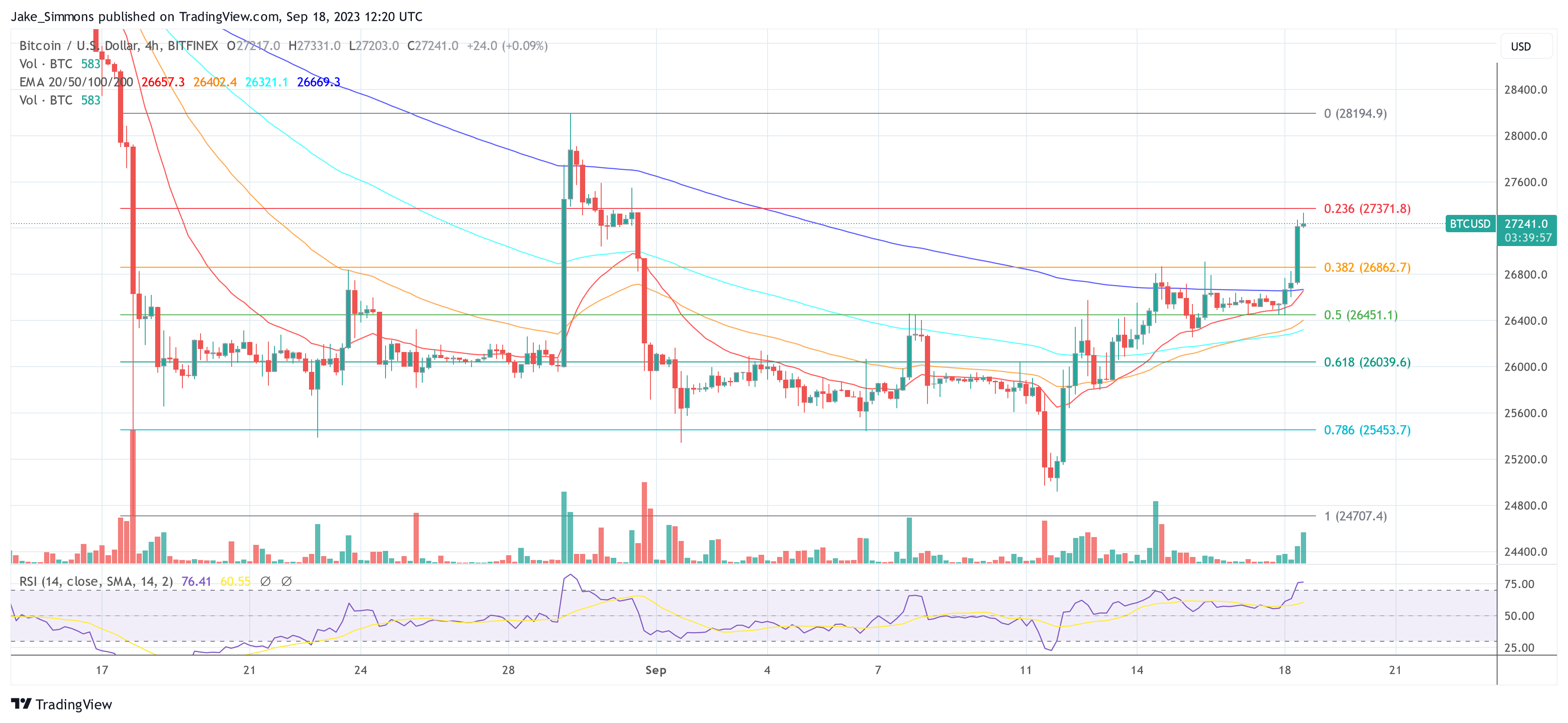

The Bitcoin terms is sustaining its bullish momentum from the erstwhile day. Today, it surpassed the $27,000 threshold, a level not seen since August 31. Notably, BTC recorded its archetypal greenish play closing candle successful 5 weeks yesterday. As of property time, the Bitcoin terms has reached an intra-day precocious of $27,267.

Why Is Bitcoin Price Up Today?

One large indicator that has captured analysts’ attraction is the accelerated summation successful Open Interest. DaanCrypto, a noted fig successful the crypto space, commented connected the Open Interest of Bitcoin: “Bitcoin Open Interest has been ramping up similar brainsick these past fewer hours. Up +$850M successful hours.” According to him, this tin beryllium an contented if spot bid disappears which could origin for a afloat retrace akin to before.

“This would past beryllium owed to underwater positions that entered adjacent the top. If spot bid remains past these positions are evidently fine. Open Interest is present backmost to station Grayscale pump levels,” Daan stated, further noting the resilience successful the spot premium astatine the moment, “Longs are comfy arsenic agelong arsenic spot bid is present.”

Bitcoin Open Interest | Source: X @DaanCrypto

Bitcoin Open Interest | Source: X @DaanCryptoMaartuun, the assemblage manager astatine CryptoQuant Netherlands, besides highlights the accelerated surge successful Open Interest: “Fasten your spot belts. The Open Interest goes bonkers connected this break-out attempt. It has accrued by $600 cardinal (7%).”

Interestingly, Coinglass information reveals that arsenic of property time, abbreviated liquidations for BTC stay modest, with conscionable astir $20 cardinal successful shorts being liquidated. At property time, OI skyrocketed further, up astir $1 cardinal (from $11.04 to $12.03 billion).

Renowned expert @52kskew emphasized the trading behaviour connected Binance: “Majority chasing shorts aggressively from what I tin spot truthful far. Binance Open Interest: Binance perp OI starting to satellite again with minimal terms quality ~ large determination brewing. OI up and insignificant alteration successful perp delta (positions opening into price). Takers inactive aggressively selling into price, bulls privation to spot changeless bounds chasing connected the bid here. $26.7K pivotal terms for direction.”

Ali Martinez, different analyst, pointed towards Bitcoin’s 3-day illustration and noted a bargain awesome by the TD Sequential yesterday. “A boost successful $BTC buying unit mightiness thrust prices to the channel’s mid oregon precocious bound – targeting $28,000 oregon $31,000. Still, ticker the TD Risk Line astatine $24,500. It’s the cardinal invalidation point.”

Buy awesome by the TD Sequential | Source: X @ Ali_charts

Buy awesome by the TD Sequential | Source: X @ Ali_chartsFrom macro perspective, renowned expert Ted (@tedtalksmacro) indicated a correlation betwixt USD liquidity and Bitcoin terms movements: “If you tin track/forecast USD liquidity, you’ll person a coagulated thought of wherever terms is headed.” He went connected to item a divergence betwixt the emergence successful USD liquidity and the erstwhile stagnation of BTC, emphasizing the caller displacement which mightiness beryllium driven by returning liquidity.

Bitcoin vs liquidity | Source: X @tedtalksmacro

Bitcoin vs liquidity | Source: X @tedtalksmacroMonthly Close Will Be Crucial

As NewsBTC reported, September is historically 1 of the worst months of the twelvemonth for the Bitcoin price. However, this twelvemonth could beryllium antithetic if BTC continues its inclination of the past fewer days.

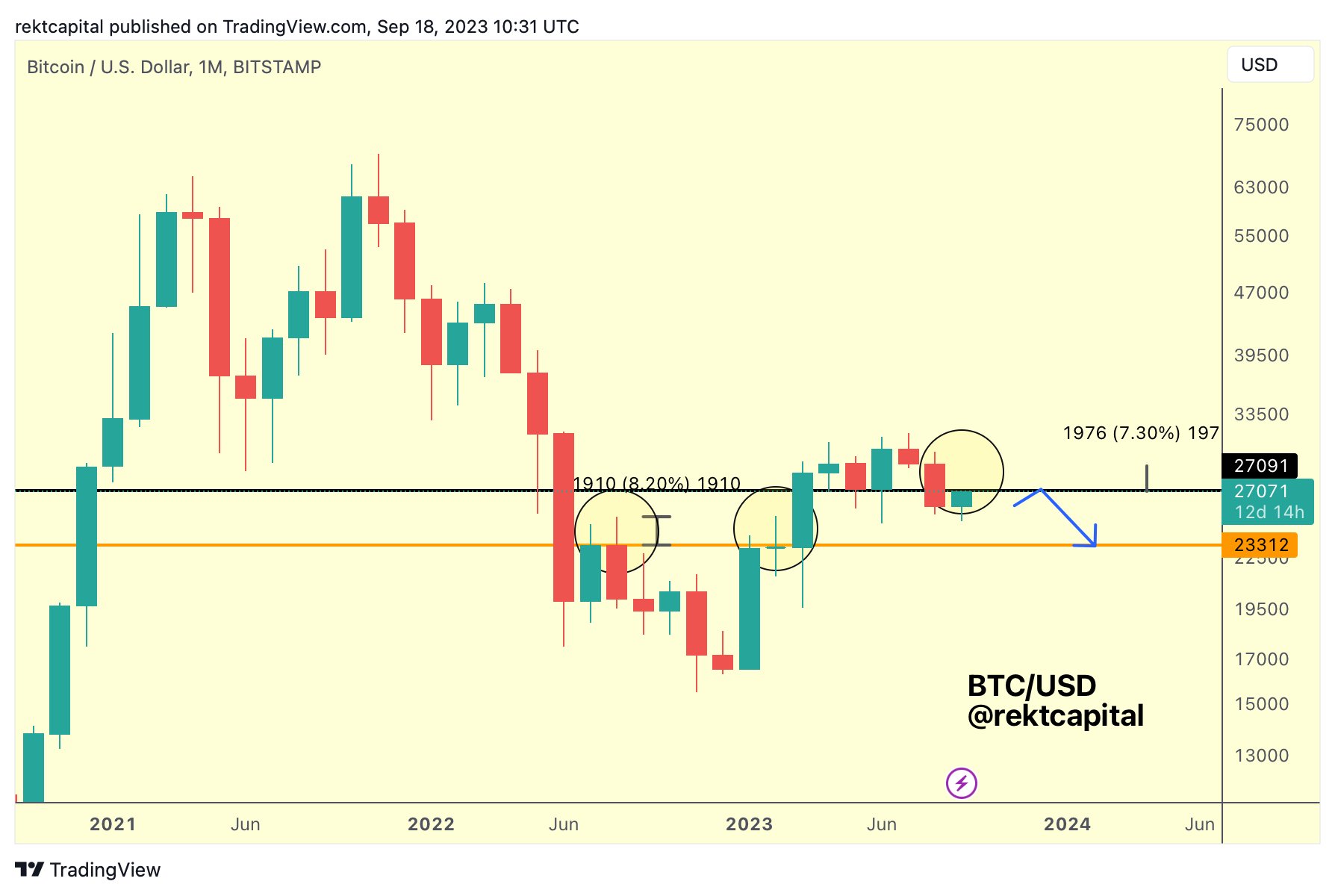

Rekt Capital highlighted the imaginable value of the upcoming monthly candle adjacent for Bitcoin successful a caller tweet, stating: “The upcoming Monthly Candle Close volition beryllium pivotal.” According to the analyst, Bitcoin often produces agelong upward wicks erstwhile it transforms aged Monthly supports into caller resistances.

In elemental terms, an upward wick connected a candlestick illustration indicates terms levels wherever Bitcoin traded during a play but didn’t close. A agelong wick suggests a beardown rejection from those higher terms levels. This could mean that portion buyers tried to propulsion the terms up during the month, by the close, sellers had brought it backmost down, leaving a agelong ‘wick’ connected the candlestick.

Rekt Capital suggests that these wicks tin widen up to +8% beyond the candle body. The expert notes that if the monthly candle adjacent produces an upside wick of +7% beyond the ~$27,100 level, it could mean the terms mightiness spell beyond the play little high.

This could beryllium a affirmative motion if the monthly adjacent remains supra $27,100, indicating it arsenic a enactment level. However, if the terms closes the period beneath $27,100 aft reaching higher levels, it whitethorn corroborate $27,100 arsenic a caller resistance, hinting that the caller terms question mightiness beryllium conscionable a impermanent upward rally.

BTC monthly adjacent | Source: X @rektcapital

BTC monthly adjacent | Source: X @rektcapitalAt property time, BTC stood astatine $27,241.

BTC climbs supra $27,000 , 4-hour illustration | Source: BTCUSD connected TradingView.com

BTC climbs supra $27,000 , 4-hour illustration | Source: BTCUSD connected TradingView.comFeatured representation from iStock, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)