Traders are watching the $2.31–$2.35 enactment portion and $2.47 absorption for signs of marketplace direction.

Updated Oct 17, 2025, 6:13 a.m. Published Oct 17, 2025, 6:13 a.m.

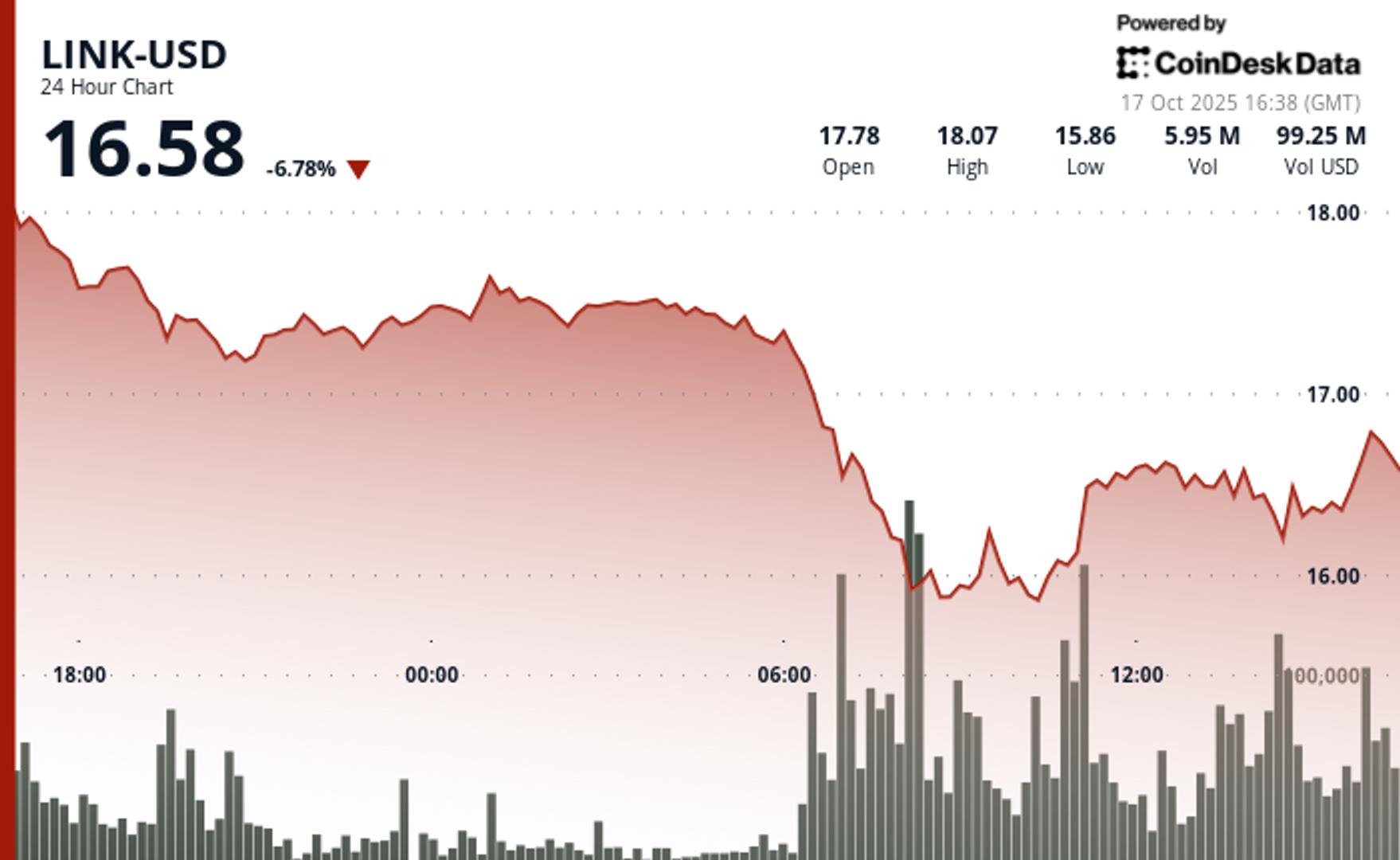

(CoinDesk Data)

What to know:

- XRP experienced a 2% diminution amid organization liquidation, stabilizing adjacent cardinal enactment levels.

- Open involvement rebounded to $1.36 billion, indicating renewed derivative trading activity.

- Traders are watching the $2.31–$2.35 enactment portion and $2.47 absorption for signs of marketplace direction.

Heavy selling unit drives XRP 2% little earlier stabilization adjacent cardinal support. Institutional positioning and caller unfastened involvement suggest accumulation astatine existent levels.

News Background

- XRP extended its diminution done the October 16–17 session, sliding 2% from $2.41 to $2.36 amid ongoing organization liquidation. Market information amusement much than 150M successful regular measurement arsenic semipermanent holders trimmed positions by 34% implicit the past 2 weeks.

- The Hodler Net Position Change metric fell from 163.7M to 107.8M tokens — a wide motion of divestment rotation pursuing the mid-month volatility spike.

- Despite the drawdown, unfastened involvement rebounded to $1.36B arsenic derivative traders began rebuilding vulnerability aft the play washout.

- Market desks accidental the renewed enactment could people the commencement of tactical agelong positioning into quarter-end ETF speculation and macro easing signals.

Price Action Summary

- XRP traded betwixt $2.31 and $2.47 implicit the 24-hour window, a $0.16 set representing 7% intraday volatility.

- Selling intensified from 14:00–20:00 arsenic terms fell 8% intraday from $2.44 to $2.29 earlier recovering modestly into the U.S. close.

- High-volume reversals supra $2.31 confirmed beardown spot request and algorithmic buying into weakness.

- Resistance remains capped adjacent $2.47 wherever repeated rejection wicks awesome ongoing proviso pressure.

- The last hr (04:34–05:33) showed $2.35–$2.36 consolidation with 1.6M successful measurement spikes — emblematic of controlled re-accumulation phases pursuing forced unwinds.

Technical Analysis

- XRP’s terms operation is stabilizing wrong the $2.31–$2.47 channel, with the $2.35 pivot acting arsenic a short-term anchor. Volume clusters astir this portion bespeak organization accumulation contempt the broader risk-off tone.

- A cleanable reclaim of $2.47 would invalidate the near-term bearish setup and unfastened a way toward $2.55.

- Momentum indicators stay neutral-to-oversold, portion backing rates turned somewhat affirmative — a motion that short-covering has slowed. Analysts expect continued choppy consolidation until macro hazard recedes oregon ETF-related flows accelerate.

What Traders Are Watching

- $2.31–$2.35 enactment portion — basal defence levels signaling purchaser absorption.

- $2.47 absorption reclaim — archetypal confirmation trigger for reversal momentum.

- Open involvement and backing normalization — grounds of re-leveraging aft flush.

- ETF timeline and Fed commentary arsenic catalysts for Q4 crypto travel rotation.

More For You

Stablecoin outgo volumes person grown to $19.4B year-to-date successful 2025. OwlTing aims to seizure this marketplace by processing outgo infrastructure that processes transactions successful seconds for fractions of a cent.

More For You

Ripple Said to Lead $1B Fundraise to Bulk Up XRP Holdings Amid Fragile Market

The caller XRP-focused DAT would reflector the structures utilized by listed accumulators similar Michael Saylor’s Strategy Inc. and Japan’s Metaplanet, some of which person seen their shares descent amid broader hazard aversion.

What to know:

- Ripple Labs is starring an effort to rise astatine slightest $1 cardinal done a special-purpose conveyance to accumulate XRP, contempt caller marketplace volatility.

- The inaugural involves creating a caller digital-asset treasury operation and marks 1 of the largest azygous raises tied to XRP.

- Ripple's program comes amid a fragile market, with the steadfast besides acquiring GTreasury to heighten its firm treasury offerings.

1 day ago

1 day ago

English (US)

English (US)