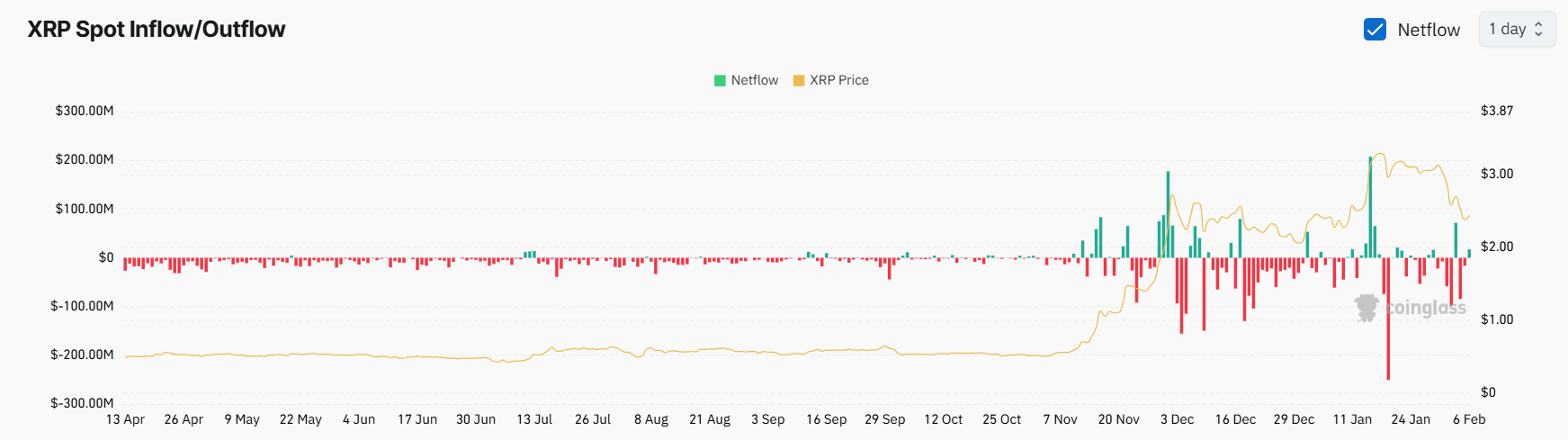

Net inflows to spot XRP tokens turned affirmative aboriginal Thursday aft days of outflows, putting the token successful absorption pursuing a record-breaking month for its autochthonal decentralized speech (DEX).

Over $15 cardinal successful XRP flowed to centralized exchanges connected Thursday led by deposits to Bybit and Kraken, Coinglass data shows. Spot inflows to exchanges whitethorn people an volition to merchantability tokens connected the unfastened market, dampening chances of a rally.

Meanwhile, 8-hour backing rates successful the XRP perpetual futures markets stood astatine -0.0065% arsenic of Thursday morning, implying a bias for abbreviated positions that nett from terms drops. Notably, XRP's backing rates were much antagonistic than ETH and BTC.

Negative backing rates mean traders holding abbreviated positions are consenting to wage a tiny interest to those with agelong positions to support their bearish bets open.

XRP beneath cardinal averages

XRP trades beneath respective cardinal moving averages, with the 10-day exponential moving mean (EMA) astatine $2.84 and 21-day EMA astatine $2.88. Trading beneath these moving averages suggests a bearish short-term outlook.

However, the 100-day elemental moving mean (SMA) is conscionable supra $2, and the 200-day SMA is astatine $1.30, some beneath the existent price, indicating a bullish longer-term trend. Moving averages assistance place trends by smoothing retired terms data, and the play readings utilized supra are popularly utilized by retail traders.

Meanwhile, contiguous absorption astatine $2.49, followed by the $2.60 level. A determination past these levels would revive the bullish outlook, mounting the signifier for a tally to the $3 mark, which it breached successful January for the archetypal clip since 2018.

XRP's 14-day comparative spot scale (RSI) — which measures magnitude of terms changes — was conscionable implicit 36 successful Asian hours, placing it successful the neutral zone. Traditionally, RSI values supra 70 bespeak overbought conditions, portion values beneath 30 suggest oversold conditions. An RSI astir 50 is considered neutral.

4 months ago

4 months ago

English (US)

English (US)