With less than 200 days to go, anticipation mounts for the halving, a four-year lawsuit that halves the proviso rate. Bitcoin’s 4th halving is projected to instrumentality spot connected oregon astir April 24, 2024. This broad usher volition assistance you recognize the halving’s effects and what to anticipate.

The Countdown to Halving and Understanding the Halving Mechanism

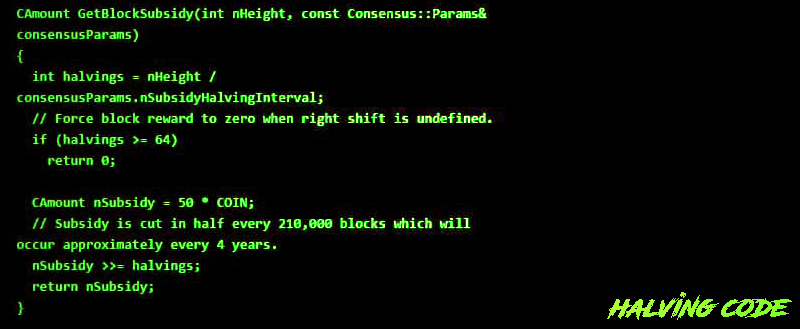

By existent measurements, 193 days remain until the halving, acceptable for April 2024. In essence, the Bitcoin halving, coded into Bitcoin by its founder, Satoshi Nakamoto, happens each 210,000 blocks, astir each 4 years. When the web hits a definite artifact number, the mining reward — the bitcoin magnitude miners gain for verifying transactions — is halved.

For instance, the archetypal mining reward was 50 bitcoins per block, and it fell to 25 bitcoins per artifact aft 2012’s archetypal halving. This strategy ensures a regulated proviso complaint that diminishes implicit time. To date, Bitcoin has undergone 3 halvings: the archetypal connected November 28, 2012, the 2nd connected July 9, 2016, and the 3rd connected May 11, 2020, erstwhile the reward declined to 6.25 BTC.

The upcoming simplification volition slash the reward from 6.25 BTC to 3.125 BTC per block. This halving volition alteration the ostentation complaint from 1.7% annually to 0.84%. Given existent prices and the existing 900 BTC issued daily, miners gain astir $24 cardinal regular successful caller bitcoins. If bitcoin’s terms stays steady, that regular gross would autumn to $12 million, though galore expect the worth to importantly summation by then. Historically, bitcoin’s marketplace terms has risen earlier each halving.

Market Response and Miner Profitability

In the months earlier the 2012 halving, bitcoin’s terms jumped from beneath $5 to implicit $13, ensuring miner profitability contempt a reduced artifact reward. Similarly, up of the 2016 halving, terms roseate from astir $400 to much than $600 by July 2016. By December 2016, it surpassed $900. Prices besides increased successful 2020, peculiarly aboriginal successful the year. While each halving tightens miners’ nett margins, terms surges person kept them up of the game.

The Future and Miner Sustainability

Although prices roseate during the past 3 halvings, it’s not guaranteed. If bitcoin’s terms doesn’t ascent astir halving times, miners look superior profitability risks. Each halving reduces miners’ artifact reward income by half. If the terms remains level oregon drops, mining could go unprofitable, perchance forcing galore miners to cease operations, consequently diminishing the network’s hashrate and wide security.

Moreover, a attraction of mining powerfulness could situation the network’s decentralization. But if bitcoin’s worth rises sufficiently to equilibrium the artifact reward cut, miners tin enactment profitable and enactment the web seamlessly. Miners mightiness besides nett from transaction fees, provided there’s important maturation successful bitcoin’s usage and adoption.

For instance, if 4 cardinal individuals each conducted a bitcoin transaction daily, with each transaction incurring a $0.01 fee, that would full $40 cardinal successful regular fees. Such a script could enactment miners adjacent aft artifact rewards vanish. While a rising bitcoin terms is captious for maintaining miner incentives during halvings, an uptick successful idiosyncratic engagement and transaction measurement tin besides let miners to payment from onchain fees connected a ample scale. The halving is simply a cardinal trial of bitcoin’s information and worth proposition arsenic an asset.

While the bitcoin protocol’s coded halvings let estimates of dates and proviso inflation, the aboriginal remains unpredictable. No 1 tin foretell bitcoin’s terms oregon mining economics astatine aboriginal halvings. The network’s reactions to tightening proviso are wholly theoretical until halvings really occur.

What bash you deliberation astir the upcoming reward halving? Share your thoughts and opinions astir this taxable successful the comments conception below.

1 year ago

1 year ago

English (US)

English (US)