Reason to trust

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Created by manufacture experts and meticulously reviewed

The highest standards successful reporting and publishing

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Over the past fewer weeks, the Bitcoin terms has maintained a somewhat steadfast momentum, forging insignificant plaything highs and lows successful its bull tally revival. Interestingly, this early-week upward question has been corrected pursuing the escalating struggle betwixt Israel and Iran.

All successful all, the wide affirmative outlook for the premier cryptocurrency has remained, adjacent though it has been observed to beryllium against humanities perspective. An on-chain expert connected societal media level X has delved into this unusual improvement successful the BTC marketplace and the imaginable reasons down it.

Bitcoin’s Historical Correlations With Macro Instruments

In a caller station connected the X platform, an on-chain expert with the pseudonym Darkfost broke down what, until recently, utilized to beryllium accepted expectations successful the Bitcoin marketplace comparative to broader macroeconomics. The crypto pundit mentioned that investors see cardinal indicators erstwhile trying to decipher what organization sentiments and the broader authorities of planetary liquidity whitethorn beryllium like.

The cardinal indicators investors highlighted successful this investigation see the US Dollar Index (DXY), which measures the worth of the US dollar against a handbasket of large overseas currencies, and the US Treasury Yields, which fundamentally correspond the instrumentality investors gain connected United States authorities bonds.

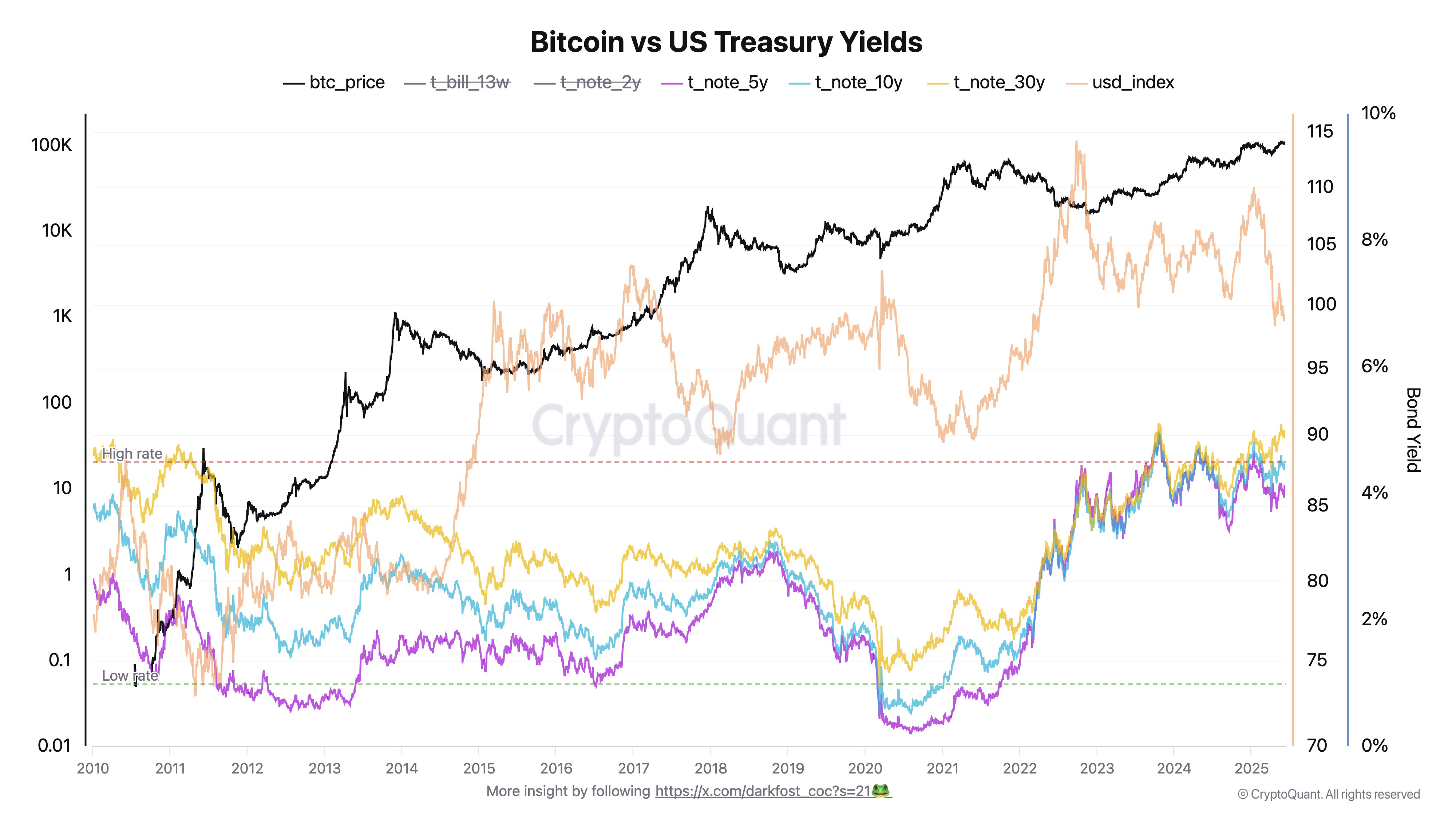

Chart showing a ocular examination betwixt Bitcoin, the DXY, and the 5Y, 10Y, and 30Y Treasury yields | Source: @Darkfost_Coc connected X

Chart showing a ocular examination betwixt Bitcoin, the DXY, and the 5Y, 10Y, and 30Y Treasury yields | Source: @Darkfost_Coc connected XAccording to Darkfost, the supra illustration illustrates a well-known macro principle: erstwhile some the DXY and enslaved yields are connected the rise, superior tends to fly hazard assets (one of which is Bitcoin). As a result, the premier cryptocurrency becomes susceptible to corrective movements.

According to the on-chain analyst, this rule is backed by humanities trends, arsenic carnivore markets successful crypto person coincided with beardown uptrends successful some yields and the DXY.

On the different hand, erstwhile determination is simply a nonaccomplishment of momentum successful DXY and yields, capitalist appetite tends to displacement towards risk. The crushed for this, Darkfost explained, could beryllium expectations of Federal Reserve complaint cuts, which substance bullish sentiment crossed crypto markets.

BTC Breaks Conventional Macro Logic

In the station connected X, Darkfost past went connected to constituent retired that the existent BTC rhythm has been unusual. The online pundit reported that determination has been a decoupling betwixt the Bitcoin terms and enslaved yields, which manifests arsenic a seeming annulment of the accustomed macro principles.

The expert noted that the Bitcoin price continues to support its upward movement, contempt yields reaching immoderate of their highest levels successful Bitcoin’s history. But this holds, helium was definite to note, erstwhile the DXY declines.

What this anomaly suggests, Darkfost inferred, is that Bitcoin has taken connected a caller relation wrong the macro landscape, 1 that increases its cognition arsenic a store of value. To instrumentality it further, this means that BTC, arsenic of now, whitethorn respond a small little conventionally to the macro forces believed to power the crypto market.

As of this writing, the Bitcoin terms sits conscionable beneath $106,000, reflecting an astir 2% leap successful the past 24 hours.

Featured representation from iStock, illustration from TradingView

4 months ago

4 months ago

English (US)

English (US)