By Francisco Rodrigues (All times ET unless indicated otherwise)

Global markets are treading h2o arsenic investors hold connected the Federal Reserve’s latest argumentation move, coming aboriginal today. It’s astir a fixed the Fed volition chopped involvement rates by 25 ground points. Traders volition alternatively absorption connected Chair Jerome Powell for signs connected aboriginal policy.

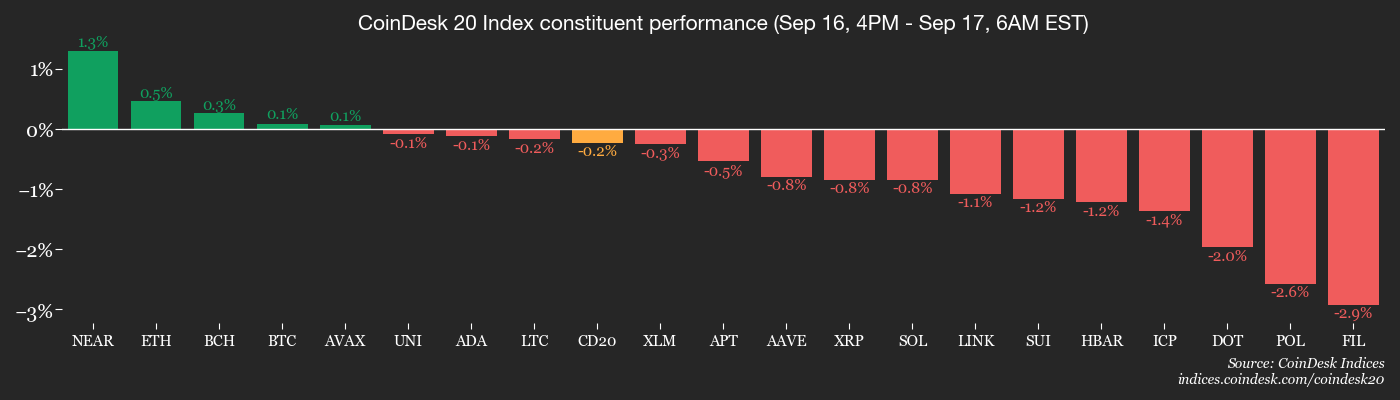

The cryptocurrency marketplace is nary different. Over the past 24 hours, the CoinDesk 20 (CD20) scale is practically unchanged, up conscionable 0.2%, portion bitcoin (BTC) is astir 1% higher. Gold, which surged to a grounds $3,700 this week, slipped 0.5%. The U.S. dollar scale added little than 0.2%.

Equities markets person hardly moved arsenic well. U.S. stocks slipped successful yesterday’s session, portion European equities are edging higher. The FTSE All-World Index precocious little than 0.1% today.

That's today. But implicit a longer period, cryptocurrencies person lagged down equities.

In the past 30 days, the FTSE All-World Index roseate 2.78%, portion the CoinDesk 20 added 2.6% and BTC gained 1.6%. The moves suggest caution adjacent up of complaint chopped that would boost the entreaty of hazard assets.

Investors are presently pricing successful six involvement complaint cuts. Three this year, and 3 adjacent year.

“Market expectations are positioned successful a Goldilocks range: six cuts correspond a mediate crushed betwixt caution and aggression,” analysts astatine QCP Capital wrote successful a note.

“A deviation successful the dot plot, however, would situation that balance, forcing investors to recalibrate astir the hazard of tighter-than-expected conditions oregon a Fed struggling to respond efficaciously to weaker growth,” the analysts added.

Markets' existent trial volition beryllium Powell’s property conference. A balanced connection is apt to further enactment hazard assets, portion hesitation would unit investors to reassess.

Despite the uncertainty, request for spot crypto ETFs has remained robust. This week, nett inflows for spot BTC ETFs are astir $550 million, portion spot ether ETFs brought successful astir $300 million. Stay alert!

What to Watch

- Crypto

- Nothing scheduled.

- Macro

- Sept. 17, 9:45 a.m.: Canada benchmark involvement complaint determination Est. 2.5% followed by a property conference.

- Sept. 17, 2 p.m.: Fed determination connected U.S. involvement rates, including updated dot crippled projections. Est. 25 bps chopped to 4.00%-4.25%, followed by a press conference.

- Sept. 17, 5:30 p.m.: Brazil benchmark involvement complaint determination Est. 15%.

- Earnings (Estimates based connected FactSet data)

- None scheduled.

Token Events

- Governance votes & calls

- MantleDAO is voting connected keeping the 2025-2026 budget astatine $52 cardinal USDc and 200 cardinal MNT. Voting ends Sept. 18.

- Sept. 17, 6 a.m.: DYdX to big an Analyst Call.

- Unlocks

- Sept. 17: ZKsync (ZK) to unlock 3.61% of its circulating proviso worthy $10.54 million.

- Token Launches

- Sept. 18: Deadline to person MKR to SKY earlier the Delayed Upgrade Penalty takes effect.

Conferences

- Day 2 of 2: Real-World Asset Summit (New York)

- Sept. 17: The Bitcoin Treasuries NYC Unconference (New York)

- Day 1 of 3: AIBC 2025 (Tokyo, Japan)

Token Talk

By Oliver Knight

- Bitcoin (BTC) continues to stubbornly commercialized successful a choky range, rising somewhat to $116,000 successful the past 24 hours, but failing to physique momentum for a interruption out.

- Altcoins are capitalizing connected the deficiency of volatility with respective spikes starring to bitcoin dominance sliding to an eight-month low of 57%, according to CoinMarketCap data.

- Dominance is simply a metric commonly utilized to measure whether superior is flowing into bitcoin oregon much speculative altcoins, arsenic seems to beryllium the case.

- Another bullish origin for altcoins is that the average crypto token RSI, an abbreviation for comparative spot index, is astatine 45.47. This means that altcoins are edging into "oversold" territory arsenic opposed to "overbought," suggesting that respective tokens are primed for an hold to the upside.

- It's worthy noting that bitcoin dominance fell each the mode to 33% successful 2017 and 40% successful 2021, meaning that altcoins inactive person much country to run.

- Much volition beryllium connected however bitcoin acts if it begins to trial grounds highs astatine $124,000. A breakout connected important measurement volition apt pb to a superior rotation backmost to the largest cryptocurrency arsenic investors effort to capitalize connected a imaginable rhythm high, with the personalities specified arsenic Eric Trump calling for $175,000 earlier year-end.

Derivatives Positioning

- BTC futures unfastened involvement crossed large venues has crept up to $32 cardinal implicit the past week.

- At the aforesaid time, the three-month annualized ground has started compressing again to astir 6-7% crossed Binance, OKX and Deribit, leaving the transportation commercialized lone marginally profitable.

- While the OI maturation suggests expanding enactment and engagement successful the market, the narrowing ground indicates that directional conviction, peculiarly connected the bullish side, is weakening, with traders little consenting to wage a precocious premium for aboriginal exposure.

- The options information besides presents a analyzable representation of marketplace sentiment.

- While the BTC Implied Volatility Term Structure illustration shows an upward-sloping curve, suggesting the marketplace expects semipermanent volatility to beryllium higher than short-term, different metrics constituent to a much contiguous bearish outlook.

- Specifically, the 25 delta skew illustration indicates that the skew is either level oregon somewhat antagonistic for shorter-term options (1-week, 1-month), which means traders are paying a premium for puts implicit calls to summation extortion against declines.

- This short-term bearish sentiment is straight contradicted by the 24-hour put-call measurement chart, which shows a higher measurement of calls than puts, indicating that implicit the past 24 hours astir options traders were positioning for a terms increase.

- Funding complaint APRs crossed large perpetual swap venues person precocious started to amusement immoderate pickup with BTC annualized backing presently astatine 17%.

- If the uptrend is maintained and followed by different venues, backing rates would suggest increasing condemnation successful a directional, much bullish stake connected prices.

Market Movements

- BTC is down 0.22% from 4 p.m. ET Wednesday astatine $116,637.44 (24hrs: +1.01%)

- ETH is unchanged astatine $4,498.24 (24hrs: +0.00%)

- CoinDesk 20 is down 0.58% astatine 4,272.21 (24hrs: +0.1%)

- Ether CESR Composite Staking Rate is down 2 bps astatine 2.86%

- BTC backing complaint is astatine 0.0077% (8.4589% annualized) connected Binance

- DXY is up 0.14% astatine 96.76

- Gold futures are down 0.52% astatine $3,705.60

- Silver futures are down 2.14% astatine $42.00

- Nikkei 225 closed down 0.25% astatine 44,790.38

- Hang Seng closed up 1.78% astatine 26,908.39

- FTSE is up 0.20% astatine 9,213.65

- Euro Stoxx 50 is up 0.11% astatine 5,377.98

- DJIA closed connected Tuesday down 0.27% astatine 45,757.90

- S&P 500 closed down 0.13% astatine 6,606.76

- Nasdaq Composite closed unchanged astatine 22,333.96

- S&P/TSX Composite closed down 0.39% astatine 29,315.23

- S&P 40 Latin America closed up 0.52% astatine 2,919.60

- U.S. 10-Year Treasury complaint is down 1 bps astatine 4.016%

- E-mini S&P 500 futures are unchanged astatine 6,669.00

- E-mini Nasdaq-100 futures are unchanged astatine 24,525.25

- E-mini Dow Jones Industrial Average Index are unchanged astatine 46,146.00

Bitcoin Stats

- BTC Dominance: 58.3% (unchanged)

- Ether-bitcoin ratio: 0.0386 (0.15%)

- Hashrate (seven-day moving average): 1,021 EH/s

- Hashprice (spot): $54.43

- Total fees: 4.18 BTC / $483,499

- CME Futures Open Interest: 144,220 BTC

- BTC priced successful gold: 31.8 oz.

- BTC vs golden marketplace cap: 8.91%

Technical Analysis

- Bitcoin has surged from $107K to $117K, present trading supra each cardinal regular exponential moving averages.

- Despite this strength, the broader bias remains cautious.

- For momentum to continue, bulls volition look for a decisive reclaim of the regular bid artifact betwixt $117K and $119K, an country that besides aligns with the play bid artifact established successful aboriginal August.

Crypto Equities

- Coinbase Global (COIN): closed connected Tuesday astatine $327.91 (+0.27%), -0.52% astatine $326.19 successful pre-market

- Circle (CRCL): closed astatine $134.81 (+0.57%), +1.07% astatine $136.25

- Galaxy Digital (GLXY): closed astatine $31.83 (+3.44%), -1.35% astatine $31.40

- Bullish (BLSH): closed astatine $51.36 (+0.55%), -0.35% astatine $51.18

- MARA Holdings (MARA): closed astatine $17.53 (+7.94%), -0.34% astatine $17.47

- Riot Platforms (RIOT): closed astatine $17.52 (+5.04%), +0.23% astatine $17.56

- Core Scientific (CORZ): closed astatine $16.18 (-0.86%), unchanged successful pre-market

- CleanSpark (CLSK): closed astatine $11.20 (+8.84%), unchanged successful pre-market

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $39.86 (+2.92%), -1.15% astatine $39.40

- Exodus Movement (EXOD): closed astatine $29.70 (+6.53%), -1.11% astatine $29.37

Crypto Treasury Companies

- Strategy (MSTR): closed astatine $335.09 (+2.23%), +0.21% astatine $335.80

- Semler Scientific (SMLR): closed astatine $29.11 (+2.54%)

- SharpLink Gaming (SBET): closed astatine $16.95 (+0.95%), unchanged successful pre-market

- Upexi (UPXI): closed astatine $5.82 (-8.06%), +3.09% astatine $6

- Lite Strategy (LITS): closed astatine $2.69 (-7.56%), +10.43% astatine $3.07

ETF Flows

Spot BTC ETFs

- Daily nett flows: $292.3 million

- Cumulative nett flows: $57.34 billion

- Total BTC holdings ~1.32 million

Spot ETH ETFs

- Daily nett flows: -$61.7 million

- Cumulative nett flows: $13.68 billion

- Total ETH holdings ~6.61 million

Source: Farside Investors

While You Were Sleeping

- Metaplanet Sets Up U.S., Japan Subsidiaries, Buys Bitcoin.jp Domain Name (CoinDesk): The world’s sixth-largest BTC treasury institution formed Bitcoin Japan to tally bitcoin-focused media platforms and U.S.-based Metaplanet Income to make gross from bitcoin-related fiscal products.

- 21Shares Hits 50 Crypto ETPs successful Europe With Launch of AI and Raydium-Focused Products: 21Shares is introducing 2 crypto exchange-traded products (ETPs), 1 tracking a radical of decentralized AI protocols and 1 offering vulnerability to the token of Solana-based decentralized speech Raydium.

- Hex Trust Adds Custody and Staking for Lido’s stETH, Expanding Institutional Access to Ethereum Rewards (CoinDesk): The firm’s one-click staking diagnostic enables clients to entree staking rewards and decentralized concern (DeFi) liquidity tools for stETH without mounting up their ain infrastructure.

- Three Things Britain Wants From Trump’s State Visit — Aside From Business Deals (CNBC): The U.K. wants Trump’s sojourn to beforehand the unfinished commercialized deal, tackle hurdles specified arsenic alloy and aluminum tariffs and fastener successful concern from BlackRock, Alphabet and Blackstone.

- UK Watchdog to Waive Some Rules for Cryptoasset Providers (Financial Times): The FCA says it volition accommodate regulations to crypto’s unsocial risks, pledging stricter safeguards connected exertion and resilience portion exploring whether investors should summation wider user protections.

1 month ago

1 month ago

English (US)

English (US)