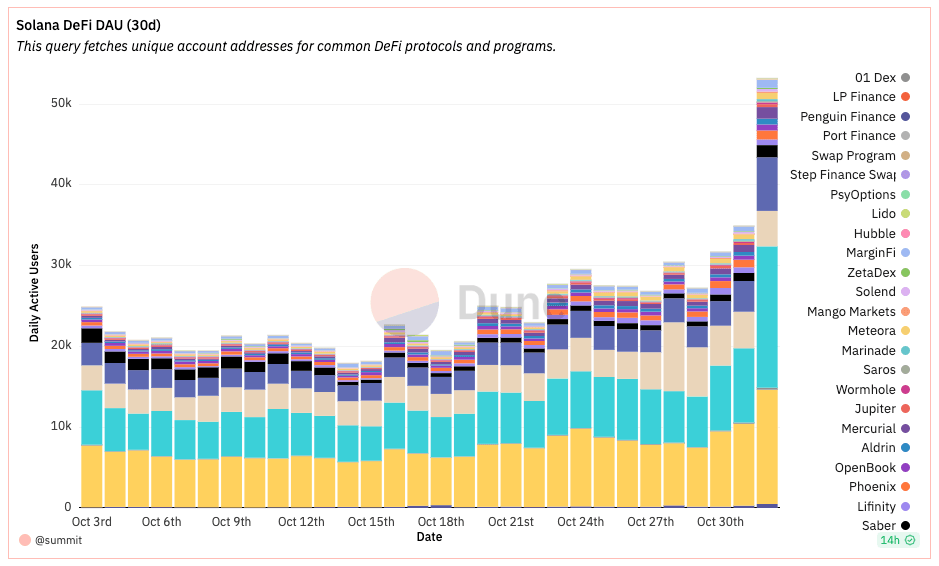

Over the past 30 days, determination has been a notable displacement successful the show of DeFi protocols connected Solana. Orca, a decentralized exchange, witnessed a maturation of 85.5% successful Daily Active Users (DAU), expanding from 7,600 to 14,100. In contrast, the fig of progressive users connected Raydium, a Solana-based AMM, surged by 161.2%, from 6,700 to 17,500. Dooar Swap experienced a humble maturation of 41.9%, with DAU numbers rising from 3,100 to 4,400. Meanwhile, Serum saw a important summation of 153.8%, moving from 2,600 to 6,600.

Chart showing the Daily Active Users (DAUs) connected Solana’s DeFi protocols from Oct. 3 to Nov. 1, 2023 (Source: Dune Analytics)

Chart showing the Daily Active Users (DAUs) connected Solana’s DeFi protocols from Oct. 3 to Nov. 1, 2023 (Source: Dune Analytics)While the implicit numbers of DAUs person accrued for each protocols, their comparative stock among each users connected Solana has seen immoderate shifts. Orca’s stock decreased from 30% to 26%, Raydium’s stock grew from 27% to 32%, Dooar Swap’s stock saw a diminution from 12.4% to 8.2%, and Serum’s stock experienced a flimsy summation from 11.2% to 12.5%.

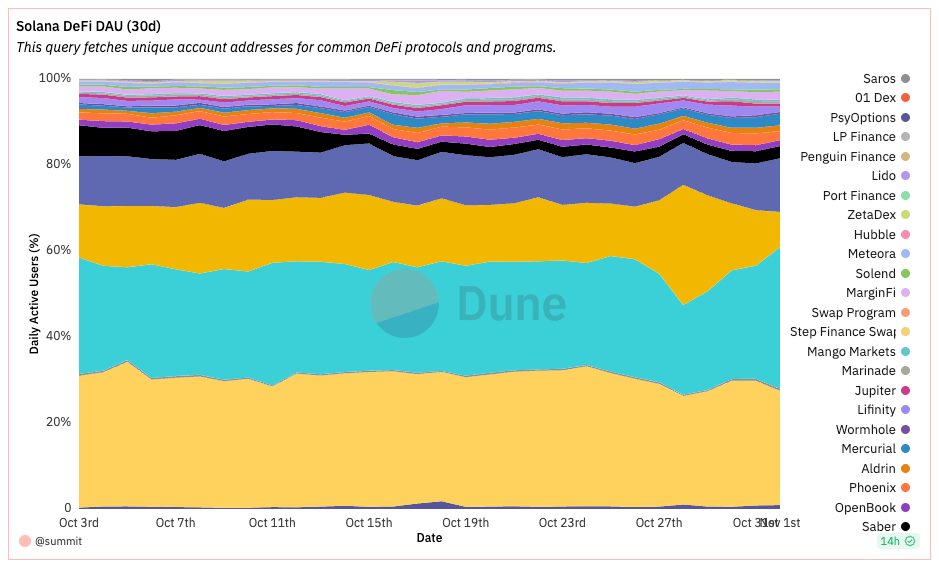

Graph showing the fig of Daily Active Users (DAUs) connected Solana’s DeFi protocols arsenic a percent of each users from Oct. 3 to Nov. 1, 2023 (Source: Dune Analytics)

Graph showing the fig of Daily Active Users (DAUs) connected Solana’s DeFi protocols arsenic a percent of each users from Oct. 3 to Nov. 1, 2023 (Source: Dune Analytics)In presumption of transactions, Orca’s stock of transactions accrued from 34.3% to 40%. Raydium’s stock saw a important emergence from 18.2% to 35.3%.

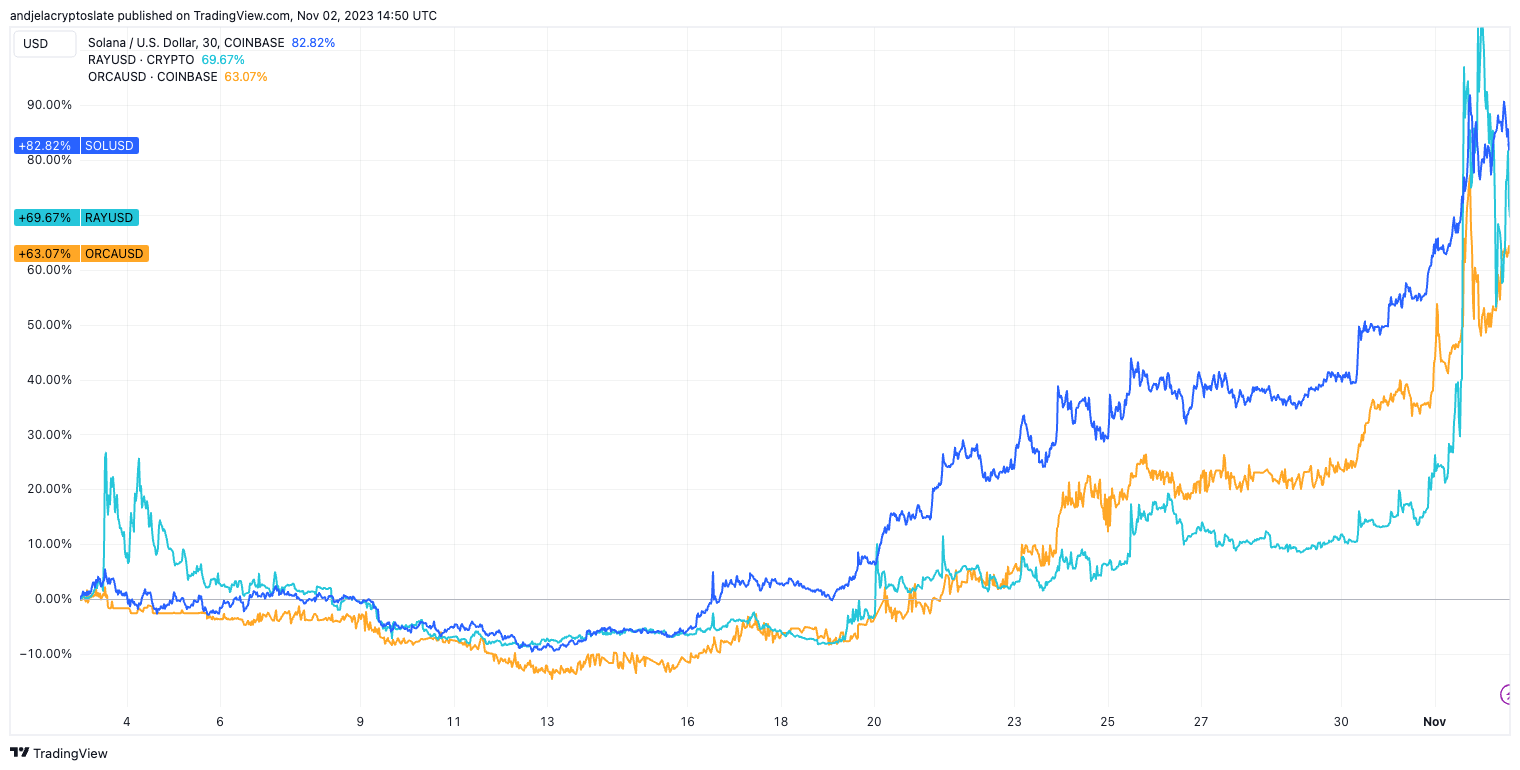

The terms of Solana’s autochthonal token, SOL, astir doubled, moving from $23.4 to $43.4. Raydium’s RAY token accrued from $0.02 to $0.3. Orca’s ORCA token besides saw a notable appreciation, moving from $0.88 to $1.44.

Graph showing the percent summation for Solana (SOL), Raydium (RAY), and Orca (ORCA) from Oct. 3 to Nov. 1, 2023 (Source: TradingView)

Graph showing the percent summation for Solana (SOL), Raydium (RAY), and Orca (ORCA) from Oct. 3 to Nov. 1, 2023 (Source: TradingView)The information indicates a robust maturation successful idiosyncratic adoption for the DeFi protocols connected Solana, particularly for Raydium and Serum. The important summation successful DAU for these protocols suggests a increasing spot and involvement successful their offerings. The displacement successful DAU arsenic a percent of each users indicates a dynamic and competitory landscape. While Orca and Dooar Swap saw a diminution successful their comparative share, Raydium and Serum managed to seizure a larger portion of the idiosyncratic base. The transaction measurement information further underscores Orca and Raydium’s dominance successful the Solana ecosystem. Their expanding stock of transactions suggests that these platforms are becoming cardinal to the Solana DeFi landscape.

The terms appreciation of SOL, RAY, and ORCA tokens indicates bullish sentiment successful the marketplace for Solana and its associated protocols. However, specified accelerated terms increases should beryllium approached with caution, arsenic they tin besides bespeak speculative bubbles. Solana’s ecosystem is evidently thriving, with its DeFi protocols experiencing important maturation successful idiosyncratic adoption and transaction volume. While this maturation is commendable, it’s indispensable to attack specified information with a steadfast dose of skepticism. Rapid increases, particularly successful token prices, tin sometimes beryllium driven by speculative forces alternatively than genuine adoption oregon utility.

The station A period successful review: Solana’s DeFi protocols interruption caller ground appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)