Key takeaways:

Bitcoin fundamentals stay intact contempt the $1 trillion driblet successful the crypto full marketplace cap.

Long-term holders and organization investors proceed to sorb Bitcoin’s distributed supply.

Analysts reason that the diminution is structural, driven by leverage and rotations, alternatively than bearish sentiment.

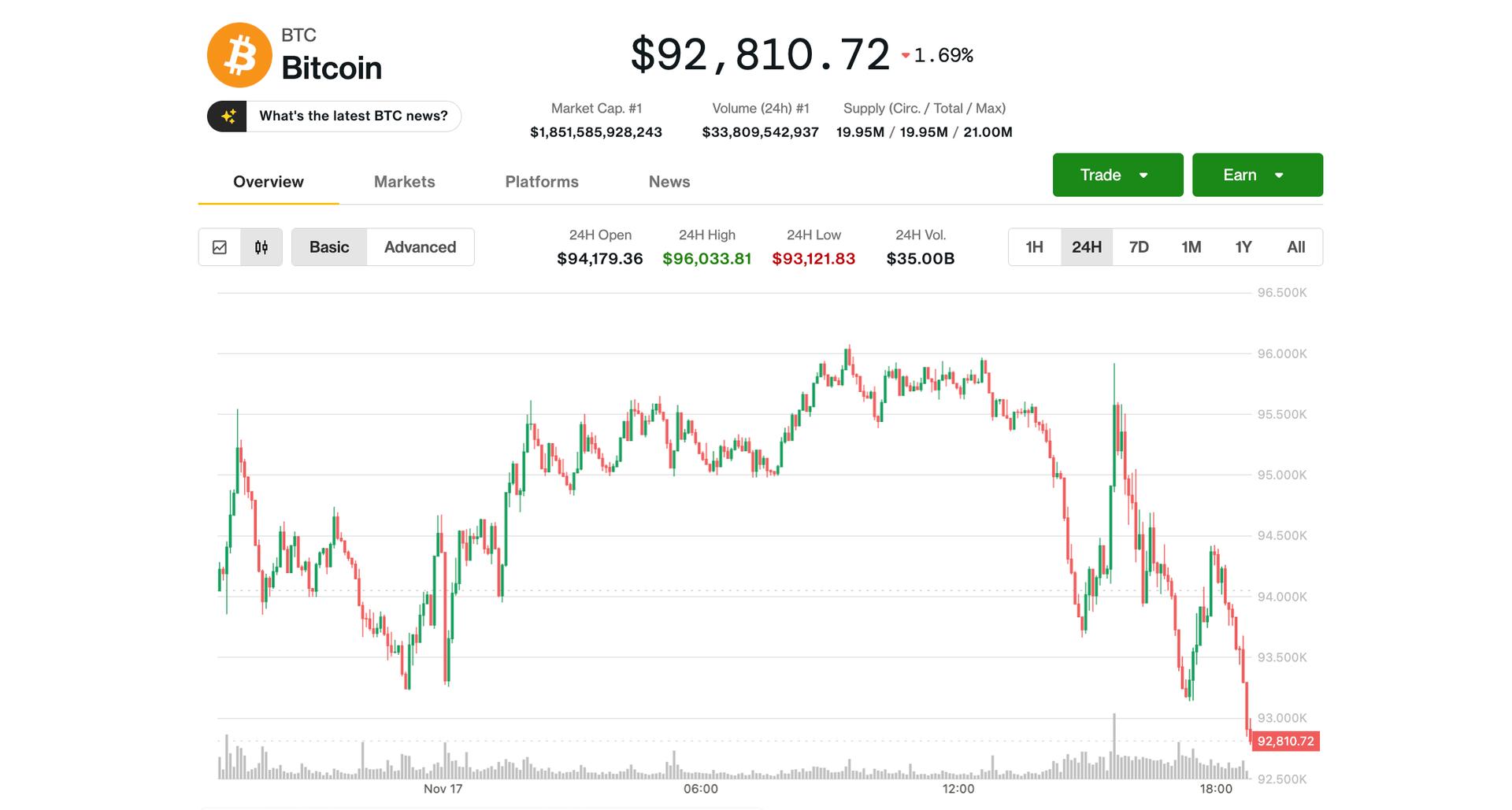

The crypto marketplace has erased much than $1.1 trillion successful worth implicit the past 41 days, averaging a staggering $27 cardinal nonaccomplishment per day, according to the Kobeissi Letter. Yet analysts reason that this is not a bearish collapse, but a structural reset driven by leverage, liquidity rotation, and mechanical marketplace flows.

According to the Kobeissi Letter, the downturn is simply a unusual anomaly owed to the lack of a large antagonistic cardinal catalyst. US governmental enactment has expressed beardown pro-crypto sentiment, and yet Bitcoin (BTC) is inactive down 25% successful a month. The newsletter attributed the descent to organization outflows opening successful precocious October, followed by a leverage-driven liquidation cascade. With galore traders operating astatine 20x–100x leverage, adjacent a 2% determination tin trigger wide wipeouts, fueling hyperactive volatility.

Likewise, John D'Agostino, caput of organization strategy astatine Coinbase, reinforced the presumption that the downturn is mechanical alternatively than fundamental, arguing that thing worldly has deteriorated successful crypto’s underlying representation since precocious September. Instead, respective large developments really strengthened the semipermanent thesis.

In a caller conception of CNBC’s Squawk Box, D’Agostino noted that the Czech National Bank precocious became the archetypal eurozone cardinal slope to acquisition Bitcoin, a landmark awesome of sovereign adoption. At the aforesaid time, companies similar Citibank and JPMorgan person started launching and investigating stablecoins to facilitate planetary lawsuit transactions, a measurement that would person been “unthinkable” during erstwhile marketplace cycles.

The Coinbase enforcement added that crypto ETFs proceed to execute strongly, with the Solana ETF achieving the champion ETF motorboat of the year, further validating organization request contempt terms volatility. From a regulatory standpoint, the situation is nary worse than it was earlier October, with planetary jurisdictions maintaining oregon expanding pathways for compliant crypto activity.

From a strategy standpoint, D’Agostino said that if investors believed successful the cardinal worth of Bitcoin, the existent situation mirrors buying discounted goods astatine a supermarket.

Related: Strategy steps up Bitcoin buys with 8,178 BTC purchase

BTC structural displacement begins arsenic selling unit eases

Glassnode noted that organisation unit is yet easing crossed respective cardinal holder cohorts aft weeks of dense selling, a imaginable aboriginal motion that the astir assertive proviso is down with BTC already 25% disconnected its highs.

CryptoQuant information reinforced this communicative with semipermanent “price-insensitive” holders absorbing 186,000 BTC since Oct. 6, the largest summation successful caller cycles. Historically, specified surges precede large rallies, but this clip the terms has fallen, creating a uncommon divergence. Analysts presently viewed 2 high-probability outcomes:

A almighty rally arsenic proviso dries up and astute wealth distributes higher.

A last washout, clearing remaining appetite earlier a durable inclination forms.

Either way, the awesome is clear: semipermanent superior is stepping successful portion sentiment collapses, and specified divergences “never past long.”

Related: Rare Bitcoin futures awesome could drawback traders off-guard: Is a bottommost forming?

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

2 hours ago

2 hours ago

English (US)

English (US)