The crypto market’s rally stalled connected Wednesday aft U.S. Secretary of Treasury Scott Bessent reiterated that a due commercialized woody betwixt Washington and Beijing would instrumentality years to ink out.

Bitcoin (BTC) is up 2.6% successful the past 24 hours and 12.2% successful the past 7 days, trading astatine $93,600 for the archetypal clip since the opening of March. The largest cryptocurrency was outperformed by ample swaths of the market, with the CoinDesk 20 — an scale of the apical 20 coins, excluding stablecoins, memecoins and speech tokens — roseate 4.2% successful the past 24 hours. Sui (SUI) jumped 24% successful that play of time, portion Cardano's ADA and Chainlink's LINK some saw 7% gains.

Crypto stocks, which opened strong, saw their show dampen arsenic the time unfolded. Miners specified arsenic Bitdeer (BTDR) and Core Scientific (CORZ) fell backmost from double-digit gains, closing the time up astir 4%. Coinbase (COIN) and Strategy (MSTR) are up 2.1% and 1.4%, respectively.

U.S. President Donald Trump seemed to beryllium dialing down the unit connected China successful the past fewer days, saying that tariffs connected the Middle Kingdom would “come down substantially” connected Tuesday. Bessent, however, said connected Wednesday that the White House had not made a unilateral connection to chopped tariffs connected China, and that a woody betwixt the 2 nations would instrumentality 2 to 3 years to achieve.

"A meaningful thaw successful relations whitethorn not materialize until substantive quality emerges from the upcoming Xi-Trump meeting," said Paul Howard, manager astatine crypto trading steadfast Wincent. Markets priced successful the archetypal pugnacious stances and tariff threats, which kept a lid connected hazard appetite implicit the past 2 months, helium said.

"History suggests that erstwhile the opening volleys pass, much constructive developments and easing volatility typically follow," Howard said, which could enactment hazard assets specified arsenic crypto.

BTC ETF flows return

In a motion of renewed capitalist demand, U.S.-listed spot BTC exchange-traded funds (ETFs) person recorded astir $1.3 cardinal successful nett inflows this week truthful far, according to SoSoValue data. The funds booked their strongest time connected Tuesday since mid-January.

"This [crypto] rally isn’t retail-driven hype—it’s organization superior positioning up of what galore spot arsenic a caller monetary and governmental regime," said Matt Mena, crypto probe strategist astatine integer plus manager 21Shares. "More investors are turning to it not conscionable arsenic a speculative asset, but arsenic a formation to information amid rising uncertainty crossed accepted markets."

Despite the beardown terms action, Mena added that BTC is facing absorption astatine astir the $95,000 level successful the abbreviated word and could propulsion back.

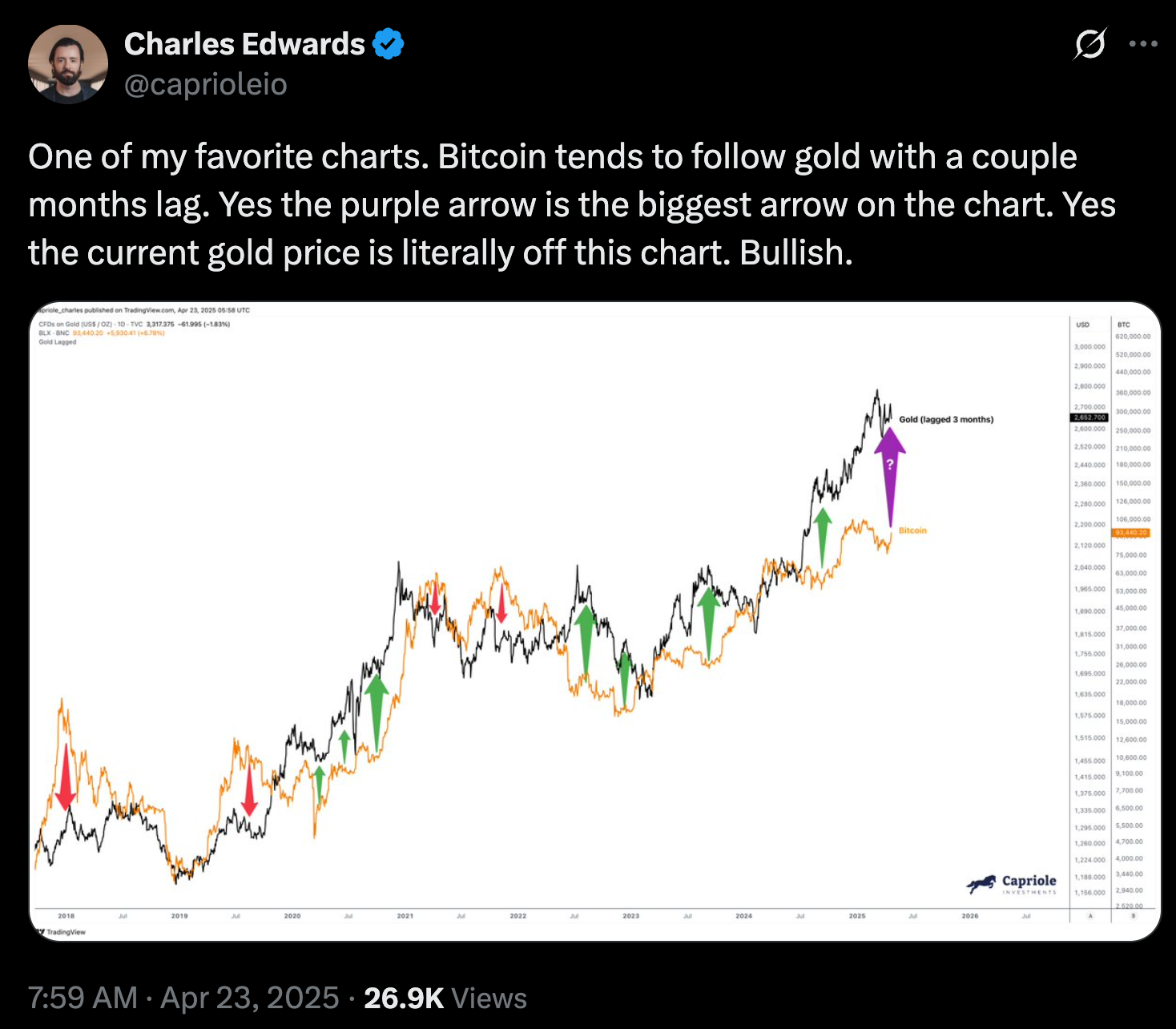

Bitcoin to drawback up to gold

Gold, meanwhile, is down 2.5% today, trading astatine $3,290 per ounce aft a tally that saw the precious metallic emergence 35% to $3,500 successful the span of 4 months, perchance hinting that the marketplace could beryllium moving past highest uncertainty.

Gold stalling aft a monolithic rally could bode good for bitcoin, said Charles Edwards, laminitis of bitcoin-focused hedge money Capriole Investments. Posting a chart connected X connected Wednesday, helium noted that BTC historically followed gold's gains with a few-month lag.

"Bitcoin is showing important strength," Edwards said successful an X post. "We person decoupled from hazard assets and the marketplace is present starting to front-run the information that bitcoin is integer gold. If hazard assets were to decay further from here, BTC is the eventual QE [quantitative easing] hedge."

Read more: Bitcoin Breaches 'Ichimoku Cloud' to Flash Bullish Signal While Altcoins Lag: Technical Analysis

6 months ago

6 months ago

English (US)

English (US)