Financial conditions successful the U.S. are the loosest they person been successful 3 years, according to the Chicago Fed's National Conditions Index (NFCI), a play gauge that takes into relationship factors specified arsenic leverage, indebtedness and equity markets and accepted banking.

The readings supply penetration into 3 circumstantial areas: risk, recognition and leverage. For the week ended Nov. 22, the scale dropped to -0.64, a level not seen since August 2021 successful the aftermath of the Covid-19 pandemic.

A antagonistic speechmaking suggests fiscal conditions are looser than mean indicating that liquidity is readily available. A affirmative reading, successful contrast, means tighter-than-average conditions with superior hard to travel by, arsenic during the 2008 planetary fiscal crisis.

Zooming out, we're successful 1 of the astir financially escaped periods since information started being collected successful 1971. With U.S. header ostentation astatine an yearly 2.6%, good supra the Federal Reserve's 2% people since February 2021, it's imaginable 75 ground points of interest-rate cuts since September and a 4.75% complaint present person done small to rein successful investors' appetite for risk.

The S&P 500, for example, has ratcheted up its 55th all-time precocious this year, adding 28% since the commencement of January, according to Zerohedge. Bitcoin (BTC) has surged 118% and the full crypto marketplace headdress has much than doubled to attack $3.5 trillion, according to the TOTAL metric connected TradingView.

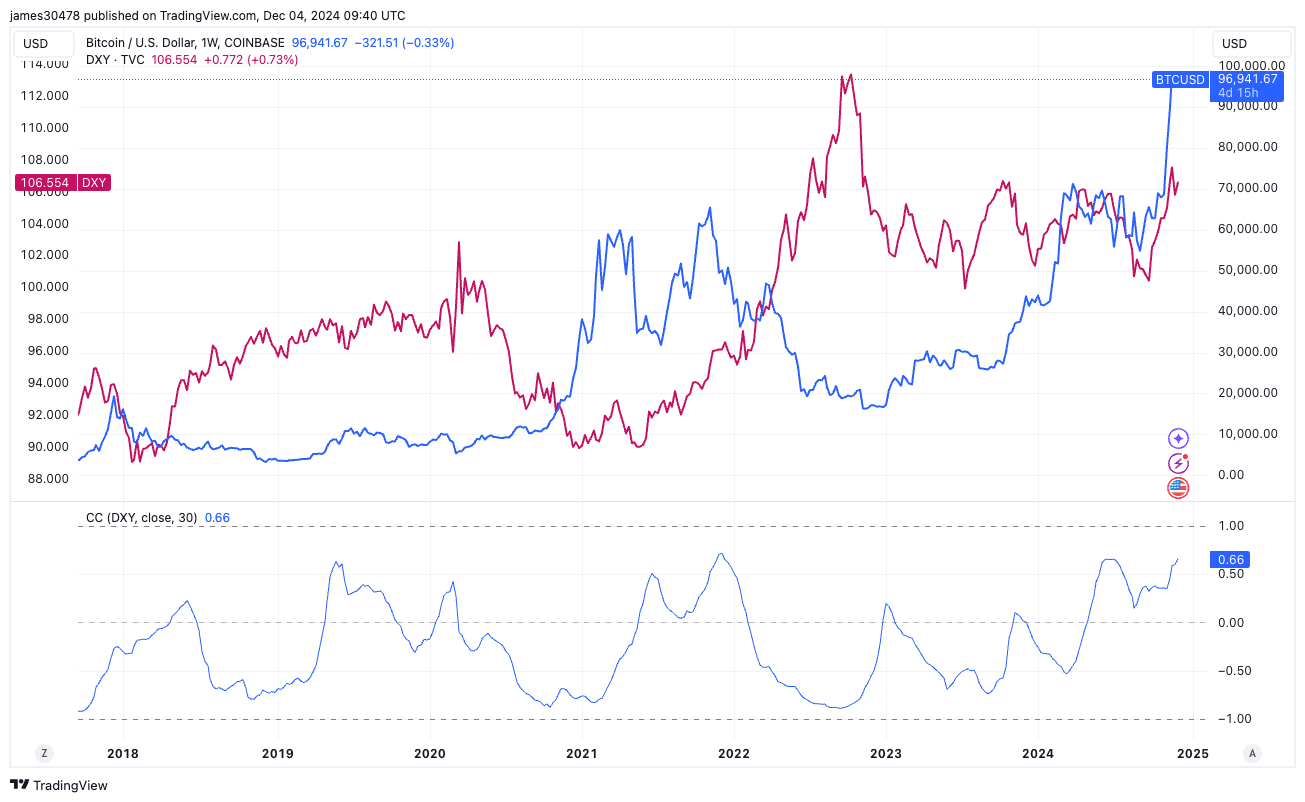

Bitcoin and DXY emergence unneurotic

Risk assets thin to person an inverse correlation with the DXY index, a measurement of the U.S. dollar against a number of different large currencies. Typically, the scale is considered beardown erstwhile it's implicit 100. It's held implicit 106 since Donald Trump won the U.S. statesmanlike election.

That makes bitcoin's rally peculiarly interesting, due to the fact that it breaks the inverse behavior. The 30-day correlation betwixt bitcoin and the DXY scale is astatine 0.66 implicit the past 7 years, 1 of the strongest levels for that period.

As fiscal conditions loosen and full U.S. indebtedness hits a grounds $36.17 trillion, the largest cryptocurrency seems to beryllium thriving with its quality to soak up liquidity overriding the beardown dollar.

8 months ago

8 months ago

English (US)

English (US)