This is an sentiment editorial by Mickey Koss, a West Point postgraduate with a grade successful economics. He spent 4 years successful the infantry earlier transitioning to the Finance Corps.

I emotion listening to Greg Foss connected podcasts, particularly erstwhile I’m gearing up for a dense dormant assistance oregon thing similar that. His no-nonsense talks astir bonds conscionable truly gets my humor flowing and my caput focused. But erstwhile I nonstop worldly similar that to my little finance-minded buddies, they often person occupation knowing what he’s talking about.

Here’s my effort astatine immoderate perchance oversimplified mathematics to explicate the indebtedness spiral.

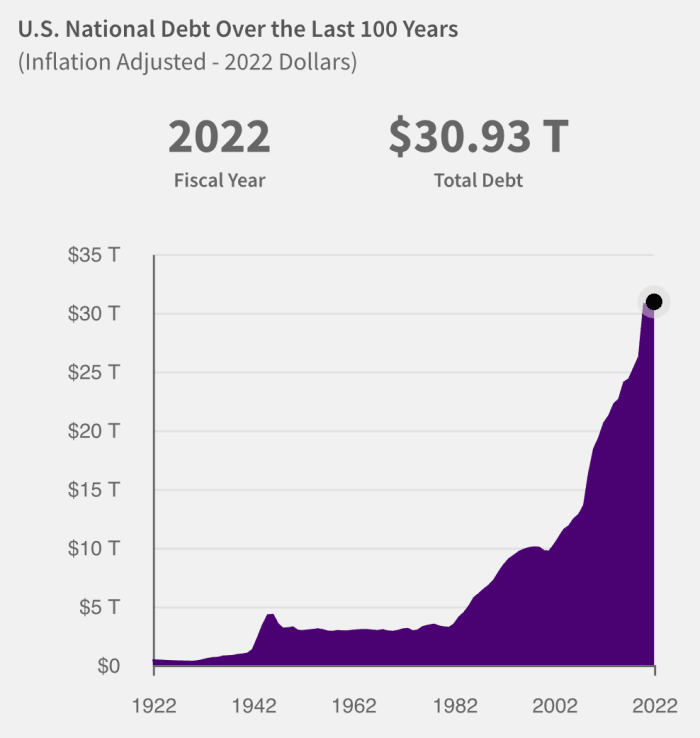

“What Is The National Debt“ from the U.S. Treasury

U.S. Federal Debt

As of October 13, 2022, the United States has $31,144,952,729,330.20 worthy of outstanding debt. This is updated regular by the Treasury. To marque the mathematics a small much simple, let’s conscionable telephone it $30 trillion. After all, what’s different trillion, springiness oregon take?

This implies a $621 cardinal yearly involvement outgo connected the indebtedness this year. The Washington Post estimates $580 billion. Let’s divided the quality and telephone it $600 billion.

If you’ve been paying attention, the Federal Reserve is aggressively raising involvement rates and the marketplace is arsenic assertive successful bidding up output connected authorities debt.. Every ground constituent that is added to the mean complaint connected U.S. authorities indebtedness volition adhd astir $3 cardinal successful further involvement expense. That’s if the indebtedness stays astatine its existent level.

That unluckily is not going to happen. Currently, the yearly budget shortfall sits astatine $946 cardinal per twelvemonth with nary signs of ever going to zero. Since this is the case, not lone volition the U.S. authorities person to contented much indebtedness astatine a complaint of astir $1 trillion much per year, it volition beryllium doing truthful portion involvement rates are going up fast.

The higher involvement rates go, the much involvement connected the indebtedness volition beryllium required to beryllium paid. The much involvement connected the indebtedness required to beryllium paid, the larger the shortage gets. The larger the shortage gets, the much indebtedness indispensable beryllium issued. More indebtedness issued, much involvement connected debt. Even if the Fed dropped rates backmost to zero, the indebtedness would proceed to turn astatine a compounding complaint due to the fact that of the quality of the deficit.

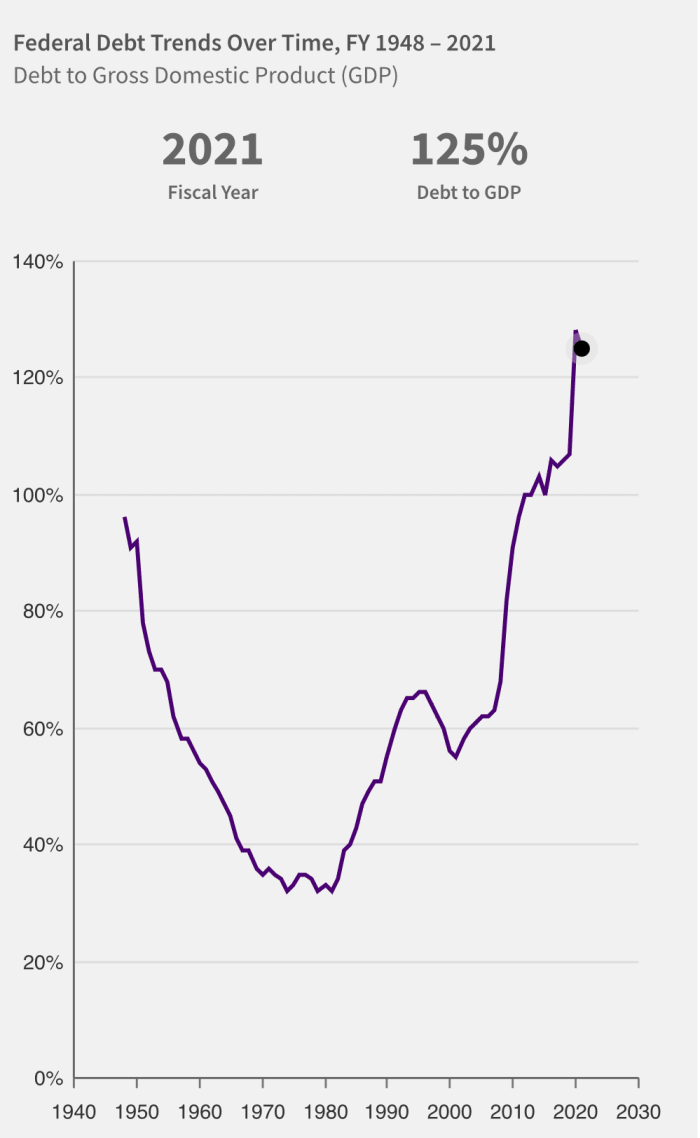

“What Is The National Debt“ from the U.S. Treasury

Even much concerning is the supra graph depicting the indebtedness arsenic a percent of gross home product. The upward slope of the enactment since the mid-1980s implies that the indebtedness has been increasing faster than the system for decades.

The quality of the perpetual fund shortage ensures that this concern is an inevitability; the Fed is conscionable accelerating it astatine the moment. Debt begets much indebtedness arsenic agelong arsenic the shortage exists.

Hopefully you get it now. This is what Greg Foss means by a indebtedness spiral. The indebtedness ne'er really gets paid off; it conscionable keeps getting rolled over, increasing astatine a compounding rate. On this trajectory, it volition commencement to accelerate.

Bitcoin Is Protection

Based connected mathematics alone, the Federal Reserve cannot proceed to rise rates for overmuch longer, nor support them this precocious due to the fact that the involvement connected the indebtedness volition go wholly unmanable. There is simply a batch to beryllium said astir a Fed Pivot and erstwhile they volition determine to taper their taper to little involvement rates backmost down. When volition they really bash it? I’m not sure, but the Fed volition person to yet driblet rates backmost down to effort and dilatory the bleeding. And erstwhile it does, the rally that the bitcoin terms volition person is going to melt your look off.

While I americium not peculiarly funny successful the terms anymore — unlike some — I americium acrophobic with mundane radical being capable to hop connected the bitcoin beingness raft earlier it shoots disconnected into space.

Absolute scarcity is an implicit imperative successful a satellite bereft of monetary scarcity. Be a bully friend: assistance radical grasp this concept, due to the fact that astir don’t recognize what’s coming.

This is simply a impermanent station by Mickey Koss. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc. oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)