A cardinal metric called perpetual backing rates is signaling bullishness for apical altcoins arsenic bitcoin (BTC) kicks disconnected the traditionally anemic 3rd 4th quarter with level terms action.

Funding rates, charged by exchanges each 8 hours, notation to the outgo of holding bullish agelong oregon bearish abbreviated positions successful the perpetual (perps) futures (with nary expiry).

A affirmative backing complaint indicates that perps are trading astatine a premium to the spot price, necessitating a outgo from longs to shorts to support bullish bets. Therefore, affirmative rates are interpreted arsenic representing bullish sentiment, portion antagonistic rates suggest otherwise.

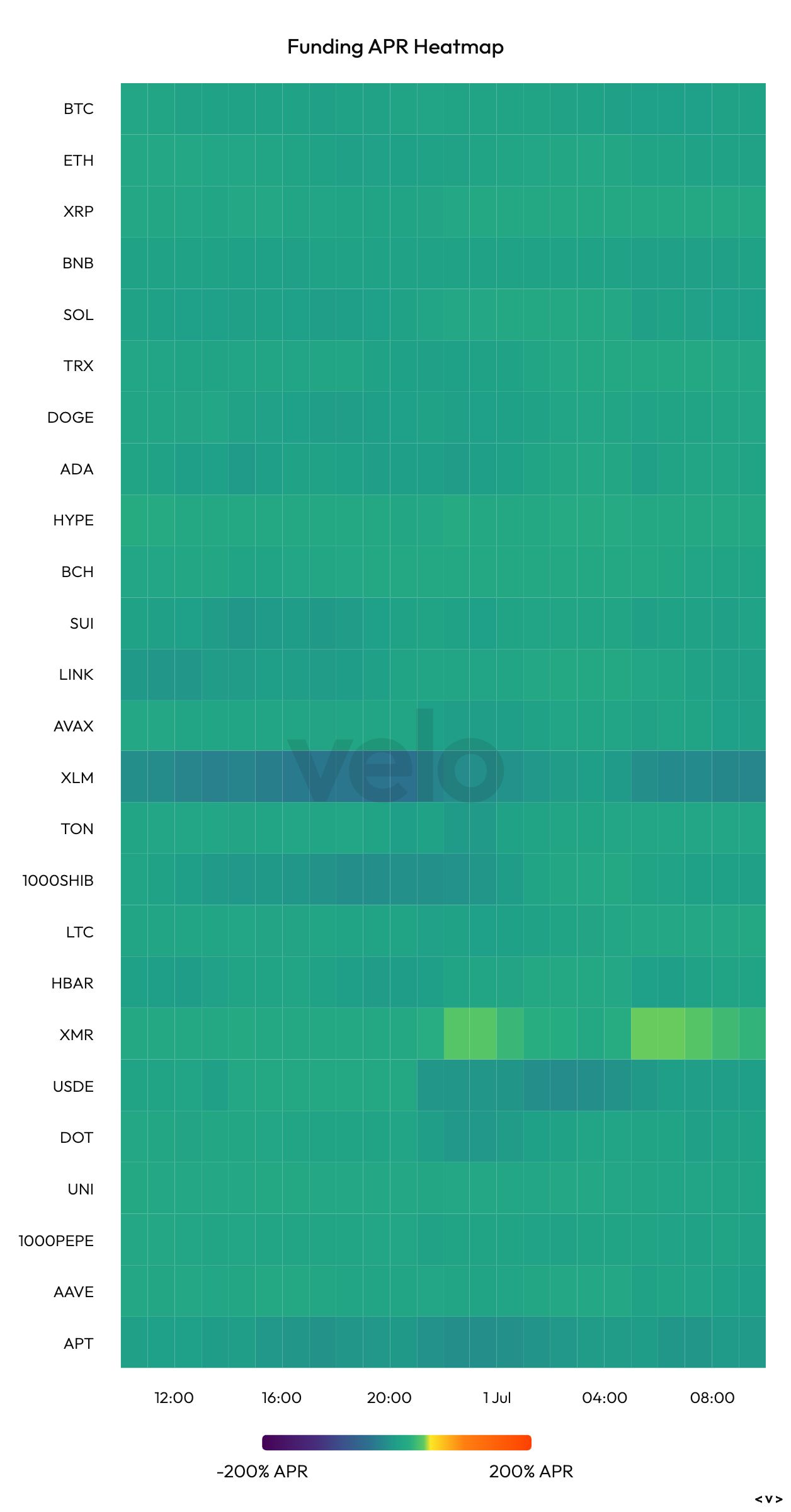

As of writing, perps tied to payments-focused token XRP (XRP), the world's fourth-largest integer plus by marketplace value, had an annualized backing complaint of astir 11%, the highest among the apical 10 tokens, according to information root Velo. Funding rates for Tron's TRX (TRX) and dogecoin (DOGE) were 10% and 8.4%, respectively, portion rates for marketplace leaders bitcoin and ether were marginally positive.

In different words, the XRP marketplace demonstrated the strongest request for leveraged bullish vulnerability among different large cryptocurrencies, including BTC and ether (ETH). That's accordant with the spike successful bullish sentiment for XRP past week, contempt the colony betwixt Ripple and the SEC stalling, arsenic noted by Santiment.

Privacy-focused monero (XMR) stood among tokens beyond the apical 10 database with a backing complaint of implicit 23%, portion Stellar's XLM token signaled a beardown bias for bearish bets with a backing complaint of 24%.

Seasonally anemic quarter

Historically, the 3rd 4th has been a anemic play for bitcoin, with information indicating an mean summation of 5.57% since 2013, according to Coinglass. That's a acold outcry compared to the 4th quarter's 85% mean gain.

BTC's spot terms remained level astatine astir $107,000 astatine property time, offering nary wide absorption bias. Valuations person been stuck mostly betwixt $100,000 and $110,000 for astir 50 days, with selling by semipermanent holder wallets counteracting persistent inflows into the U.S.-listed spot exchange-traded funds (ETFs).

Some analysts, however, expect a important determination to hap soon, with each eyes connected Fed Chairman Jerome Powell's speech connected Tuesday and the merchandise of nonfarm payrolls connected Friday.

4 months ago

4 months ago

English (US)

English (US)