The crypto marketplace appears to person stabilized nevertheless traders are proceeding with caution portion dealing with altcoins, similar XRP, portion continuing to rotate wealth into marketplace person bitcoin (BTC).

Payments-focused XRP, which Ripple uses to facilitate cross-border payments, has risen implicit 3% to $2.24 successful the past 24 hours chiefly connected hopes that the ineligible conflict betwixt blockchain company Ripple and the Securities and Exchange Commission (SEC) could reason soon.

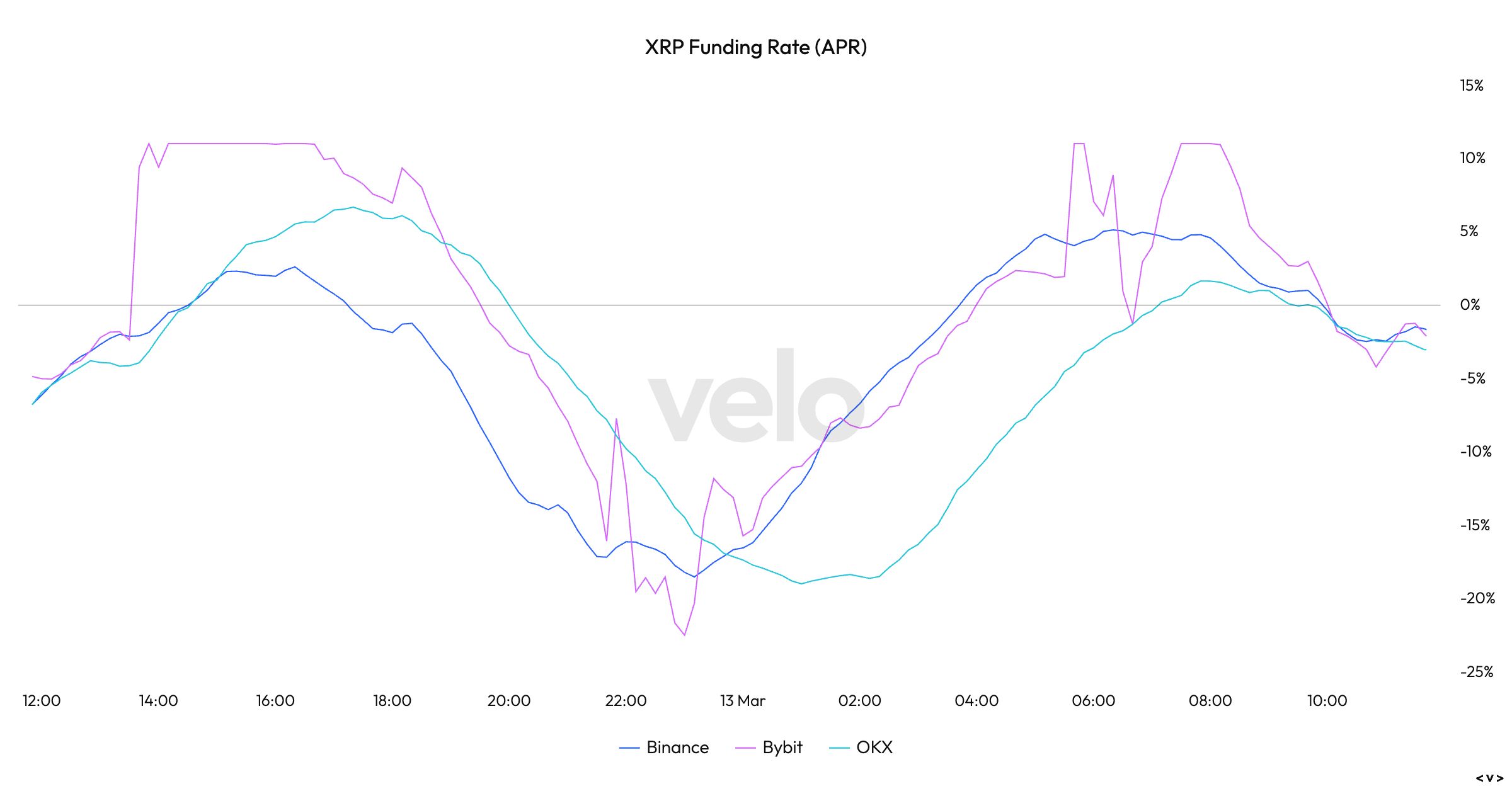

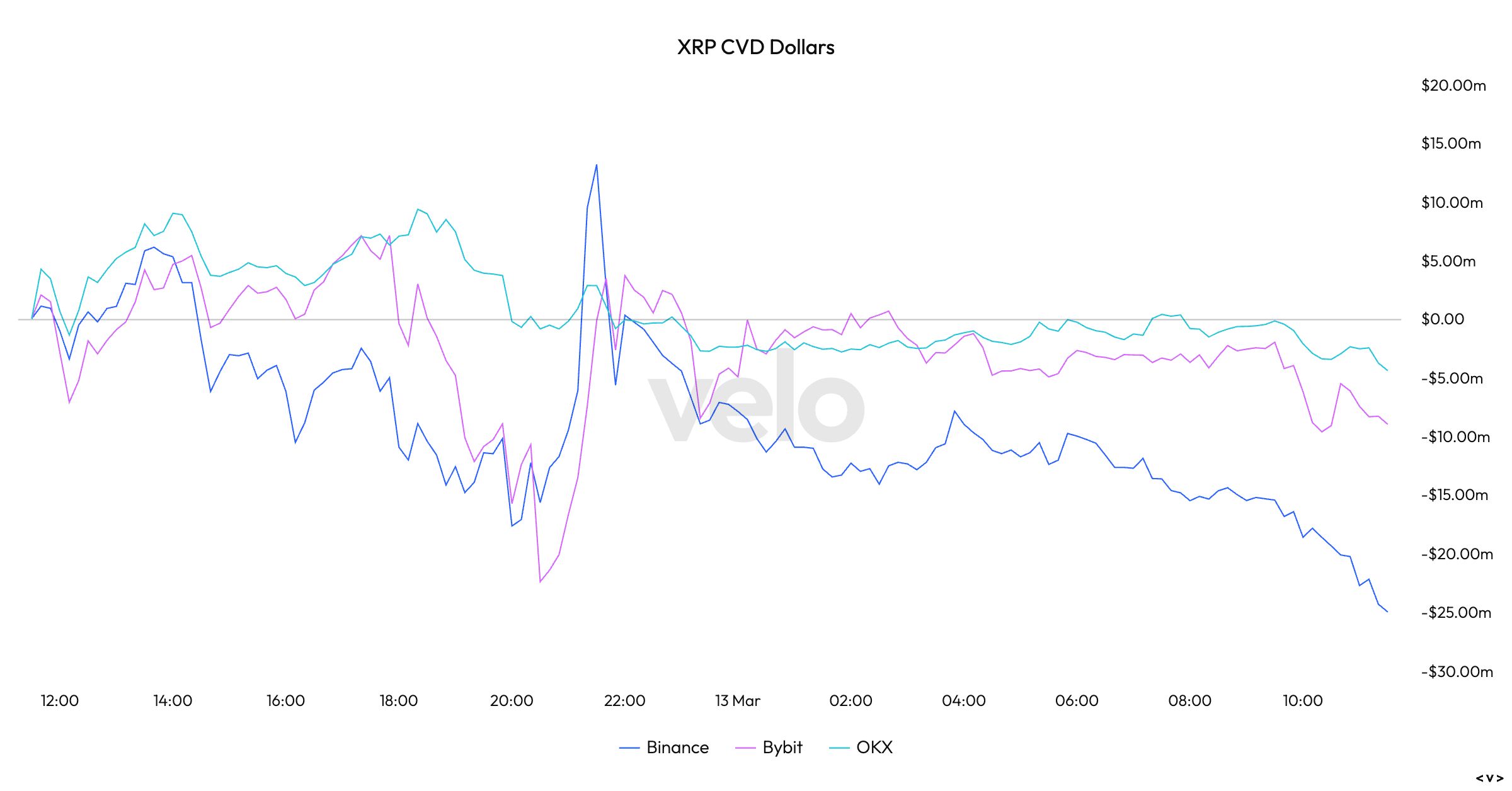

Amid the terms rise, cumulative unfastened involvement successful perpetual futures listed crossed large exchanges has stabilized adjacent 1.35 cardinal XRP, with annualized backing rates and cumulative measurement delta printing negative, according to information root Velo.

Negative backing rates mean shorts are paying fees to counterparties to support their bearish bets open. It shows the dominance of bearish abbreviated positions successful the market. The antagonistic cumulative measurement delta, which measures the nett superior inflows into the market, indicates that selling measurement has accumulated much than buying volume, perchance signaling a bearish trend.

Both indicators, therefore, formed uncertainty connected whether XRP's terms emergence has legs. At property time, respective different large-cap tokens similar DOGE, SOL, SUI, HBAR, LTC, BTC, TRX and HYPE had antagonistic CVDs connected a 24-hour basis.

Speaking of DOGE, the 50-day elemental moving mean (SMA) of the token's terms is astir to transverse beneath the 200-day SMA, confirming the alleged decease cross. The ominous-sounding signifier indicates that the short-term terms momentum is present underperforming the semipermanent momentum, with the imaginable to germinate into a large bearish trend.

These SMA crossovers are wide followed by inclination traders, meaning the confirmation of the decease transverse could bring much selling unit to the market. That said, semipermanent SMA crossovers are lagging indicators, reflecting the sell-off that has already materialized and person a mixed record of predicting terms moves successful the BTC and ETH markets.

Note that, DOGE has already dropped 65% since peaking astatine implicit 48 cents successful December.

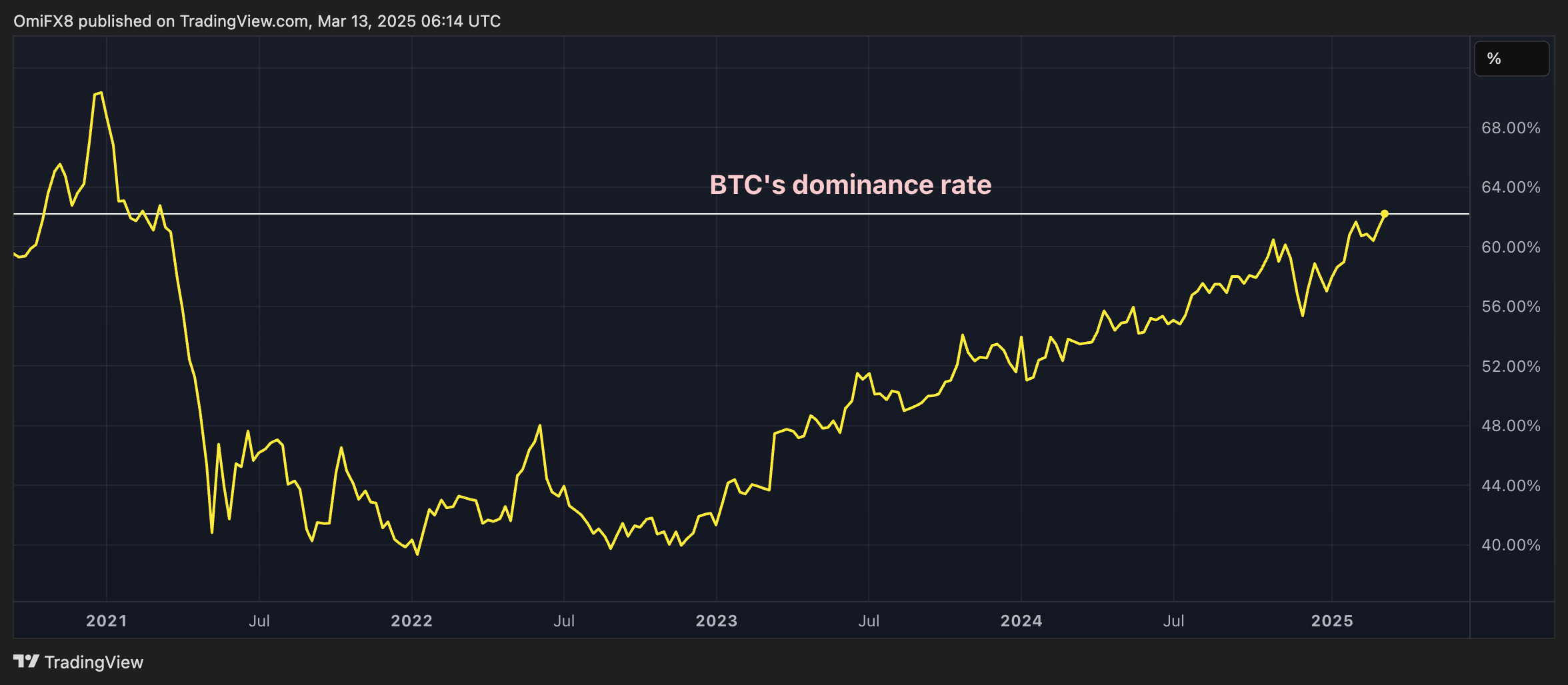

BTC astir ascendant successful 4 years

Bitcoin's dominance rate, oregon the cryptocurrency's stock successful the full marketplace capitalization, has accrued to 62.5%, the highest since March 2021, according to information root TradingView.

Notably, the metric has accrued from 55% to implicit 62% since the full crypto marketplace capitalization peaked supra $3.6 trillion successful December.

It signifies a continued penchant for BTC, peculiarly during the broader marketplace downturns.

7 months ago

7 months ago

English (US)

English (US)