On July 6, 2023, the World Gold Council (WGC) released its 2023 Mid-Year Outlook, revealing that a “strong archetypal fractional for golden is apt to springiness mode to a much neutral H2.” According to WGC researchers and marketplace strategists, cardinal banks are “nearing the extremity of their tightening cycles,” and the marketplace statement indicates “a mild contraction successful the U.S. successful precocious 2023.”

Gold Maintains Resiliency successful H1

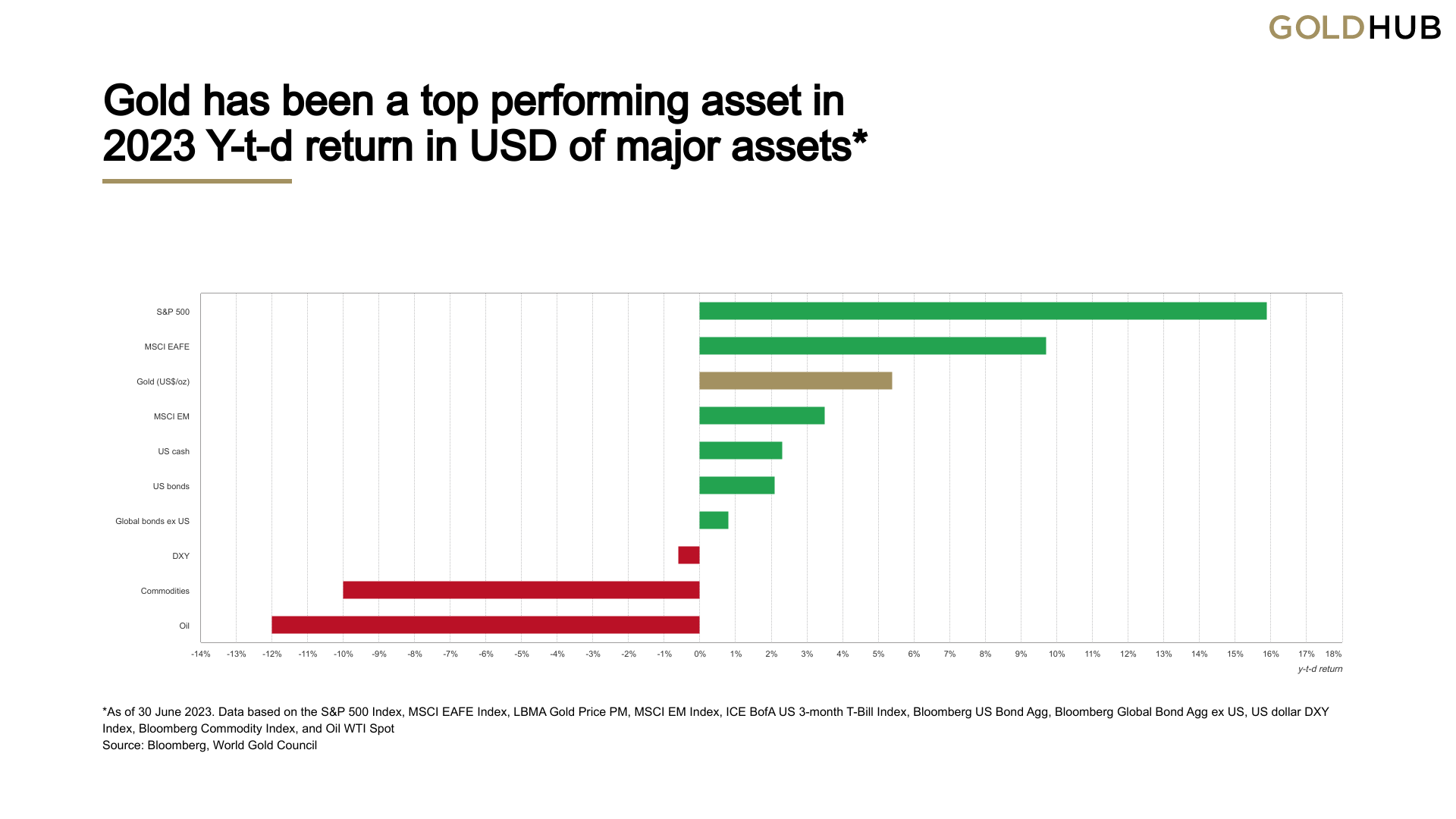

At property time, the terms of an ounce of .999 good golden hovers conscionable supra the $1,900 range, specifically astatine $1,924 per unit. Over the past 30 days, this precious metallic has maintained a comparatively unchangeable position, portion the archetypal fractional (H1) statistic bespeak a 5.4% summation against the U.S. dollar. Over the past 5 years, golden is up 53% against the greenback.

The World Gold Council (WGC) emphasizes successful its latest 2023 Mid-year Outlook report that it anticipates “gold to stay supported connected the backmost of rangebound enslaved yields and a weaker dollar.” The study further highlights that if economical conditions worsen, golden volition acquisition heightened demand. “Conversely, a brushed landing oregon overmuch tighter monetary argumentation could effect successful disinvestment,” the study explains.

“If the recession hazard increases, golden concern could spot greater upside,” the WGC study details. “An economical deterioration could beryllium driven by a important summation successful defaults pursuing tighter recognition conditions oregon different unintended consequences of the high-rate environment. Historically, specified periods person resulted successful higher volatility, important banal marketplace pullbacks, and an wide appetite for precocious quality, liquid assets specified arsenic gold.”

While bitcoin (BTC) is not mentioned among the competitory assets, the WGC mid-year study specifies that golden emerged arsenic 1 of the top-performing assets successful 2023 erstwhile compared to U.S. cash, U.S. bonds, and the MSCI EM Index. In contrast, BTC proved to beryllium the strongest performer successful the archetypal fractional (H1), experiencing a important summation of implicit 80% during the archetypal six months of 2023.

The World Gold Council’s investigation shows golden has a inclination to surpass equities successful show erstwhile the manufacturing purchasing managers’ scale (PMI) is beneath 50 and declining. Additionally, humanities information indicates that if the PMI drops beneath 45, gold’s outperformance could beryllium adjacent much significant.

WGC researchers and marketplace strategists further accidental golden tends to beryllium much influenced by enslaved yields alternatively than existent argumentation rates. This is due to the fact that enslaved yields encompass marketplace expectations regarding aboriginal argumentation decisions and the probability of an ensuing economical downturn.

“Given the inherent uncertainty successful predicting the planetary macroeconomic outcome, we judge that gold’s affirmative asymmetrical show tin beryllium a invaluable constituent to investors’ plus allocation toolkit,” the 2023 Mid-year Outlook study concludes.

Will gold’s resilience proceed to radiance amidst economical uncertainties, oregon volition investors research alternate assets? Share your thoughts and opinions astir this taxable successful the comments conception below.

2 years ago

2 years ago

English (US)

English (US)