One of the Uniswap DAO’s apical contributors walked distant successful vexation connected Monday amid concerns that different stakeholders wield excessively overmuch powerfulness implicit the decentralised protocol.

Pepo, a pseudonymous delegate whom different token holders entrusted to ballot connected their behalf, had participated successful Uniswap’s governance since 2023. He wielded 455,000 UNI tokens, making him 1 of the apical 20 largest delegates.

The crushed for the departure? Other organisations progressive successful the moving of Uniswap — chiefly the nonprofit Uniswap Foundation — person pushed speech the opinions of DAO members and person been unreceptive to feedback, Pepo said successful an X post.

“The Foundation’s behaviour seems to person prioritized insulation implicit collaboration, and successful doing so, whitethorn person actively harmed Uniswap,” Pepo said.

Devin Walsh, Executive Director of the Uniswap Foundation, didn't supply nonstop remark to CoinDesk erstwhile asked astir the accusation. However, she did supply a rebuttal connected societal media.

“Delegate information is indispensable to the occurrence of the Uniswap ecosystem,” she said connected X. “The Uniswap Foundation takes their feedback seriously.”

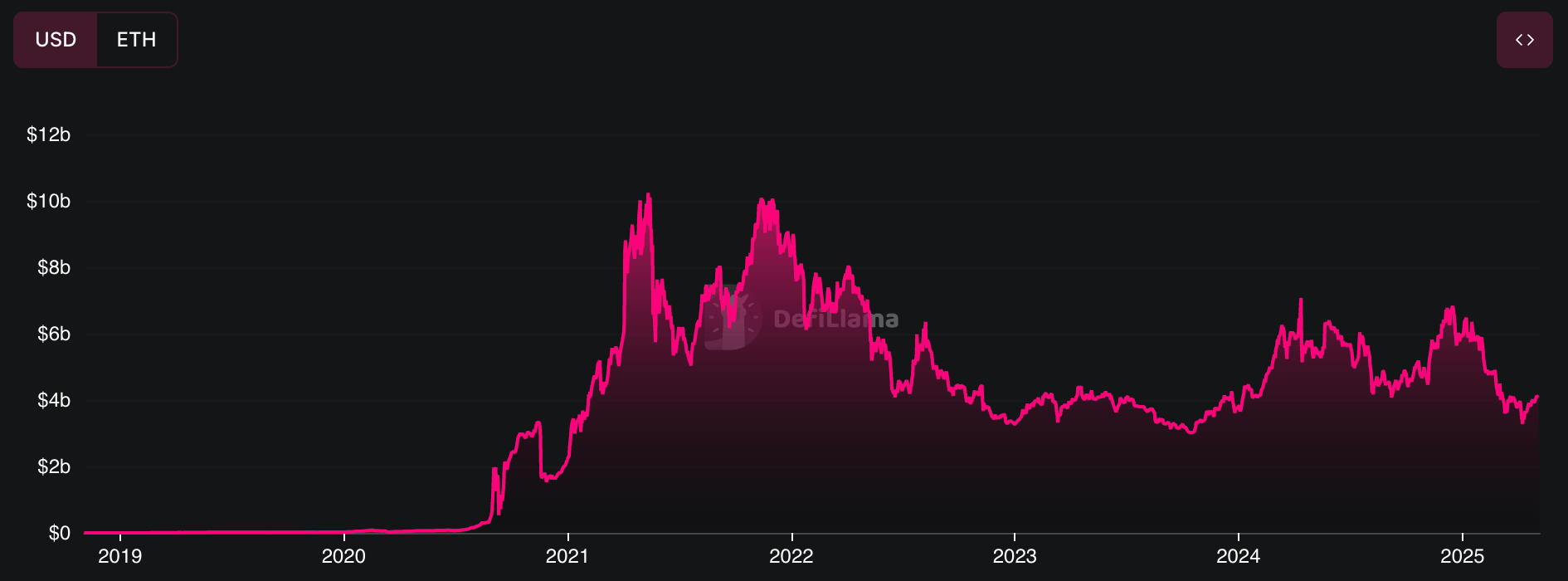

Uniswap is the biggest decentralized speech with immoderate $4 cardinal worthy of deposits, down 60% from its highest of astir $10 cardinal total-value-locked during 2021-2022, according to DefiLlama data.

Like galore DeFi protocols, Uniswap is controlled and managed done a somewhat byzantine structure.

The protocol was created by Uniswap Labs, a for-profit institution which is besides liable for its continued development. The Uniswap Foundation, a nonprofit, is tasked with supporting Uniswap and its community, portion protocol changes and allocation of resources is controlled by the Uniswap DAO, a benignant of crypto corporate governed by holders of the UNI token.

In March, the DAO granted the instauration $165 cardinal to boost Uniswap ecosystem maturation and development. This gave the instauration a mandate to bash definite things successful pursuit of its goals without straight consulting the DAO.

Some, similar Pepo, consciousness the Uniswap Foundation’s actions are putting the DAO’s interests down those of itself and Uniswap Labs.

This concern highlights the persistent conflict to equilibrium the interests of DeFi protocol token holders with those of different stakeholders.

Not the archetypal time

Pepo isn’t the lone 1 to item a perceived deficiency of DAO power astatine Uniswap.

In October, Billy Gao, vice president of Stanford Blockchain Club, a Uniswap delegate, said Uniswap Labs’ abrupt determination to motorboat its ain blockchain “raised superior questions astir DAO governance.”

Gao argued that the Uniswap DAO should person been told astir the blockchain up of clip and allowed to measurement successful connected cardinal decisions successful its implementation. “It calls to question (once again) however decentralized [Uniswap’s] governance really is,” helium said.

Uniswap Labs did not instantly respond to a petition for comment.

Others person questioned however the Uniswap Foundation uses the funds granted to it, and person complained that it isn’t transparent capable astir its spending and determination making.

“Transparency and connection are values that galore delegates hold with,” Doo Wan Nam, Co-founder of DAO governance solutions supplier StableLab, a Uniswap delegate, told CoinDesk. “There person been improvements.”

On May 1, the Uniswap Foundation responded to disapproval by creating a Foundation Feedback Group, intended to guarantee effectual connection and fortify accountability betwixt the instauration and the DAO.

Additionally, arsenic a nonprofit company, the instauration indispensable legally publish its finances.

But the occupation is that for immoderate delegates, it’s not enough.

“It’s a nonaccomplishment for immoderate DAO whenever a delegate feels the lone mode to marque an interaction is done stepping down,” PaperImperium, Governance Liaison astatine Uniswap DAO delegate GFX Labs, told CoinDesk.

Behind the scenes

Some governance participants besides complained that a batch of Uniswap DAO connection and decision-making happens privately, alternatively of publically connected the Uniswap governance forums.

This has led to complaints that large decisions are each agreed connected by ample delegates down closed doors earlier going to a nationalist vote.

It’s indispensable for proposals to person a grade of feedback earlier being presented publicly, Nam said.

It’s not dissimilar accepted governance. “Congressmen won't conscionable blindly constitute bills without talking to applicable stakeholders oregon different Congressmen,” Nam said.

But it’s a double-edged sword. As DAOs mature, there’s besides a consciousness that they are becoming much astir authorities and appearances alternatively than pursuing what’s champion for the protocol.

Multiple Uniswap delegates declined to remark to CoinDesk erstwhile asked astir the complaints highlighted by Pepo.

3 months ago

3 months ago

English (US)

English (US)