Reason to trust

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Created by manufacture experts and meticulously reviewed

The highest standards successful reporting and publishing

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The Bitcoin terms action is presently investigating investors’ nerves arsenic it hovers astir $100,000. While it flirts with this intelligence level, analysts are highlighting June 22, 2025, arsenic a cardinal day for imaginable volatility. Backed by some humanities volatility patterns and method indicators, this day is gearing up to beryllium a captious model for Bitcoin’s adjacent move.

Bitcoin Price Braces For Volatility On June 22

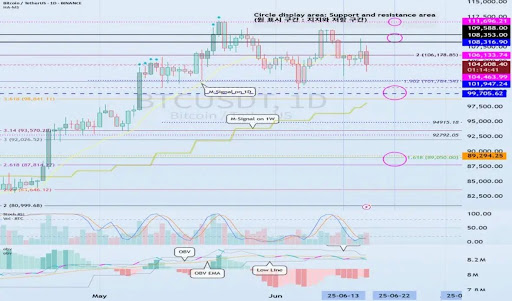

Bitcoin is entering a decisive signifier arsenic it trades supra the $100,000 mark, with method signals identified by TradingView adept ‘readCrypto’ aligning astir a captious clip frame—-June 22. The illustration investigation shows that June 22 is an important date, signaling the projected commencement of Bitcoin’s adjacent volatility window, with a imaginable to interruption retired oregon interruption down depending connected however the flagship cryptocurrency reacts to cardinal enactment and absorption zones.

Currently, Bitcoin is trading astatine $104,731, adjacent to a pivotal confluence scope betwixt $104,463 and $106,133—a portion highlighted arsenic a structural mid-point. This country is defined by the DOM (60) and a Heikin-Ashi precocious constituent connected the terms chart, marking the enactment of a caller precocious boundary. Moreover, the little extremity of the scope sits astir $99,705, which is the HA-High enactment level, wherever the terms has antecedently been tested but not yet broken.

Source: ReadCrypto connected Tradingview

Source: ReadCrypto connected TradingviewAccording to the analyst, the June 22 day is important due to the fact that it coincides with the confluence of cardinal terms levels with the M-Signal indicator connected the play chart. This indicator is presently rising and aligning adjacent the $99,705 HA-high level. If Bitcoin falls beneath this level, it could awesome the commencement of a deeper corrective move, perchance toward the monthly M-Signal enactment oregon adjacent the $89,294 region, corresponding with the 2.618 Fibonacci.

Conversely, if Bitcoin holds supra this level and breaks retired of the $108,316 resistance, momentum could displacement backmost to the upside. The expert has set precocious bullish targets adjacent $109,598 and $111,696, reflecting the last absorption portion earlier caller highs.

Support Zones And Momentum Indicate Tense Standoff

Moving past readCrypto’s volatility-driven projection, the TradingView analyst’s Bitcoin illustration shows that the On-Balance-Volume (OBV) oscillator remains beneath the zero line. This suggests that contempt caller gains, selling unit whitethorn inactive beryllium dominating the broader market. However, the histogram successful the illustration shows signs of waning momentum connected the merchantability side.

This divergence aligns with Bitcoin’s weakening Stochastic Relative Strength Index (RSI), which indicates momentum whitethorn beryllium cooling. The debased OBV readings, combined with the caller bounce from a little enactment range, besides underscore an aggravated standoff wrong the market. If Bitcoin breaks beneath the Heikin Ashi precocious constituent astatine $99,705, a retest of caller lows astatine $89,294 is much than likely.

Until then, readCrypto’s investigation shows that each eyes are connected the $104,000 to $106,000 zone. The country betwixt $99,705 and $108,316 present defines the high-boundary consolidation range. A confirmed determination extracurricular this range, chiefly triggered during the June 21-13 window, could dictate Bitcoin’s adjacent large move.

Featured representation from Pixabay, illustration from Tradingview.com

4 months ago

4 months ago

English (US)

English (US)