Aside from wiping retired billions from the planetary marketplace cap, the collapse of FTX besides wiped retired the assurance of adjacent the astir convinced Bitcoin holders.

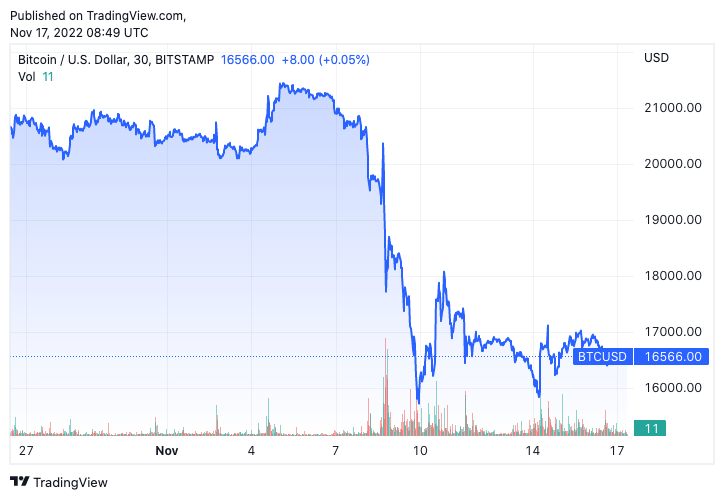

The marketplace saw assertive selling unit past week, pushing Bitcoin’s terms down to arsenic debased arsenic $15,500.

Graph showing Bitcoin’s terms successful November 2022 (Source: CryptoSlate BTC)

Graph showing Bitcoin’s terms successful November 2022 (Source: CryptoSlate BTC)CryptoSlate looked astatine the changes successful Bitcoin ownership among short-term holders (STH) and semipermanent holders (LTH) to spot wherever the selling unit was coming from.

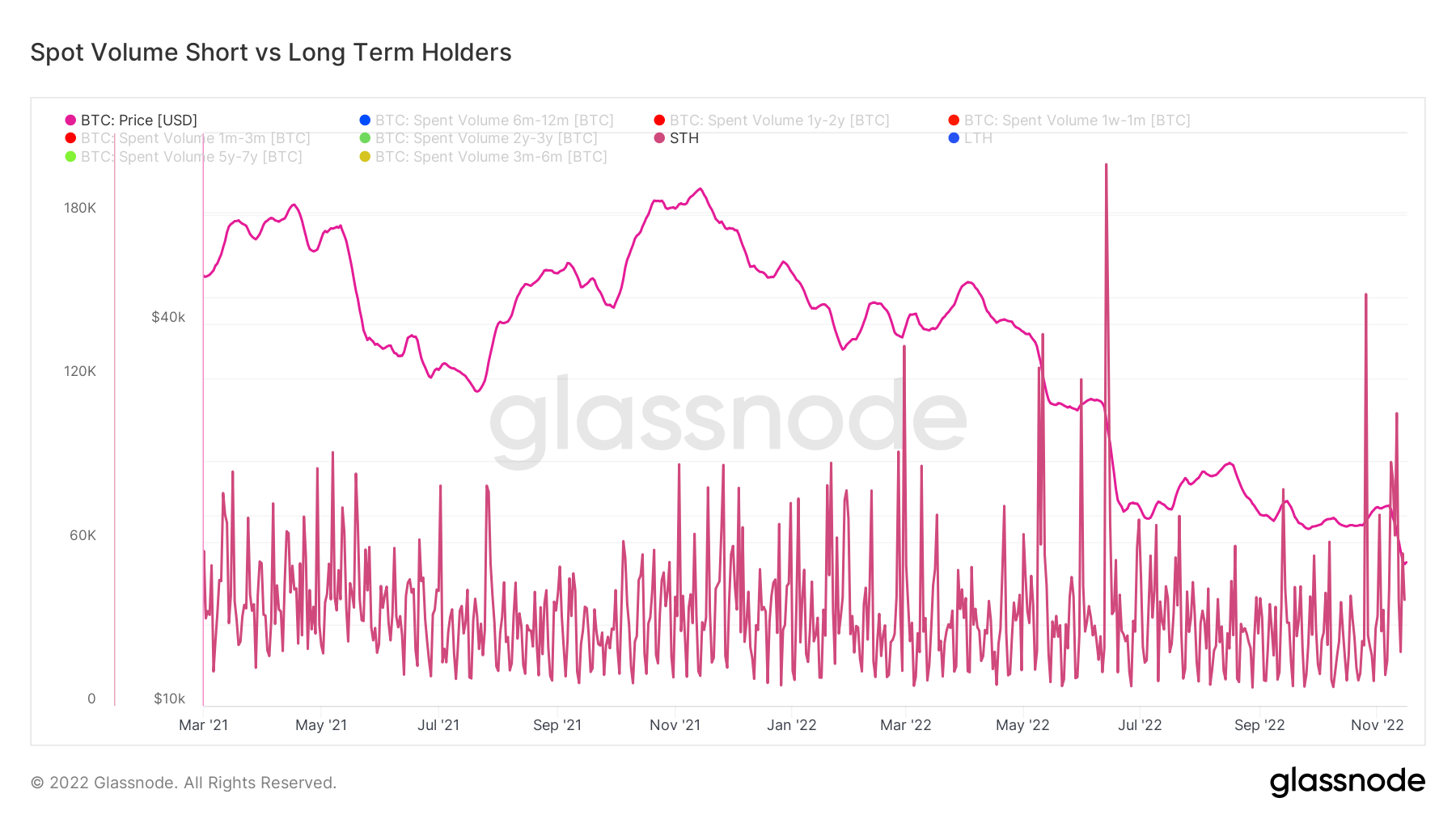

Historically, short-term holders are the archetypal to merchantability their coins erstwhile the marketplace turns red. However, the ongoing volatility hasn’t affected STHs overmuch arsenic erstwhile marketplace turmoils. Data from Glassnode shows that the FTX fallout saw lone the fifth-largest fig of STH sellers since March 2021. Around 400,000 BTC belonging to STHs were sold betwixt Nov. 10 and Nov. 17.

Graph showing Bitcoin spot trading measurement generated by short-term holders from March 2021 to November 2022 (Source: Glassnode)

Graph showing Bitcoin spot trading measurement generated by short-term holders from March 2021 to November 2022 (Source: Glassnode)The ongoing marketplace situation hasn’t shaken the assurance of semipermanent holders.

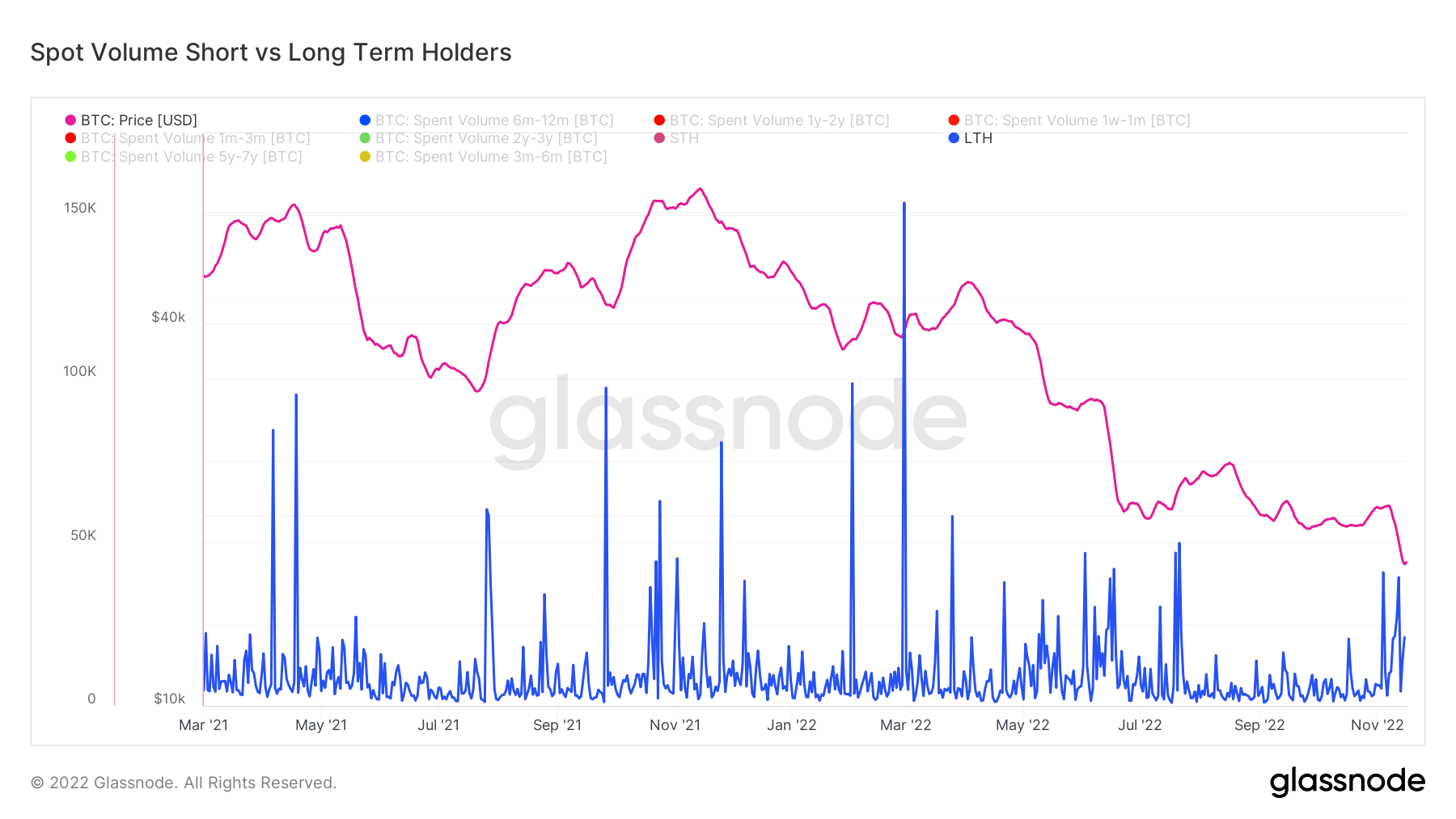

Those holding their coins longer than six months sold nether 100,000 BTC successful the past week, information analyzed by CryptoSlate showed. This is importantly smaller than the selling unit caused by Russia’s penetration of Ukraine successful February and Luna’s illness successful June.

Graph showing Bitcoin spot trading measurement generated by semipermanent holders from March 2021 to November 2022 (Source: Glassnode)

Graph showing Bitcoin spot trading measurement generated by semipermanent holders from March 2021 to November 2022 (Source: Glassnode)The information that astir semipermanent holders stay unfazed by marketplace volatility isn’t surprising. Holders successful this radical are statistically the slightest apt to merchantability their BTC and person agelong been creating the strongest absorption for its price.

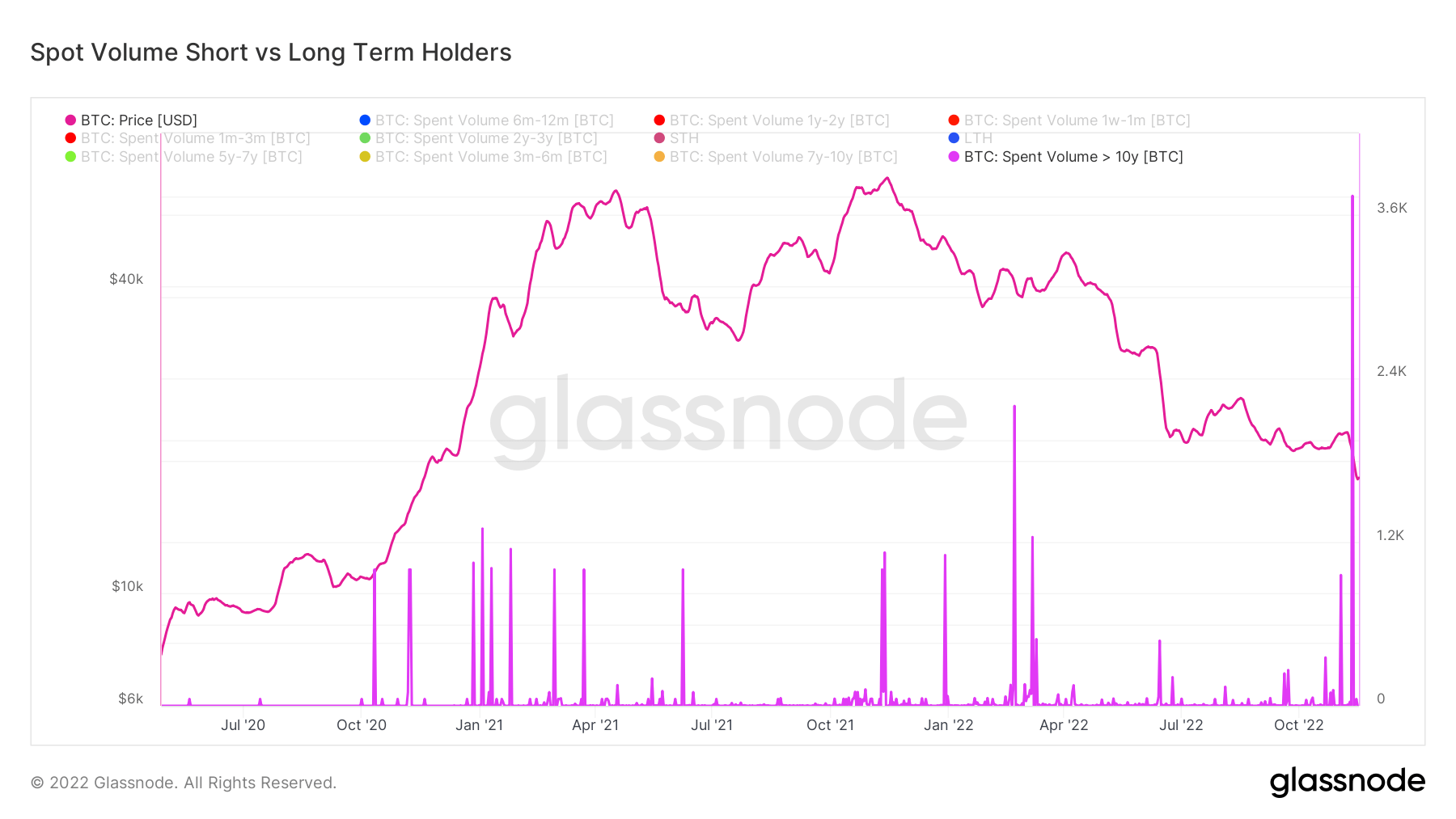

However, what is astonishing is that addresses that held Bitcoin for implicit 10 years look to beryllium the ones the situation affected the most. While the 3,600 BTC they sold implicit the past week fades compared to the spent measurement generated by STHs, it’s inactive the astir coins these ultra-long holders ever sold.

Graph showing Bitcoin spot trading measurement generated by addresses that held Bitcoin for longer than 10 years (Source: Glassnode)

Graph showing Bitcoin spot trading measurement generated by addresses that held Bitcoin for longer than 10 years (Source: Glassnode)The station Who sold the astir BTC successful the aftermath of the FTX collapse? 10yr holders merchantability astatine highest ever rate appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)