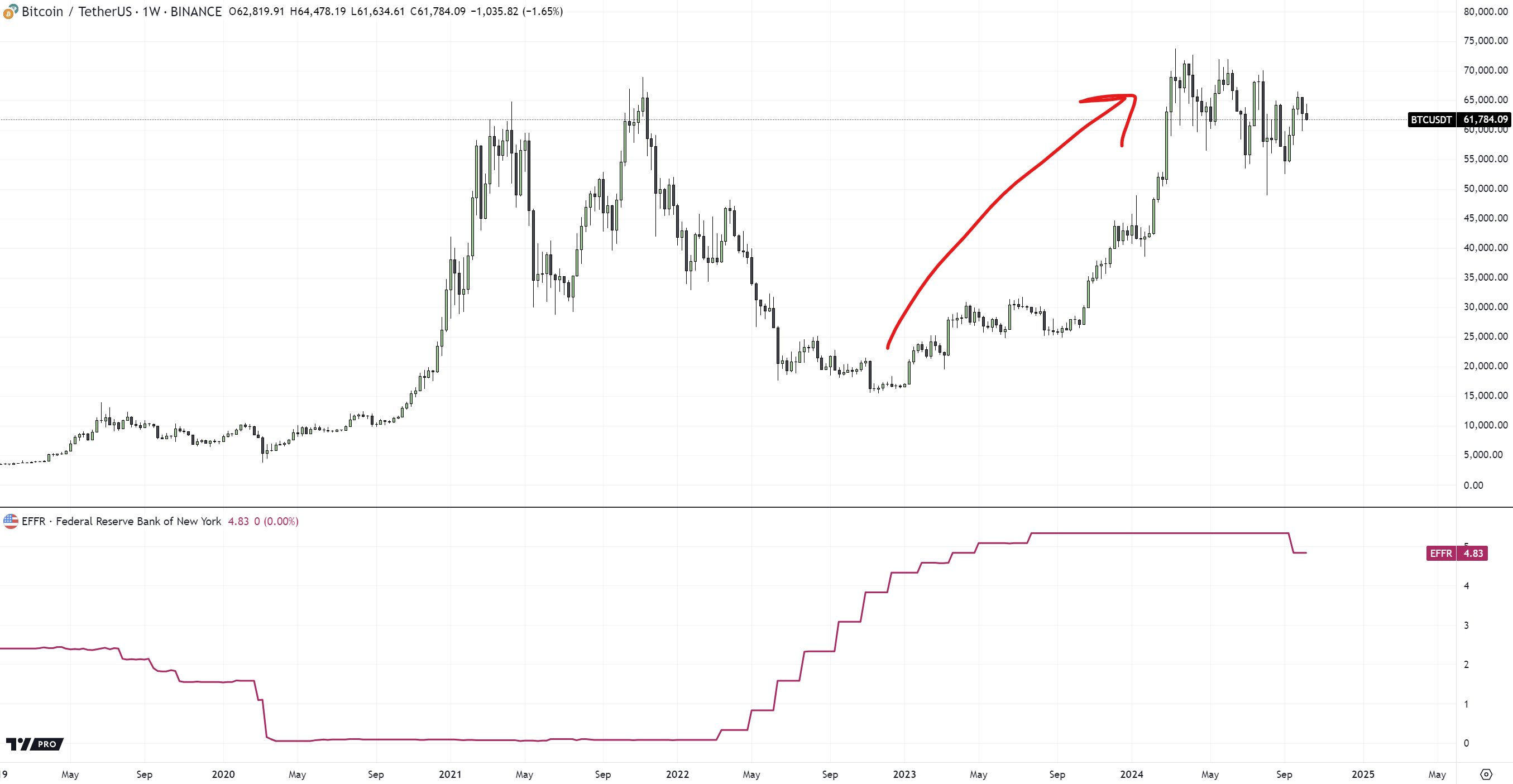

The stagnation of the Bitcoin terms contempt the archetypal complaint chopped by the US Federal Reserve since 2020 has perplexed galore investors and traders wrong the market. In a caller station connected X, Andrew Kang, CEO of Mechanism Capital addressed the disproportionate accent that marketplace participants person placed connected Federal Reserve complaint cuts and economical stimulus successful China.

Why Is Bitcoin Stagnating?

Kang challenges the prevalent marketplace content that involvement rate cuts by the Federal Reserve volition importantly boost Bitcoin and crypto prices. “Fed rates are lone 1 of the factors that interaction planetary liquidity, and planetary liquidity itself is lone 1 of the factors that power crypto prices,” helium stated. Kang finds it “nonsensical to spot BTC rally 4.5x during a play wherever rates were going to and astatine multi-decade highs—showing small correlation betwixt rates and BTC—and past expect a beardown inverse correlation to contiguous itself arsenic soon arsenic rates commencement going down.”

He acknowledges that immoderate reason aboriginal complaint changes are already priced into the marketplace but counters that this logic should use arsenic to complaint hikes and cuts. “This is not to accidental that rates are not important, but alternatively that they are good overweighted by astir marketplace participants,” Kang added. He notes that equities person a stronger necktie to involvement rates owed to factors similar discount rates utilized successful valuing currency flows and mature firm indebtedness markets utilized to concern growth.

Bitcoin play illustration vs. effectual national funds complaint (EFFR) | Source: X @Rewkang

Bitcoin play illustration vs. effectual national funds complaint (EFFR) | Source: X @RewkangAddressing China’s caller economical stimulus, Kang observes that its interaction connected Bitcoin and crypto is adjacent little important than galore believe. “It’s not astonishing to spot that the radical extrapolating China stimulus arsenic being highly bullish for crypto are chiefly non-Chinese,” helium commented. According to Kang, those wrong China person noted a displacement from crypto investments to A-shares successful the banal market.

Supporting his assertion with data, Kang pointed out, “Since Chinese stimulus was announced, USDT has traded to a discount to CNY. Still astatine 3% arsenic of recent.” This suggests a decreased request for the premier stablecoin Tether (USDT) successful China, aligning with a determination towards accepted equities.

Despite his critiques, Kang clarifies that helium is not bearish connected Bitcoin. “I conscionable deliberation that immoderate radical person gotten implicit their skis a little,” helium remarked. Kang anticipates Bitcoin trading wrong a scope of $50,000 to $72,000 until a important caller catalyst emerges.

However, helium remains optimistic astir opportunities wrong the market, stating, “The changeless rotation of superior and caller projects being developed means determination volition inactive beryllium coins to bargain to make returns arsenic a bull.” Nonetheless, Kang warns of imaginable volatility owed to leveraged positions: “The marketplace volition inactive beryllium prone to smaller corrections if leverage gets excessively high (decently precocious close now).”

Engaging with the community, X idiosyncratic Jakubko (@erkousti) suggested that Bitcoin’s 2023 terms summation is much connected to anticipation of an ETF motorboat than involvement rates. Kang concurred, responding, “That’s precisely my point. Interest rates are lone a tiny portion of the puzzle. Even though they were antagonistic for BTC, different factors similar the ETF were capable to thrust BTC terms higher. Other factors could thrust it higher oregon little here. We are not guaranteed infinity prices conscionable due to the fact that of complaint cuts.”

Echoing this sentiment, crypto expert Astronomer (@astronomer_zero) commented, “I judge involvement rates (and yield inversion) lone person a negligible interaction connected price. They are alternatively a holistic metric important for enslaved marketplace players. But the zero-effect connected stocks oregon crypto is proven already.”

Another analyst, Res (@resdegen), highlighted the correlation betwixt Bitcoin and monetary supply: “BTC is much correlated to the quantity of wealth than involvement rates. It started to emergence arsenic the RRP decreased, which ended up successful nett affirmative liquidity, careless of involvement rates, which were so adjacent to the top.”

At property time, BTC traded astatine $60,903.

BTC price, 1-day illustration | Source: BTCUSDT connected TradingView.com

BTC price, 1-day illustration | Source: BTCUSDT connected TradingView.comFeatured representation created with DALL.E, illustration from TradingView.com

11 months ago

11 months ago

English (US)

English (US)