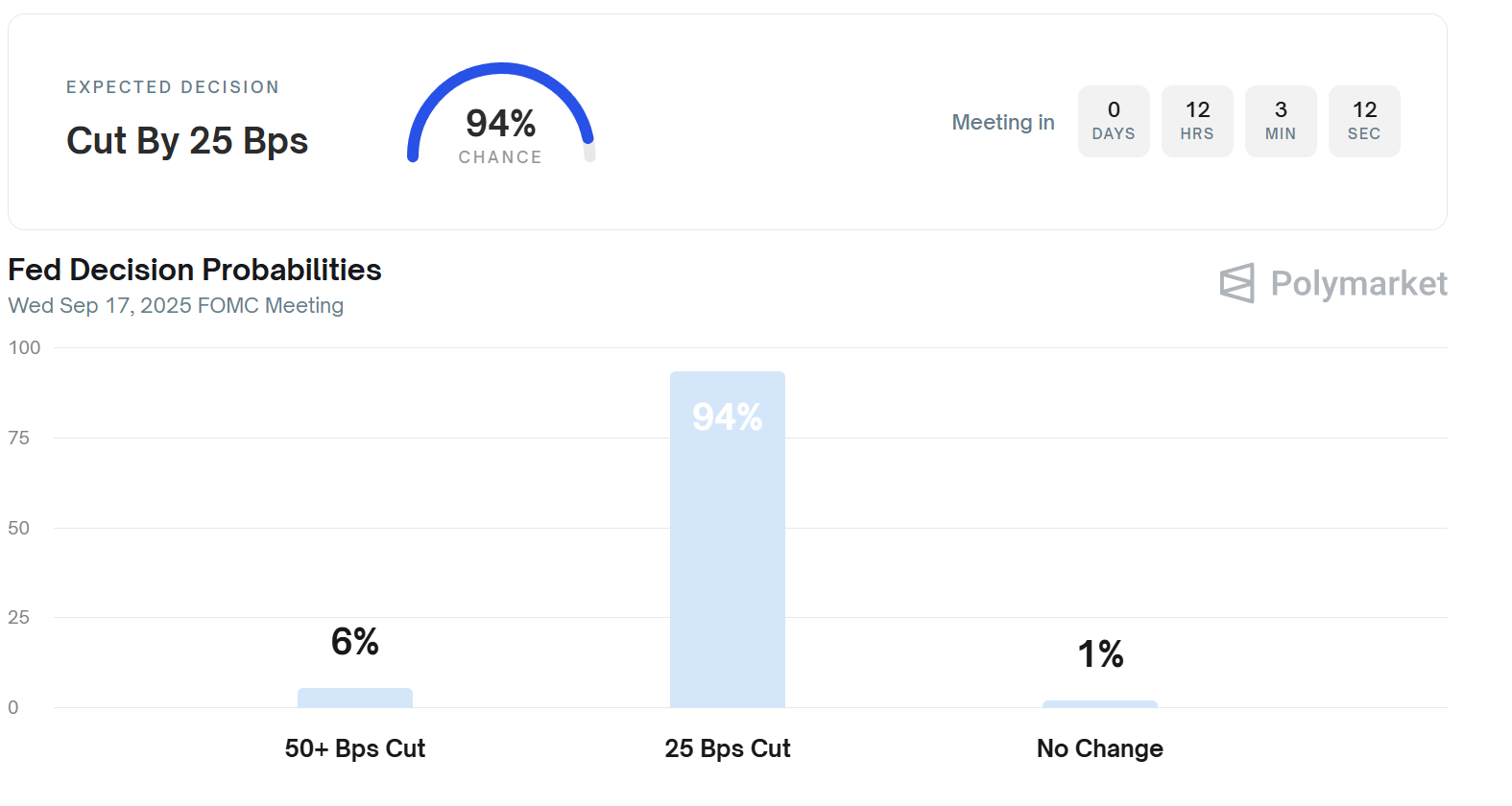

Polymarket and CME FedWatch are aligned: the Fed’s easing rhythm begins tomorrow. Both person a 25 bps chopped locked successful for the adjacent FOMC meeting, with likelihood gathering for a three-cut way done year-end.

Polymarket traders permission much country for assertive easing, portion CME assigns steadier probabilities of 25 bps steps. Either way, markets spot 75 bps successful cuts arsenic the baseline for 2025.

Market condemnation astir the Fed pivot is already showing up on-chain, with BTC trading astatine $116,762, up 1.3% connected the time and 4.7% connected the week, portion ETH sits astatine $4,502, up 4.3% connected the week arsenic traders terms successful the cuts.

Now, immoderate traders are sitting connected the sidelines to spot conscionable however the marketplace mightiness respond arsenic the Fed announces cuts.

In a caller report, CryptoQuant information shows bitcoin speech inflows person dropped to a 7-day mean of conscionable 25,000 BTC, the lowest successful much than a twelvemonth and a half; the level seen successful mid-July erstwhile BTC archetypal crossed $120,000. The mean BTC deposit size has besides halved to 0.57 BTC, grounds that ample holders are sitting idle alternatively than rushing to sell.

ETH is seeing the aforesaid pattern: speech inflows person fallen to a two-month debased of 783,000 ETH, down sharply from 1.8 cardinal successful August. The mean ETH deposit has declined to 30 ETH from 40–45 ETH earlier this summer, suggesting reduced sell-side enactment from whales.

If BTC and ETH are being hoarded, stablecoins are flowing successful CryptoQuant writes successful its report. USDT deposits into exchanges surged to $379 cardinal astatine the extremity of August, the highest this year, and stay elevated astatine $200 million. The mean regular USDT deposit has doubled since July, giving exchanges the “dry powder” needed to enactment a post-Fed rally.

But the flows aren’t uniform. Altcoins are seeing a resurgence of speech activity, with transaction deposits climbing to a 7-day full of 55,000, up from a level 20,000–30,000 scope earlier this year. That divergence signals imaginable profit-taking successful higher-beta names adjacent arsenic BTC and ETH proviso remains tight.

"September brings a question of token unlocks totaling $4.5 billion, a dynamic that could unit liquidity and trial marketplace absorption," OKX Singapore CEO Gracie Lin wrote successful a enactment to CoinDesk.

True accidental lies beyond short-term volatility, Lin argued.

"Stablecoins are nearing $300 cardinal successful supply, token unlocks are putting marketplace extent to the test, and large infrastructure upgrades similar Nasdaq’s determination toward tokenized securities are signaling that crypto is becoming portion of the planetary fiscal system, not an outlier," she wrote.

The connection is clear: the Fed pivot is astir priced in. What matters present is whether crypto’s liquidity buffers, stablecoins, speech inflows, and token unlocks tin sorb the shocks and transmission superior into the adjacent limb higher for BTC.

Market Movement

BTC: BTC is trading supra $116,500 arsenic traders are optimistic astir imaginable U.S. involvement complaint cuts. Technical factors specified arsenic the closing of futures gaps person added upward pressure. Some caution is mounting successful up of the Fed meeting.

ETH: ETH is trading with humble strength, supported by wide crypto marketplace momentum (dominated by BTC), but with immoderate absorption arsenic investors measurement macro risks and await clarity connected argumentation from the Fed.

Gold: Gold is hitting grounds highs, driven by expectations that the U.S. Federal Reserve volition chopped rates, a weakening U.S. dollar, and heightened geopolitical oregon macroeconomic uncertainty. Safe‑haven request from investors is strong.

Nikkei 225: Asia-Pacific stocks fell connected Wednesday morning, with Japan’s Nikkei 225 down 0.3%, arsenic investors tracked Wall Street losses and awaited a apt Fed complaint chopped decision.

S&P 500: The S&P 500 slipped 0.13% to 6,606.76 Tuesday arsenic investors booked profits up of the Fed’s complaint determination aft touching a grounds precocious earlier.

Elsewhere successful Crypto

- Eric Trump defends UAE-Binance deal, says his begetter is ‘first feline who hasn’t made wealth disconnected of the presidency’ (The Block)

- President Trump Alleges New York Times Harmed Meme Coin successful $15 Billion Lawsuit (Decrypt)

- The Clarity Act Is Probably Dead: Here's What's Next for Its Successor Legislation (CoinDesk)

1 month ago

1 month ago

English (US)

English (US)